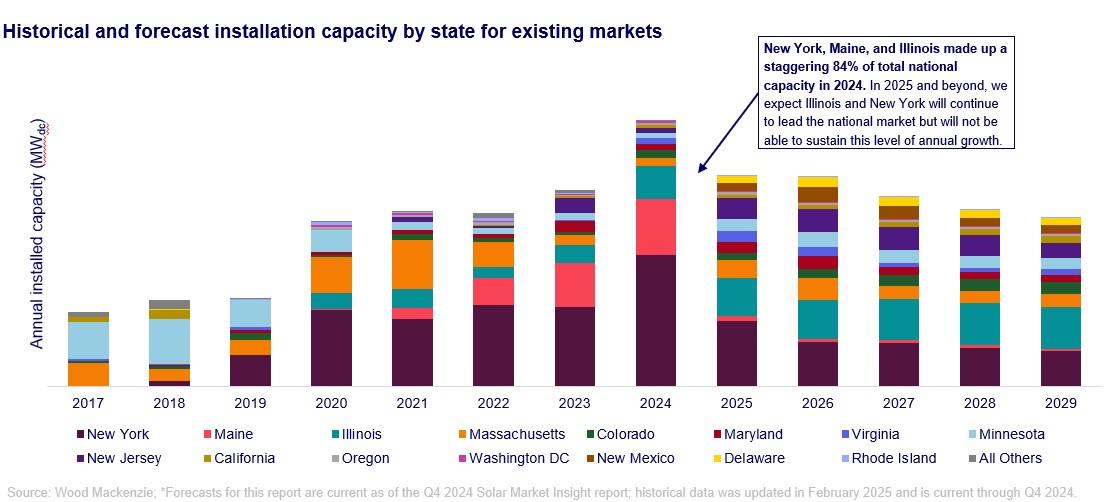

U.S. community solar installations soared to new heights in 2024 to reach a record-setting 1.7 gigawatts (GW), according to a report released this week by Wood Mackenzie and the Coalition for Community Solar Access.

The 35% increase in installations from 2023 levels was driven by annual records set by New York, Maine and Illinois. Together, the three states accounted for 83% of the nation’s capacity.

Solar has been a fast-growing source of electricity generation in the U.S. amid the push to lower greenhouse gas emissions. Declining costs, higher demand and incentives have bolstered the renewable energy’s competitiveness among fuel sources.

Caitlin Connelly, research analyst and lead author of the report, called the activity “the strongest year yet for community solar growth,” but warned the growth may not be long-lasting.

“Despite impressive 2024 installation volumes, the top state markets are saturating quickly and will not be able to sustain the same levels of growth long-term,” Connelly said. “Additionally, emerging markets have been slow to ramp up and program size caps limit the potential for growth in these states to make up for declines in larger markets.”

Wood Mackenzie said it anticipates community solar growth will contract 8% annually on average through 2029 in its base case. Cumulative community solar installed could surpass 15 GW by then, up from 8.6 GW today.

Policy changes and interconnection reform, however, could impact the growth outlook, Wood Mackenzie said in the report.

“Although the new U.S. administration has fueled an extreme amount of uncertainty in the U.S. solar sector, material actions so far have resulted in minimal changes to our base case outlook,” said Connelly. “However, in a low case representing an extreme downside scenario, our five-year outlook contracts 40% compared to the base case. By contrast, business as usual at the federal level and rapidly improving state policy and interconnection conditions result in a high case outlook 37% higher than the base case.”

Here’s a roundup of some other renewable energy news.

Biofuels

KKR Acquires Additional Stake in Eni Biofuel Business

U.S.-based investment fund KKR has agreed to buy an additional 5% stake in Eni’s biofuel business Enilive for 587.5 million euros ($614.17 million), KKR said in a news release Feb. 18.

The move will bring KKR’s total stake in the business to 30% following its initial acquisition in October 2024.

“Having first signed our investment in Enilive in October last year, this transaction reiterates our confidence in the business’ ability to provide innovative and effective emission-reducing technology solutions, in line with our strategy to support transformative energy projects across Europe,” said Marco Fontana, managing director for KKR’s European Infrastructure team. “We’re excited to continue working alongside Eni to further establish Enilive as a market leader.”

Energy storage

Exxon, SLB Flag Interest in Lithium Projects in Chile, Document Shows

(Reuters) U.S. oil major Exxon Mobil is planning a meeting with Chilean officials to discuss lithium investment opportunities, according to a registry of lobbyist meetings and a person familiar with the matter, as fossil fuel companies increasingly look to invest in production of the metal needed for electric vehicle batteries.

Top U.S. oilfield services company SLB, which is similarly expanding into lithium, also recently met with Chilean mining officials, according to the registry and the source.

The meetings reveal the first known details of interest from the companies to seek opportunities in Chile, the world's second-biggest lithium producer, where output currently comes from just two companies in the Atacama salt flat.

The government is working to boost production, both through efforts spearheaded by state-run copper giant Codelco, and by encouraging private investment.

Oil and gas companies, under pressure to reduce carbon emissions from operations, see parallels between conventional oil and gas drilling methods and lithium extraction from brine, which is the form of production used in Chile.

In January, a Chilean representative for Exxon met with mining ministry officials to discuss an upcoming visit by executives “interested in lithium projects in Chile,” according to a registry of lobbyist meetings.

The registry did not provide further details. The source with knowledge of the meeting said the visit was expected in the coming months. Asked about interest in Chile, Exxon said in a statement, “we have collaborations and investments all over the world,” and noted it was consistently evaluating opportunities in the energy sector.

In late 2023, the top U.S. oil producer announced plans to produce lithium in the U.S. with the goal of supplying the ultralight metal to EV makers and becoming a top global producer. It told Reuters it was studying where else in the world it could produce lithium.

Exxon is also working to use an innovative method to separate the metal from brine, known as direct lithium extraction (DLE), which Chile has called for as a way to mitigate environmental impacts.

Also in January, SLB Head of Mining Nicholas Lugansky met with a top Chilean mining official to discuss the New Energy unit, which includes lithium projects.

The meeting’s aim was to “explore potential collaborations with Chile and its state and private companies,” according to the lobbyist registry.

SLB in September was one of eight companies selected to test its lithium extraction technology in the Altoandinos salt flats in northern Chile.

SLB declined to comment, and Chile’s mining ministry declined to comment on both companies.

Chile’s lithium output currently comes from Chile’s SQM and U.S. miner Albemarle.

Geothermal

Elemental Energies, Iceland Drilling Form Geothermal JV

Geothermal drilling contractor Iceland Drilling Co. has formed a joint venture (JV) with Elemental Energies to provide integrated well engineering and project delivery solutions for the geothermal market, according to a Feb. 19 news release.

The JV will offer services that include early project planning, feasibility studies and subsurface modeling, as well as conceptual and detailed engineering, integrated drilling services, project management and operational execution, the release states.

“As projects scale, they will require consolidated expertise to meet increasing demand. This JV brings together leading capabilities in well engineering and well construction to enhance coordination, reduce risk, and manage costs,” said Iceland Drilling CEO Sveinn Hannesson. “By integrating these critical services, we aim to accelerate project execution and make geothermal development more efficient and cost-effective.”

The partnership takes shape as momentum builds in the geothermal sector. Data from the International Energy Agency show geothermal could supply up to 15% of global electricity demand growth by 2050, generating nearly 6,000 terawatt-hours per year. That’s roughly equivalent to the current electricity demand of the U.S. and India combined, according to the news release.

“By combining our technical expertise in subsurface and well engineering with Iceland Drilling’s advanced geothermal drilling services, we are in a strong position to lead the charge in delivering scalable solutions to the global geothermal market,” said Elemental Energies CEO Mike Adams. “We are committed to supporting the next phase in the sector’s growth and are proud to be doing so alongside Iceland Drilling.”

Hydrogen

TotalEnergies, Air Liquide Form Hydrogen Joint Venture

TotalEnergies has teamed up with industrial gases company Air Liquide to utilize electrolytic hydrogen in an effort to help lower emissions from refinery operations.

The Paris-based company on Feb. 18 said the companies will work together on two projects in Europe, producing about 45,000 tons per year of green hydrogen using power mostly sourced from TotalEnergies and RWE’s OranjeWind offshore wind farm. The projects are expected to reduce CO2 emissions from TotalEnergies’ refineries in Belgium and the Netherlands by up to 450,000 tons per year, the company said in a news release.

“Following the first partnership agreement with Air Liquide to supply the Normandy refinery with green hydrogen, and the agreements to supply the Grandpuits and La Mède biorefineries with renewable hydrogen, the partnership with Air Liquide takes on a new dimension and marks a new step in TotalEnergies’ ambition to decarbonize the hydrogen consumed by its refineries in Europe by 2030,” said Vincent Stoquart, president of refining and chemicals at TotalEnergies.

The companies agreed to set up a 50-50 joint venture with both investing about €600 million. As part of the partnership, Air Liquide will build and operate a 250-megawatt (MW) electrolyzer near the Zeeland refinery. Here, up to 30,000 tons of green hydrogen will be produced annually, according to the release.

As part of Air Liquide’s 200-MW ELYgator electrolyzer project in Maasvlakte (Netherlands), TotalEnergies said it signed a tolling agreement for 130 MW for the production of 15,000 tons per year of green hydrogen for its platform in Antwerp. TotalEnergies will supply electricity produced by OranjeWind to Air Liquide for the hydrogen production process. The project is expected to be operational by the end of 2027.

“Flagship projects such as the ones we are announcing today will play a key role in reducing emissions, particularly in hard-to-abate sectors such as industry and heavy mobility,” said Emilie Mouren-Renouard, member of the Air Liquide’s executive committee in charge of Europe operations.

The two projects will complete the five Air Liquide low carbon units already in operation or construction in Europe, Mouren-Renouard added.

Enagas Plans Multibillion-euro Investment in Hydrogen Infrastructure

(Reuters) Spanish gas grid operator Enagás plans to invest more than 4 billion euros (US$4.18 billion) by the end of the decade, with more than three quarters of that earmarked for hydrogen infrastructure.

With Spanish gas demand falling, Enagás has sold assets, reduced dividends and cut debt to fund plans to diversify into managing a network of hydrogen infrastructure. It is also targeting ammonia and CO2 capture.

Hydrogen will be “the driving force to advance towards the Enagás of the future,” CEO Arturo Gonzalo said Feb. 18.

Of the planned 4.04 billion euros in net investment between 2025 and 2030, hydrogen infrastructure will account for 3.13 billion euros, Gonzalo told analysts as he presented the company’s strategic update.

Enagás, in which the state owns a 5% stake, is part of a consortium working on the planned trans-European H2Med corridor aimed at connecting Iberia’s hydrogen networks with northwest Europe. It also plans to build a hydrogen network in Spain.

The company expects to invest 520 million euros in gas networks and a further 225 million euros in a new company, Scale Green Energy, focused on infrastructure and services for businesses such as CO2 capture.

The company expects core profit of about 875 million euros in 2030. The hydrogen business is expected to contribute about 290 million euros, with its other gas business contributing 400 million euros.

This year’s core profit is forecast to fall to 670 million euros from 760.7 million euros last year, the company said, with net debt remaining around 2.4 billion euros.

Solar

OCI Energy, Arava Power to Develop Solar Farm in Texas

San Antonio, Texas-based OCI Energy on Feb. 20 said it will jointly develop a 260-MW solar farm in Wharton County, Texas, with Israel’s Arava Power.

The companies are scheduled to begin construction on the solar farm, called Project SunRoper, in 2025. The project marks the second time OCI Energy and Arava Power have teamed up. Their first solar farm, the 200-MW SunRay in Uvalde County, began operations in September 2024.

“The partnership between OCI Energy and Arava Power reflects our shared vision for advancing solar energy solutions and enhancing grid reliability in high-demand markets,” said OCI Energy President Sabah Bayatli. “Project SunRoper represents a significant step forward to drive economic growth and energy security across communities in Texas and beyond, advancing our mission to enable a sustainable, prosperous future.”

EDPR NA Brings Mississippi Solar Park Online, Lines Up Amazon As Buyer

EDP Renewables North America (EDPR NA) on Feb. 19 said its 100-MW Ragsdale Solar Park in Mississippi started operations with Amazon contracting all of the power generated.

The solar park located south of Canton in Madison County generates enough energy to power the equivalent of more than 15,700 homes in Mississippi annually, EDPR NA said in a news release. The park became operational in the fourth quarter of 2024. Amazon has a 15-year power purchase agreement in place for electricity generated.

“The opportunity to develop utility-scale solar and contract directly with customers like Amazon, who are also committed to expanding their own presence in Mississippi, has been invaluable,” EDPR NA CEO Sandhya Ganapathy said.

Development of the solar park was started in 2016 by Acadian Renewable Energy, a joint venture between SunChase Power and Eolian, according to the release. EDPR NA acquired Ragsdale from Acadian in early 2022. The project marks EDPR NA’s second utility-scale project in Mississippi.

Lightsource BP Secured 10 Power Purchase Deals Totaling 1.3 GW Last Year

(Reuters) Renewable energy developer Lightsource BP, a unit of BP, secured 10 power purchase agreements (PPAs) last year totaling 1.3 GW of renewable energy capacity globally, the firm said Feb. 19

Lightsource BP said the PPAs were contracted across Europe, the Americas and Asia Pacific regions for mainly solar power. Lightsource BP includes companies such as Microsoft, Google, chemicals company LyondellBasell and fashion retailer H&M as customers. The average duration of agreements is 12 years.

Some of the 10 deals were publicly disclosed last year, the firm said. The value of the deals were not disclosed.

PPAs are long-term contracts between an electricity generator and a customer such as a government or company during which time the buyer buys energy at a fixed price.

Renewable power project developers are increasingly tying their electricity output to long-term PPAs to provide revenue security, while corporate buyers are keen to lock in supply and ensure they meet targets for sourcing clean power.

“Buyers are becoming increasingly sophisticated. They are looking for partners who can offer a portfolio of projects across borders. This flexibility allows buyers to diversify their energy sources and mitigate risks, which is something Lightsource BP is well-positioned to provide as we are active across 20 markets globally,” Zosia Riesner, global chief commercial officer at Lightsource BP, told Reuters.

Wind

Ørsted Begins Construction of Wind Farm Off Taiwan

Ørsted on Feb. 18 said it has begun offshore construction for the 920-MW Greater Changhua 2b and 4 wind farms offshore Taiwan.

Together, the wind farms will have 66 Siemens Gamesa wind turbines about 35 km to 60 km off the coast of Changhua County, Taiwan. The global wind player said it expects to complete offshore installation work for the wind farms by year-end 2025 and fully connect them to the grid in 2026.

“Once completed, Ørsted will reach a combined operational offshore wind capacity in Taiwan of nearly 2 GW, producing clean energy enough to power two million Taiwanese households,” the company said.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

ADNOC, OMV to Merge Petrochemical Firms to Create $60B Giant

2025-03-04 - The merged entity, Borouge Group International, is set to be the fourth largest polyolefins firm by production capacity, behind China's Sinopec and CNPC, and U.S.-based Exxon Mobil, ADNOC Downstream CEO Khaled Salmeen told Reuters.

ConocoPhillips to Sell Interests in GoM Assets to Shell for $735MM

2025-02-21 - ConocoPhillips is selling to Shell its interests in the offshore Ursa and Europa fields in the Gulf of Mexico for $735 million.

Elk Range Acquires Permian, Eagle Ford Minerals and Royalties

2025-01-29 - Elk Range Royalties is purchasing the mineral and royalty interests of Newton Financial Corp., Concord Oil Co. and Mission Oil Co.

KNOT Offshore Partners Conducts Shuttle Tanker Asset Swap

2025-03-02 - KNOT Offshore Partners LP subsidiary KNOT Shuttle Tanker AS is trading shuttle tanker assets with Knutsen NYK Offshore Tankers AS, the company said Feb. 27.

ConocoPhillips Sells $600MM in Noncore Permian Basin Assets

2025-02-06 - Following its $22.5 billion deal to buy Marathon Oil, ConocoPhillips is targeting $2 billion in asset sales— a goal a company executive said would largely be achieved this year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.