Denmark-based Copenhagen Infrastructure Partners (CIP) is on track to become the world’s largest greenfield renewable energy fund, having raised about US$6.6 billion (€6 billion) for its latest fund, the firm said this week.

With more than 40 renewable energy infrastructure projects, CIP’s CI V fund has surpassed the firm’s other funds and has a potential commitment of about €20 billion.

“The strong and accelerating demand for new renewable infrastructure to secure energy independence and deliver on ambitious climate pledges creates many new investment opportunities,” said CIP Managing Partner Jakob Baruël Poulsen. “The fund and CIP are well-positioned to capture the attractive market opportunities, backed by our strong and extensive track record, our large team of experienced industrialists, and our ownership of one of the world’s largest portfolios of greenfield renewable energy projects.”

The fund aims to add 20 gigawatts (GW) of new clean energy capacity to the grid, equivalent to powering more than 10 million households and preventing about 15 million metric tons of CO2 from entering the atmosphere. The fund made its first final investment decision (FID) in June on a more than 400-megawatt (MW) onshore wind project in the U.S.

The investment comes amid unwavering desire for clean energy technologies, which the International Energy Agency (IEA) said is “significantly outpacing spending on fossil fuels as affordability and security concerns triggered by the global energy crisis strengthen the momentum behind more sustainable options.”

The IEA forecasts that more than $1.7 trillion will be invested in clean technologies, such as renewables, EVs and low-emissions fuels in 2023 alone. So far, investments have been led by solar.

“The new energy economy is emerging faster than many think,” the IEA said July 12. It pointed out that renewables make up 30% of the world’s electricity generation, as renewable electricity capacity jumped to 340 GW.

Here is a look at other renewable energy news this week.

RELATED:

Energy Transition: It Takes More than a Village

Experts Shed Light on US Critical Minerals Challenges, Solutions

Energy Storage

TC Energy’s Proposed Storage Project Moves to Final Evaluation

The Ontario Ministry of Energy could give a decision on the proposed Ontario Pumped Storage Project by the end of the year, developer TC Energy said July 10, following the province’s release of its sustainable roadmap.

If approved by regulators and TC Energy’s board of directors, the pumped hydro storage facility would become Ontario’s largest energy storage project, capable of storing enough clean electricity to power one million homes for 11 hours, the company said in a news release.

“Ontario Pumped Storage will be a critical component of Ontario’s growing clean economy and will deliver significant benefits and savings to consumers,” said Corey Hessen, executive vice president and president of TC Energy, Power and Energy Solutions. “Ontario continues to attract major investments that will have large power needs — many of which are seeking zero-emission energy before they invest.”

With a 1,000-MW power capacity, the project is expected to lower greenhouse-gas emissions by about 500,000 tonnes per year—equivalent to taking 150,000 cars off the road, according to TC Energy. Developers have proposed constructing the project, which includes a 375-acre reservoir, at the Department of National Defense’s 4th Canadian Division Training Centre in Meaford, Ontario in the territory of the Saugeen Ojibway Nation, a prospective project partner.

“Should the partnership proceed, Saugeen Ojibway Nation will jointly develop, construct, operate and own the project, and would be entitled to a significant share of the project’s revenues that would provide lasting economic benefits to both Nations for years to come,” Conrad Ritchie, chief of Saugeen First Nation, and Veronica Smith, chief of Chippewas of Nawash Unceded First Nation, said in a joint statement.

TC Energy plans to make an FID on the project in 2024. The project is expected to start operations in the early 2030s, pending regulatory and corporate approvals.

United Power, Ameresco Seal Battery Storage Contract

United Power Inc., a Colorado-focused electric cooperative, has tapped Ameresco Inc. to install a multi-site 78.3-MW battery storage project on the cooperative’s electric distribution system, according to a July 10 news release.

The project comes as part of a 20-year agreement between the two companies. Ameresco will provide four 11.75-MW and four 7.84-MW battery arrays at eight of United Power’s substation sites, allowing the power company to dispatch power as needed.

“The use of batteries on our distribution network is essential to a resilient and responsive power system, and we are excited to be moving ahead with one of the most aggressive plans for such a system,” United Power CEO Mark A. Gabriel said in a news release. “These battery arrays will allow us to balance our power needs throughout the day and incorporate local renewables more efficiently.”

Hydrogen

Hyzon Marks Milestone in 200-kW Single-stack Fuel Cell System

New York-based Hyzon Motors, a hydrogen fuel cell technology developer, said July 10 it has successfully completed factory acceptance testing of its first nine single-stack 200-kilowatt (kW) Fuel Cell System (FCS) B-samples at its production and innovation center in Illinois.

The advancement moves the company closer toward commercialization and commencement of full-scale production of the fuel cell systems in 2024.

“Our goal is to accelerate the clean energy transition by providing hydrogen fuel cells to power zero-emission mobility,” Hyzon CEO Parker Meeks said in a news release.

Instead of pairing two 110 kW FCS, which is typically done by fuel cell electric vehicle suppliers, Hyzon said its single-stack design has the same output with a lighter weight and lower cost. The company also said the single-stack FCS is expected to have a 20% increase in miles per kilogram of hydrogen versus a 120-kW FCS.

Work is underway by the company to boost its FCS manufacturing rate with the installation of more full- and semi-automation assembly and inspection process equipment, Hyzon said. Next steps include completing production of the remaining 16 B-samples and starting production of C-samples in second-half 2023.

JLEN to Invest in German Green Hydrogen Production Site

JLEN Environmental Assets Group said on July 10 it will invest up to €9.2 million (US$10 million) in a green hydrogen production site in Germany, along with a consortium of investment funds and clean energy developer HH2E.

The production site is in Lubmin, Germany, and will be able to produce over 6,000 tonnes of green hydrogen per year during its first phase.

Further development phases are expected to increase capacity to over 1 GW with annual production exceeding 60,000 tonnes of green hydrogen.

The Lubmin plant will be built and operated by HH2E and will produce green hydrogen to the transport industry and large-scale energy and industrial consumers, JLEN said.

An FID is expected in the coming months, with construction of the plant starting directly afterward, it added.

RNG

Casella Waste, Waga Enter RNG Deal

U.S.-based Casella Waste Systems and Waga Energy have signed an agreement to initially produce about 380 gigawatt hours of renewable natural gas (RNG) per year using Wagabox technology at Casella landfills in northeastern U.S.

Waga said July 11 it will deploy the capital needed to fund the construction of three RNG units, which it will own and operate for 20 years, according to the commercial agreement with Casella.

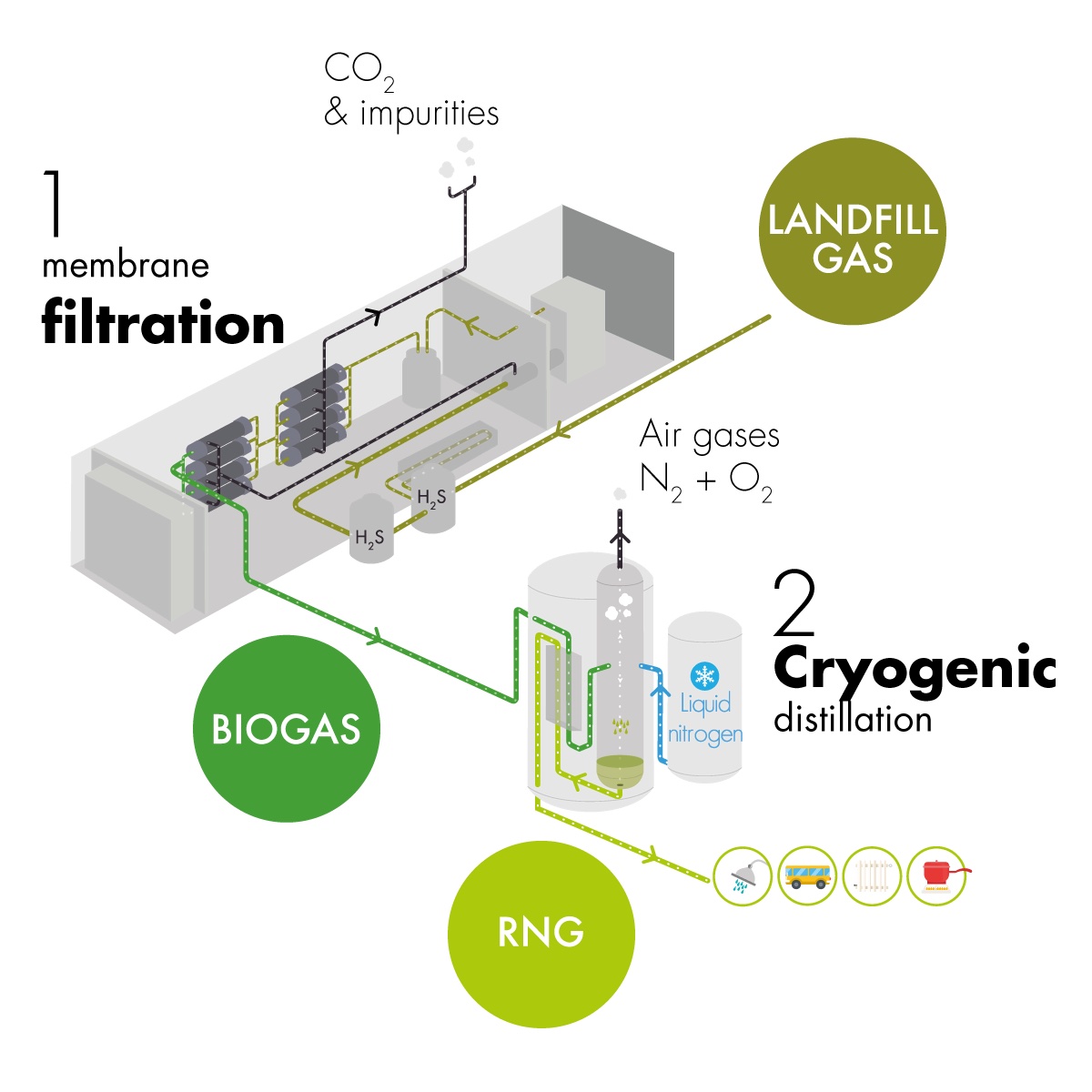

The company’s Wagabox technology combines the membrane filtration and cryogenic distillation upgrading processes. As explained by Waga, CO2 and impurities from the landfill gas are removed by the membrane filtration. A cryogenic vessel is then used to separate methane from the oxygen and nitrogen, resulting in RNG. The company said the technology recovers 90% of methane gas in landfills.

Operations are scheduled to start in about 24 months.

Solar

Eni’s JV GreenIT Signs Deal to Start Up Four Solar Projects in Italy

Eni-led renewable energy joint venture GreenIT has signed a deal with UK-based Hive Energy and SunLeonard Energy to build up four agri-voltaic solar projects in Italy, the Italian energy group said on July 10.

The new sites will have an overall capacity of up to 200 MW and will be located in the central and southern regions of Lazio, Apulia, and Sicily.

The solar panels structures will be installed on arable land and raised above ground level to lever the synergies between agriculture and the production of renewable energy, Eni said.

GreenIT is owned by Eni’s renewable and retail unit Plenitude for 51% and by CDP Equity for the remaining 49%.

RELATED: SolarBank Invests in Photovoltaic Developer

Wind

BP, TotalEnergies Victorious in $14B Wind Auction Offshore Germany

Germany’s offshore wind journey started a new chapter July 12 as the country’s regulator named energy giants BP and TotalEnergies as top bidders in an auction that brought in €12.6 billion (US$14 billion).

The winning bids mark both companies’ entry to the German offshore wind market amid a push toward development of lower-carbon energy resources.

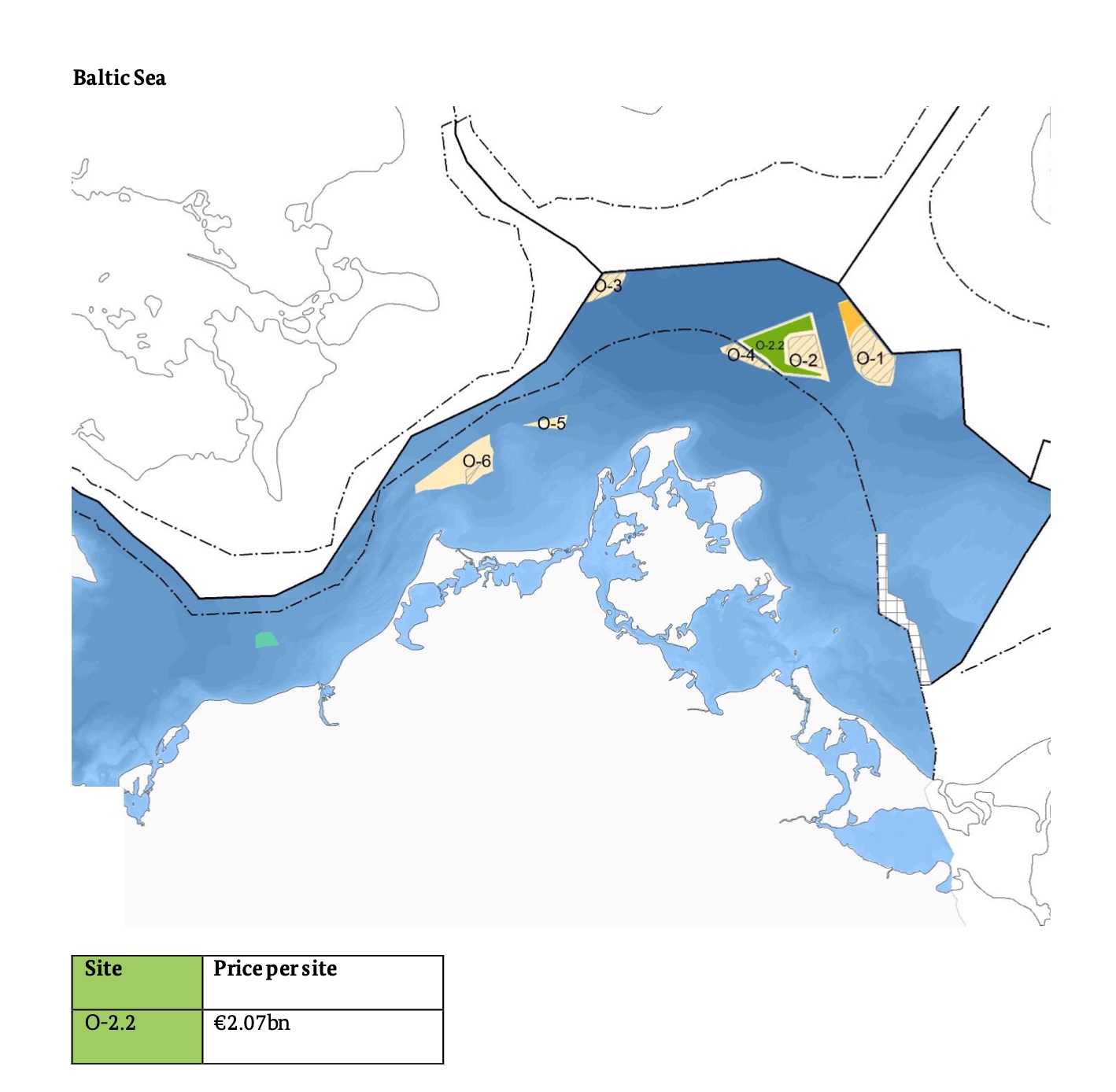

Four sites were up for grabs—three in the North Sea and one in Baltic Sea—with a total combine volume of 7 GW, according to German energy regulator Bundesnetzagentur. The auction, which utilized a dynamic bidding process for the first time after several zero cents per kilowatt hour (kWh) were submitted, took place as Germany targets 30 GW of offshore wind capacity by 2030.

“The results confirm the attractiveness of investing in offshore wind energy in Germany,” said Klaus Müller, president of the Bundesnetzagentur. “Competition in offshore wind power has never been so high.”

BP landed rights to develop two sites, with winning bids of €1.83 million/MW for site N-11.1 in the North Sea and a bid of €1.56 million/MW for another site in the North Sea. Located in water depths of about 40 m, the sites have combined generating capacity of 4 GW. Total bids for BP were about €$6.7 billion.

TotalEnergies was awarded two concessions: a 200-sq-km site in the North Sea capable of producing 2 GW of electricity and a 100-sq-km, 1-GW site in the Baltic Sea with a 1-GW potential. Together, the wind farms will produce enough electricity to power 3 million homes, the company said. Its bid for the two sites totaled about €5.8 billion.

Pattern Energy Starts Operations at Lanfine in Alberta

California-headquartered Pattern Energy said on July 11 operations have begun at its 150-MW Lanfine Wind power project in Alberta, Canada.

The company has secured a 10-year power purchase agreement with wood products company West Fraser for half of the facility’s output, Pattern said in a news release.

The CA$335 million project features 35 Vestas V150 4.3-MW turbines. Electricity produced at the wind farm is enough to power 30,000 homes annually in Alberta.

With the startup of Lanfine, Pattern Energy boosts its operated wind facilities in Canada to 11.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

NextEra Energy, GE Vernova Partner to Bolster US Grid

2025-01-27 - The CEO of NextEra Energy, which has entered a partnership with Ge Vernova, said natural gas, renewables and nuclear energy will be needed to meet rising power demand.

Freeport LNG’s Texas Plant Back in Production Post Winter Disruption

2025-01-27 - vWiner storm Enzo knocked out the Quintana Island, Texas plant’s electrical supply on Jan. 21.

What's Affecting Oil Prices This Week? (Jan. 27, 2025)

2025-01-27 - For the upcoming week, Stratas Advisors predict that the price of Brent crude will threaten $75.

Trump Stirs Confusion with Support, Spurning of Canadian Oil

2025-01-24 - President Trump signed an order that could boost Canadian crude imports — and then said the U.S. doesn’t need Canadian crude.

US LNG Exporter Venture Global's Shares Dip After IPO

2025-01-24 - Venture Global’s pre-IPO pricing at $25 a share valued the Gulf Coast LNG operator at some $65 billion, but shares fell below $25 by about 3% in trading Jan. 24.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.