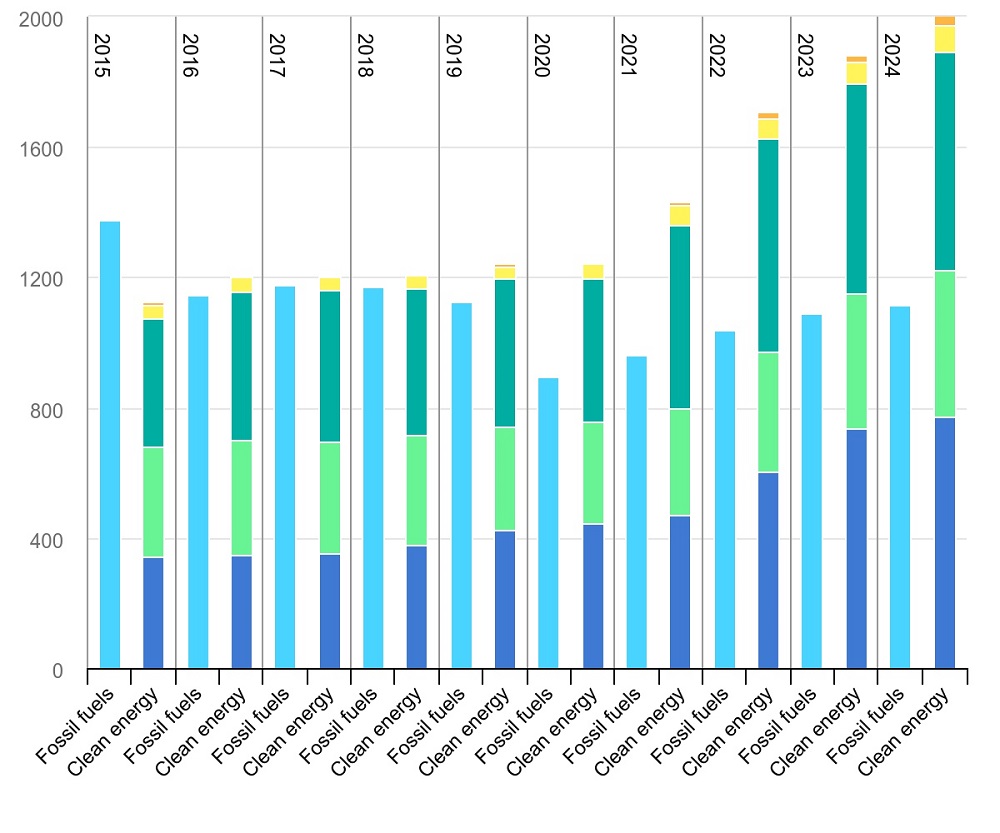

Global clean energy investments in technology and infrastructure are expected to reach $2 trillion in 2024, nearly double that of the amount going into fossil fuels, according to a report released this week by the International Energy Agency (IEA).

The upbeat outlook for clean energy came as supply chain woes eased and costs continued to fall, despite pressures on financing. However, that doesn’t mean dollars are flowing everywhere they are needed. IEA Executive Director Fatih Birol said clean energy investment in developing economies is “severely lacking today.”

“For every dollar going to fossil fuels today, almost two dollars are invested in clean energy,” Birol said in a release. “The rise in clean energy spending is underpinned by strong economics, by continued cost reductions and by considerations of energy security.”

Industrial policies also play a factor as major economies compete for advantages in new clean energy supply chains.

“More must be done to ensure that investment reaches the places where it is needed most,” Birol said.

The Paris-based intergovernmental organization forecasts total energy development will surpass $3 trillion this year, with about $2 trillion going toward clean energy technologies that include efficiency improvements, electric vehicles (EV), energy storage, grids, heat pumps, low-emission fuels, nuclear power and renewables. About $1 trillion in investment is forecast for coal, natural gas and oil.

Globally, more investments are going into solar photovoltaics for electricity generation. The sector is expected to see investments rise to $500 billion as module prices fall, the IEA said.

Of the clean energy investments, China is slated to account for the biggest share—at an estimated $645 billion—driven by EVs, lithium batteries and solar investments, according to the report. Europe comes in second with an expected investment of $370 billion, followed by the U.S. at about $315 billion.

The U.S., which remains the world’s largest oil and gas producer, accounts for 15% of global clean energy investment, according to the report, which highlighted federal incentives that are speeding up deployment and development of new clean energy manufacturing capacity. Clean energy investment in the U.S. overtook fossil fuels in 2020, rising to about $280 billion in 2023 from $200 billion in 2020, the IEA said.

Here’s a look at other renewable energy news this week.

Energy storage

Russia to Speed Up Sole Lithium Project to Cut Import Reliance

Russia plans to speed up its only lithium production project by 3years - 4 years, from an originally planned 2030, to cut its dependence on imports and battery components, the CEO of the Polar Lithium joint venture (JV) said June 6.

Supplies from Chile and Argentina have dried up since 2022 after sanctions were imposed on Russia. Russia has since had to rely on lithium carbonate supplies from Bolivia and China.

Polar Lithium, a JV of Russian metals giant Nornickel and state-owned nuclear energy firm Rosatom, is developing the Kolmozerskoye lithium deposit in northwestern part of the country. It aims to become Russia’s first-ever domestic producer of lithium-bearing raw materials and eventually build full local production of lithium-ion batteries.

“Lithium is really clearly becoming the oil of the 21st century,” Polar Lithium CEO Igor Demidov said during a conference in St. Petersburg.

The project was originally expected to reach full annual production capacity of 45,000 metric tons of lithium carbonate and hydroxide by 2030. Subject to shareholder approval later this month, Polar Lithium aims to speed up development of the deposit and launch the first stage of production—in the pilot mode and at 10% of total planned capacity—in 2026-2027, Demidov said.

RELATED

Occidental, BHE Renewables Form JV to Extract Lithium

Geothermal

Inpex Gears Up for Geothermal Drilling in Japan

Inpex Corp. on June 6 said it will begin in an exploratory geothermal drilling project in Japan in 2027, having carried surveys assessing potential resources.

The company plans to drill in Shibetsu Town, Hokkaido. Inpex, which is stepping up its renewable energy initiatives, is targeting geothermal power generation to help lower emissions.

“If the exploratory drilling operations result in the discovery of geothermal resources in sufficient quantities to warrant the development of the project, this is expected to contribute to the expansion of INPEX’s geothermal business in Japan in alignment with the company’s net zero ambitions,” the company said.

Hydrogen

TotalEnergies, Air Products Ink 15-year Hydrogen Deal

Industrial gas supplier Air Products has agreed to supply hydrogen to TotalEnergies’ northern European refineries as part of a 15-year agreement, according to a June 7 news release.

Starting in 2030, Air Products will begin supplying 70,000 tons of green hydrogen annually, which is expected to avoid about 700,000 tons of CO2 each year. The agreement was reached following TotalEnergies’ call for tenders in 2023. The Paris-headquartered energy company strives to lower greenhouse-gas emissions from its operated oil and gas operations by 40% by 2030 compared to 2015 levels, the release said.

“We always believed that if we made clean hydrogen available at commercial scale, the demand would be there,” said Air Products CEO Seifi Ghasemi. “This contract validates our long-term strategy. Clearly the demand is here, and it will grow significantly as we move forward, playing an essential role in decarbonizing heavy industry and other sectors.”

TotalEnergies also signed a power purchase agreement with Air Products to supply 150 megawatts (MW) of solar power in Texas.

Shell Selects Ceres for Green Hydrogen

Ceres Power Holdings on June 4 said it was chosen by Shell to design a solid oxide electrolyzer (SOEC) module capable for use in large-scale industrial applications.

The 10-MW electrolyzer would be used to produce green hydrogen at 36kWh/kg, the company said in a news release. The U.K.-based clean tech company has been working with Shell to deploy a 1-MW SOEC system at the energy company’s R&D facility in Bangalore, India.

“Building on this demonstration, the focus of this contract is to develop a pressurized module design that can be scaled to 100s of megawatts and be integrated with industrial plants to produce sustainable future fuels,” Ceres said in a news release.

The electrolyzer could be used to produce hydrogen for synthetic fuels, ammonia and green steel.

RELATED

Element Fuels Progresses Plans for Hydrogen-powered Refinery, Power Plant

Industry Angst Mounts as Treasury Weighs Hydrogen Tax Credit Rules

Hydrogen Left Hanging as DOE Prolongs Contract Negotiations

Solar

NextEra, Entergy to Develop 4.5 GW of Solar, Energy Storage Projects

NextEra Energy is partnering with Entergy to develop up to 4.5 gigawatts (GW) of solar generation and energy storage projects, the companies said June 7.

The two companies have entered a five-year joint development agreement to accelerate development of projects in Arkansas, Louisiana, Mississippi and Texas.

“We believe the power sector is at an inflection point, and growing electricity demand will be met by low-cost, renewable generation and storage,” said Rebecca Kujawa, president and CEO of NextEra Energy Resources, the renewable energy unit of NextEra. “We’re pleased to reach this agreement because it further strengthens our long-standing collaboration and adds up to 4.5 GW on top of the more than 1.7 GW of renewable energy projects already underway with Entergy.”

The agreement was reached as Entergy works to grow its renewable capacity to about 9 GW by 2031. In April, the Louisiana-headquartered company had about 8.9 GW of renewable generation projects in service or in development. Entergy currently provides electricity for about 3 million utility customers in Arkansas, Louisiana, Mississippi and Texas.

Recurrent Energy Marks Initial Closing of BlackRock Investment

Canadian Solar subsidiary Recurrent Energy has closed on most of the planned $500 million investment from a fund managed by BlackRock’s Climate Infrastructure business, the solar company said June 3.

When the transaction is fully complete, the investment will represent 20% of the outstanding fully diluted shares of Recurrent Energy on an as-converted basis, Canadian Solar said in a news release. The funds will help Recurrent transition from being a developer of utility-scale solar and energy storage projects to also being a long-term owner and operator in select markets in regions that include the U.S. and Europe.

Recurrent currently has a global project development pipeline of 26 GW in solar and 56 gigawatt-hours (GWh) in storage, according to the release. The company aims to have 4 GW of solar and 2 GWh of storage in operation in the U.S. and Europe by 2026.

“With this financial and strategic support from BlackRock, Recurrent Energy is well-equipped to advance our development of key solar and energy storage projects globally,” said Recurrent Energy CEO Ismael Guerrero. “We value our partnership with BlackRock and appreciate their commitment to our mission of delivering clean, reliable, and affordable power to the world, today and tomorrow.”

The investment from BlackRock’s Climate Infrastructure Global Renewable Power Fund IV was first announced in January 2024.

Engie Solar Project in Texas Starts Operations

Paper and packaging company WestRock said the 230-MW Bernard Creek Solar project developed in Texas by Engie North America has started operations.

Looking to lower its global greenhouse-gas emissions, WestRock entered a virtual power purchase agreement with Engie for 207 MW from the project, according to a news release.

The project is located in Wharton County, southwest of Houston. It is designed to produce about 500,000 megawatt hours annually.

RELATED

Recurrent Energy Marks Initial Closing of BlackRock Investment

Wind

BOEM Clears Way for Central Atlantic Offshore Wind Leases

The Bureau of Ocean Energy Management (BOEM) issued on June 6 its final environmental analysis that found “no significant impacts” from leasing Central Atlantic coastal areas for potential offshore wind development off the Delaware, Maryland and Virginia coasts.

“BOEM is proud to continue to support the clean energy transition in a responsible manner in the Central Atlantic region,” said BOEM Director Elizabeth Klein.

“We will continue to work closely with Tribes, our other government partners, ocean users, and the public to ensure that any development in the region is done in a way that avoids, reduces or mitigates potential impacts to ocean users and the marine environment.”

As per the release, BOEM plans to hold a sale in the Central Atlantic later this year and a final sale notice will be published at least 30 days prior to the sale, including the time and date of lease sale and qualified participants.

The Department of the Interior announced a proposed offshore wind lease sale for two Wind Energy Areas in the Central Atlantic and one offshore the Commonwealth of Virginia in early December last year, the agency added.

Scientists are still investigating the potential impacts of offshore wind energy development on marine life, according to the National Oceanic and Atmospheric Administration website. Site assessment, construction and operations increase ocean noise, which could affect the mating and navigation behaviors of fish, whales and other species.

RELATED

NY Finalizes Contracts for Two Offshore Wind Projects

Balmoral Focusing on ‘Buoyant’ Offshore Wind Sector

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

Polar LNG Express: North American NatGas Dynamics to Change with LNG Canada

2025-02-21 - The next major natural gas export project in North America has a location advantage with Asian markets. LNG Canada opens up a new pathway that will change the price dynamics for producers.

Glenfarne Signs on to Develop Alaska LNG Project

2025-01-09 - Glenfarne has signed a deal with a state-owned Alaskan corporation to develop a natural gas pipeline and facilities for export and utility purposes.

Trinity Gas Storage Adds Texas Greenfield Gas Storage Complex

2025-01-20 - Trinity Gas Storage has opened a 24-Bcf gas storage facility in Anderson County, Texas, to support the state’s power grid.

Venture Global’s Plaquemines Gets FERC Approval for Phase 2 Generators

2025-03-24 - Venture Global continues to ramp up production after an early winter startup.

Brookfield Sells Pipeline Stake to ArcLight for Exit Totaling $1.7B

2025-03-24 - Kinder Morgan will continue as Natural Gas Pipeline Co. of America’s operator following Brookfield Infrastructure’s sale of a 25% stake to Arclight Capital Partners.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.