Electric vehicle and battery maker Tesla plans to build a megafactory near Houston where it will manufacture and distribute utility-scale battery energy storage systems and other products, according to a tax abatement agreement with Waller County in Texas.

As part of the tax agreement, which was approved by Waller County commissioners on March 5, the company will receive abatements from the county based on property upgrades that include $44 million in facility improvements and $150 million in Tesla manufacturing equipment. Tesla, owned by businessman and head of the U.S. Department of Government Efficiency Elon Musk, already leases a building in the Empire West Industrial Park in Brookshire, but the space is occupied by a third-party logistics company—not Tesla, a county official said during the commissioners’ court meeting.

The facility will be similar to one of Tesla’s factories in Lathrop, California, according to Tesla. The Lathrop Megafactory has a capacity of 40 gigawatt hours with an annual target of 10,000 Megapacks, the company’s utility-scale batteries.

“We are super excited about this opportunity—1,500 advanced manufacturing jobs in this county and in the city,” Tesla representative Shiv Mysore said during the meeting. “We’re going to be here operating as Tesla, bringing advanced manufacturing into this community.”

In addition to the battery energy storage systems, the facility will be used for warehousing, distribution and storage of automobile-related items as well as for research and development, according to the tax agreement.

If Tesla complies with the terms of the agreement, the company could receive a 60% tax abatement for 10 years starting in 2026.

Here’s a roundup of some other renewable energy news.

Energy storage

E3 Lithium, Imperial Oil Finalize Land Deal for Clearwater Project

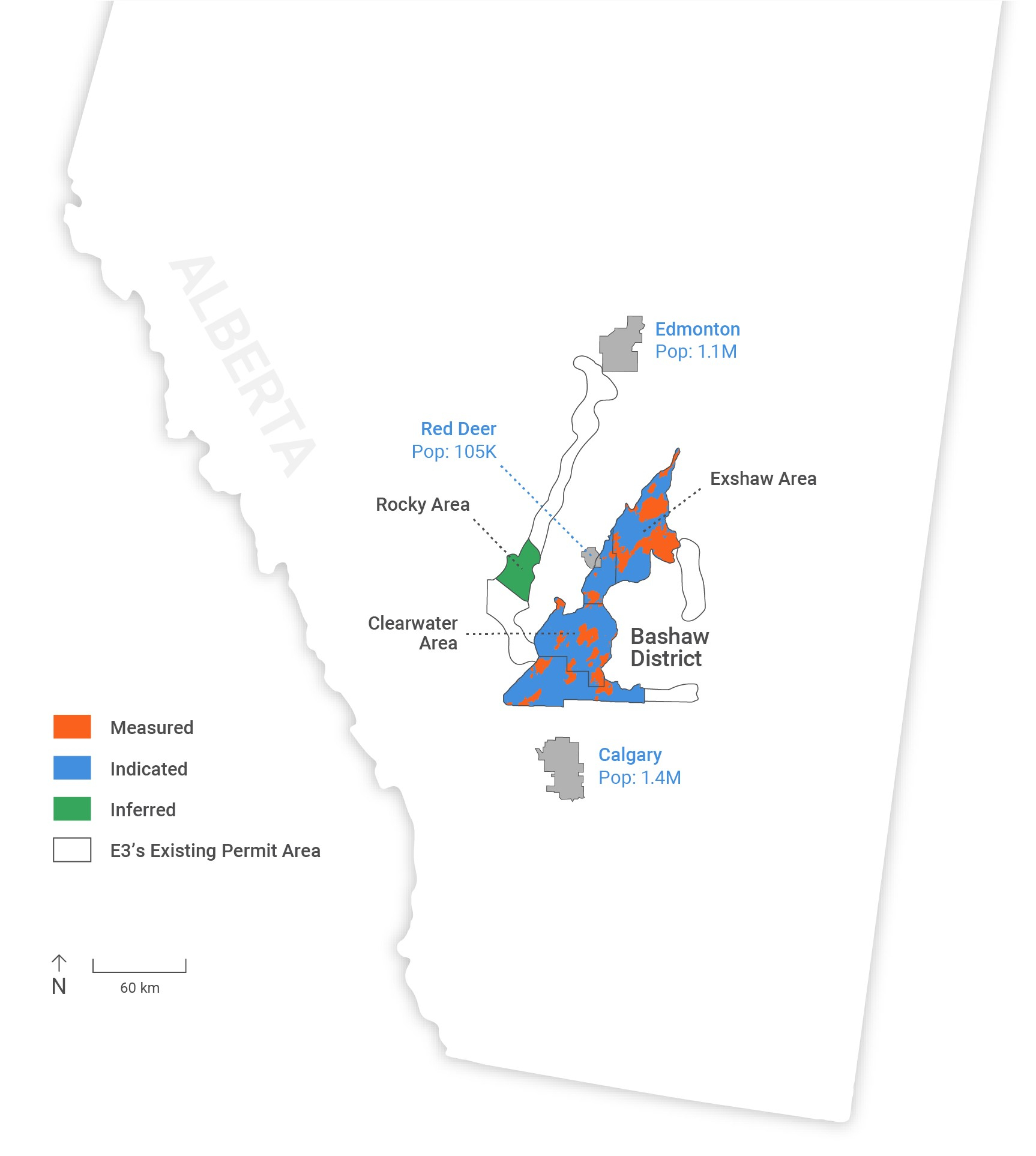

Calgary-based E3 Lithium has finalized agreements with Imperial Oil Ltd. for freehold mineral land for the Clearwater lithium project in Alberta, Canada.

The lease, which has a 10-year primary term with a renewable 10-year term on the mineral title, covers 110 sections of Imperial’s freehold land. The agreement includes cancellation of more than 3.4 million warrants granted to Imperial at CA$1.86 per warrant, with E3 paying CA$4.15 million (US$2.89 million) in three installments through the first three quarters of 2025, according to a news release.

“Imperial’s successful collaboration with E3 Lithium has been instrumental in advancing E3’s lithium extraction pilot and progressing opportunities from the Leduc reservoir,” said Heather Eggleston, vice president of Low Carbon Solutions at Imperial. “Imperial’s contribution of its freehold land leases provides further support for E3 Lithium’s Clearwater Project and their overall lithium development in Alberta.”

E3 said the agreement enables the company to build on the success of its 2023 pilot operations as it carries out its 2025 demonstration program for the project. The company plans to begin construction on Clearwater by mid-2026 and the demonstration facility commissioned in third-quarter 2025. The project will use direct lithium extraction to convert brine into battery-grade lithium.

In related news, E3 Lithium said it was conditionally approved for up to $4.7 million in a non-repayable investment from Canada’s Critical Minerals Infrastructure Fund. The funding will be used to advance the Clearwater project.

Alabama Power to Build 150-MW Battery Storage System on Former Power Plant Site

(Reuters) Utility Southern Co.’s Alabama unit said on March 3 it will develop a 150-megawatt (MW) utility-scale battery energy storage system (BESS) on the site of its former coal-fired power plant in Walker County.

The new Gorgas Battery Facility will house lithium ion phosphate batteries that will have a two-hour duration. Construction is expected to begin this year and be completed by 2027. The seven-acre facility will be designed as a standalone system that will connect to and charge directly from the electric grid, Alabama Power added.

With companies and countries increasingly moving to clean energy to combat climate change, BESSs are becoming increasingly more important. These systems can store excess energy generated from renewable sources, which can be particularly useful for optimizing energy usage during times of low power generation or high demand.

Batteries have the potential to help integrate additional clean energy resources into the company’s power generation mix, providing complementary technology for variable, weather-dependent resources, such as solar.

“Batteries can charge when energy costs are lower and discharge when energy costs are higher, helping keep costs down. They can also supply energy to our system quickly in response to changing conditions,” said Brandon Dillard, senior vice president of Alabama Power’s generating fleet.

Geothermal

Google, SLB, Project Innerspace Form Geothermal Partnership

Google Cloud has teamed up with SLB and geothermal-focused nonprofit Project Innerspace to accelerate the adoption of global geothermal energy, the tech giant said March 6, aiming to simplify the resource identification, development anfrrd deployment process.

As part of the collaboration, Project Innerspace’s geothermal data set, called GeoMap, will be combined with expertise from SLB’s geothermal consulting services business GeothermEx to identify geothermal resources worldwide. GeoMap, also known as the Geothermal Exploration Opportunities Map, was developed by Project Innerspace in partnership with Google. The data set includes surface and subsurface modules, a suitability analysis tool and a techno-economic sensitivity test, according to the organization’s website.

Hosted on the Google Earth Engine, GeoMap utilizes Google Cloud's scalable infrastructure, BigQuery and Vertex AI. It also integrates diverse datasets, allowing users to visualize and analyze geothermal potential across different regions, effectively pinpointing promising locations for development, Google said in a news release.

“This collaboration paves the way for widespread geothermal deployment on a global scale and will help meet future energy needs,” said Kyle Jessen, managing director, Energy Sector, Google Cloud. “By bringing Project Innerspace’s GeoMap, built on Google Cloud’s AI and data technologies, and SLB's expertise in geothermal energy, businesses will have access to the tools and experience needed to grow geothermal energy programs around the world.”

US Defense Department Taps Sage, GreenFire, Others to Explore Geothermal

Sage Geosystems and GreenFire Energy were selected by the U.S. Department of Defense (DoD) and the U.S. Air Force to explore ways geothermal energy can be deployed to boost U.S. national security and energy dominance.

Having achieved the “awardable” status, the companies can explore developing utility-scale geothermal power plants domestically and abroad at U.S. military bases, the companies said in separate news releases March 3.

“We deliver premium power by matching the right technology to fit the geology,” said GreenFire Energy President Rob Klenner. “We can ensure that our military has access to reliable, co-located, scalable baseload power—even when grid reliability is in question.”

Sage received the awardable status for three separate applications. Two of the submissions involve partnerships—one with an independent energy and carbon management company and another with a major energy equipment manufacturing company and an energy service company.

“We are excited to play a role in helping unleash America’s energy dominance with secure, plentiful, geothermal energy,” Sage CEO Cindy Taff said.

The companies were selected through the DOD’s Chief Digital and Artificial Intelligence Office’s innovative solicitation process known as the Tradewinds Solutions Marketplace, which is designed to accelerate the procurement and adoption of mission critical technologies, the releases stated.

Hydrogen

StormFisher Hydrogen Selects MAN Energy Solutions for Power-to-X Project

MAN Energy Solutions has been selected by StormFisher Hydrogen to carry out pre-FEED work for a 200-MW Power-to-X methanation reactor for a plant that will be built in North America, according to a March 5 news release.

The reactor will convert hydrogen, made via electrolysis using about 200 MW of renewable electricity, and CO2 into methane. StormFisher said the plant will produce 2.5 million MMBtu of e-methane annually, which is equivalent to about 50,000 metric tons of LNG.

“The planned facility is a major component in StormFisher Hydrogen’s plans to support increasing e-fuel production capacity in North America and reinforcing American leadership in the energy sector,” said StormFisher Hydrogen CEO Judson Whiteside. “MAN Energy Solutions has the expert knowledge in methanation required to deliver the pre-FEED study to keep the project moving forward on a successful track.”

MAN Energy Solutions plans to conduct in-house tests at its Deggendorf, Germany, facility to validate a quality booster, StormFisher said. The booster is designed to increase methane purity by reducing unreacted components in the e-methane output, according to the release.

Solar

Tandem PV Secures $50MM in Funding, Debt to Make Solar Panels

Solar panel maker Tandem PV has landed $50 million in Series A funding and debt to help it build a commercial-scale manufacturing facility in the U.S., the company said March 4.

The company, which specializes in perovskite solar technology, said the fund raise was led by investment company Eclipse with participation from Constellation Energy, Planetary Technologies, Uncorrelated Ventures, Trellis Climate, Tom Werner (former CEO of SunPower), Stifel Bank, CSC Leasing and other existing and new investors.

“This investment is a resounding endorsement of our mission to revolutionize solar energy and re-establish the U.S. as a leader in renewable technology," said Tandem PV CEO Scott Wharton. “With Eclipse’s backing, we are no longer just developing breakthrough technology—we are bringing it to market at scale. As global demand for clean energy surges, Tandem PV is stepping up to meet it—delivering next-generation solar power that is more powerful, more sustainable, and made in America.”

Corning, US Solar Manufacturers Partner on American-Made Panel

(Reuters) Technology company Corning has struck a deal with U.S. solar manufacturers Suniva and Heliene to produce what will be the only solar panel composed of all American-made components, the companies said on March 6.

The alliance between Georgia-based cell maker Suniva, panel maker Heliene and Corning is a meaningful milestone in the effort to establish a U.S. solar manufacturing sector that can compete with China. Heliene is based in Canada but produces panels in Minnesota. Corning and its subsidiary Hemlock Semiconductor produce silicon wafers and polysilicon, the solar industry’s raw material, in Michigan.

“Corning is excited to leverage our advanced manufacturing expertise to deliver top-quality solar components and secure the U.S. energy supply chain,” said AB Ghosh, Corning vice president and general manager of solar technologies and CEO of Hemlock Semiconductor.

U.S. solar manufacturing capacity has grown steadily in recent years thanks to generous tax credits for clean energy factories included in former President Joe Biden's 2022 Inflation Reduction Act.

President Donald Trump has refocused the nation's energy policy onto maximizing oil and gas production and away from fighting climate change, but clean energy companies argue their businesses are aligned with Trump’s agenda to boost domestic energy resources and American jobs.

The new module contains a solar cell with up to 66% domestic content—the highest percentage on the market, according to the companies. The product would allow solar project developers to qualify for a bonus domestic content tax credit of 10% on top of the base Inflation Reduction Act tax credit for clean energy projects of 30%.

Wind

EDF Renewables, Masdar Ink Texas Wind Deal with Soluna

Soluna Holdings, a data center developer and operator, has tapped EDF Renewables North America (EPFR-NA) and Abu Dhabi Future Energy Co.-Masdar for power from their jointly-owned wind farm in south Texas.

As part of the power purchase agreement, Soluna will purchase up to 166 MW of energy produced at the Las Majadas wind project in Willacy County, EDFR-NA said in a news release. The behind-the-meter power will be used by Soluna’s nearby Project Kati data center.

“This innovative PPA structure provides a flexible solution to the challenges of transmission constraints and curtailment, essentially allowing an alternate route to capture under-utilized electricity,” the release states. “In parallel, it provides clean power to an energy intensive operation—advanced computing applications, including artificial intelligence (AI).”

BP, JERA Offshore Wind JV Unveil Leadership Teams

Power generator JERA Co. Inc. and BP have named the leadership team of their 50:50 offshore joint venture (JV) announced in December 2024.

Nathalie Oosterlinck, who currently serves as CEO of JERA Nex, will be CEO of the Nex BP offshore wind JV. Erin Eisenberg will serve as CFO. She is currently the vice president of finance, low carbon energy at BP. Richard Sandford, currently senior vice president of offshore wind at BP, will be the JV’s chief development officer.

Other members of the leadership team include: Zlati Christov, currently chief investment officer at JERA Nex, as the JV’s chief Investment officer; Eric Antoons, currently co-CEO of Parkwind, as COO; and Alfonso Montero Lopez, currently vice president of offshore wind engineering at BP, as chief technical officer.

BP and JERA announced plans to combine their offshore wind businesses in December. The alliance formed as BP pulled back from renewables to focus on higher returns and cash flow generation. The offshore wind sector, including in the U.S., has faced high interest rates, supply chain issues and inflation that slowed or stopped some developments in recent years.

The new entity, subject to regulatory and other approvals, will have operating and development assets with a total potential net generating capacity of 13 GW across Europe, Asia Pacific and the U.S., BP said in the release.

Ørsted, Nuveen Crank Up Gode Wind3 Off Germany

Ørsted and partner Nuveen Infrastructure have commissioned the Gode Wind3 wind farm offshore Germany, producing enough electricity to power about 250,000 households, according to a news release.

The wind farm has an installed capacity of 253 MW and consists of 23 Siemens Gamesa wind turbines.

“This milestone underscores our shared commitment to advancing renewable and independent energy solutions and delivering sustainable value for society, the environment, and our investors,” said Jordi Francesch, managing director of renewable energy investments at Nuveen Infrastructure.

The wind farm marks the fifth for Ørsted offshore Germany. Ørsted and Nuveen are also working on the 913-MW Borkum Riffgrund 3 in the German North Sea. The project comprises 83 turbines and is expected to begin operations in 2026.

TotalEnergies, Skyborn Commission Yunlin Wind Farm Offshore Taiwan

The 640-MW Yunlin wind farm offshore Taiwan has started full operations, providing enough electricity to power about 600,000 homes, TotalEnergies said March 4.

The company and its partners recently inaugurated the wind farm. Located about 15 km off Taiwan’s west coast, Yunlin consists of 80 wind turbines.

“This 640 MW project will help us achieve our 2025 targets for 35 GW of gross renewable capacity and over 50 TWh of net electricity production, amounting to 10% of TotalEnergies’ energy output,” said Olivier Jouny, senior vice president of renewables at TotalEnergies. “Our role as technical operator on Yunlin will allow us to strengthen our offshore wind competencies as we look ahead to our future projects in Germany, Denmark, and the United Kingdom.”

Development and construction were led by Skyborn Renewables, which holds a 31.98% stake in the project. TotalEnergies has a 29.46% stake in Yunneng Wind Power Co. Ltd., the joint venture responsible for the project, according to the news release. Other stakeholders are EGCO Group with 26.56% and Sojitz with 12%.

Yunlin is one of the largest wind farms offshore Taiwan.

Skyborn CEO Patrick Lemmers called the project a testament to the company delivering on its promises and creating value. “We promised to deliver it, and we’ve done just that,” he said.

Skyborn will continue to lead management services for the wind farm, while TotalEnergies said it will take the lead on technical operations management.

Saipem, Divento Sign Deal for Floating Offshore Wind Technology

Italy-based Saipem has signed an agreement with Divento, a consortium led by Copenhagen Infrastructure Partners, Plenitude and CDP Equity, for floating offshore wind projects in Italy, the companies said March 5.

The deal involves using Saipem’s STAR 1 floating wind technology for the approximately 250-MW 7 Seas Med project planned for offshore Sicily and the 504-MW Ichnusa Wind Power project planned for offshore Sardinia. Both projects, which are in the development phase, are awaiting completion of the regulatory framework for Italy’s first auctions for renewables technologies, which include floating offshore wind.

Saipem’s STAR 1 technology, designed to make semi-submersible floating wind foundations, will support the projects’ participation in the auctions.

Britain to Invest $71MM in Scottish Port for Offshore Wind Expansion

(Reuters) Britain will invest 55.7 million pounds (US$71.45 million) in the Port of Cromarty Firth in Scotland to expand the facility to become a hub for floating offshore wind, the government said March 5.

Britain has a target to largely decarbonize its electricity sector by 2030, which will require a huge ramp up in renewable power like offshore wind. Using floating turbines not fixed to the seabed like traditional wind farms allows the projects to be much deeper out at sea, making them less visible to communities that might object and where wind speeds are likely to be stronger.

Currently, technology costs for floating wind projects are higher than for fixed turbines, while few ports have the capacity to host the huge structures.

“This initial financial backing from the U.K. government paves the way for the port to secure match-funding from other investors, with the port expected to become operational by the start of 2028,” a statement from The Department for Energy Security and Net Zero said.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

Velocity Management Invests in Pipeline Builder M Wright Services

2025-01-16 - Velocity Management Advisors has made a minority investment in M Wright Services and three of Velocity’s partners will join the construction firm’s board.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Venture Global LNG Pares IPO Hopes by 15% to $2.2B

2025-01-22 - LNG exporter Venture Global nearly halved the price per share, while increasing the number of shares it expects to offer.

Argent LNG, Baker Hughes Sign Agreement for Louisiana Project

2025-02-03 - Baker Hughes will provide infrastructure for Argent LNG’s 24 mtpa Louisiana project, which is slated to start construction in 2026.

Pinnacle Midstream Execs Form Energy Spectrum-Backed Renegade

2025-02-03 - Renegade Infrastructure, led by Permian-centric Pinnacle Midstream developers Drew Ward and Jason Tanous, have received a capital commitment from Energy Spectrum Partners.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.