Meta, the parent company of Facebook, has again topped the list of corporate solar users with nearly 5.2 gigawatts (GW) of capacity, according to a report released this week by the Solar Energy Industries Association (SEIA).

The company was joined by tech players Google and Amazon as the top three companies with the most solar procurements under contract through first-quarter 2024, SEIA said in its Solar Means Business report Nov. 20. The report said about 40 GW of onsite and off-site solar capacity has been installed by U.S. businesses through the first quarter.

Big Tech companies have emerged as dominant solar buyers as they look for resources to meet surging power needs amid data center growth. The deep-pocketed companies, which seek to satiate power needs quickly, are also looking to meet sustainable goals with renewable and lower-carbon power sources.

However, they aren’t the only ones tapping solar. Retail giants Walmart and Target (largest onsite corporate solar user) along with Verizon and Home Depot are among the top 10 corporate solar users, according to the report.

“Some of the largest industrial and data operations in the world continue turning to solar and storage as a reliable, low-cost way to power their operations,” said SEIA president and CEO Abigail Ross Hopper. “These industry giants are investing in solar through a diverse range of applications, including onsite and off-site installations, on carports, paired with storage, or even as an anchor tenant for a community solar project.”

With 936 megawatt-hours (MWh) of installed battery capacity, Google topped the list of energy storage users, which was tracked for the first time this year in the report. It was followed by Apple and Meta, with Target, Walmart, Home Depot and Kohl’s also making the list.

“Adding new solar energy to the grid is a critical aspect of our approach to ensuring our data centers are supported by clean and renewable energy,” said Carolyn Campbell, head of clean and renewable energy, East, at Meta. “We’re thrilled to rank number one for corporate solar procurement in SEIA’s report this year and we continue to find ways to grow the grid to benefit everyone and support our goal of matching our global operations with 100% clean and renewable energy.”

Here’s a look at other renewable energy news.

Bioenergy

Anaergia Scores Operations Contract at Waste-to-RNG Facility

Anaergia Services has entered a long-term operations and maintenance contract for Sevana Bioenergy’s waste-to-renewable natural gas facility, Anaergia said in a Nov. 15 press release.

The Rialto Bioenergy Solutions (RBS) facility, the largest of its kind in North America, is designed to convert up to 1,000 tons per day of municipal wastewater biosolids and landfill-diverted organic waste into up to 985,000 MMBtu per year of RNG and fertilizer.

RNG is produced from processed organic waste extracted from mixed municipal solid waste using Anaergia’s OREX, an advanced anaerobic digester technology.

Under the terms of the contract, Anaergia is set to operate the facility for the next 10 years.

“The RBS is a critical asset serving the organic waste diversion needs of Los Angeles’ RecycLA franchise and the broader Southern California region. We are making capital and operational improvements to ensure we provide a reliable organics processing solution,” said Steve Compton, president of Sevana Bioenergy.

RELATED

Valuable Waste: Synata Bio’s Microbes Convert Waste CO2 Into Ethanol

Supermajors Ramp Up Biofuel Investments, Rystad Says

Energy storage

Element Energy Commissions Second-Life Battery Storage Project in Texas

Element Energy has commissioned what is being called the world’s largest second-life battery storage project, the company said Nov. 21.

Located in west central Texas, Element Energy’s 53-MWh storage project consists of 900 repurposed electric vehicle batteries. The project has been dispatching power to the Electric Reliability Council of Texas grid since May.

“We’re thrilled that our technology completes the circular supply chain for energy storage, while also making batteries safer,” said Element Energy CEO Tony Stratakos. “With our commercial project in West Central Texas, we have validated our technology at scale. We are now focused on deploying our growing supply of second-life batteries.”

The project was awarded $7.9 million in Bipartisan Infrastructure Law funding by the U.S. Department of Energy. The company said it plans to carry out more grid-scale projects, having screened nearly 2 gigawatt hours (GWh) of second-life batteries.

E3 Lithium Lands Site for Production Facility in Alberta

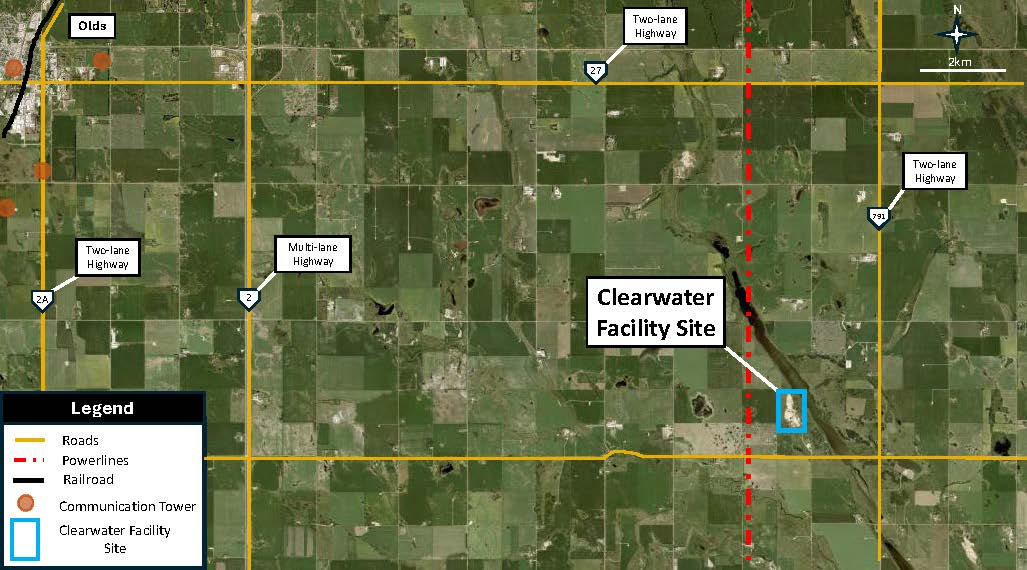

E3 Lithium has secured an end-of-life gravel pit as the site of its Clearwater project after Mountain View County authorities in Alberta, Canada approved the company’s request.

The project aims to become Western Canada’s first commercial lithium production facility.

The company on Nov. 21 said it secured the brownfield site on the former Dyck Gravel Pit land in Mountain View County under an option with the county. The option to purchase for CA$1,562,128 (US$ 1117513.91) has not been exercised, the county said in a separate news release Nov. 21. The option includes provisions for a municipal reclamation cost, and requires E3 to rehabilitate and return the site to pastureland once commercial operations are completed.

“We have a significant opportunity to build the Clearwater Project in an ideal location; repurposing an existing industrial site fits into the vision for E3,” said E3 Lithium CEO Chris Doornbos. “The site also happens to be easily accessible and surrounded by essential infrastructure for successful operations. This positioning is crucial for securing future growth pathways as the company develops into a key player in the expanding global lithium market in Western Canada.”

With access to utilities and roadways, the site will host the central facility where brine will be collected, lithium will be extracted and battery-grade lithium salts will be produced, E3 said in a news release.

A pre-feasibility study for the Clearwater project indicated 1.13 million tonnes of proven and probable lithium hydroxide monohydrate reserves.

Chile Mining Group SQM’s Net Profit Slips on Lower Lithium Prices

(Reuters) Chile’s SQM, the world’s second-largest lithium producer, reported a 73% drop in third-quarter profit on Nov. 20, as higher sales volumes failed to offset a sharp decline in prices due to a supply glut.

Lithium miners around the world have been impacted by a sustained drop in lithium prices in the past few months due to weaker-than-expected demand for electric vehicles. Lithium is a major component of batteries for electric cars.

SQM reported net profit of $131 million for the quarter, below analyst estimates of $162 million, based on LSEG data. Revenue fell 41% year-on-year to $1.07 billion, in line with analyst forecasts.

Lithium sales volumes rose almost a fifth compared with the same period last year, but average prices plunged 67%, the mining group said. Between the second and third quarters, prices dropped 24% for the metal.

Prices are expected to fall further in the current quarter, SQM said, tracking with the company’s prior forecasts of weak pricing throughout 2024.

“Although demand continues to grow at a strong pace, mainly driven by strong EV sales growth in China, we continue to see the prices pressured by an oversupply,” CEO Ricardo Ramos said in a statement.

In a call with analysts to discuss the results, executives said they did not plan to pull back on production in response to excess supply dragging down prices.

“For next year, we’re not planning any curtailment,” said Felipe Smith, commercial vice president of SQM’s lithium business. “We’re just planning to increase our sales in line with increasing production.”

RELATED

Exxon Mobil, LG Chem Ink Deal for Lithium Carbonate

MVP Lithium Taps Evove to Commission DLE Plant in Canada

Hydrogen

Hystar Launches Hydrogen Technology Pilot in Norway

Norway-headquartered Hystar has inaugurated its HyPilot project located at the Kårstø gas processing plant in Rogaland, Norway, the company said Nov. 19.

The project is the in-field demonstration of Hystar’s 1.5-MW containerized proton exchange membrane electrolyzer, the company said in the release. The project will provide performance data from different operating regimes, including intermittent power supply, it added.

“HyPilot marks an important juncture both for Hystar and for the global green hydrogen industry,” Hystar CEO Fredrik Mowill said. “The project allows us to showcase our patented, ultra-efficient electrolyzers and the exceptional benefits of our unique design and scalable technology … bring to the industry.”

In October, Hystar announced it was the recipient of a €26 million grant from the EU Innovation Fund. The funding will go toward an automated factory Hystar is developing in Norway with an annual capacity of 1.5 GW . The company said it is targeting startup in 2027 with ambitions to scale to 4.5 GW of annual capacity in 2031.

Japan’s MOL, KEPCO Sign Agreement for Liquefied Hydrogen Carrier Study

(Reuters) Japan’s Mitsui OSK Lines and Kansai Electric Power Co. have signed a memorandum of understanding for the joint study of a liquefied hydrogen carrier, the companies said in a joint statement Nov. 19.

This is the first agreement in Japan between a shipping company and a power generation company for marine transport of liquefied hydrogen, as they work toward establishing a hydrogen supply chain.

The companies will study and review optimal vessels and operations in the liquefied hydrogen supply chain and the safety of such vessels, as well as international laws and regulations related to the marine transport of liquefied hydrogen.

RELATED

Gulf Coast, Midwest Hydrogen Hubs Land up to $2.2B in DOE Funding

Solar

Pivot Energy Lands Over $450MM in Financing for Solar Projects

Independent power producer (IPP) Pivot Energy has secured more than $450 million in financing to support construction of 300 MW of distributed generation projects across the U.S., the company said Nov. 21.

Led by First Citizens Bank with support from ATLAS SP Partners, Bank United, Comerica and Cadence Bank, the $450 million debt warehouse facility will help fund Pivot’s initial projects underway. The portfolio of nearly 100 projects is mostly community solar projects aiming to become operational within the next two years.

The company also said it closed a structured equity investment from HA Sustainable Infrastructure Capital Inc. in a new project joint venture (JV). The JV will support the same portfolio of projects with the opportunity to sell tax credits directly to large corporations instead of relying on complex tax equity structures, Pivot said.

The financing agreement is Pivot’s largest to date, the company said.

“Pivot is redefining how to finance portfolios of distributed generation solar projects at scale which reflects our mission to advance the renewable energy transition,” said Pivot Energy CFO Bret Labadie. “We are thrilled to expand our longstanding partnership with First Citizens Bank and welcome new relationships with key institutions like ATLAS and HASI, all of which are deeply respected in the clean energy space.”

The community solar projects are located in California, Colorado, Delaware, Hawaii, Illinois, Maryland, Minnesota, New York and Virginia.

China Finalizes Stricter Investment Guidelines for Solar Manufacturing

(Reuters) China’s industry ministry on Nov. 20 finalized investment guidelines for solar photovoltaic (PV) manufacturing projects in an effort to rein in overcapacity, according to a notice on the ministry website.

The guidelines direct companies to ensure a minimum capital ratio of 30% for solar PV projects. Previously, that standard applied only to polysilicon manufacturing projects while the minimum capital ratio for other PV projects was 20%.

The ministry did not provide a definition of the ratio, which typically refers to the percentage of total investment shareholders invest with their own assets.

However, the rule, which also contains guidelines on efficiency and energy consumption, is not binding in project approvals. It encourages local governments to rationally allocate manufacturing projects based on local resource endowment and industrial foundations.

The ministry said the guidelines were aimed at upgrading and structural adjustments in the PV industry.

The announcement follows a reduction in export tax rebates for solar components that analysts say would lead to slight price increases for overseas buyers as costs are passed on.

China’s solar panel manufacturers have been calling for the government to step in and curb over-investment in the industry that has led to a plunge in prices of solar cells and modules, but prices have remained stubbornly low.

RELATED

RWE Acquires Majority Interest in R3 Renewables

National Renewable Solutions Raises $145MM for Solar, Storage Project in New Mexico

SolarBank Plans for 4.6-MW Solar Project in New York

Wind

Return, Verified to Develop Wind-Powered DAC Hub in Texas

Return Carbon, a direct air capture (DAC)-focused project developer and investor, has partnered with Texas-based startup Verified Carbon and IPP Greenalia to develop a wind-powered DAC hub in Tom Green County, Texas, according to a Nov. 21 news release.

Called Project Concho, the project aims to initially remove 50,000 tons of carbon annually before 2030 but is designed to scale to 500,000 tons annually. Greenalia will build the new wind farm, while Dutch climate tech company Skytree will use its DAC technology for the project.

“Project Concho is a significant step forward in scaling up DAC,” said Martijn Verwoerd, managing director of Return Carbon. “This opportunity aligns perfectly with Return Carbon and Verified Carbon’s joint mission to mitigate climate change through the scalable commercialization of new technologies in impactful infrastructure projects.”

The consortium says the project will be the first-ever wind-powered DAC carbon removal development

Octopus Energy Partners with Skyborn to Enter France’s Offshore Wind Market

(Reuters) Britain’s Octopus Energy said on Nov. 19 that the French government has selected its JV between its Octopus Energy Generation business and Skyborn Renewables (Skyborn) to bid in next year’s offshore wind tender.

The news marks Octopus’ first foray into early-stage offshore wind tenders globally.

The French government has pre-qualified 12 bidders for the up to 2.9-GW AO9 tender for four offshore wind sites, including Iberdrola, RWE and TotalEnergies. No financial value was announced.

Winners are due to be announced in autumn 2025, with the projects due to become operational between 2032 and 2034.

France has a relatively small offshore wind market, with around 1 gigawatt (GW) of installed capacity, but the government is targeting growing this capacity to 18 GW by 2035 and to 45 GW by 2050, Octopus said in a statement.

“Offshore wind will undoubtedly play an integral role in France’s energy system, harnessing strong winds to generate more clean power,” said Zoisa North-Bond, CEO of Octopus Energy Generation.

Octopus, which started investing in offshore wind farms in 2022, has six wind farms across the United Kingdom, Netherlands and Germany. It has invested $2 billion in offshore wind globally and is planning to inject $20 billion into the sector by 2030.

It has also invested in developers of new offshore wind projects in countries including Norway, Sweden and South Korea.

Skyborn is an offshore wind developer and operator which had partnered with EDF Renewables, a subsidiary of Enbridge Inc. and Canada Pension Plan Investment Board (CPP Investments) and had successfully commissioned a 500-MW wind farm earlier this year and has another offshore wind project under construction in the country.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

How DeepSeek Made Jevons Trend Again

2025-03-21 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

BYOP (Bring Your Own Power): The Great AI Race for Electrons

2025-01-06 - Data-center developers, scrambling to secure 24/7 power, are calling on U.S. producers to meet demand as natgas offers the quickest way to get more electrons into the taps.

E&P Seller Beware: The Buyer May be Armed with AI Intel

2025-02-18 - Go AI or leave money on the table, warned panelists in a NAPE program.

Paradoxes and Power: Why DeepSeek AI May Be Good News for Energy

2025-03-05 - The lower cost and power demand of DeepSeek could be a positive for AI adoption and result in increased proliferation and demand, an analyst said.

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.