Despite headwinds facing the scaleup of hydrogen globally, several companies are pushing forward with projects. Air Liquide, TotalEnergies and Ecopetrol are among the companies making moves at refineries and elsewhere.

In solar news, a Japan-based company plans to develop 2.5 gigawatts (GW) of solar module manufacturing capacity by year-end 2025 in the Houston area.

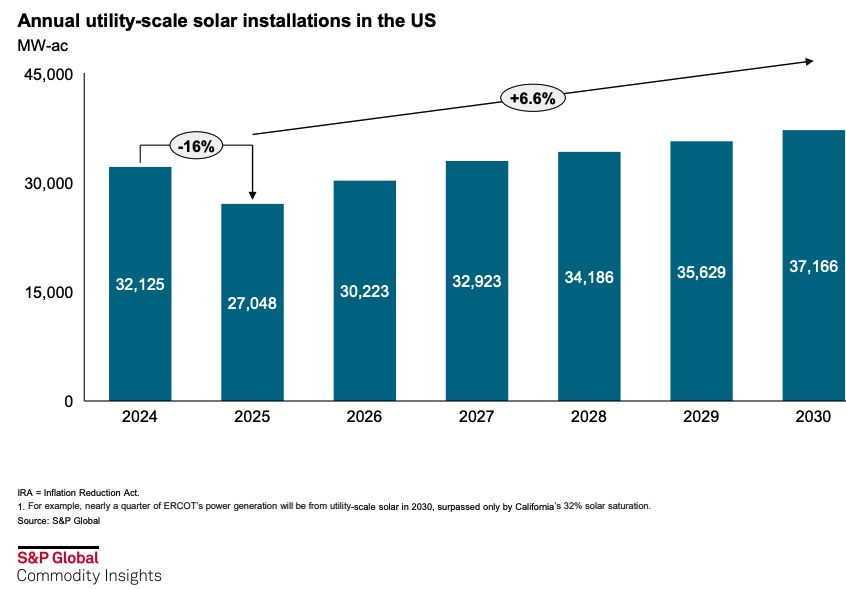

Plus, an inaugural solar market report from American Clean Power and S&P Global forecasts that 2024 will be another record-breaking year for utility-scale solar installations at more than 32 GW.

The report projects new installations will reach 37 GW in 2030 as capital costs continue to fall. The levelized cost of energy for utility-scale solar could drop from $46 per megawatt hour (MWh) to $38/MWh by 2030, though the report cautioned there are risks associated with new tariffs that may increase costs.

RELATED

New US Solar Tariffs on Southeast Asia to Raise Prices, Cut Profit Margins

The solar industry, like some other renewables and lower-carbon technologies, have benefited from incentives, including investment and production tax credits in the Inflation Reduction Act (IRA).

“The incoming administration and new Congress could attempt to change or remove certain portions of the IRA and accompanying guidance,” according to the report, “but the IRA is unlikely to be completely undone.”

Here’s a roundup of some renewable energy news.

Hydrogen

Air Liquide, TotalEnergies Partner to Produce Hydrogen in France

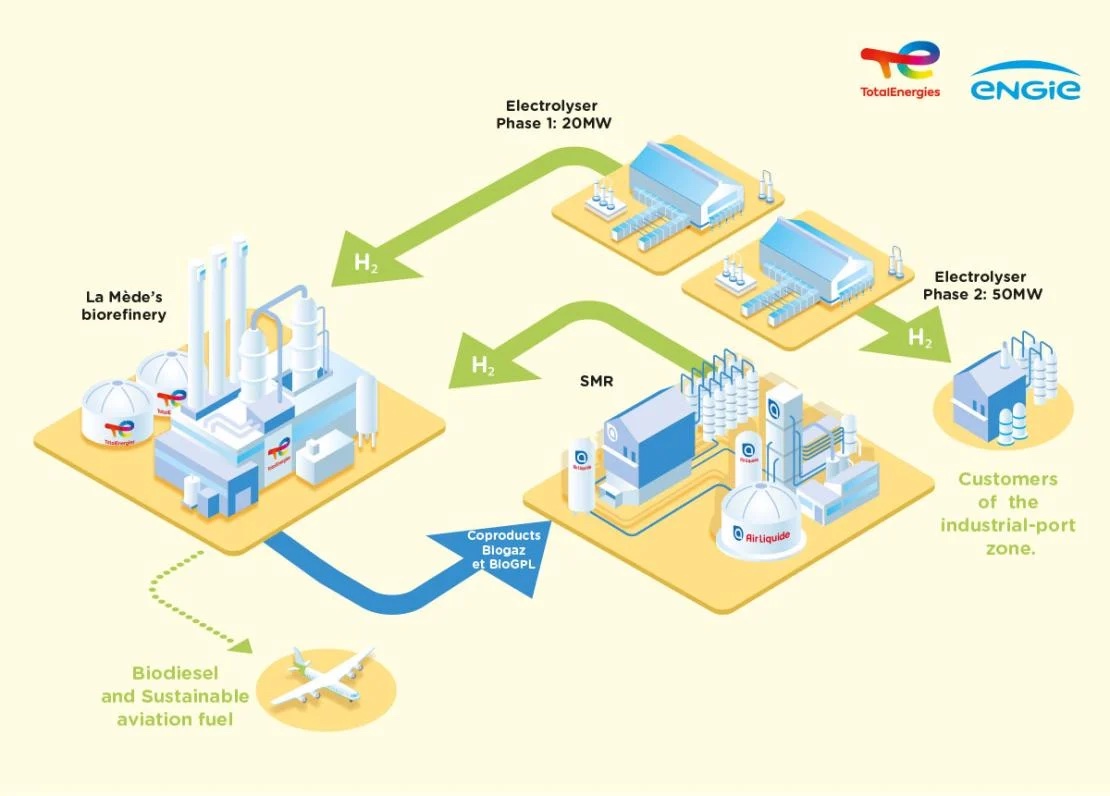

Industrial gases company Air Liquide and TotalEnergies will jointly invest €150 million (US$158 million) and work together to produce renewable hydrogen at the La Mède biorefinery in southeast France, TotalEnergies said Nov. 25.

The partnership takes shape as TotalEnergies moves to decarbonize its European refineries. Plans are for Air Liquide to build and operate a hydrogen production unit, using steam methane reforming, at La Mède with an annual capacity of 25,000 tons, according to a news release. The hydrogen will be used at the biorefinery to produce biodiesel and sustainable aviation fuel.

The new unit is expected to start production in 2028, TotalEnergies said.

“This new renewable hydrogen production project, carried out with Air Liquide, allows us to accelerate the decarbonization of our La Mède platform,” said Vincent Stoquart, president of refining and chemicals for TotalEnergies. “Almost ten years after the announcement of its conversion, La Mède is continuing its transformation and is becoming a low-carbon hydrogen production center, thus contributing to the decarbonization ambition of the Provence-Alpes-Côte-D’azur region.”

The company’s efforts also include the Masshyli green hydrogen project with Engie. The companies aim to have an annual capacity of 10,000 tons per year. If subsidies are secured and the project is approved by European and French regulators, plans are to start the first 20-MW electrolyzer in 2029.

Ecopetrol to Build Green Hydrogen Plant at Cartagena Refinery

Ecopetrol, Colombia’s majority state-owned energy company, plans to build a new green hydrogen plant at its refinery in the Caribbean city of Cartagena for some $28.5 million, it said Dec. 2.

The plant will produce 800 tonnes of green hydrogen per year, making it Latin America’s biggest such facility, Ecopetrol said.

Colombia’s President Gustavo Petro has made weaning the Andean country off of fossil fuels a major goal of his administration and Ecopetrol—the country’s biggest company—has previously announced plans to take part in an auction for planned offshore wind projects.

“Ecopetrol has entered the modern era of producing clean fuels,” the company’s CEO, Ricardo Roa, said in the press release.

Production of low-emission hydrogen could contribute between $400 million and $485 million on average per year by 2040 to the company’s EBITDA, Ecopetrol added.

Germany’s KfW to Provide $25B Loan for Hydrogen Network

KfW will provide a €24 billion (US$25 billion) loan to help develop a future hydrogen network in Germany, the state lender told Reuters, at a time when companies have warned that the technology will take longer than expected to take off.

Germany is betting on hydrogen, which can be used in part to replace natural gas, as it seeks to decarbonize the economy and find ways to absorb intermittent renewable supplies into the power grid.

A core 9,040-km network for hydrogen, to be built by 2032, is an essential part of the planned shift to the fuel.

While existing natural gas pipelines will make up 60% of the network—connecting ports, industry, storage facilities and power plants—their operators and owners will still have to shoulder billions of euros in investments to either retrofit lines for hydrogen or build new ones.

In order to keep user fees for the network at an acceptable level, KfW will compensate operators via a so-called amortization account, with plans to have the costs paid back by 2055, KfW said. As revenue from network fees increase in the future, surplus income will be redirected to the amortization account, facilitating gradual repayment of the loan, KfW added.

If the amortization account is not balanced by the planned end of the hydrogen ramp-up in 2055, the federal government will assume 76% of the risk with the remaining 24% to be borne by the core network operators.

KfW’s announcement comes amid growing skepticism among German companies about whether Berlin’s plans to rely more heavily on hydrogen to cut emissions are realistic and affordable.

In September, Norway’s Equinor scrapped plans to export hydrogen to Germany, citing high costs and insufficient demand.

Earlier this month, German state-owned utility Uniper warned it was likely to slow down a planned €8 billion investment in cleaner fuels amid slower than expected industrial demand for hydrogen.

Solar

BLM Sets Aside Land for Solar Project Review in Utah

The U.S. Bureau of Land Management (BLM) has temporarily set aside just under 5,160 acres of public land associated with the Star Range solar project in Utah.

The move, announced Nov. 29, means the land will be withdrawn from public land laws for two years while the BLM reviews potential environmental impacts of the proposed project. The withdrawal from laws includes the Mining Law but excludes the Mineral Leasing Act.

Located near Milford in Beaver County, Utah, the project proposed for development by Hanwha Energy Corp.’s 174 Power Global could generate an estimated 600 megawatts (MW) of solar electricity.

Part of the site is on approximately 4,288 acres of BLM-administered public land, which is undeveloped and relatively flat terrain, according to the BLM. The project, which will be built in two 300-MW phases, will tie into the adjacent Sigurd to Red Butte 345 kV transmission line.

Japan’s Toyo to Buy Solar Facility Near Houston, Produce 2.5 GW of Panels

Japan-based Toyo Co. Ltd. has agreed to acquire a solar module manufacturing facility in the Houston area, where it plans to develop 2.5 GW of solar module manufacturing capacity by year-end 2025.

The company said Nov. 25 it agreed to buy, via its subsidiary Toyo Solar, 100% of membership interests in Solar Plus Technology Texas. The step came as Toyo establishes a manufacturing footprint in the U.S. to meet demand for American-made solar panels.

Toyo Holdings, which holds 75.01% of membership interests in Toyo Solar, will make a capital contribution of $19.96 million to Toyo Solar, according to the news release. The capital will go toward the Phase 1 construction of the manufacturing site.

“Our strategy is to supply end customers with solar solutions that are technologically advanced, highly reliable and cost competitive,” Toyo CEO Junsei Ryu said in a news release. “We are committed to building a robust global solar supply chain structure that efficiently and competitively serves the U.S. market and other regions, adapting to a dynamic policy environment.”

Toyo said its newly leased facility in the Houston metropolitan area is just over 567,000 sq ft. The company plans to start production of 1 GW of annual module capacity by mid-2025 and before ramping up to 2.5 GW by the end of 2025. It aims to hit 6.5 GW by 2029.

“We are confident that our expansion in the U.S. will effectively deliver a comprehensive solar technology solution, addressing bottlenecks for developers, meeting local content requirements for U.S. solar projects, and enhancing Toyo’s competitive advantage,” Ryu said.

Spruce Power Acquires Solar Residential Portfolio in New Jersey

New Jersey Resources (NJR) on Nov. 25 said its subsidiary NJR Clean Energy Ventures has sold its 91-MW residential portfolio to Spruce Power Holding Corp. for $132.5 million.

Proceeds of the sale will be used to lower NJR corporate debt and for general working capital purchases, the company said in a news release.

“Following this transaction, Clean Energy Ventures will have a sharpened focus on the strong opportunities for growth within its commercial solar portfolio, driven by a nearly 1 GW pipeline of diverse investment options,” New Jersey Resources CEO Steve Westhoven said.

Clean Energy Ventures is one of the largest owner-operators of commercial solar in New Jersey. Its residential solar program operated under the brand The Sunlight Advantage. As part of the sale, existing lease agreements for about 9,800 participating landowners will be assumed by Spruce, according to the release.

Colorado-based Spruce owns and operates distributed solar energy assets across the U.S. Earlier this year, the company said it was evaluating residential solar portfolio M&A opportunities as well as organic growth prospects.

Wind

Salamander Offshore Seeks Supplier Innovations

The Salamander Offshore Wind Farm joint venture of Ørsted, Simply Blue Group and Subsea7 is looking for supplier for its 100-MW floating offshore wind project.

The JV said it is opening the second phase of its call for supplier innovation. Registration opens Dec. 3 and access ends Jan. 14, 2025. Areas of interest include construction and operational health and safety; wind turbine foundation integration; novel anchor technology; low carbon materials and processes; and construction vessel optimization, Salamander said in a Nov. 28 news release.

“We want to be engaging with the right people at the right time within our project development,” Tom Brown, innovation manager for Salamander, said in the release. “From a technical perspective, we have already undertaken our concept and pre-FEED engineering stages, so we’re in a better position now to identify solutions that will address project challenges.”

The company plans to begin project construction in 2027 and start operations in 2029.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.