Texas-based Plus Power said this week it has secured $1.8 billion in new financing for standalone battery storage projects aimed at stabilizing the U.S. electrical grid with solar and wind energy.

The company, which develops and owns battery energy storage systems, said Oct. 17 it plans to use the funds to construct and operate five projects with a combined capacity of 1,040 megawatts (MW).

The financing includes $707 million for the 250-MW Sierra Estrella energy storage facility in Avondale, Arizona. The fund raise is also making way for construction of 700 MW of batteries for the Electric Reliability Council of Texas grid, which issued several energy conservation requests during the summer as temperatures and energy demand rose.

“Three new Plus Power battery plants will begin operation by next summer to handle increased demand amid increasingly extreme temperatures and numerous days of scarce operating reserves on the power grid,” Plus Power said in a news release.

With operations in more than 25 U.S. states and Canadian provinces, Plus Power said it has more than 60 projects in its portfolio, 10 gigawatts (GW) in interconnection queues and about 1,650 MW either in operation or construction.

“Over the last year, Plus Power has raised an unparalleled amount of capital for standalone storage projects from a wide range of leading energy project finance banks and investors," Plus Power CFO Josh Goldstein said in the release. “This capital will support the ongoing buildout of the largest and most diverse portfolio of standalone storage projects in the U.S.”

The projects, according to the release, include:

- $212.2 million in tax equity financing from Foss & Co., plus $276 million in construction and term financing for the 300-MW Rodeo Ranch Energy Storage facility in Pecos, Texas;

- $196 million of construction and term financing for the 200-MW Ebony Energy Storage facility in Comal County, northeast of San Antonio.

- $200 million of construction and term financing for the 200-MW Anemoi Energy Storage facility in Hidalgo County on the Mexican border.

The Arizona projects include $202 million in tax equity for the Sierra Estrella facility with a $505 million construction, term loan and letter of credit facility. The 90-MW Superstition Energy Storage project in Gilbert, southeast of Phoenix, secured a $196 million construction, term loan and letter of credit facility.

Energy Storage

E3 Lithium Says Field Pilot Results Exceed Expectations

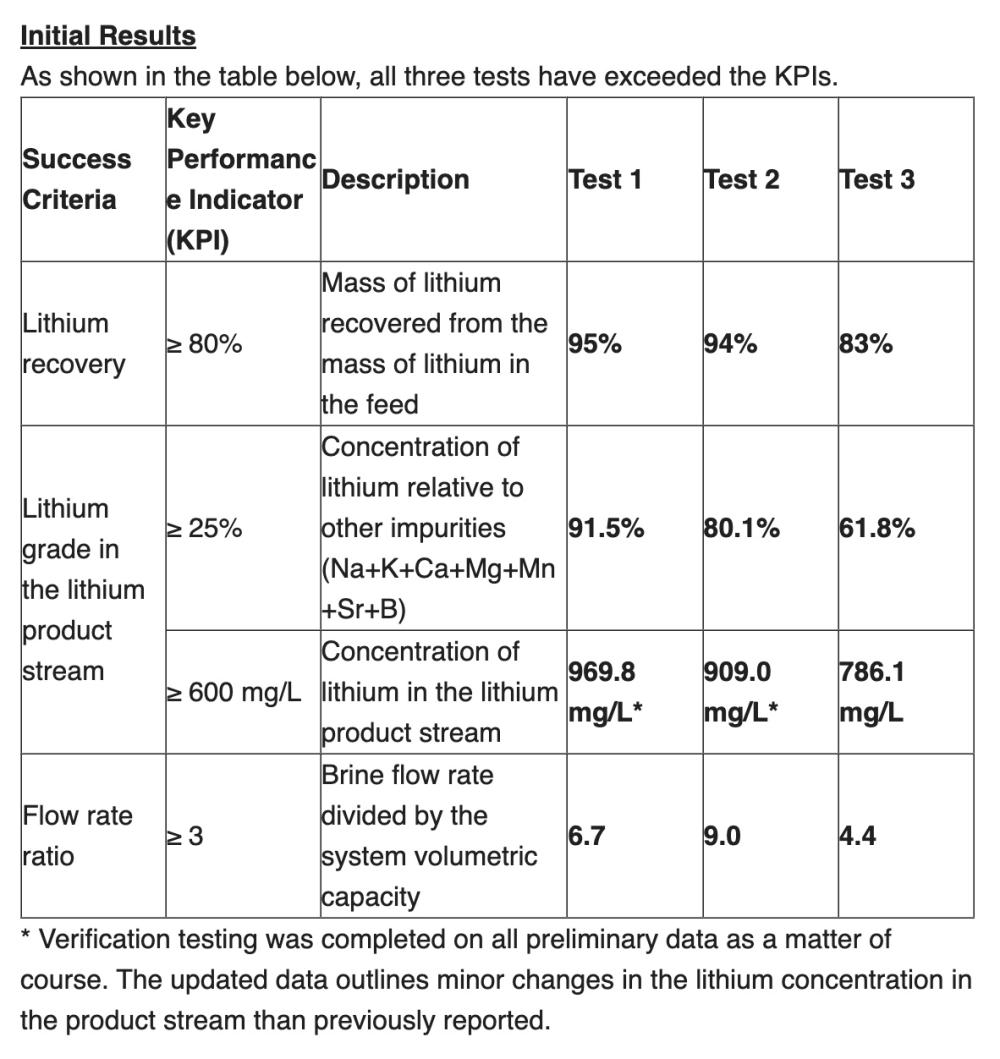

Canada-based E3 Lithium said Oct. 18 results from three optimized tests at its Direct Lithium Extraction (DLE) field pilot plant in Alberta surpassed key performance indicators.

The tests, which help determine whether lithium can be efficiently and effectively extracted at scale from the Leduc brines in Alberta, focused on lithium recovery, lithium grade in the lithium product stream and the flow rate ratio. The results will factor into the overall design of the company’s commercial facility.

“These results have exceeded our expectations and are extremely encouraging,” said E3 Lithium CEO Chris Doornbos said in a news release. “The team is working through the impact of these positive results as we progress the engineering of the facility via our Pre-Feasibility Study. The team continues to operate the pilot to confirm these results and working safely is the highest priority.”

The global push to lower emissions has led to higher demand for lithium, a critical metal and key ingredient for rechargeable batteries. Unlike lithium mined from rock in open pits, DLE is seen as a more environmentally-friendly way of extracting lithium from brine using chemical processes such as ion exchange, solvent extraction or adsorption.

“The goal of the initial three tests was to maximize the flow rate ratio while maintaining lithium recovery and the purity of the product stream,” E3 Lithium explained in a news release. “Various parameters in each of the three tests were modified to increase the flow rate ratio while aiming to ensure recovery was maintained, along with achieving high levels of purity and high lithium concentration.”

Next steps include progressing the testing of the second third party system in fall 2023, the company said.

RELATED

US Announces $3.5 Billion to Bolster Power Grid, Deploy Clean Energy

Hydrogen

HH2E in Talks to Raise Up To $317MM in Debt to Fund Growth

Hydrogen project developer HH2E is in talks to raise up to 300 million euros (U.S.$317 million) in debt to fund its two planned projects in Germany, two people familiar with the matter said.

The company, in which U.K.-listed funds Foresight Group and HydrogenOne Capital Growth own stakes, is working with BNP Paribas as debt adviser, the people said.

HH2E is currently working on getting two hydrogen projects off the ground in Germany, both located in the eastern part of the country, which could both be ramped up to a combined 2 GW in capacity by 2030.

The company, co-founded by former Uniper CEO Andreas Schierenbeck, wants to have 4 GW of capacity in Germany by 2030 and already requires up to 300 million euros in funds for its initial expansion phase.

HH2E confirmed that it has engaged with BNP Paribas as a debt adviser.

German Gas Grid Operator OGE Joins Hydrogen Pipeline Project

German gas grid operator Open Grid Europe (OGE) is joining its French, Spanish and Portuguese peers working to develop a multibillion-euro hydrogen pipeline connecting the Iberian Peninsula to France and on to Central Europe, CFO Frank Reiners said on Oct. 18.

Reiners was speaking at an event on the project, known as H2MED, where a senior German government official called for the pipeline development to be sped up.

“I’m confident we’ll be able to work faster on this project now,” Franziska Brantner, state secretary at Germany’s economy and climate ministry, said at the event held at the Spanish embassy in Berlin. She acknowledged that the path has been “difficult.”

Spain and France, which are both investing in hydrogen to help drive Europe’s transition to a low carbon economy, have disagreed over whether the H2MED pipeline should carry the gas if it is produced using nuclear power.

Solar

Lightsource BP, Conway Complete Solar Farm in Arkansas

Lightsource BP said Oct. 19 it completed the 135-MW Conway Solar at Happy solar farm in Arkansas, which will provide energy to utility Conway Corp. as part of a power purchase agreement.

The solar farm is expected to generate enough clean energy to power 21,000 homes, Lightsource BP said in a news release. Located in Arkansas’ White County, the solar farm also includes a five-acre native pollinator garden with 46 varieties of plants native to Arkansas.

“Work on this project began in 2019 and it is one of the most significant projects for Conway Corp. since our incorporation in 1929,” Conway CEO Bret Carroll said in the release.

Lightsource BP developed, financed and constructed the project, making a $125 million private capital investment. The company said it will also operate the solar farm, which is expected to abate about 162,800 metric tons of carbon emissions annually.

EDPR Sunseap Seeks to Further Boost Solar Capacity in Asia-Pacific

Singapore-based renewables firm EDPR Sunseap has more than doubled its installed solar capacity in the Asia-Pacific region since last year and is looking at new investment opportunities to more than double it again to 2.4 GW by 2026.

Portugal’s EDP Group, which acquired Sunseap in February 2022, said in a statement on Oct. 19 the unit’s capacity was now above 1 GW, which EDP CEO Miguel Stilwell called a “significant milestone” for growth.

“We continue to see attractive new investment opportunities and we have a goal of reaching 2.4 GW of installed renewable capacity in this region by 2026,” he said.

EDPR Sunseap is the Asia Pacific hub for EDP subsidiary EDPR, the world’s fourth-largest renewable energy producer.

EDPR Sunseap is present in nine Asia-Pacific markets, with an installed capacity of 510 MW in Vietnam, 335 MW in Singapore, 100 MW in China and 75 MW in other markets including Japan, Taiwan and Malaysia.

Out of the total capacity, 47% is comprised of large-scale solar parks. The rest are decentralized solar energy projects installed in corporate or residential buildings.

Wind

Avangrid, CIP Install First Turbine at Vineyard Wind

Iberdrola Group’s renewable energy company Avangrid Inc. and fund manager Copenhagen Infrastructure Partners (CIP) said Oct. 18 the Vineyard Wind 1 joint venture installed the first GE Haliade-X wind turbine generator.

The 13-MW turbine is one of 62 wind turbines set to be installed for the project offshore Massachusetts. With a height up to 260 m and a rotor diameter of 220 m, each turbine has one tower, three 107-m blades and one nacelle.

“While this is a landmark for this first-in-the-nation project and the industry, we remain focused on the important work ahead to continue the successful installation campaign of these massive turbines and deliver the first power to Massachusetts homes and businesses this year,” Avangrid CEO Pedro Azagra said in a news release.

Each turbine is capable of providing power to more than 6,000 homes and businesses in the state, the companies said. Together, the 62 turbines are expected to generate enough electricity to power more than 400,000 homes and businesses.

Offshore construction for the 806-MW Vineyard Wind 1 started in 2022 off Martha’s Vineyard. Developers aim to deliver first power by year-end 2023.

Vineyard Wind will be the first U.S. utility-scale offshore wind energy project.

TotalEnergies Commissions Its Largest Wind Farm with Partner SSE Renewables

TotalEnergies and SSE Renewables’ joint offshore wind farm Seagreen, located in the North Sea, is fully operational and running at a 1,075-MW capacity.

Seagreen is a joint venture between TotalEnergies (51%) and SSE Renewables (49%) and is TotalEnergies’ biggest operational offshore wind farm out of its offshore wind portfolio of more than 13 gigawatts (GW). With a foundation reaching almost 60 m below sea level, Seagreen is the deepest fixed bottom wind farm in the world.

Seagreen’s development and construction was led by SSE and began in June 2020, with approximately $4 billion invested since. SSE will now operate the offshore wind farm for its expected 25-year lifetime.

TotalEnergies will commercialize its share of Seagreen production through a mix of a long-term contracts at guaranteed price, including a 15-year contract for difference awarded by the U.K. government, a 15-year private contract for difference with the SSE Group and short-term sales on the whole sale market.

The wind farm can generate 5 terawatt hours—enough electricity to power 1.6 million homes in Scotland annually, according to the company.

“Our participation in the project alongside SSE has enabled us to strengthen our offshore wind expertise which will be extremely useful for our future projects in the United Kingdom, the United States and Germany,” said Patrick Pouyanné, chairman and CEO of TotalEnergies. “It’s also very good news for Scotland, as Seagreen makes a significant contribution to the country’s net zero ambition for 2045.”

Enlight CEO: Genesis Wind Operating Despite Tragic Events

Israel-based Enlight Renewable Energy said Oct. 16 it has begun selling electricity from its Genesis Wind farm in the Golan Heights area, with only five of 39 turbines left to start commercial operations.

“Despite the tragic events in Israel during the past week, the company is continuing to operate normally,” Enlight CEO Gilad Yaavetz said in a news release. “After years of hard work, the vision has now become a reality, as the largest renewable energy project in Israel commences commercial operation.”

The turbines online have a capacity to generate 180 MW of electricity; however, capacity will increase to 207 MW when the remaining five turbines begin operating after testing is complete, Enlight said.

The company added that it plans to develop additional projects in the region, given the wind project included installation of a new 27-km underground high-voltage transmission cable connecting Golan Heights to the Israeli grid.

When fully commissioned, the wind farm is expected to generate enough power for about 70,000 households annually, avoiding an estimated 180,000 tons of CO2 emissions annually, according to Enlight.

Ørsted Enters Deal to Divest 50% Stake in Gode Wind

Ørsted said Oct.17 it agreed to divest a 50% stake in the Gode Wind 3 offshore Germany to funds managed by Glennmont Partners from Nuveen, a clean energy infrastructure-focused fund, in a EUR 473 million deal (US$501 million).

The wind farm, currently under construction, will have a capacity of 253 MW. Ørsted and Glennmont also are partners in the Borkum Riffgrund 3 Offshore Wind Farm, also under construction in the German North Sea, and is a co-owner of Ørsted’s Gode Wind 1 Offshore Wind Farm.

Besides a 50% ownership share in Gode Wind 3, the transaction also includes a commitment to fund half of the project’s construction. If regulatory approvals are granted, the transaction is expected to close in the coming months, Ørsted said.

Gode Wind 3 is scheduled to begin commercial operations in 2024.

In an unrelated deal announced Oct. 17, Ørsted said it selected Taiwan’s Cathay Life Insurance and its affiliate as the preferred bidder to acquire a 50% stake in the 583-MW Greater Changhua 4 wind farm offshore Taiwan. The two companies agreed to enter an exclusivity period to finalize negotiations.

Eolus, Volvo Form Offshore Wind Partnership

Sweden-based renewable energy developer Eolus has teamed up with Volvo Cars to collaborate on developing the Västvind offshore wind power project offshore Sweden, according to a news release Oct. 17.

Located off the coast of Gothenburg, the Västvind will have a capacity of 1,000 MW and potentially generate up to 4.5 TWh of renewable electricity annually. Eolus said the partnership was formed based on hopes that the wind farm would power Volvo Cars’ operations at Hisingen in Gothenburg.

The partnership forms as Volvo Cars moves toward its goal of selling only fully electric cars by 2030.

“We are working hard to reduce the carbon footprint of the entire lifecycle of the car, including the electricity used to manufacture the cars and their batteries,” Johan Lannering, head of strategic collaborations for Volvo Cars, said in the release. “By committing to electricity from offshore wind power outside Hisingen, we want to secure our access to locally produced, renewable electricity at a reasonable cost.”

If required permits are granted, the companies aim to complete the project by 2029.

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

Judgment Call: Ranking the Haynesville Shale’s Top E&P Producers

2025-03-03 - Companies such as Comstock Resources and Expand Energy topped rankings, based on the greatest productivity per lateral foot and other metrics— and depending on who did the scoring.

PE Firm Voyager to Merge Haynesville OFS Firm with Permian’s Tejas

2025-03-17 - Private equity firm Voyager Interests’ Haynesville Shale portfolio company VooDoo Energy Services will merge with Tejas Completion Services as part of a transaction backing Tejas, Voyager said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.