(Source: RigER; Shutterstock.com)

[Editor's note: A version of this story appears in the June 2020 edition of E&P. Subscribe to the magazine here. It was originally published June 1, 2020.]

In today’s hypercompetitive market, energy service companies are quickly learning that it is not enough to be the best at their core business; the greater competitive advantage comes through improving operational efficiency. Old-school tools are out the window as companies race toward operations excellence. While this is an important first step, the true digital oil field offers great advantages in reporting and analytics.

A true digital process helps accounting to bill faster and accurately, and it gives operations detailed information on each piece of inventory, service and rental fleet in real time. The operations department gains insights on hours in use, status of repairs or maintenance, revenue versus costs, and more, for each asset.

These issues were already a problem for companies still using paper tickets. Since the outbreak of COVID-19 and the resulting oil price crash, revenue losses could send a company into bankruptcy.

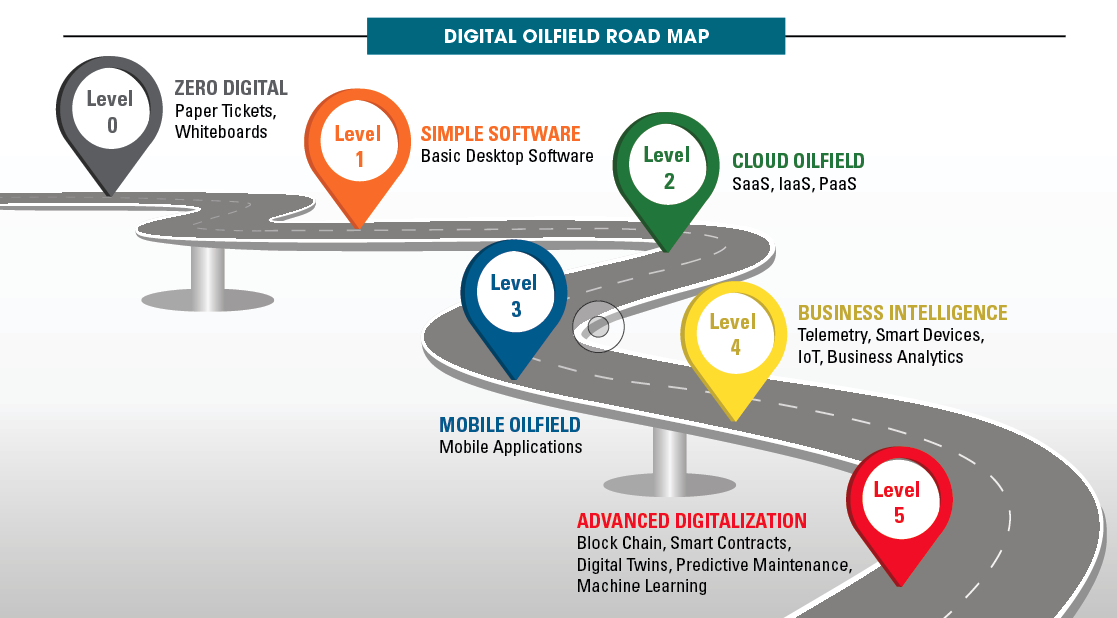

The RigER approach identifies six basic levels of automation in its Digital Oilfield Road Map. A few years ago, most companies were at Level 0 or 1 on the road map, but now more and more have advanced to about Level 3. While it can take up to a few years to get from Level 0 to 5, most companies move incrementally, seeing significant bottom-line savings and efficiencies at each step. This moves them toward operational excellence.

Taking the path forward

The automation process often starts with a basic desktop database such as Microsoft Excel, which is certainly an improvement over the paper and whiteboard system of Level 0. But spreadsheets offer little in the way of operational analysis.

Advancing further opens the door for deeper operational insights. By connecting back-office people to the field through a mobile-enabled system, as in Levels 2-3, departments can share data smoothly—and each can create their own unique reports.

The deep data and analytics available at Level 4 let an organization clearly see and fix billing and cash flow bottlenecks. Empowered by live information and analytics, managers and investors can then make daily data-driven decisions instead of waiting for monthly or quarterly updates. Data visibility leads to precision in actions.

On the operations side, higher levels allow the tracking of a number of key metrics (i.e., client performance, equipment utilization, schedules for maintenance/repairs, job costs and other data) that management needs to assess progress on the path to operational excellence.

Large integrated companies may have the resources to create their own ticketing, tracking and billing software in house. But even in this case, a system requires ongoing investments in upgrades to stay current and useful.

Smaller companies may buy off-the-shelf software that requires the user to adapt to the software instead of the software being tailored to the user’s needs. This is still inefficient. The way a company operates is their competitive advantage, and the system must fully support it.

Solutions

A growing number of oilfield service companies are finding cost efficiencies by using leading-edge solutions that bring them as close to Level 5 as possible. This lets them rely on professional system providers to take their existing base product and tailor it to the client’s requirements. The service company gets the operational and reporting functions it needs without building an in-house system or bending their own operations to the unyielding requirements of a one-size-fits-all product.

Properly tailored software brings sales, operations and accounting departments together by supplying the need for fast-paced information in operations and the requirements in accounting for cumulative data less often. It allows the sales department to understand each client’s needs and how to serve them better. A common database stores all field ticket data, from which both departments draw what they need in real time.

Searches by client, equipment status (e.g., rented, returned, rental/service history, maintenance costs), job status and more allow all departments to discover and remedy revenue bottlenecks. The company can identify its most and least profitable assets and decide whether to expand its best assets and minimize or eliminate its lowest-performing items.

As equipment ages out, it may become more cost-effective to replace it than to continue to repair, especially when adding together the cost of parts with lost revenue from time spent in the shop. Level 5 digitalization gives management the numbers needed to make these decisions.

When data are immediately available across departments, it creates the ultimate transparency. No longer can a single manager tailor a report to boost their own department’s numbers. Nor is knowledge concentrated in the mind of one person who could depart suddenly, leaving a crippling information gap.

Starting in place

Current market instability is the right time for companies to advance their automation levels, because survival may depend on becoming more efficient. Each move up the map brings more savings, better diagnostics and companies closer to operational excellence.

While stepping up the ladder pays off in many ways, it is important to remember internal human factors during the change. Any kind of change encounters some resistance and temporary pain during the learning process, so it is important to change at a speed acceptable to staff. Moving too fast can sour staff members on any change, no matter how beneficial it is after the transition.

A step toward keeping people on the job

The crash in commodity prices also put downward pressure on pricing and payment schedules for service companies. Moving up the automation scale to any extent can improve cash flow on the front end. In the back office, its real-time and extensive database’s reporting functions can quickly reveal areas of greatest profit as opposed to areas of negative cash flow. This information lets companies focus on their strongest areas and adjust or eliminate the worst ones. All of this improves the bottom line in ways that can be the difference in staying in business or shutting the doors and putting more people out of work.

Recommended Reading

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: Jan. 13, 2025

2025-01-13 - Here’s a roundup of the latest E&P headlines, including Chevron starting production from a platform in the Gulf of Mexico and several new products for pipelines.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.