Offshore engineering, procurement and construction (EPC) contracts are forecast to close at $61 billion in 2024— a 47% year-over-year increase, according to Westwood Global Energy Group. (Source: Shutterstock)

As the oil and gas industry makes its way through the second half of 2024, E&Ps are trying to read trends in a chaotic market awash in economic and geopolitical reverberations.

Along with ongoing wars in the Middle East and Europe, OPEC has held fast to production cuts, as the oil market contends with a 1.8 MMbbl/d undersupply, based on OPEC and International Energy Agency forecasts.

A notable reduction in planned final investment decisions (FID) for offshore oil, gas and LNG projects represents a substantial downward revision from earlier projections. The sector is facing dual trends of project delays and inflationary pressures, which are taking a toll.

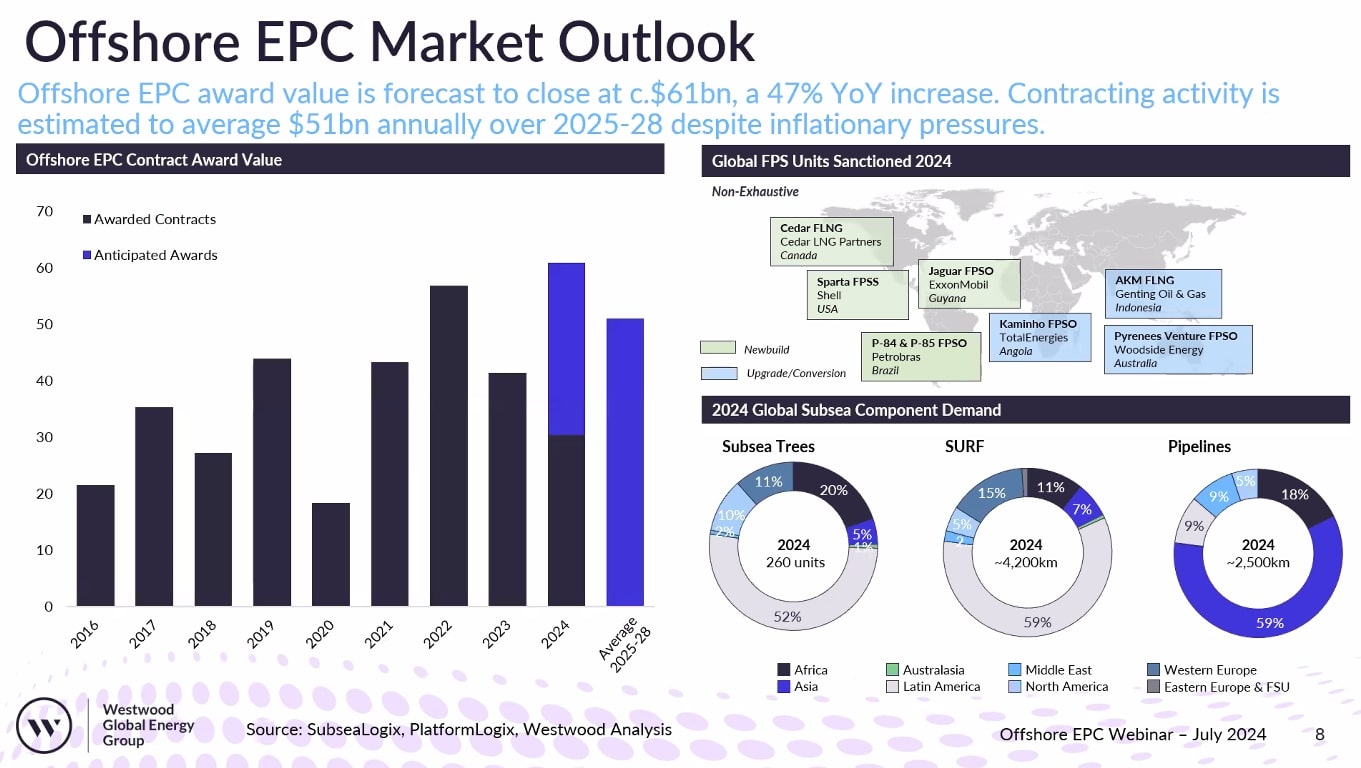

The offshore sector, particularly in shallow water, remains a crucial component in addressing global oil demand. Offshore engineering, procurement and construction (EPC) contracts are forecast to close at $61 billion in 2024— a 47% year-over-year increase, according to Westwood Global Energy Group.

The period from 2020 to 2025 has been characterized by a steady rise in demand, which has increased by more than 1 MMbbl/d annually as the market rebounded from the COVID-19 pandemic. The growth and market stabilization has been spurred by fixed and floating platforms as well as shale operations in the Middle East and the U.S., but forecasts suggest that this growth will slow after 2025, with peak demand for liquids expected around 2030.

“So of all this talk of new fixed and floating units, the question is how will that begin to change the picture for offshore production when it comes to water depths,” Ben Wilby, senior analyst at Westwood, said during a July 31 webinar. “Truth is, it doesn’t massively change things over the forecast, but the slow and gradual change in proportion of production between shallow and deep.”

In 2023, shallow water fields accounted for 73% of offshore production. This dominance is expected to decline slightly, with shallow water’s share projected to fall to 70% by 2028. Most of the production comes from fixed platform developments in the Gulf Cooperation Council (GCC) region comprised of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates. The GCC is anticipated to counterbalance the decline in shallow water output as the industry transitions towards deeper waters.

“Deepwater production is forecasted [to] reach about 16.1 million barrels of water equivalent per day by 2028 and that’s up from 12.7 million barrels of water equivalent per day in 2023 and this will primarily be a result of those aforementioned FPS [floating production and storage] units entering the market,” Wilby said.

Offshore investments

So far in 2024, a total of 43 FIDs have been forecast for offshore field investments. High-profile projects such as Pemex’s Zama development and Repsol’s Polok and Chinwol projects offshore Mexico, as well as Ping Petroleum’s Avalon development in the U.K.’s North Sea, have all faced delays. But despite these setbacks, significant developments are underway.

“For the remainder of 2024, we currently anticipate another 26 field FIDs to be sanctioned, with TotalEnergies’ Block 58 project offshore Suriname being the headline for that one,” Mark Adeosun, research director at Westwood, said.

BP’s Kaskida project in the U.S. Gulf of Mexico (GoM) is another key project looking to come online during the period. BP said on July 30 it made an FID on the project, which is expected to start producing in 2029. Some projects from 2023, such as Shell’s Sparta in the GoM, saw their FID announcements in late 2023 but only began EPC contracts in early 2024.

In the Americas, Brazil, Guyana and Mexico are on track to bolster their offshore production capabilities, with Mexico introducing 12 new projects by 2028, Westwood analysts said. The GoM will see six new FPSOs deployed in deepwater, including major projects like Beacon Offshore Energy’s Shenandoah and Shell’s Spar and Whale projects.

Wilby noted that as shallow water production “is declining quite rapidly, but the deepwater production is of such a scale that it’s still increasing,” which will help balance lost volumes.

Subsea equipment outlook

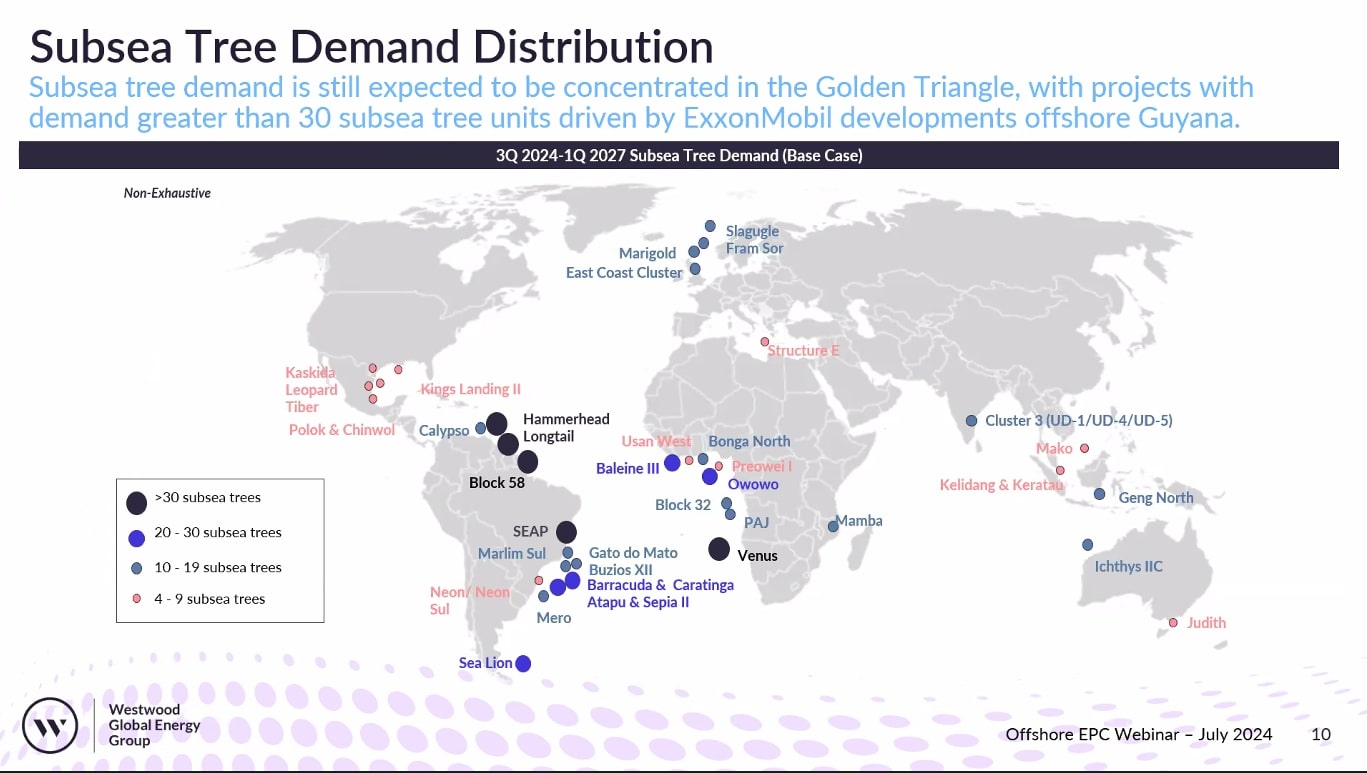

Exxon Mobil’s Whiptail project offshore Guyana has been a major driver in the subsea equipment market, accounting for 44% of the subsea tree units recorded in the first half of the year. Additionally, Petrobras’ Atapu Phase 2 and Sepia 2 projects offshore Brazil are notable, with an EPC award value of approximately $8.1 billion for newbuild FPSO units. Other significant projects include Energean’s Kaplan project offshore Israel and Woodside’s Xena III project in Australia.

The demand for subsea equipment remains robust, with forecasts indicating the need for 260 subsea tree units for the remainder of 2024. Approximately 110 of these units were awarded in the first half of the year, with about 4,200 km of subsea lines anticipated to be awarded throughout the year.

The outlook from 2025 to 2028 suggests continued strong demand for offshore EPC spending, projected at $51 billion despite what Adeosun calls “inflationary pressures.” The supply chain is expected to adapt, with spare capacity set to accommodate upcoming projects. Subsea tree demand is projected to average between 280 units and 290 units annually post-2024, with 2025 expected to close with over 300 units.

“Though we’ve recorded some delays, as well as project cancellations or tender cancellations, we believe that we’re beginning to expect spare capacity within the supply chain to be able to accommodate some of the projects that [are] currently in the pipeline,” Adeosun said.

Adeosun’s key projects to watch include Shell’s Bonga North development offshore Nigeria and Aker Energy’s Pecan project offshore Ghana, though both face delays. Eni’s Coral North project offshore Mozambique is also a major development expected to support subsea tree demand. In Latin America, significant subsea developments include Exxon Mobil’s Hammerhead and Longtail projects, as well as Shell’s Gato Do Mato project offshore Brazil.

The period from 2024 to 2028 will be crucial for balancing offshore production with global demand, Westwood analysts said. With 67 FPSO deployments anticipated, including 19 units yet to be sanctioned, the industry faces potential project delays and shifts in the supply-demand equilibrium. Despite inflationary pressures and project delays, offshore production—in shallow and deep waters—remains vital to meeting the world’s evolving energy needs throughout the decade, Woodside analysts said.

Recommended Reading

WhiteWater-Led NatGas Pipeline Traverse Reaches FID

2025-04-04 - The Traverse natural gas pipeline JV project will give owners optionality along the Gulf Coast.

DOE Identifies 16 Sites for Rapid AI Data Center Growth

2025-04-04 - The Department of Energy is requesting details on potential development approaches to establish AI infrastructure at select sites.

Energy Transition in Motion (Week of April 4, 2025)

2025-04-04 - Here is a look at some of this week’s renewable energy news, including Maverick Metals securing funding to accelerate commercialization of proprietary critical metals recovery technology.

Acquisitive Public Minerals, Royalty Firms Shift to Organic Growth

2025-04-04 - Building diverse streams of revenue is a key part of growth strategy, executives tell Oil and Gas Investor.

US Oil Rig Count Rises to Highest Since June

2025-04-04 - Baker Hughes said oil rigs rose by five to 489 this week, their highest since June, while gas rigs fell by seven, the most in a week since May 2023, to 96, their lowest since September.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.