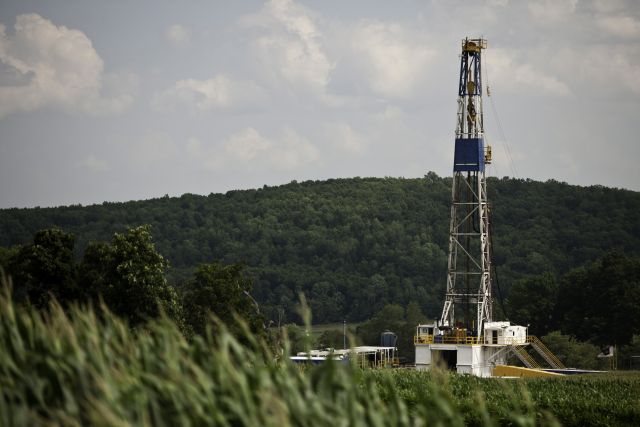

In addition to the midstream sale, EQT is planning to sell the remaining non-operated interests in its northeast Pennsylvania assets. (Source: Hart Energy archives)

EQT Corp. is pursuing sales of upstream and midstream interests as the Appalachia gas giant works to reduce debt after acquiring Equitrans Midstream.

Pittsburgh-based EQT is marketing the remaining 60% interest in its northeast Pennsylvania non-operated assets, after selling the first 40% to Equinor earlier this year. EQT executives said the assets are attracting interest from U.S. and even overseas dealmakers.

EQT is also pursuing a minority equity sale of midstream assets regulated by the Federal Energy Regulatory Commission (FERC) and picked up through the $5.45 billion acquisition of Equitrans Midstream Corp., the developer of the notoriously delayed Mountain Valley Pipeline (MVP) project. EQT closed the Equitrans transaction on July 22.

Selling a minority equity stake in Equitrans’ regulated midstream assets is expected to generate approximately $700 million of adjusted EBITDA, EQT CFO Jeremy Knop said.

“This strategy will allow EQT to retail full operational control and upside value associated with synergy capture and future pipeline expansions,” Knop said during EQT’s second-quarter earnings call on July 24.

Retaining some ownership of the regulated Equitrans assets still provides EQT with value and optionality.

The regulated transmission and storage segment of Equitrans, which includes approximately 940 miles of FERC-regulated, interstate pipelines, “is really an extension of the gathering system,” Knop said.

“Maintaining the right pressures on those systems, being able to control things like expansions, is really integral to maintaining the gathering systems appropriately,” he said.

EQT has pondered sales of Equitrans’ FERC-regulated assets to pay down debt for some time, including the possibility of offloading the MVP.

But EQT still wants to own and operate the MVP, and the company sees a line of sight toward expanding the Appalachia gas pipeline system in the future.

MVP could be expanded through additional compression, boosting the system’s capacity from 2 Bcf/d to 2.5 Bcf/d.

“That's something that we want to get done to evacuate more gas out of Appalachia and get it to a premium end market in the southeast,” Knop said. “We want to make sure that project happens—whether five or 10 years from now. It makes sense to still own something like MVP.”

EQT aims to wrap up the minority equity sale of Equitrans’ regulated assets by the end of the year.

RELATED

In Service: Appalachian E&Ps Banking on MVP for Bigger Returns

Non-op Marcellus sale

In addition to the midstream sale, EQT is planning to sell the remaining non-operated interests in its northeast Pennsylvania assets.

EQT closed a partial sale of its non-op Marcellus assets through a transaction with Norwegian energy firm Equinor earlier this year.

Under terms of the transaction, Equinor sold 100% of its interests in operated Marcellus and Utica assets and paid a cash consideration of $500 million. EQT, in exchange, provided 40% of its non-op interest in the northeast Pennsylvania assets.

EQT picked up 26,000 net acres in Monroe County, Ohio, and 10,000 net acres in Lycoming County, Pennsylvania, through the Equinor swap. The deal, valued at approximately $1.1 billion in total, represented Equinor’s full exit from its U.S. onshore operated positions.

Compared to the Equinor deal earlier this year, EQT is seeing “a renewed set of interest” from several new names in the marketing process, Knop said during the earnings call.

“A lot of new names, actually, in the process from the international space that we didn’t see the first time around,” Knop said.

EQT exited second quarter 2024 with $4.9 billion in net debt, down from $5.7 billion at the end of 2023.

The company repaid $600 million of 2025 senior notes in June with cash on hand and proceeds from the Equinor transaction.

Due to low natural gas prices, EQT curtailed approximately 1 Bcf/d of gross production throughout most of the second quarter. Along with non-operated curtailments, the reductions impacted EQT’s net production by approximately 60 Bcfe during the quarter.

EQT expects 2024 total sales volumes of between 2,100 Bcfe and 2,200 Bcfe, including approximately 180 Bcfe of net production curtailments. EQT plans to curtail around 90 Bcfe of net gas output during the second half of the year.

U.S. gas producers have contended with record-low commodity prices during the first half of 2024.

Henry Hub gas prices averaged $1.49/MMBtu in March, the lowest average monthly inflation-adjusted price since at least 1997, according to U.S. Energy Information Administration (EIA) data.

Additionally, prices from February through April 2024 were the lowest ever recorded for those months, per EIA data.

Gas producers eventually responded to the prolonged period of low prices by slashing production and deferring new well completions.

Public operators, including EQT, Chesapeake Energy, Range Resources, CNX Resources and Gulfport Energy, have reported declining activity in recent earnings.

RELATED

EQT Marketing Rest of Marcellus Non-op Assets After Equitrans Close

Recommended Reading

Pickering Prognosticates 2025 Political Winds and Shale M&A

2025-01-14 - For oil and gas, big M&A deals will probably encounter less resistance, tariffs could be a threat and the industry will likely shrug off “drill, baby, drill” entreaties.

Industry Players Get Laser Focused on Emissions Reduction

2025-01-16 - Faced with progressively stringent requirements, companies are seeking methane monitoring technologies that make compliance easier.

Biden Bans E&Ps from 625 Million Acres of Offshore Oil, Gas Leases

2025-01-06 - While the White House said the move doesn’t affect existing leases, oil and gas industry groups called excluding offshore waters “significant and catastrophic.”

Pioneer to Adapt Emvolon’s Flare Gas-to-Methanol Tech

2025-01-13 - The Department of Energy awarded Pioneer Energy $6 million to demonstrate the technology at an oil and gas facility in the Eagle Ford Shale for 12 months.

Bridger Photonics Announces New CEO to Support Company Growth

2025-01-29 - Bridger Photonics announced Ben Little as the company’s new CEO in support of the growth Bridger has experienced with the growing market adoption of its methane detection solutions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.