Power provider Vistra Corp., which operates from California to Maine, sees a 40 GW supply deficiency by 2030 in each of its two largest markets, for example: the mid-Atlantic states’ PJM independent service operator (ISO) and Texas’ Ercot. (Source: Shutterstock)

A natural gas producer, a wind operator and leading power generators meet at the Dallas Fed.

They’re all frustrated—by permitting, policy and other hurdles in getting electricity to U.S. consumers.

Adult conversations are needed to solve the imminent avalanche of new U.S. power demand that will meet an already increasingly inadequate U.S. grid, they said in a joint Dallas Fed and Kansas City Fed energy program recently.

The fighting that has made for an impasse in permitting and completing new energy infrastructure has to stop, said Javier Fernandez, president and CEO of power generator Omaha Public Power District (OPPD).

“People's lives depend on what we do,” Fernandez said. “…We need to talk about natural gas. We need to talk about nuclear, as we are talking about solar and batteries and wind.

“It can't be one versus the other. We have to stop this fighting [that is based on] assuming that one source of energy can replace the other 100%,” Fernandez said.

Warren Buffett

The Omaha power company is the one responsible for keeping the lights on at “the Oracle of Omaha” Warren Buffett’s office. Its service area is the eastern half of Nebraska.

Berkshire Hathaway’s Buffett himself told shareholders earlier this year he has an “ominous” outlook for future U.S. electric-power supply.

For the conglomerate’s Berkshire Hathaway Energy (BHE) unit, “the regulatory climate in a few states has raised the specter of zero profitability or even bankruptcy—an actual outcome at California’s largest utility and a current threat in Hawaii,” he wrote.

“When the dust settles, America’s power needs and the consequent capital expenditure will be staggering.”

BHE operates utilities in 11 U.S. states and has 5.3 million power and natural gas accounts. Its generating capacity in 2023, including in the U.K. and Canada, was 36 gigawatts (GW), including capacity under construction.

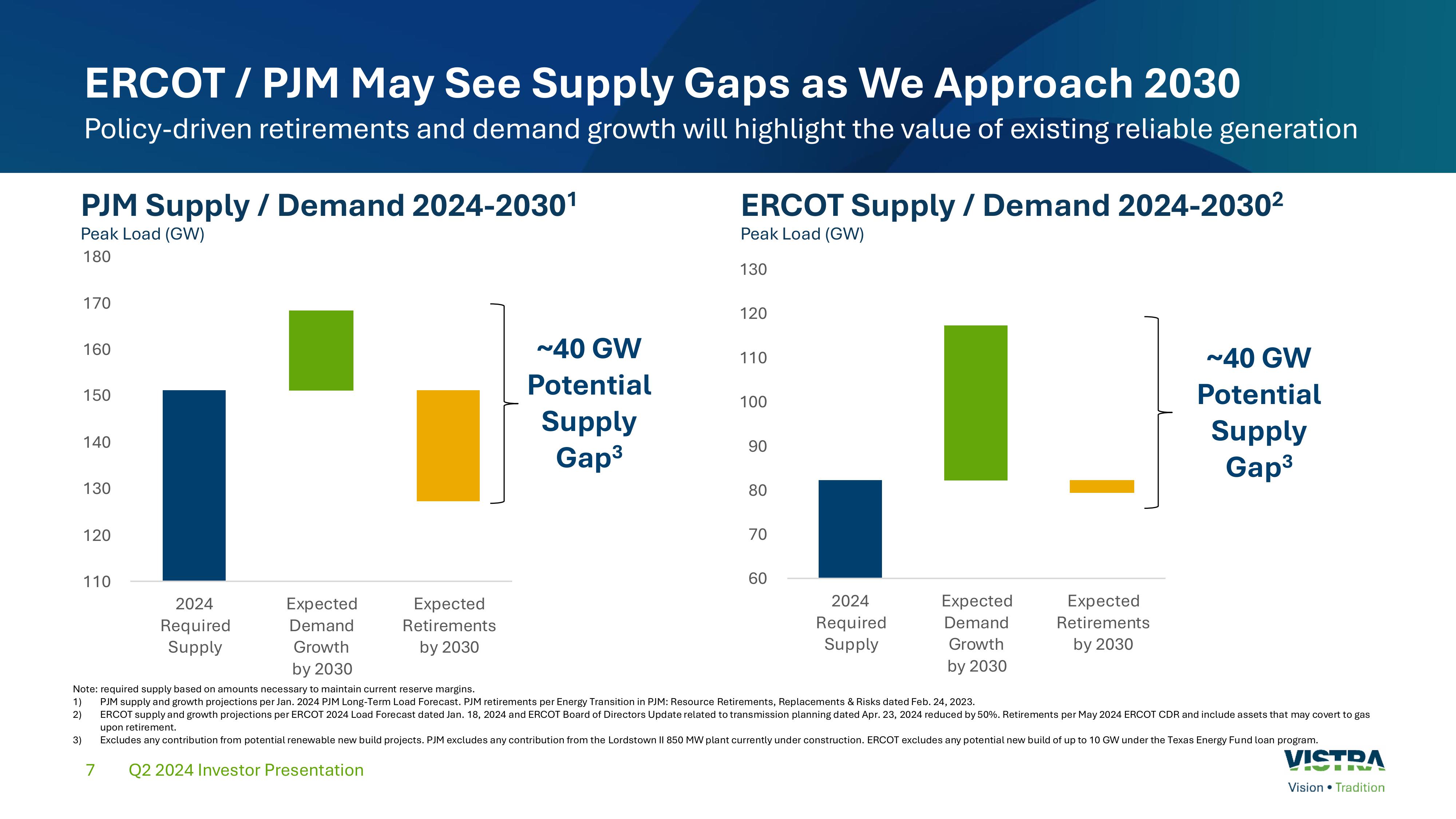

40-GW gaps in PJM, Texas

Power provider Vistra Corp., which operates from California to Maine, sees a 40 GW supply deficiency by 2030 in each of its two largest markets, for example: the mid-Atlantic states’ PJM independent service operator (ISO) and Texas’ Ercot.

Stacey Dore, Vistra chief strategy and sustainability officer, said in the Fed program, “We’re going to have a supply gap.”

This is no matter what the data-center demand growth figures turn out to be, she added. The 40-GW deficit in each of the two markets factors for plant retirements and is derived from PJM and Ercot’s own forecasts.

“We’re going to have a supply gap because retirements are happening more quickly than we're bringing on new supply,” Dore said.

‘Hell of a crisis’

Oil and gas producer Devon Energy President and CEO Rick Muncrief called for all stakeholders to sit down and have adult conversations.

What has become clear, “irrespective of what part of the energy sector you're in, is that permitting reform has to take place,” Muncrief said.

“…Whether it's pipelines. Whether it's electricity. It doesn't matter. We have to figure that out.”

And urgently, he added. “With energy, you can only kick a can down the road so far and you're going to wake up one day and have a hell of a crisis on your hands.”

The conversations’ goal is a simple one: “What do we need to do to keep the lights on?”

“It's a wonderful world until we don't have energy or we don't have food or we don't have water. Things unravel pretty quickly and it doesn't matter if you're [a Republican or Democrat] or anything else.

“When the power’s out, the power’s out and that's when meltdowns occur.”

‘Over and over’

Kristina Lund, president of the wind, solar, transmission and energy-storage developer Pattern Energy Group, said difficulty with permitting is an issue in her space too.

Pattern’s $11 billion, 4-GW wind project in New Mexico is the largest renewables project in the Western Hemisphere. It took 16 years to develop due to regulatory processes, she said.

“That means four different presidential administrations [and] 11 heads of the Bureau of Land Management (BLM). That is obviously a timeframe that is not going to get us to our energy transition goals if we have to repeat that over and over.”

The project is being capitalized by 26 financial institutions.

The concern goes beyond permitting too. Once new power is ready to come online, “the regional interconnection queues are all backed up,” Lund said.

“Many of them are, for all intents and purposes, closed.”

Most immediately, resolution is needed “to clear out those queues and get projects moving.” Projects not getting through the interconnection process “actually backs up the whole system and is one of the things that we need to address.”

‘Barely anything now’

Rob Gramlich, president of Washington, D.C.-based consulting firm Grid Strategies, noted U.S. power demand had been mostly flat for most of this century.

But in gathering intel from data center developers and other sources of upcoming demand growth, his co-workers’ “eyes were bugging out.”

They quickly surmised “my job is 10 times bigger than I thought it was six months ago. I have to procure this much energy.”

In the past two years, grid planners have tripled their five-year forecast from around 3% to around 8% peak demand growth, which is 66 GW.

“For those of you who don't do electricity, think about roughly 800 GW of peak power demand,” Gramlich said.

One firm has forecasted 15 GW in demand growth “but I swear we have 15 new GW [of new demand coming] within 20 miles of my house in Maryland [alone].”

The world’s largest data-center concentration is in northern Virginia.

“So I don't believe that 15 [GW figure]. Nationally, maybe 60 GW by 2030,” Gramlich said.

Whatever the figure, though, “I don't think we have the infrastructure planned to meet all this,” Gramlich said.

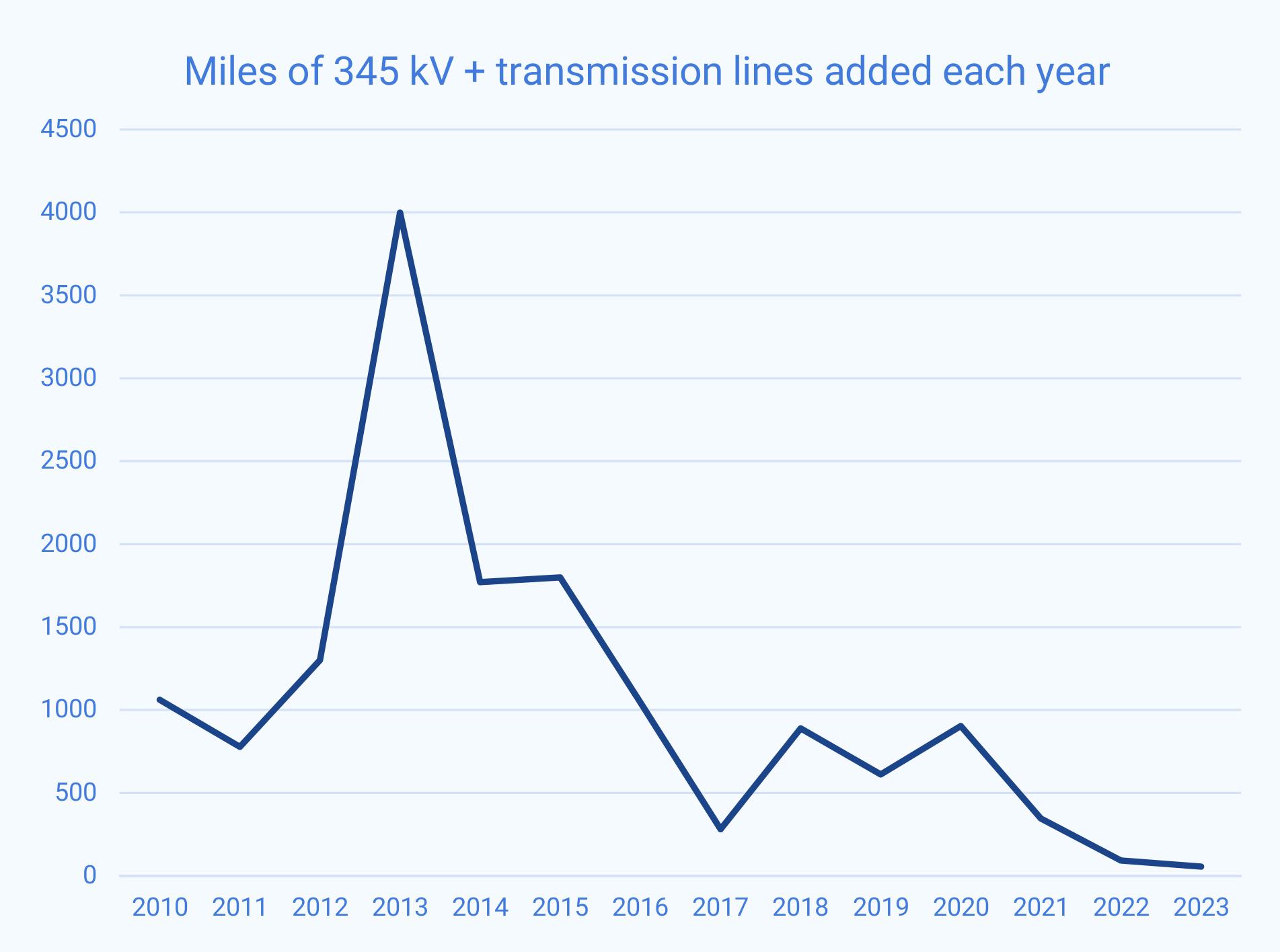

He added, “If you look at 10 years ago as a nation, we built about 4,000 miles of 345-kilovolt-and-above transmission, and this has really trickled down to barely anything now.”

‘Load is load is load’

Vistra’s Dore said it’s important to note that the demand growth isn’t just from data centers, “despite the sort of breathless headlines that we read.”

And all demand must be served. “Load is load is load,” she said.

Also, she noted that the U.S. has met grid challenges in the past. Electricity demand doubled between 1950 and 1980 and again from 1980 to 2010. Vistra is projecting another doubling between 2020 and 2050.

“We’ve met this challenge before,” she said. “We think we can meet it again.”

But policy is a hurdle. “The difference now, I will say, and something that we need to confront from a policy perspective, is that today and for the last couple of decades … we have policies in place that actually incentivize and favor certain [powergen] types over others.”

These are wind, solar, hydro, natural gas, coal, nuclear and others.

“That wasn't the case when we originally started meeting these growth trajectories in electricity [in the past century].

“So we do have to think about whether those policy choices are allowing us to meet the demand as efficiently and as effectively as we can.”

‘Really old’

The Omaha power company’s Fernandez said there is scant acknowledgement of the age of the U.S. power generation fleet.

Plant retirements are underway, as Dore noted in the supply-gap forecast for PJM and Ercot.

“The American fleet is old,” Fernandez said. “Our grandparents built the American fleet between 1950 and 1980 for the most part.”

In the state of Nebraska alone, “50% of the generators are 40 years old or older and 25% of them are 50 years old,” he said.

One was celebrated recently for its 70th year of continuous operation. While it was cause for celebration, he said, that same fact bothered him.

“I'm thinking, ‘it's 70 years old and we're putting the balance of the grid and people's lives depend on these machines that are really old, including transmission.’”

Authorities who are responsible for keeping the lights on “have the age of the fleet, load growth and decarbonization all coming to us at the same time.”

The challenge for the OPPD and others is massive. “We only have an hour, right?”

In short, though, what OPPD is confronting is that “I have the distinct honor or challenge of doubling the size of the utility by 2030.”

Fernandez was named CEO in 2021. The next year, the board determined, “Now, you have to double the size of the utility. Good luck.”

And there’s more: “I can tell you today that even doubling the size of the utility is not going to be enough. We have requests for additional power that we haven't even begun planning or procuring.

“I am doubling the size of our generation fleet from 3.5 GW to 7 GW and I have to have that by 2030.”

‘Pointing their finger’

When asked for an example of where an adult conversation is needed, Muncrief said one is in southeastern New Mexico where Devon operates.

The area is running out of electricity, is on federal land and “you have a utility company that is shrugging their shoulders, pointing their finger at the BLM because they can't get a permit” to place the power infrastructure.

The utility is also pointing at regional transmission operator Southwest Power Pool, and the “Southwest Power Pool is saying ‘it's not us.’”

The gridlock on the U.S. power grid—and in all areas of U.S. energy—is expected to come to an end under President-elect Trump, who announced Nov. 15 that he will form a National Energy Council.

The group is to be led by North Dakota Gov. Doug Burgum, who Trump intends to nominate as Interior Secretary, and “will consist of all departments and agencies involved in the permitting, production, generation, distribution, regulation [and] transportation of all forms of American energy,” Trump posted on his Truth Social account.

Its task will be to achieve U.S. energy dominance “by cutting red tape, enhancing private sector investments across all sectors of the economy and by focusing on innovation over longstanding, but totally unnecessary, regulation,” he wrote.

Recommended Reading

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

How DeepSeek Made Jevons Trend Again

2025-03-25 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

TGS to Reprocess Seismic Data in India’s Krishna-Godavari Basin

2025-01-28 - TGS will reprocess 3D seismic data, including 10,900 sq km of open acreage available in India’s upcoming 10th Open Acreage Licensing Policy (OALP) bid round blocks.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.