Expand Energy sees LNG as a more durable demand center than emerging demand for AI data centers. (Source: Shutterstock.com)

Producers are gassed up about growing natural gas demand to fuel data centers, with Appalachia, the Permian and the Haynesville fighting for a piece of the AI pie.

But it’s LNG, not AI, that underpins Expand Energy’s outlook for natural gas demand growth.

“Just to be clear, in our view at least 75% of the natural gas demand growth is going to come from LNG,” Expand Energy CFO Mohit Singh said at the 2025 NAPE Summit in Houston.

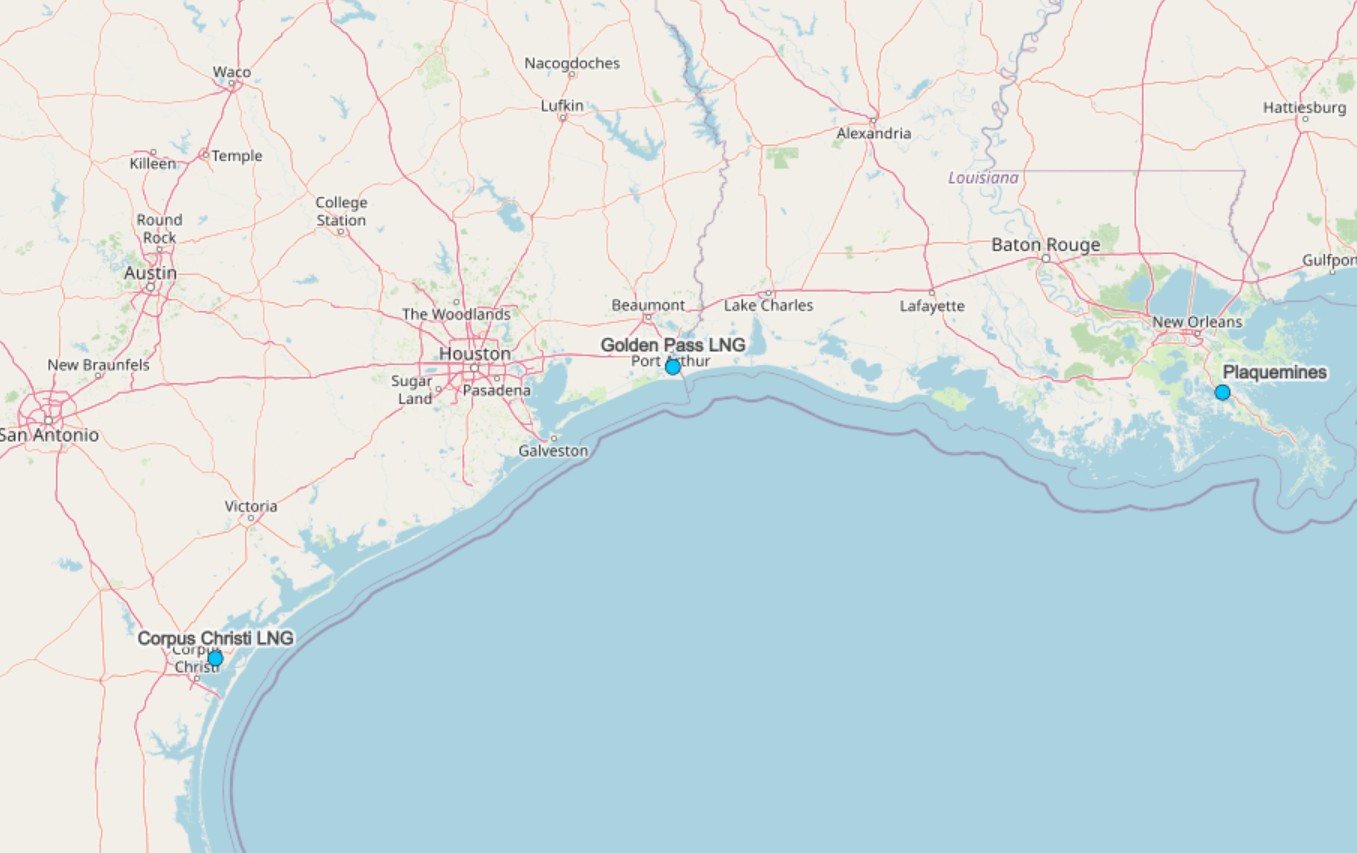

Around 5.6 Bcf/d of incremental gas demand is coming online within the next 12 months to fuel three new LNG projects on the Gulf Coast.

Venture Global’s Plaquemines plant is currently pulling around 1.3 Bcf/d after coming online in late 2024. The Plaquemines project on the Mississippi River south of New Orleans has Federal Energy Regulatory Commission approval to export 3.3 Bcf/d.

Cheniere Energy’s expansion at Corpus Christi, Texas, began liquefaction in December. Full capacity from the seven-train expansion will be 1.3 Bcf/d, bringing the plant’s total output to more than 3.3 Bcf/d.

Exxon Mobil’s long-awaited Golden Pass LNG plant is also expected to come online within the next 12 months. Golden Pass LNG has FERC approval for 2.6 Bcf/d.

LNG projects represent “durable demand” within Expand Energy’s massive gas portfolio, Singh said. Chesapeake Energy and Southwestern Energy merged last year to form Expand, the nation’s largest pure-play gas producer.

“When LNG is taking that gas off the grid, that’s doing it every day, every week, every month, every year,” he said. “That’s durable through cycles, over decades.”

Looking at LNG plants that have reached final investment decisions (FID) and pre-FID projects, it’s “easy” to estimate that U.S. production will rise to 120 Bcf/d to 130 Bcf/d, Singh said.

U.S. total dry natural gas production averaged 103.1 Bcf/d in 2024, according to U.S. Energy Information Administration data.

RELATED

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

AI ‘wild card’

If LNG delivers durability to natural gas demand, AI and data centers insert volatility.

Producers and stakeholders along the gas value chain are frothing at the mouth with excitement for new gas demand to fuel energy-hungry data centers.

Hyperscalers such as Google, Meta, Microsoft and Amazon are competing in an “adapt or die” AI landscape and looking for reliable power. Some are looking at restarting shuttered nuclear plants, including the infamous Three Mile Island plant in Pennsylvania.

But producers still think natural gas will make up a considerable amount of the power stack to fuel AI’s growth.

Supermajors Exxon Mobil and Chevron are each having conversations with tech customers about building gas-fired power generation for specific data center projects.

But future gas-demand forecasts for data centers and AI vary widely. Gas demand could increase by 10 Bcf/d by 2030 due to AI, according to Wells Fargo projections—a 28% increase over the roughly 35 Bcf/d currently consumed for U.S. electricity generation.

Appalachian gas giant EQT Corp. has told investors that AI fervor could result in as much as 18 Bcf/d in incremental demand by the end of the decade.

Expand has heard forecasts ranging from 2 Bcf/d all the way up to 20 Bcf/d of incremental gas demand, Singh said.

But that was all before DeepSeek.

Tech and power markets are still scrambling after the launch of an energy-efficient AI chatbot by Chinese firm DeepSeek, raising questions about just how much power AI really needs to succeed.

The back-and-forth movement in AI-demand scenarios will be “noisy” in the coming years, Singh said.

“I think we’ll land around an incremental 5 Bcf/d of natural gas demand from data centers,” he said.

RELATED

US LNG Exporter Venture Global's Shares Dip After IPO

‘Gas-on-gas competition’

Producers are clinging to the “demand growth” light at the end of the tunnel.

And with demand growth spurred by LNG exports, data centers and the overall electrification trend, utility buyers are worrying about their ability to buy all the gas they need.

“We are sensing a lot of fear among end buyers about gas-on-gas competition, because where is that next molecule going to go?” Singh said.

Will gas be hoovered up by the next massive LNG export facility to come online?

Will gas go toward another power-hungry data center for Meta or Microsoft?

Could industrial buyers on the utility grid face shortages, impacting operations and productivity?

And never mind those everyday citizens using more and more electricity to power their EVs and other gadgets.

But valid questions also remain about where all the gas is going to come from.

The top gas-producing regions in the U.S.—Appalachia (35.3 Bcf/d in 2024, per EIA figures), the Permian Basin (24.8 Bcf/d) and the Haynesville (15 Bcf/d)—each have their own challenges to getting gas to market.

Appalachia’s Marcellus and Utica shales hold the lowest-cost gas reserves to drill. But pipeline takeaway constraints strand considerable volumes within the basin, to the ire of producers and mineral rights owners.

Tim Pawul, president of the Minerals & Royalties Authority, said mineral and royalty owners in Appalachia are excited about the prospect of in-basin gas demand fueled by new data center projects.

Associated gas production in the Permian is a byproduct and cost of doing business to drill for oil. The Permian is churning out more and more associated gas each year, and only so much takeaway capacity exists today. Midstream companies are racing to add new gas pipeline projects. Others, such as the as the 2.5-Bcf/d Matterhorn Express, have already come online, though Matterhorn quickly filled up.

The Haynesville is in a goldilocks position to be the swing producer for LNG supply, with ample takeaway capacity and nearness to the Gulf Coast. But Haynesville gas is deep and expensive to drill, and high-quality Tier 1 inventory is depleting in the play’s core.

Higher Henry Hub gas gas prices are needed to spur future Haynesville development, experts say.

“Obviously it’ll be volatile," Singh said. “But on average we think [gas] prices naturally are going to go up because there’s more competition and there’s more demand.”

Expand will announce fourth-quarter and full-year 2024 results after markets close on Feb. 26.

RELATED

LNG, Data Centers, Winter Freeze Offer Promise for NatGas in ‘25

Recommended Reading

Chevron JV Plans 4-GW Project to Fulfill US Data Center Power Needs

2025-01-28 - Chevron U.S.A. Inc., Engine No. 1 and GE Vernova will develop the natural gas-fired power plants co-located with data centers amid President Trump’s push for AI dominance.

Nabors SPAC, e2Companies $1B Merger to Take On-Site Powergen Public

2025-02-12 - Nabors Industries’ blank check company will merge with e2Companies at a time when oilfield service companies are increasingly seeking on-site power solutions for E&Ps in the oil patch.

Shell Completes Deal to Buy Power Plant in Rhode Island

2025-01-24 - Shell has completed its previously announced acquisition to buy a 609-megawatt combined cycle gas turbine power plant in Rhode Island from RISEC Holdings.

Bloom Energy, Chart Industries Form CCUS Partnership for Low-Emissions NatGas

2025-02-14 - Bloom Energy and Chart Industries aim to use natural gas and fuel cells to generate power through their carbon capture partnership.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.