Expand Energy is the largest gas producer in the U.S. (Source: Shutterstock)

Like its peers, Expand Energy is in conversations to directly supply some of its nearly 7 Bcfe/d of net natural gas output to data center power generation, executives confirmed in an investor call Oct. 30.

Another northeastern U.S. gas producer, Range Resources, said on Oct. 23 that conversations are materializing around data centers’ future power demand.

“Those conversations have been happening in the background,” Expand CFO Mohit Singh said Oct. 30 in the company’s first earnings call since Chesapeake Energy and Southwestern Energy merged to form Expand.

The two gas producers combined Oct. 1 in a $7.4 billion deal that created the largest U.S. natural gas producer.

“We are in the process of consolidating the efforts that legacy Southwestern was doing on its end and what legacy Chesapeake was doing on our end,” Singh said.

Participants in the discussions include a consortium of data center developers, power generation companies, end-users, midstream operators and gas producers.

“It's fair to say there is lots of interest from all the different stakeholders involved in that value chain,” Singh said. “…We are having tons of conversations with all the right stakeholders.”

Of Expand’s gas production, about 63% is from the Appalachian Basin in the epicenter of the world’s largest data-center concentration—Data Center Valley in northern Virginia.

Fellow Appalachian producer, EQT Corp., told investors in a call Oct. 30 that data-center buildout—particularly AI-chip centers—is expected to result in an additional 10 Bcf/d of additional U.S. gas demand by 2030.

A “more aggressive data center buildout scenario drives plausible upside to ~18 Bcf/d of incremental natural gas demand by 2030,” EQT reported.

At Expand, President and CEO Nick Dell’Osso told investors that “demand domestically is clearly growing—and growing faster than I think a lot of models were predicting … one to two years ago in the form of power generation.”

A lot of the power demand for AI “is going to take several more years to develop,” he added.

But the call on U.S. gas will be “structural and long-term and provide a pretty important tailwind,” Dell’Osso said.

1 Bcf in the hole

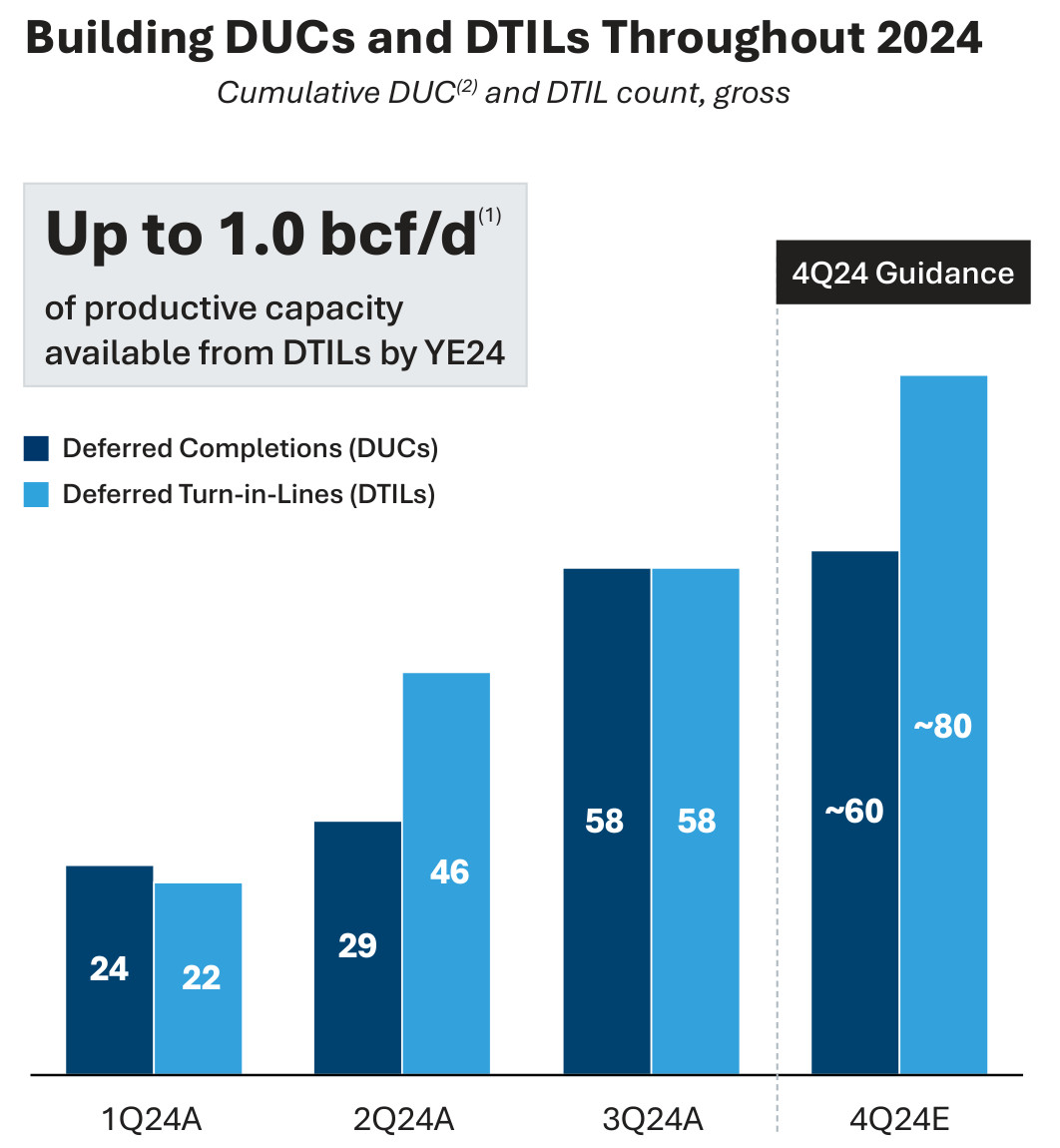

Expand began building a DUC inventory this spring and deferring TILs (turning wells inline to pipe) as a relatively mild winter didn’t draw much gas from storage, resulting in a sub-$2/MMBtu near-term futures market.

Adding DUCs that Southwestern held, Expand now holds 58, excluding those it has scheduled for completion. The company’s deferred TILs also total 58.

Expectations are that its DUC count will be mostly unchanged: DUCS at year-end will be at about 60 and deferred TILs will number roughly 80.

From the TIL inventory, Expand has up to 1 Bcf/d behind choke that can be put into pipe nearly immediately.

Meanwhile, the 60 DUCs will cost some $300 million to complete and turn into sales.

Several securities analysts asked Dell’Osso when Expand will let loose.

The 1 Bcf/d is “completely at our control as to whether or not we bring that online,” he said.

If gas futures are soft coming out of this winter—due to excess supply in storage again—“then these volumes don't need to come online,” Dell’Osso said.

When the market stabilizes, “we'll be prudent about turning production online and ready to rapidly respond to market condition when pricing improves,” Dell’Osso said.

Expand’s hedges currently have its gas getting more than $4/MMBtu.

“Simply put, we have effectively protected our 2025 program from a prolonged down-cycle while ensuring we can still capture significant upside value in periods of higher prices.”

Expand has 12 rigs at work currently—eight in the Haynesville Shale and four in Appalachia—and two completion crews, split 50-50 between the two plays. It can hold production flat with 12 rigs.

‘Flat to down’

Dell’Osso sees overall U.S. gas supply unchanged or lower through most of 2025, at least. Supply rose recently, but that’s typical as producers are getting new output into pipe at winter-contract prices, he noted

“But if you think about the rig count that we have for gas in the Lower 48, it is down quite a bit and it's not positioned to grow,” he said.

Permian associated gas production will be flat until more takeaway pipe is added.

“The trend we believe we're observing is that supply is going to be flat to down and probably remain that way until you see a rig-count change, which then has quite a lag time to it.

“So the dynamics for supply/demand fundamentals for gas are very strong.”

Winter demand will affect “the timing of when supply and demand come together to change the character of the strip. But we definitely see it changing sometime in the relatively near future,” Dell’Osso said.

Recommended Reading

Energy Spectrum, UGI JV Buys Three Appalachia Gathering Systems

2025-01-28 - Pine Run Gathering LLC, a joint venture between Energy Spectrum Partners and UGI Corp., purchased three gathering systems in Pennsylvania from Superior Midstream Appalachian LLC.

Langford Enters Midland Basin with Murchison Oil and Gas Deal

2025-01-14 - Langford Energy Partners closed on an acquisition of 8,000 acres in the Midland Basin from Murchison Oil and Gas LLC.

Enverus: M&A Set to Cool with Smaller Deals, Higher Breakevens

2025-01-21 - With fewer acquisition targets, Enverus Intelligence Research said the quality of acquired inventory is declining, with breakevens averaging $50/bbl in 2024 versus $45/bbl in 2022 and 2023.

Ovintiv Closes $2B Uinta Sale to FourPoint Resources

2025-01-22 - Ovintiv is exiting Utah’s Uinta Basin in a $2 billion sale to FourPoint Resources, which will take over some of the play’s highest quality acreage.

PRB’s Sage Butte Ready for M&A Across Lower 48, Maybe Canada Too

2025-01-08 - Private E&P Sage Butte Energy, which operates in the Powder River Basin, is less interested in the Permian Basin, citing the cost of entry.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.