Darren Woods, CEO of Exxon Mobil Corp., pictured at CERAWeek by S&P Global in March 2023. (Source: CERAWeek by S&P Global)

Editor's note: This article has been updated to include new details and upgraded maps of Exxon Mobil and Pioneer Natural Resources' Permian Basin holdings.

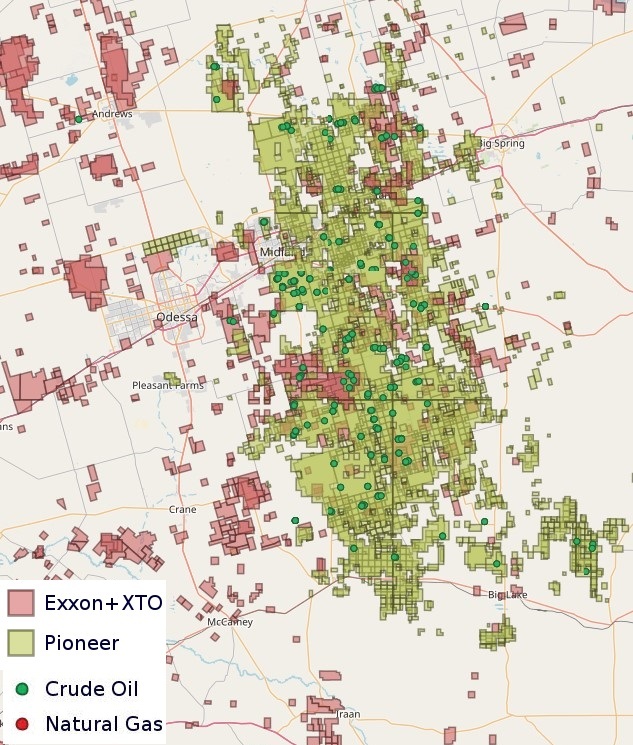

Exxon Mobil Corp. closed its blockbuster acquisition of Pioneer Natural Resources on May 3, cementing the U.S. supermajor as the Permian Basin’s top oil and gas producer.

The transaction valued Permian juggernaut Pioneer Natural Resources at $59.5 billion, or $253 per share, when the acquisition was announced last October. Exxon Mobil will also assume Pioneer’s debt, which totaled about $4.84 billion as of year-end 2023, according to regulatory filings.

The deal represents the largest shale oil transaction ever signed—and Exxon Mobil’s largest transaction since the $84.4 billion merger between Exxon Corp. and Mobil Corp. in 1999.

Exxon Mobil’s production in the Permian Basin, the nation’s top oil-producing region, will double to 1.3 MMboe/d on the Pioneer acquisition.

The deal also delivers Exxon Mobil a massive boost in the Permian’s Midland Basin, where Pioneer owns interests across more than 850,000 net acres.

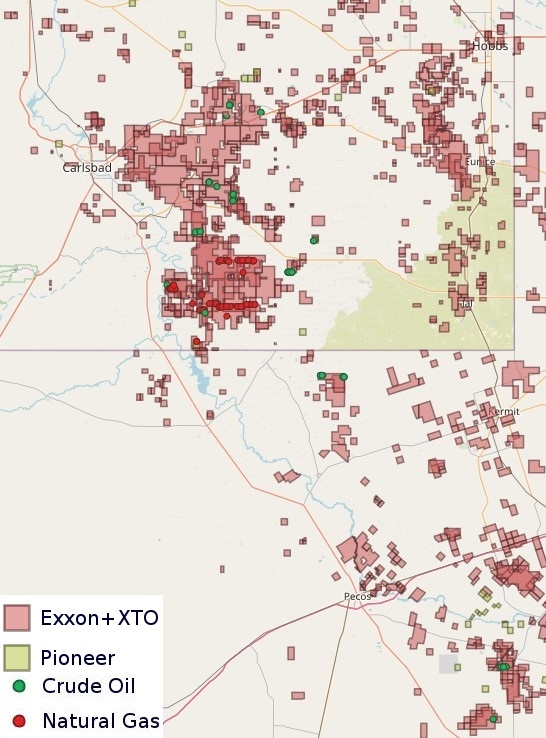

Before the Pioneer acquisition, Exxon Mobil was larger in the Delaware Basin of West Texas and New Mexico. The company got deeper in the core of the New Mexico Delaware Basin through a $6.6 billion acquisition of Bass family acreage in early 2017.

Exxon also owns acreage and legacy vertical wells in the Permian’s Central Basin Platform.

“This premier, tier-one asset is a natural fit for our Permian portfolio and gives us a greater opportunity to deploy our technology and deliver operating and capital efficiency for long-term shareholder value,” Exxon Mobil Chairman and CEO Darren Woods said in a press release. “The combination of our two companies benefits this country’s energy security and economy, and also furthers society’s environmental ambitions as we move Pioneer’s 2050 net zero goal to a 2035 plan.”

By layering in Pioneer’s production and assets, Exxon Mobil aims to ramp up Permian output to approximately 2 MMboe/d in 2027.

Pioneer fetched such a strong valuation because of the attractiveness of its Midland Basin asset base: The company owns a massive, blocky acreage position in the core of the shale play, where operators can drill gushing oil wells for relatively low costs.

Exxon expects a cost of supply of less than $35/bbl from Pioneer’s Midland Basin assets.

That’s an extremely low cost compared to the average $62/bbl price operators need to breakeven drilling a Midland Basin well, according to the most recent Dallas Fed Energy Survey.

Exxon Mobil was relatively late to U.S. shale development by the time it acquired unconventional gas player XTO Energy for $36 billion in 2010.

XTO’s shale operations were bought much closer into the Exxon fold after CEO Darren Woods took the helm of the U.S. supermajor. The company has worked to drill cheaper and more efficient wells in the Permian Basin by developing multiple stacked pay intervals—often called the “cube” development strategy.

Exxon has also been a leader in drilling three- and four-mile laterals on its existing footprint in the Delaware Basin. The company has brought online a handful of four-mile lateral wells in the New Mexico Delaware, according to data from Enverus Intelligence Research.

The company now plans to apply more than a decade’s worth of learnings drilling longer and more efficient Permian wells to Pioneer’s blocky Midland asset, Senior Vice President Neil Chapman when the deal was announced last year.

RELATED

$60B Pioneer Deal ‘Completely Different’ from XTO Takeover

FTC scrutiny

The mega-merger between Exxon Mobil and Pioneer was permitted to proceed after facing scrutiny by the U.S. Federal Trade Commission.

But under a proposed consent order announced by the FTC on May 2, Pioneer founder, chairman and former CEO Scott Sheffield will be barred from serving on Exxon Mobil’s board of directors after the deal closes.

In a complaint, the FTC alleged that Sheffield, through public statements and private communications, has attempted to collude with the oil cartel OPEC—and the broader OPEC+ alliance—to reduce oil and gas production to inflate company profits.

“Sheffield, for example, exchanged hundreds of text messages with OPEC representatives and officials discussing crude oil market dynamics, pricing and output,” the FTC wrote in a May 2 press release.

“In discussing his efforts to coordinate with Texas producers under a production cut mandated by the Railroad Commission of Texas, Sheffield said, ‘If Texas leads the way, maybe we can get OPEC to cut production. Maybe Saudi and Russia will follow. That was our plan,’ he said, adding: ‘I was using the tactics of OPEC+ to get a bigger OPEC+ done,’” per the release.

Pioneer, in a May 2 response, said it disagreed with and was surprised by the FTC’s complaint regarding Sheffield.

The company, and Sheffield, believe that the FTC’s complaint “reflects a fundamental misunderstanding of the U.S. and global oil markets and misreads the nature and intent” of his actions.

However, Pioneer and Sheffield emphasized they would make no attempt to prevent the merger from closing despite the FTC’s move.

“As he has for his entire career, Mr. Sheffield is electing to place the interests of investors, employees and the competitive health of the U.S. energy industry ahead of his own,” Pioneer said in a release.

Exxon, in a statement, said it would not add Sheffield to the board and has entered into a consent decree with the FTC to that effect.

“We learned about these allegations from the Federal Trade Commission. They are entirely inconsistent with how we do business,” Exxon said in a statement.

“In fact, following its comprehensive investigation and after Exxon Mobil submitted more than 1.1 million documents, 1.5 million lines of production and sales data, over 63,000 contracts and additional communications in response the FTC’s request, the Commission raised no concerns with our business practices,” the company continued.

RELATED

FTC OKs Exxon-Pioneer Merger, but Bars Sheffield from Exxon’s Board

Recommended Reading

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Stonepeak Backs Longview for Electric Transmission Projects

2025-03-24 - Newly formed Longview Infrastructure will partner with Stonepeak as electric demand increases from data centers and U.S. electrification efforts.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

USEDC’s Plans for $1B in Capex, M&A on Track as Oil Prices Stumble

2025-04-11 - Volatility won’t affect Permian Basin-focused U.S. Energy Development Corp.’s day-to-day operations or its plans for deals, CEO Jordan Jayson told Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.