Exxon Mobil Corp. is considering selling legacy conventional assets in the Permian Basin, the company said in a statement. (Source: Shutterstock.com)

Exxon Mobil Corp. is exploring a sale of select conventional assets in the Permian Basin.

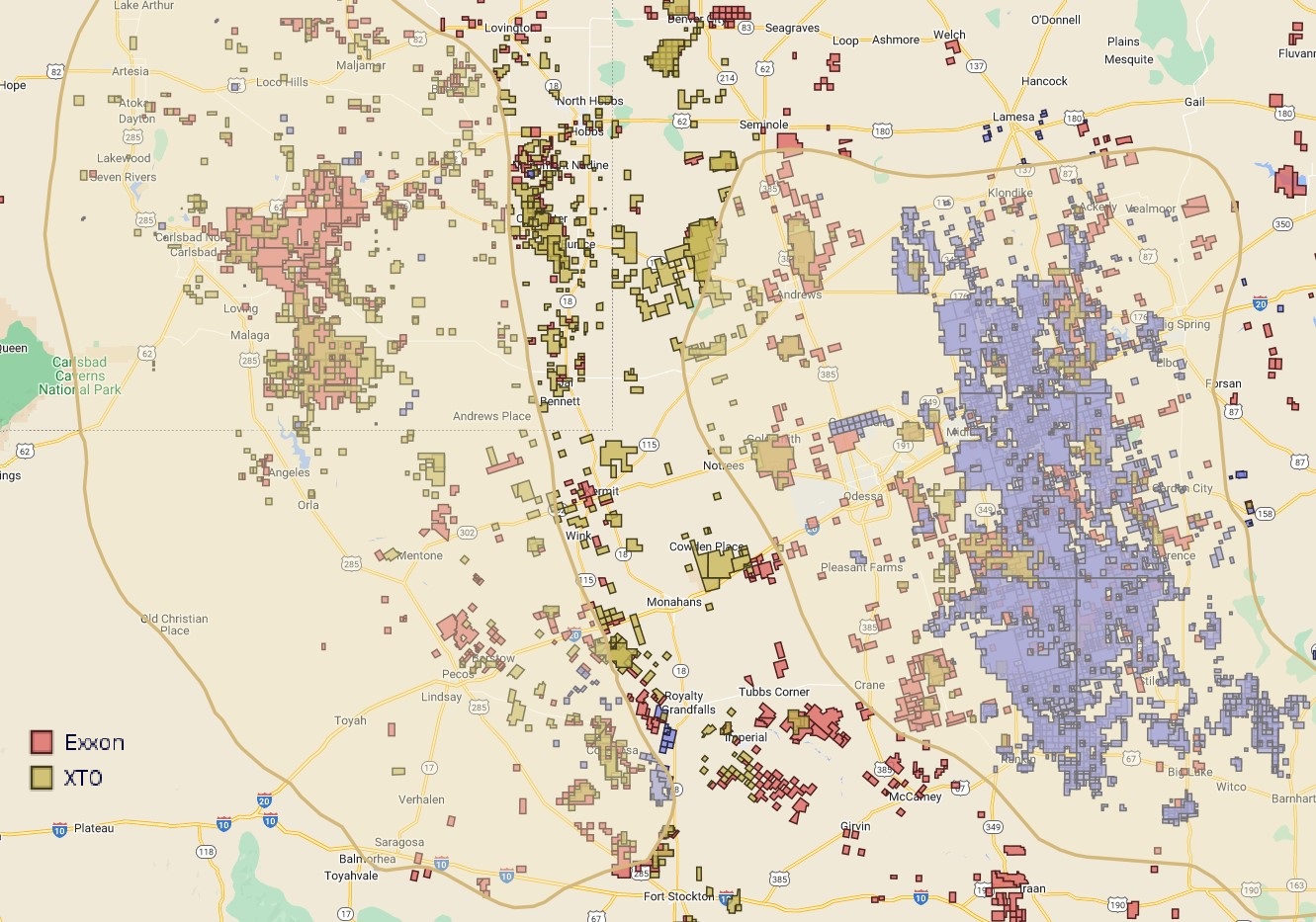

Exxon Mobil’s shale subsidiary XTO Energy, “is exploring market interest for select conventional assets in West Texas and Southeast New Mexico,” the Texas-based supermajor said in a statement.

Operations are expected to continue as normal through the marketing process, Exxon said.

XTO is reportedly marketing packages of assets in the Permian’s Central Basin Platform that could fetch approximately $1 billion in a sale, depending on oil prices. The Central Basin platform is a legacy part of the Permian Basin focused on conventional production.

“This decision is consistent with our strategy to continually evaluate our portfolio,” the company said.

XTO and Exxon are also both active in the Midland and Delaware unconventional reservoirs, where horizontal shale development has transformed the Permian Basin into the nation’s top oil-producing region.

Exxon added Midland Basin depth through a $60 billion acquisition of Pioneer Natural Resources, which closed in May.

APA Corp., parent company of Apache, is also reportedly considering asset sales in the Central Basin Platform and the Permian’s Northwest Shelf.

APA closed its own $4.5 billion acquisition of Callon Petroleum in April, adding depth in the Midland and Delaware basins.

RELATED

Exxon Pairs Record Pioneer Output with Record Legacy Permian Volumes

Recommended Reading

USD Completes Final Asset Sale of Hardisty Terminal

2025-04-11 - USD Partners was obligated to sell the Hardisty Terminal, in Alberta, Canada, after entering a forbearance agreement with its lenders on June 21 2024.

USEDC’s Plans for $1B in Capex, M&A on Track as Oil Prices Stumble

2025-04-11 - Volatility won’t affect Permian Basin-focused U.S. Energy Development Corp.’s day-to-day operations or its plans for deals, CEO Jordan Jayson told Hart Energy.

BP Forecasts Dip in First-Quarter Upstream Production

2025-04-11 - BP anticipates a quarter-over-quarter decline in upstream production when it reports earnings later this month.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.