Darren Woods, chairman and CEO, Exxon Mobil Corp. (Source: CERAWeek by S&P Global)

Exxon Mobil will boost spending later this decade as the U.S. supermajor looks to grow global production by 18%.

Spring, Texas-based Exxon plans to invest $28 billion to $33 billion per year from 2026 through 2030. That’s up from about $28 billion budgeted for 2025, the company told investors during a Dec. 11 corporate update.

Exxon plans to grow global oil and gas production from 4.7 MMboe/d in 2025 to 5.4 MMboe/d in 2030.

Around 70% of the spending will be directed into Exxon’s top projects: the Permian Basin, Guyana and LNG developments.

“Through 2030, we plan to deploy about $140 billion to major projects and the Permian Basin development program,” said Exxon CEO Darren Woods.

Permian M&A pays off

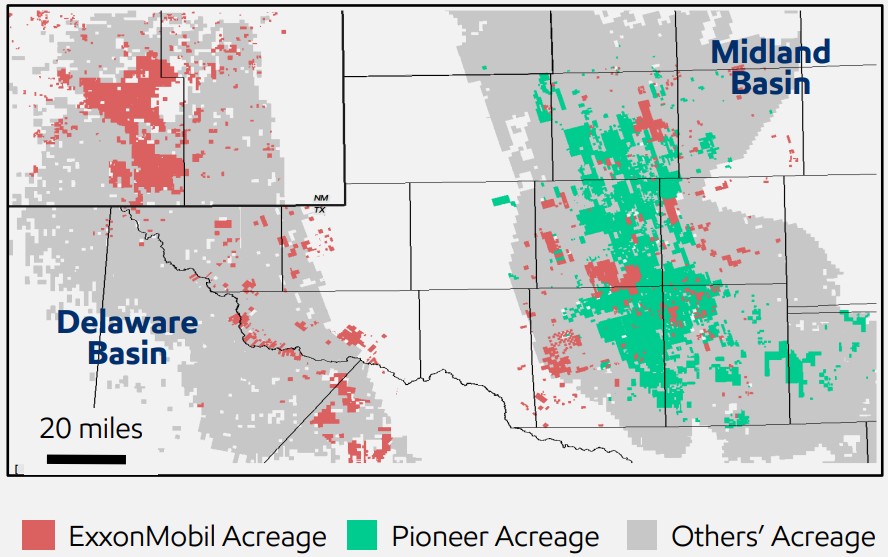

Exxon is seeing better-than-expected efficiencies in the Permian Basin after closing a transformational $60 billion acquisition of Pioneer Natural Resources.

Exxon expects to see over $3 billion in annual synergy cost savings following the acquisition and integration of Pioneer, a more than 50% increase over previous guidance.

The company aims to roughly double Permian production to 2.3 MMboe/d by 2030.

Exxon is seeing benefits from drilling longer Permian laterals—the company has already drilled among the longest horizontal wells in the basin, including 4-mile laterals in the New Mexico Delaware Basin.

Exxon anticipates that its average Delaware lateral lengths will grow from around 10,000 ft in 2022 to around 14,000 ft in the back half of the decade.

The company has discussed drilling longer Midland Basin wells after integrating Pioneer’s massive land position. Exxon plans to spud the first-ever 20,000-ft wells on Pioneer’s Midland asset this quarter.

Exxon also aims to drive higher value from its Permian asset through multi-bench co-development, or “cube” development.

The company has worked for several years to optimize spacing for multi-zone design, helping to drive higher capital efficiency.

Co-developing cube projects has increased net present value (NPV) by 20% compared to developing a single “best” bench, Exxon said.

By leveraging updated spacing patterns, longer laterals and a proprietary lightweight proppant derived from refinery coke, Exxon aims to improve Permian NPV by an additional 15%.

Exxon said its proprietary proppant technology has improved resource recovery by up to 15% so far. The technology, which leverages the company’s large North American refining footprint, has opened a greater fracture area compared to sand.

The company is planning to use the proprietary proppant for more than 200 Permian wells in the next year.

All these factors, in aggregate, are driving cost savings on Exxon’s legacy Permian asset and its new Pioneer Midland asset.

Enhanced cube design allows Exxon to keep recovery flat with 20% fewer wells. Longer laterals reduce surface and drilling costs by at least 25%. Greater Permian scale is driving other efficiencies throughout the drilling and completion process.

RELATED

Q&A: Exxon Mobil Pioneers the Permian and Guyana

Gas and power

With four LNG projects under development, Exxon plans to have offtake agreements in place for 40 million tonnes per annum (mtpa) by 2030.

Exxon is currently developing Golden Pass LNG on the Texas Gulf Coast. Golden Pass will add 16 mtpa of capacity after starting up late in 2025.

Working with partner QatarEnergy, Exxon is co-developing the Qatar North Field East (NFE) expansion project—also expected to come online in late 2025. Exxon holds a 25% interest in the joint venture.

Exxon is also targeting final investment decisions for LNG projects in Papua New Guinea (+6 Mtpa) and Mozambique (+18 Mtpa) in 2026.

Outside of gas exports, Exxon sees an opportunity to produce gas-fired power generation for data centers.

The company is reportedly designing a natural gas-fired power plant built to directly supply electricity to data centers. Exxon also plans to develop the project with carbon capture, utilization and storage technologies to capture over 90% of the facility’s CO2 emissions.

The “fully-islanded” power generation project would be developed behind the meter, limiting reliance on an already strained power grid.

Exxon isn’t alone in its aspirations to feed electricity to power-hungry data centers. Chevron recently discussed developing behind-the-meter natural gas power plants for data centers, according to analysts at Jefferies.

Plans are in early stages, but Chevron is engaged with several potential partners, Jefferies analyst Julien Dumoulin-Smith wrote in a Dec. 10 report.

RELATED

NatGas Pundits Pitch Fossil Fuel Reliability to Meet Needs of Big Tech

Chevron pulls back

As Exxon looks to boost spending, rival Chevron is doing the opposite.

Chevron is budgeting $15 billion in 2025 capex, a $2 billion reduction year-over-year, the company announced Dec. 5.

“The 2025 capital budget along with our announced structural cost reductions demonstrate our commitment to cost and capital discipline,” Chevron CEO Mike Wirth said.

Upstream spending will be about $13 billion, roughly two-thirds of which will be directed into Chevron’s U.S. portfolio.

Chevron plans to spend between $4.5 billion and $5 billion in the Permian next year, lowering production growth in favor of driving free cash flow.

The remaining U.S. spending will be invested in the Gulf of Mexico (GoM) and Colorado’s Denver-Julesburg Basin.

Chevron’s deepwater GoM projects continue to ramp up and are expected to contribute offshore production of 300,000 boe/d in 2026.

The deepwater Anchor project, which taps into an ultra-high-pressure, high-temperature GoM reservoir, reported first oil in August.

Anchor was the first production from any of the region’s super high-pressure formations at 20,000 lb psi. Industry experts say the breakthrough will unlock new areas of the GoM that were previously unreachable with older technology.

RELATED

What Chevron’s Anchor Breakthrough Means for the GoM’s Future

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.