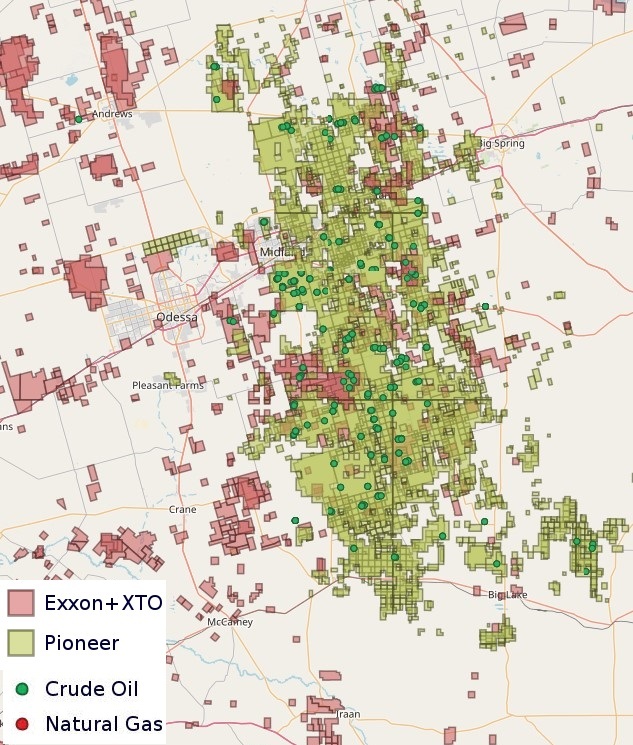

Exxon Mobil set records for drilling times and lateral lengths on Pioneer Natural Resources’ Midland Basin asset in the third quarter. (Source: Shutterstock.com)

Exxon Mobil is producing record volumes from the Permian Basin after closing a $60 billion takeover of Pioneer Natural Resources in May.

And Spring, Texas-based Exxon Mobil is already seeing the benefits of adding Pioneer’s massive Permian Basin acreage position to its world-class portfolio.

Exxon drilled the longest laterals on Pioneer’s acreage during the third quarter—at 18,250 ft, or nearly 3.5 miles, CEO Darren Woods said.

“The benefits of long laterals are significant: fewer wells, a smaller surface footprint and greater capital efficiency,” Woods said during Exxon’s third-quarter earnings call on Nov. 1.

The company plans to spud the first-ever 20,000-ft laterals on Pioneer’s acreage this quarter, he said.

Exxon Mobil’s Permian output averaged over 1.4 MMboe/d during the third quarter, including Exxon’s heritage Permian production and new production added from the Pioneer deal.

The company anticipates its full-year total Permian production to average around 1.2 MMboe/d.

Exxon is already drilling some of the longest wells in the entire Permian Basin, including a handful of 4-mile laterals on its Delaware Basin asset in New Mexico, according to Enverus Intelligence Research data.

Before acquiring Pioneer, Exxon’s ability to drill longer laterals in the Midland Basin was constrained because of its fragmented acreage position.

RELATED

Go Long: Exxon, EOG Extend Permian Laterals, Lead US Onshore Drilling

Apart from drilling longer laterals, Exxon is also leveraging Pioneer’s scale in the Midland Basin in other ways.

Pioneer’s “world-class water infrastructure network” allows Exxon to service the combined assets at a lower cost, Woods said. The two companies are also working together on supply chain needs for Permian operations.

“We're harmonizing a lot of the specifications that we have on materials and services to try to take advantage of the scale and to simplify the procurement supply chain and drive cost efficiencies,” Woods said.

The combined company is also reporting strong drilling efficiencies, setting an all-time Pioneer record for lateral feet drilled per day during the third quarter.

Exxon also reports leveraging its “cube” design on Pioneer’s acreage to good effect. Exxon has been a leader in cube development in the Permian, where multiple wells targeting different stacked intervals are drilled from a single pad.

Exxon aims to achieve an average of $2 billion in annual cost savings over the next decade by combining with Pioneer, CFO Kathy Mikells reiterated.

“Obviously that would start smaller and build,” she said, “and we’re clearly seeing more synergies than we initially anticipated.”

The company’s total year-to-date earnings were $26.1 billion, compared to $28.4 billion over the same period last year.

Pioneer’s Permian volumes contributed approximately $1.2 billion to Exxon’s earnings in the third quarter.

The company’s third-quarter upstream earnings totaled $6.2 billion, down $916 million quarter-over-quarter because of lower crude oil prices and higher exploration costs.

Structural cost savings and strong production—including from Exxon’s highest liquids volumes produced in 40 years—partially offset the slide in upstream earnings.

Exxon’s worldwide production averaged 4.6 MMboe/d during the third quarter.

The company plans to divulge additional details on 2025 capital spending and drilling and completion plans in the Permian during a corporate plan update in December, executives said.

Exxon reported weakness in its downstream products solutions segment during the third quarter, as industry refining margins and natural gas prices dipped from last year’s “historically high levels.”

RELATED

Beyond the Horizon: Exploring the Permian’s Longest Laterals

Recommended Reading

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.