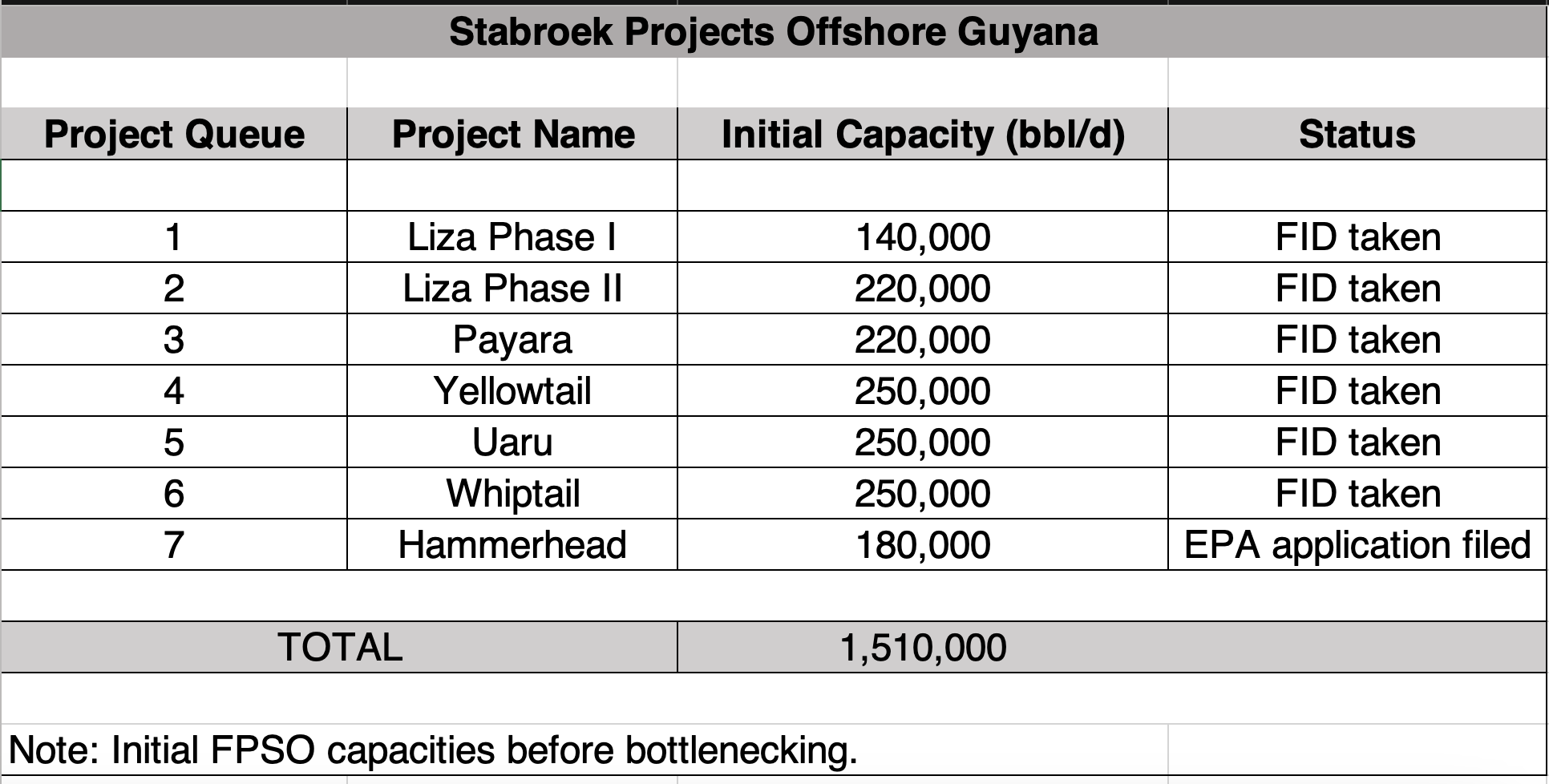

Exxon Mobil Corp. announced plans for its seventh development offshore Guyana, Hammerhead, which will add 120,000 bbl/d to 180,000 bbl/d of production capacity starting in 2029. (Source: Shutterstock.com, Exxon Mobil)

Exxon Mobil’s seventh project offshore Guyana, Hammerhead, will feature an FPSO with a 28% smaller processing capacity than the previous three FPSOs announced for the deepwater Stabroek Block, the company said on July 18.

The last three projects to reach final investment decision (FID) offshore Guyana include Yellowtail, Uaru and Whiptail. The FPSOs associated with each had a stated production capacity of 250,000 bbl/d.

The FPSO for Hammerhead is expected to add 120,000 bbl/d to 180,000 bbl/d of production capacity. The FPSO will be able to store between 1.4 MMbbl and 2 MMbbl, Exxon said in its June 2024 application for environmental authorization filed with Guyana’s Environmental Protection Agency (EPA). The document was officially posted to the EPA’s website and made available to the public on July 15.

RELATED

Offshore Guyana: ‘The Place to Spend Money’

As a result, the Hammerhead FPSO will be the second smallest in the Exxon fleet offshore Guyana along with the 140,000 bbl/d Liza Destiny FPSO assigned for the Liza Phase 1 development.

“Like all our vessel designs, we consider a range of factors that allow us to maximize resource recovery given the characteristics of a particular location,” Exxon told Hart Energy via email. “As a result, Hammerhead will likely be a different size than the other six FPSOs, but with the same degree of optimism for yet another industry-leading development.”

Hammerhead will have an estimated duration of at least 20 years with startup expected in 2029. The project will also produce between 60 MMcf/d to 120 MMcf/d of gas, according to the project summary that accompanied the application.

Exxon affiliate Exxon Mobil Guyana Ltd. operates the 6.6-million-acre Stabroek Block with 45% interest on behalf of partners Hess Guyana Exploration Ltd., which holds 30% interest, and CNOOC Petroleum Guyana Ltd. with 25% interest.

The consortium started producing oil from Stabroek in Dec. 2019. To date, three developments with associated FPSOs are producing over 600,000 bbl/d. Exxon and Hess have reiterated there is potential for up to 10 FPSOs to develop the over 11 Bboe of estimated gross discovered recoverable resources in Stabroek.

Hammerhead development plan

The oil discoveries offshore Guyana have been transformational to the economy of the small South American country, which has boasted double-digit growth rates since 2020. The economy is expected to grow at least 34.2% in 2024.

When it comes online in 2029, Hammerhead stands to push Guyana’s total production to about 1.5 MMbbl/d. At that level, Guyana would rank among the top three producing countries in Latin America, along with leader Brazil and either on par, above or below Mexico.

Spring, Texas-based Exxon said submission of the environmental authorization application was the first step in progressing project approvals as it continues to evaluate and define the potential scope of Hammerhead.

Hammerhead is located in the south-central portion of Stabroek, some 15 km southwest from the current location of the Liza Destiny FPSO and approximately 160 km from Guyana’s capital Georgetown.

Current plans call for the use of drill ships to produce oil using approximately 14 to 30 production and injection wells, according to the project summary that accompanied the application.

Production facilities to be installed offshore Guyana include subsea equipment as well as processing equipment. The subsea equipment will be installed in a water depth of approximately 750 m to 1,200 m.

The FPSO to be used to develop Hammerhead is expected to be a very large crude carrier (VLCC) conversion facility with double sided and double bottom protection.

Recommended Reading

Nabors, Corva Expand Alliance to Boost AI-Driven Innovation at Rig Sites

2025-04-11 - Nabors Drilling Technologies and Corva AI will use the RigCloud platform to provide real-time insights to crews directly at drilling sites, the companies said.

Inside Prairie’s 11-Well Program in the D-J

2025-04-08 - Prairie Operating Co.’s 11-well program in the Denver-Julesburg Basin is drilling horizontal 2-milers with a Precision Drilling rig.

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.