(Source: Franklin Mountain Energy)

Private Delaware Basin E&P Franklin Mountain Energy may be getting noticed as an attractive M&A target, but the company appears to be pressing ahead and “punching above its weight” without paying much attention to the gossip.

Stephen Trauber, chairman and global head of energy and clean technology at Moelis & Co., has said that Franklin Mountain would likely command somewhere in the “$3 billion-ish range” in a deal. The company could fit in a variety of larger, public E&Ps including EOG Resources, Devon Energy, Permian Resources or Matador Resources.

Franklin Mountain CEO Craig Walters, speaking at the EnerCom Denver conference on Aug. 20, made it clear from the outset that he wasn’t on stage to spin the company for investments or investors; that he wouldn’t share any forward projections, financials or customary disclosure statements.

But he did talk about a company that continues to push boundaries, including teasing an 18-well project that had freshly come online in the southern portion of its Lea County, New Mexico, acreage.

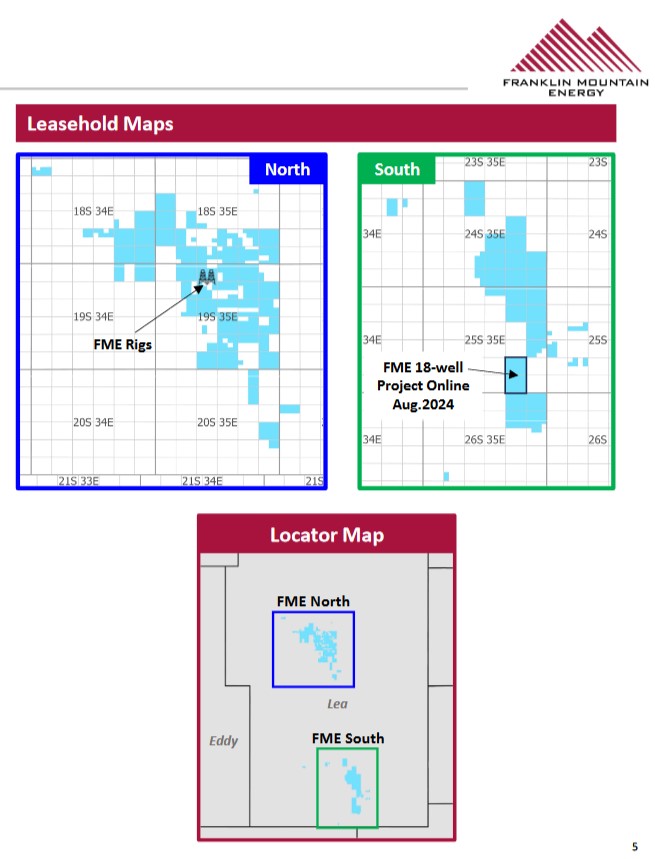

Since initially acquiring acreage in the basin in 2018, Franklin Mountain has executed on 144 wells, Walters said. “The basin continues to push off to the right,” Walters said. “Not only have we been able to develop this southern position, but we've pulled off another very transformative set of acquisitions in late December of ‘22. This time we did two acquisitions in the same day to really form that northern position.”

Walters said he wouldn’t go into details about the deal so as to “not to give up our competitive advantage.”

“What I will say is the basin’s edge continues to push out and what we've seen, obviously, is our increasing efficiencies on the drilling and completion side, and we decreased costs,” he said.

In practice, he said, that means a lot of the inventory that was Tier 2 “yesterday is today’s Tier 1 locations.”

Across Franklin Mountain’s 32,000 net acres (98% operated), the company has developed production averaging 50,000 boe/d, 73% oil and, overall, 85% liquids. The company operates a total of 170 wells with a deep inventory of Bone Spring and Wolfcamp formations. Franklin Mountain’s laterals average about 2 miles or more in length.

“I really attribute that to the building blocks [of the company] … creativity, patience, conviction and flexibility on the creativity side, not just the initial formation of the company, but in some transformative trades and acquisitions that we've made along the way to provide us a much larger operated footprint,” he said.

Part of that patience involved waiting on an operated drilling program until all of its midstream pieces and critical infrastructure were in place.

“Our M.O. is really to make sure that the only thing that's going to hold production back is the choke of the wellhead,” Walters said. “In other words, when we bring our project on, we've got all that stuff solved.”

And Walters said he saw no sense in using third-party midstream operators.

“I don't want to offend any midstream companies in the room today, but why would I pay you a high teens or low twenties rate of return if my cost of capital is lower than that?” he said. “I have conviction around my production profile and, oh, I may find some other horizons out here ultimately that are going to take advantage of that fixed infrastructure. And so that's exactly what we've done.”

The company also invested in what Walters broadly termed “technology and science,” including 3D seismic “from day one to understand well planning and geosteering.”

“More importantly, some of that science was around pilot holes, full open holes, suite logs, microseismic studies, frac studies, all in an effort to better understand the rock frac interactions and how to develop this acreage and maximize the value,” he said.

Some of those efforts led to the Bone Spring in the Avalon, “and really those tests were a result of some of what we had learned with those science dollars that we spent,” he said.

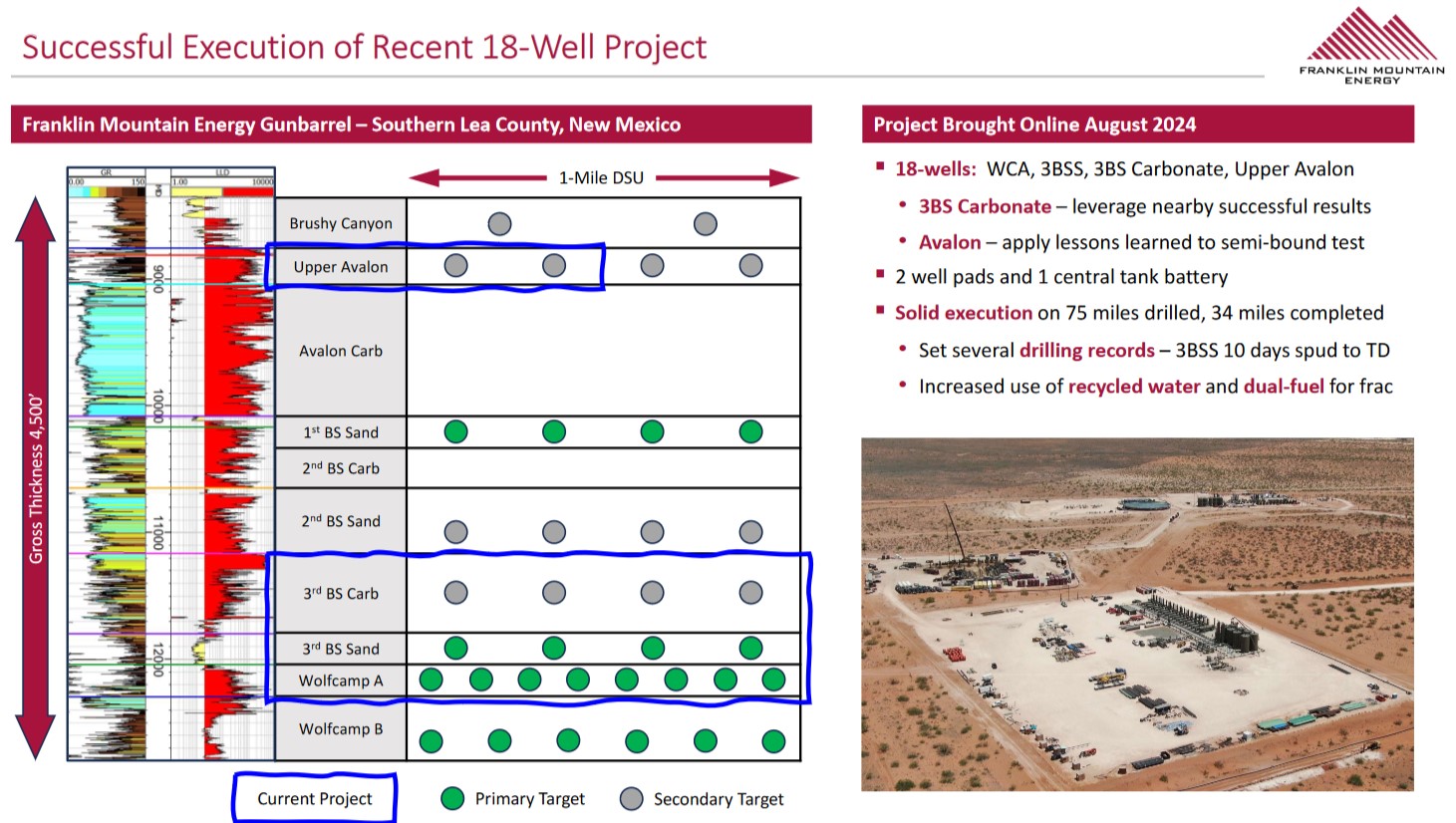

All of that culminated, most recently, in Franklin Mountain’s Gunbarrel project in southern Lea County.

In August, the company brought Gunbarrel’s 18 wells online, targeting the company’s core horizons, including the Third Bone Spring and Wolfcamp A.

“We have layered in some Third Bone Spring carb in this particular development and we're not ashamed to look across the fence at other operators in the area and see what they're starting to develop,” he said.

Franklin Mountain had previously drilled a single Avalon well, which at the time was the farthest east anyone had drilled in the Delaware.

“When we did that in 2022, we liked the results there. We wanted to follow that up in this particular project with two wells to have a semi-bound test,” he said.

During completion operations, Walters said Franklin Mountain’s team delivered solid execution on the project—drilling 75 miles and completing 34 miles.

“We've seen that subsequently on every project we do, we continue to set records on the drilling side, the completion side, obviously recycled water, dual fuel,” he said.

“Like I tell our team internally, we punch way above our weight class, whether it comes down to ESG or taking on an 18-well project,” Walters said. “We're not afraid to take this stuff on at the bigger boys’ town. And so it's been kind of fun to watch.”

Walters declined to talk about specific results, saying it was too early to do so.

In a phone interview, Walters told Hart Energy that the earliest well was brought online Aug. 5 and results were still coming in.

“The costs came in very good and we’re encouraged by early results,” he said.

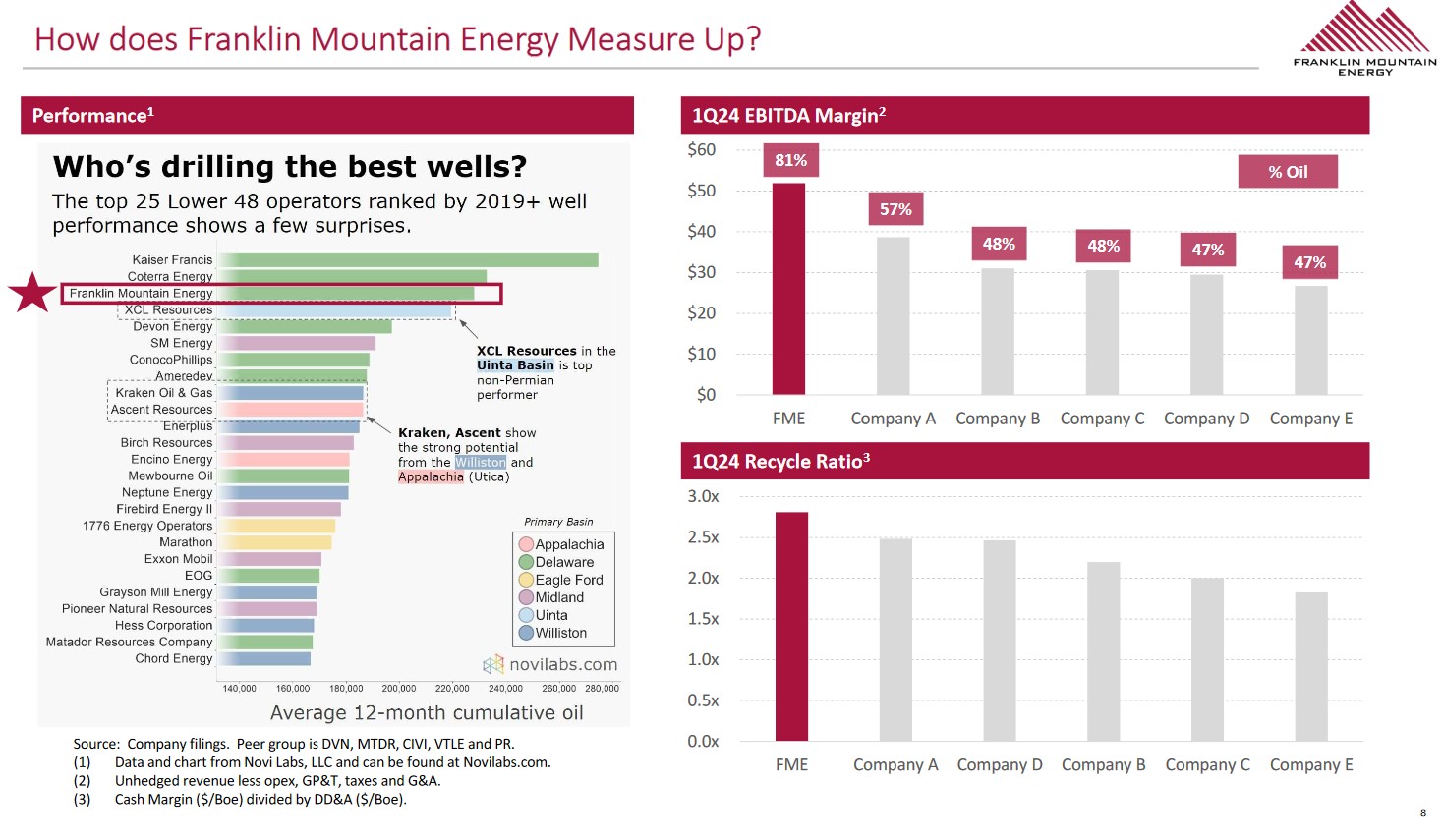

At EnerCom, Walters also said Franklin Mountain wanted to know how the company measured up according to independent data provider, Novi Labs.

“Franklin Mountain … is number three with regard to average 12-month cumulative oil across all basins, all operators,” Walters said. “And it's great to have great rock, great execution, strong well results.”

“But at the end of the day, we're here to run a business and that business needs to have margin. We're a commodity-based business, but we also need to get a return on investment,” he added.

Stacked up against its peers in the Permian, at $50/bbl the company's EBITDA margin is about 70% higher than five of its comparable rivals in the basin, he said.

“So margins are important, but also are you getting a return on that capital investment? And that's really what's detailed by the recycler ratio here. And so again, we've got great rock, we've delivered great results, and that's both operationally and more importantly, financially.”

Recommended Reading

Aethon: Haynesville E&Ps Hesitate to Drill Without Sustained $5 NatGas Prices

2025-03-12 - Operators are looking to the Haynesville to fill rising natural gas demand for U.S. LNG exports. Haynesville E&P Aethon Energy says producers need sustained higher prices to step up drilling.

Haynesville Horsepower: Rigs Needed to Crest the Coming ‘Wall of Demand’

2025-04-01 - How many drilling rigs are needed in the Haynesville Shale to meet growing natural gas demand for LNG exports? Keybanc ran the numbers.

‘Golden Age’ of NatGas Comes into Focus as Energy Market Landscape Shifts

2025-03-31 - As prices rise, M&A interest shifts to the Haynesville Shale and other gassy basins.

Operators Look to the Haynesville on Forecasts for Another 30 Bcf/d in NatGas Demand

2025-03-01 - Futures are up, but extra Haynesville Bcfs are being kept in the ground for now, while operators wait to see the Henry Hub prices. A more than $3.50 strip is required, and as much as $5 is preferred.

Aethon Dishes on Western Haynesville Costs as Gas Output Roars On

2025-01-22 - Aethon Energy’s western Haynesville gas wells produced nearly 34 Bcf in the first 11 months of 2024, according to the latest Texas Railroad Commission data.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.