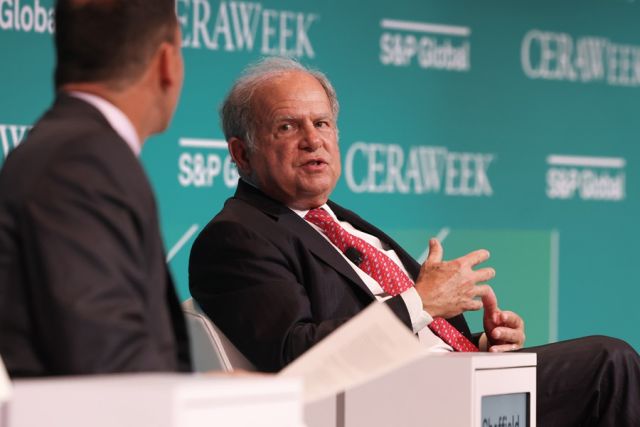

A megamerger between Exxon Mobil and Pioneer Natural Resources can proceed, but Pioneer Chairman Scott Sheffield is out, the Federal Trade Commission says. (Source: CERAWeek by S&P Global)

The Federal Trade Commission (FTC) will allow a blockbuster $59.5 billion merger between Exxon Mobil and Pioneer Natural Resources to proceed, but blocks Pioneer founder and chairman Scott Sheffield from gaining a seat on Exxon’s board.

Exxon said the deal, which originally had Sheffield taking a board seat, is set to close May 3.

At the heart of the FTC’s order and consent order are allegations that, on Exxon’s board, Sheffield would engage in “collusive activity” that could potentially raise crude oil prices, leading consumers and businesses to pay higher prices for gasoline, diesel fuel, heating oil and jet fuel.

In a proposed consent order, the FTC alleges that Sheffield has attempted to collude with representatives of OPEC to influence oil prices while conversely alleging that Sheffield has tried to align Permian Basin operators to drive prices below OPEC’s goals. The FTC further stipulates that Exxon “shall not nominate, designate or appoint any Pioneer employee or director” for a period of five years.

RELATED

Exxon Acquiring Pioneer for $60B as Permian Oil Takes Center Stage

In a May 2 press release, Pioneer said it disagreed and was surprised by the FTC’s Complaint “saying that Mr. Sheffield’s record and statements on matters of public interest should disqualify him from serving on the ExxonMobil Board of Directors.”

However, Pioneer and Sheffield said they will not take any steps to prevent the merger from closing. Sheffield instead has elected to place the interests of investors and employees and the competitive health of the U.S. energy industry first, the company said.

“At the same time, Mr. Sheffield and Pioneer believe that the FTC’s Complaint reflects a fundamental misunderstanding of the U.S. and global oil markets and misreads the nature and intent of Mr. Sheffield’s actions,” Pioneer said.

Exxon said the allegations raised by the FTC are “entirely inconsistent with how we do business.” Exxon said it submitted 1.1 million documents, 1.5 million lines of production and sales data and 63,000 contracts in response to the FTC’s request. “The Commission raised no concerns with our business practices,” the company said.

Exxon said it would not add Sheffield to its board but welcomed other Pioneer employees who will take leadership roles in the combined Permian business, including Rich Deal, Pioneer’s CEO. Maria Dreyfus, current Pioneer Board Member, to join the Exxon's board effective May 3.

But Kyle Mach, deputy director of the FTC’s Bureau of Competition, said Sheffield’s past conduct “makes it crystal clear that he should be nowhere near Exxon’s boardroom.

“American consumers shouldn’t pay unfair prices at the pump simply to pad a corporate executive’s pocketbook. The FTC will remain vigilant in its enforcement efforts to protect competition in these vital markets,” Mach said in an FTC press release.

The FTC cited Sheffield’s public statements, text messages, in-person meetings, WhatsApp conversations and other communications while at Pioneer in accusing Sheffield of seeking to align oil production across the Permian Basin in West Texas and New Mexico with OPEC+.

“Sheffield, for example, exchanged hundreds of text messages with OPEC representatives and officials discussing crude oil market dynamics, pricing and output,” the FTC said. “In discussing his efforts to coordinate with Texas producers under a production cut mandated by the Railroad Commission of Texas, Sheffield said, “If Texas leads the way, maybe we can get OPEC to cut production. Maybe Saudi and Russia will follow. That was our plan,” he said, adding: “I was using the tactics of OPEC+ to get a bigger OPEC+ done.”

In a partially redacted FTC complaint, the commission alleges that Sheffield has “publicly threatened” U.S. shale producers who might deviate from a coordinated output reduction scheme. It cites a number of his remarks, referencing an interview in which he said the industry’s public independents were “staying in line… I’m confident they will continue to stay in line.”

The complaint also cites Sheffield’s “close communications with high-ranking OPEC officials continued during the early days of the COVID pandemic,” as well as his efforts to limit Permian oil production in the face of falling oil prices.

In heavily redacted sections of the complaint, the SEC alleges that Sheffield not only exchanged information with OPEC representatives but also served as a “conduit.” Sheffield also worked to facilitate direct communications between his competitors in the Permian and OPEC, the FTC alleges.

The complaint further states that in 2020, Sheffield lobbied the Texas Railroad Commission to impose output restrictions on Permian oil production at the outset of the COVID pandemic.

“Mr. Sheffield was the leader of the movement advocating RRC-mandated production cuts, which would have reduced output and increased crude oil prices above market levels.”

The FTC also noted that Sheffield’s appointment to Exxon’s board would be anticompetitive because he currently serves on the board of Williams Cos., which operates a host of natural gas pipelines; natural gas gathering, processing, and treating assets; and other businesses that directly overlap with Exxon’s operations.

Pioneer's response

In its response to the FTC complaint and consent order, Pioneer argued that over the course of his 50-year career, Sheffield has been at the forefront of building a competitive U.S. shale industry, which comprises “scores of public and private independent companies.”

“Sheffield is widely recognized as a leader in the energy industry and is frequently asked to speak publicly and share his observations,” the company said. “He was instrumental in making the case that restrictions on the export of U.S. oil should be eased – which flipped the U.S. from being a net importer to a net exporter of oil and was key to reducing U.S. reliance on external sources for energy, further strengthening our country’s energy independence and national security, along with increasing competition for global supplies of oil and natural gas.”

Sheffield also led the effort to curb methane emissions and flaring in the Permian Basin. He has been a champion of building a competitive industry labor market, improving skills and opportunities and an advocate for fostering an employee culture rooted in respect, integrity, safety, diversity and collaboration.

Pioneer said that during Sheffield’s career, it was neither the intent nor an effect of Sheffield’s communications to circumvent the laws and principles protecting market competition.

“On the contrary, Mr. Sheffield focused on legitimate topics such as investor feedback on independent oil and gas company growth and capital reinvestment frameworks; unfair foreign practices that threatened to undermine U.S. energy security; and, through dialogue with government officials, the need to sustain a resilient, competitive and economically vibrant oil and gas industry in the United States,” Pioneer said.

Sheffield’s insights come from having lived through six industry downturns in which OPEC and OPEC+ oversupplied the market, causing substantial turmoil for U.S independents, including Pioneer, small private energy companies and other important parts of the U.S. economy. The companies were forced to significantly curtail drilling activity, lay off employees, refinance debt and/or declare bankruptcy, among other actions, Pioneer said.

“By way of example, the extraordinary collapse in oil demand and oil prices, during which oil traded at an all-time low of negative $37 per barrel in April 2020 — driven by the COVID-19 pandemic and compounded by the predatory practices of OPEC, Russia and other producing nations, which flooded the market with oil — posed a direct threat to the stability and competitiveness of the U.S. energy industry and consequently to the U.S.’s long-term energy and national security,” Pioneer said.

Given the significance and unusual circumstances, Sheffield, as a leading and internationally respected industry authority, voiced concerns aimed at raising awareness of the issue and encouraging state, federal and international governments to act. That included encouraging legally authorized actions by the Texas Railroad Commission when the global pandemic and the oil market was at its worst.

“Those concerns, and Mr. Sheffield’s right to express them, are protected by the First Amendment and an unbroken line of U.S. Supreme Court cases known as the Noerr-Pennington Doctrine.”

Further, in 2019, Sheffield and other senior Pioneer leaders visited with Pioneer’s major investors, including the largest pension fund managers in the U.S. Investors wanted better capital discipline, which would allow Pioneer to generate competitive returns and free cash flow that could be used to improve liquidity and return cash back to shareholders.

Based on the investor feedback, Pioneer began discussing and initiating planned capital reinvestment and return of capital changes at investor conferences and on its earnings calls. These actions were solely motivated by Pioneer’s desire to meet investor expectations that the company offer a competitive total return framework compared to other industries.

Over the same period, Pioneer continued to be a leader in growing U.S. production and a large contributor to the revival of the Permian Basin, which is now one of the largest oil fields in the world, with oil production exceeding 6 MMbbl/d.

“The growth of total U.S. oil production to over 13 million barrels of oil per day has contributed to reduced gasoline prices for U.S. consumers,” the company said. “Pioneer, from 2019 to 2023, has more than doubled its daily production from 346,000 barrels of oil equivalent to 715,000 barrels of oil equivalent, significantly adding to U.S. energy supplies.”

Recommended Reading

Colonial Shuts Pipeline Due to Potential Gasoline Leak

2025-01-14 - Colonial Pipeline, the largest refined products pipeline operator in the United States, said on Jan. 14 it was responding to a report of a potential gasoline leak in Paulding County, Georgia and that one of its mainlines was temporarily shut down.

Colonial’s Line 1 Gasoline Service Restored, Company Says

2025-01-20 - Colonial Pipeline Co. stopped flows on the gasoline transport line following reports of a leak in Georgia.

MPLX Acquires Remaining Interest in BANGL for $715MM

2025-02-28 - MPLX LP has agreed to acquire the remaining 55% interest in BANGL LLC for $715 million from WhiteWater and Diamondback.

Kinder Morgan Acquires Bakken NatGas G&P in $640MM Deal

2025-01-13 - The $640 million deal increases Kinder Morgan subsidiary Hiland Partners Holdings’ market access to North Dakota supply.

Tallgrass, Bridger Call Open Season on Pony Express

2025-02-14 - Tallgrass and Bridger’s Pony Express 30-day open season is for existing capacity on the line out of the Williston Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.