Hydrogen storage hub concept. (Source: Shutterstock)

Two hydrogen hubs in the Gulf Coast and Midwest have joined three other hubs across the U.S. in securing federal funding as the nation works to establish a clean hydrogen network to help decarbonize high-polluting sectors.

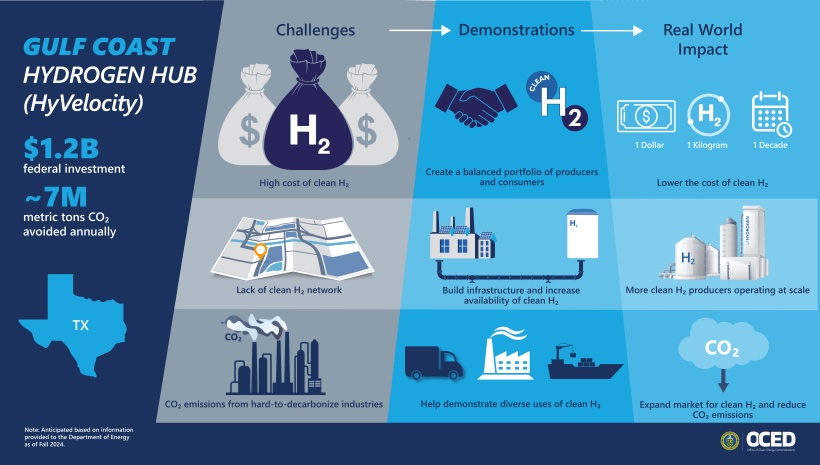

The U.S. Department of Energy (DOE) said Nov. 20 it is committing up to $1.2 billion of federal cost share for the HyVelocity-led Gulf Coast Hydrogen Hub and up to $1 billion of federal cost share for the Midwest Hydrogen Hub, which is led by the Midwest Alliance for Clean Hydrogen LLC (MachH2).

“The Biden-Harris administration has followed through on its promise to kickstart a new domestic hydrogen industry that can produce fuel from almost any energy resource in virtually every part of the country and that can power heavy duty vehicles, heat homes and fertilize crops,” said U.S. Secretary of Energy Jennifer M. Granholm. “Today’s announcement marks a major milestone in DOE’s Hydrogen Hubs program, signaling our deep commitment to strengthening America’s energy security and boosting our economic and global competitiveness while also tackling the climate crisis.”

The funding is part of up to $7 billion the U.S. allocated to establish hydrogen hubs across the country. The hubs, which position hydrogen producers and consumers together with infrastructure, are part of ongoing efforts to reduce greenhouse-gas emissions.

Located along the Texas Gulf Coast, home to some of the biggest industrial and energy companies, HyVelocity’s partners include AES Corp., Air Liquide, Chevron, Exxon Mobil, MHI Hydrogen Infrastructure LLC and Ørsted, with GTI Energy serving as the administrator. Other collaborating organizations include the University of Texas at Austin, the Center for Houston’s Future and Houston Advanced Research Center.

“More than 150 energy companies based on the U.S. Gulf Coast have supported our efforts to create HyVelocity, including major clean hydrogen suppliers, international EPCs [engineering, procurement and construction], infrastructure companies, clean hydrogen equipment suppliers and trading companies,” said Brett Perlman, managing director for the Center for Houston’s Future. “We are excited that HyVelocity will now become the organizing force for creating this broad-based clean hydrogen ecosystem.”

The HyVelocity hub plans to produce hydrogen through electrolysis and from natural gas with carbon capture and storage. As detailed by the DOE’s Office of Clean Energy Demonstrations (OCED), the hub’s seven proposed projects, which are spread across the Texas Gulf Coast near Houston, include:

- AES’ Bayou Green, an electrolytic hydrogen plant near Houston with a production capacity of up to 175 metric tons per day (mt/d) powered by renewable energy;

- Ørsted’s Star e-methanol, an electrolytic hydrogen project powered by solar and wind energy. The power-to-X project aims to use hydrogen to create e-methanol;

- Air Liquide and Equistar Chemical’s Project Zeus, a project in which Air Liquide plans to build a clean hydrogen pipeline to a retrofitted Equistar chemical manufacturing plant where hydrogen will be used as a fuel source;

- Air Liquide’s Project Mercury, a clean hydrogen liquefaction facility the industrial gases company plans to build in the so-called “Texas Triangle.” It will be capable of producing 30 mt/d of clean liquid hydrogen;

- Chevron’s Crescent Bayou, a natural gas-fueled hydrogen production facility that would produce up to 700 mt/d of hydrogen for conversion into lower-carbon ammonia;

- Exxon Mobil’s hydrogen pipeline, which will connect hydrogen to demand; and

- MHI Hydrogen Infrastructure’s Morning Hawk, a proposed electrolytic production plant with up to 240 mt/d nameplate capacity of clean hydrogen in Duval County, Texas.

Of the up to $1.2 billion federal commitment, OCED has awarded the hub $22 million to begin Phase 1. Expected to last about 18 months, Phase 1 entails planning, design and community and labor engagement activities, OCED said.

With plans to use natural gas, renewable energy and nuclear energy as feedstock, MACH2’s Midwest Hydrogen Hub has proposed projects spread across Illinois, Indiana, Iowa and Michigan. Of the up to $1 billion federal commitment, OCED has awarded the hub $22.2 million to begin Phase 1.

The Midwest hub’s proposed projects, according to OCED, include plans by Constellation to construct an electrolysis facility to produce hydrogen via a proton exchange membrane. If cleared by Illinois state regulators, Nicor Energy Ventures aims to build 25 miles of pipeline to transport gaseous hydrogen from a potential nuclear-powered electrolysis production plant to two end users in LaSalle County, Illinois.

Air Liquide is also involved in the Midwest hub. Here, it is evaluating teaming up with Invenergy to build an electrolysis facility co-located with a liquefaction site it is also considering.

BP is also contemplating Midwest hydrogen action. The company is considering building a hydrogen production facility near its existing Whiting refinery in Northwest Indiana, according to OCED. Other projects have also been proposed by GTI Energy; the Michigan Department of Environment, Great Lakes and Energy; the Mass Transportation Authority; and the Midwest Hydrogen Corridor Coalition.

The Biden-Harris administration aimed to produce 10 million metric tons of hydrogen annually by 2030. The public investments in the regional hubs are expected to generate more than $40 billion in private investments and create thousands of jobs, according to the DOE.

The three other hubs that have secured federal funding include the Appalachian Hydrogen Hub known as ARCH2, the California Hydrogen Hub called ARCHES and the Pacific Northwest Hydrogen Hub PNWH2.

Recommended Reading

Delivering Dividends Through Digital Technology

2024-12-30 - Increasing automation is creating a step change across the oil and gas life cycle.

E&P Highlights: Jan. 13, 2025

2025-01-13 - Here’s a roundup of the latest E&P headlines, including Chevron starting production from a platform in the Gulf of Mexico and several new products for pipelines.

Baker Hughes: US Drillers Keep Oil, NatGas Rigs Unchanged for Second Week

2024-12-20 - U.S. energy firms this week kept the number of oil and natural gas rigs unchanged for the second week in a row.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Baker Hughes: US Drillers Keep Oil and NatGas Rigs Unchanged for Third Week

2024-12-27 - U.S. energy firms this week operated the same number of oil and natural gas rigs for third week in a row.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.