OPEC is “back in the driver’s seat” as the top swing producer amid slowing U.S. shale growth, Hess Corp. CEO John Hess said on Nov. 17 at an investor conference in Miami, Florida.

Hess anticipates U.S. oil production will hit around 13 million bbl/d in the next few years and then plateau. U.S. production growth has been slower than anticipated at the beginning of this year due to investor pressure to focus on returns over growth, along with inflation and inventory depletion.

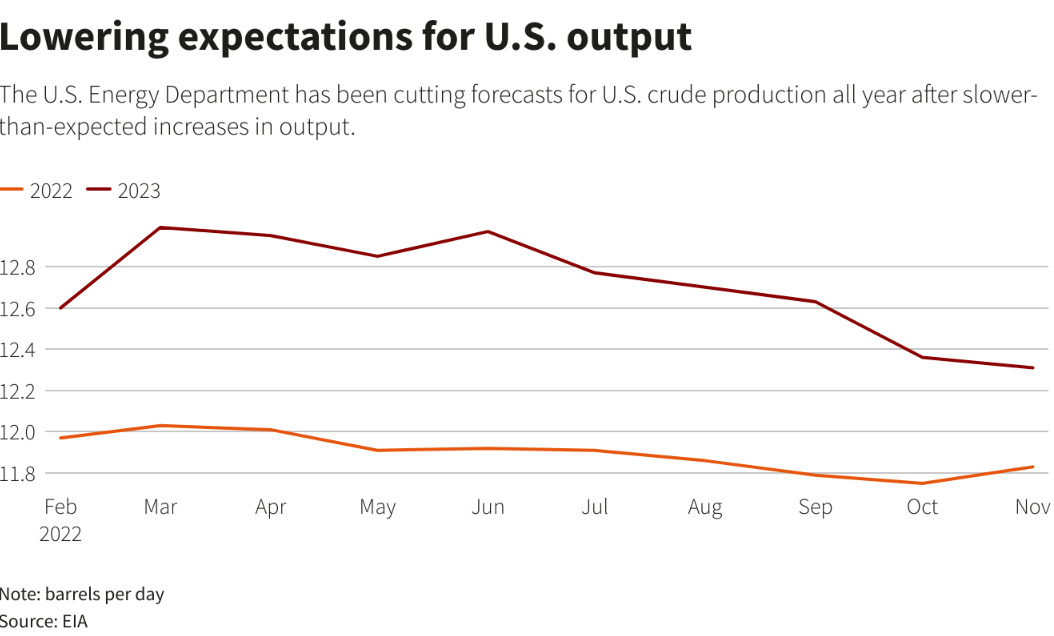

U.S. shale executives in recent weeks have lamented lower-than-expected productivity on certain wells, and warned that output growth in the prolific shale patch is poised to slow. The U.S. Energy Information Administration (EIA) last week cut its forecast for 2023 shale growth by 21%.

Output hit nearly 12 million bbl/d as of August, according to the latest EIA data available, up about 600,000 bbl/d from January.

“Shale was thought of as a swing producer, the Saudis and the OPEC have waited this out. Now, really OPEC is back in the driver’s seat where they are the swing producer,” Hess said, cautioning though that OPEC lacked spare capacity to easily boost its production.

The producer group in October agreed to cut oil output by 2 million bbl/d amid concerns of an economic slowdown. On Nov. 17, Hess said the cut was as much a political jab at U.S. President Joe Biden, who was trying to lower gasoline prices, as it was an economic move.

In the U.S., where Hess operates in the massive Bakken shale of North Dakota, he warned that many companies only have about a decade of life remaining.

“A lot of companies have already hit the wall,” he said, adding they were missing production and investment targets. “I think you are starting to see some cracks in the armor in that regard.”

Hess anticipates U.S. oil production will grow by about 500,000 bbl/d this year and next.

The company’s future decline in shale will be more than compensated by growth in Guyana, he added. An Exxon Mobil Corp.-led consortium Hess participates in expects to triple current production to 1.2 million bbl/d in 2027, with a potential to double estimates of recoverable oil volumes in the country from the current 11 billion barrels.

“We are in the resource business and if you are going to grow future cash flow, you have to grow your resource,” he said.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Plains All American Prices First M&A Bond of Year

2025-01-13 - U.S. integrated midstream infrastructure company Plains All American Pipeline on Jan. 13 priced a $1 billion investment-grade bond offering, the year's first to finance an acquisition.

EnLink Investors Vote in Favor of ONEOK Buyout

2025-01-30 - Holders of EnLink units voted in favor of ONEOK’s $4.3 billion acquisition of the stock, ONEOK announced Jan. 30.

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.