Birch Resources is continuing its big-oil-well streak in the Permian Basin's Dean formation. (Source: Shutterstock, Birch Resources)

Birch Resources brought two giant Dean wells on in the oily northern Midland Basin’s Dawson County, producing more than 216,863 bbl combined in their first two months online.

Hot Pie A #2DN made 118,973 bbl in June and July, the latest month the Texas Railroad Commission (RRC) reported production data.

Its first-24-hour IP in April was 2,342 bbl from a 10,404-ft lateral landed in the Dean at about 8,700 ft, overlying Wolfcamp.

Alongside it, Hot Pie C #6DN tested 2,768 bbl in its first 24 hours, also in April, from a 10,229-ft lateral. It made 97,890 bbl in its first two months online through July.

The two-well pad is about 18 miles southeast of Lamesa, Texas, at southeastern Dawson’s intersection with Borden, Martin and Howard counties.

Each lateral stretches from County Road 32 to County Road 34. The Dean is part of the Spraberry (Trend Area) Field.

In the Hot Pie A, Birch Resources also took a look at the underlying Wolfcamp, Canyon, Pennsylvanian and Mississippian before turning horizontal uphole in Dean, according to the RRC’s well-completion file.

Birch didn’t respond to a request for comment on its Dawson County development by press time.

Ghost wells

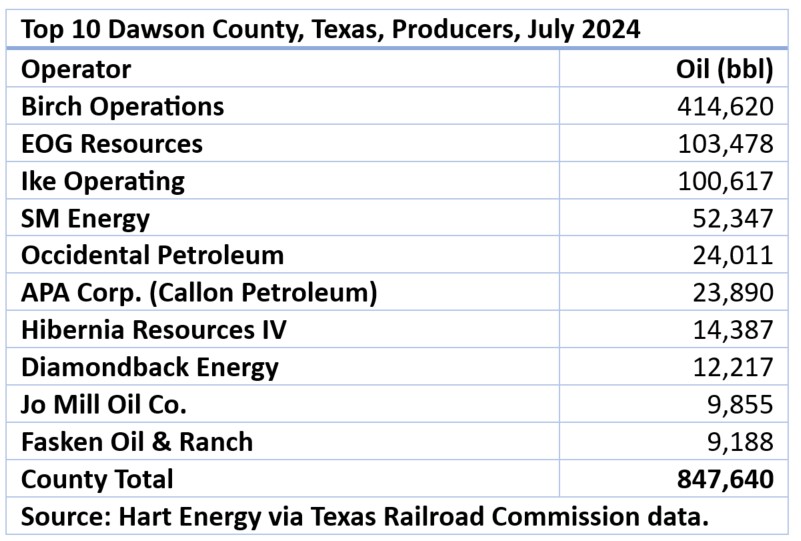

The two Hot Pie wells’ combined 103,093 bbl in July brought Birch’s Dawson-wide output to 414,620 bbl in that 31-day period, or 13,375 bbl/d, according to RRC data.

Casinghead gas in July from the Hot Pie wells totaled 239 MMcf.

Other Birch new-drills include Ghost 35-26 B #4DN, which IP’ed 1,890 bbl from a 10,400-ft lateral in Dean in late 2023, according to the RRC.

A companion well, Ghost 35-26 A #2DN, tested 1,785 bbl in Dean from a 10,200-ft lateral.

Both were brought online in January. The #4DN produced 227,902 bbl in its first seven months through July, while the #2DN surfaced 163,652 bbl.

About Birch

Birch began operating in Dawson County in July of 2022, growing output from its leasehold from some 30,000 bbl that month to 200,000 bbl in July 2023 and more than 400,000 bbl this past July.

Its first-25-month production from the county was 5.3 MMbbl, according to RRC data.

Privately held, six-year-old Birch is led by Jason Cansler, president and CEO.

A geologist, Cansler co-founded Rock Oil II, which built a 26,000-net-acre position in Howard County, southeast of Dawson, ramping production to 5,000 boe/d and selling it in 2017 for $1 billion.

After Rock II, Cansler co-founded Rock Oil III, which built a position in the Merge play in Oklahoma.

Including from Andrews, Dawson, Howard, Martin and Midland counties, Birch’s July production was 46,333 bbl/d.

Ike’s and EOG’s new wells

Also in southeastern Dawson, Ike Operating’s Aquila 13-24 #6DN came on with 1,175 bbl from a 10,300-ft lateral, also in Dean.

It was the No. 3 producer in Dawson in July, reporting 100,617 bbl that month, behind EOG Resources’ 103,478 bbl and Birch’s 414,620 bbl.

Meanwhile in southwestern Dawson, EOG brought its Panther B Unit on in March, surfacing 126,802 bbl through July in its first five months.

In January, EOG turned to sales the Arcadia A Unit. It produced 115,419 bbl in its first seven months.

Also in January, it turned to sales its Trinity C Unit. Through July, it made 139,237 bbl, while a companion lateral, Trinity D Unit, produced 127,362 bbl.

The Trinity development includes two wells brought on in June of 2022: Trinity A and Trinity B.

In their first 25 months, Trinity A made 180,716 bbl through July, while Trinity B made 303,262 bbl.

EOG began operating in Dawson County in April of 2020, initially as CGS Operating. Its output was 3,338 bbl/d in July.

EOG has not publicly commented yet on its Dawson County wildcatting. Otherwise in West Texas, it operates in the Delaware Basin.

SM in the Dean

Meanwhile, SM Energy entered Dawson County in July of 2023, acquiring 20,750 net acres producing some 1,500 bbl/d from privately held Midland-based Reliance Energy for $93.5 million.

Tim Rezvan, an analyst with KeyBanc Capital Markets, reported this spring that Reliance’s results in the area measured “up well to anything being drilled in the Midland Basin by anybody today.”

SM is expected to provide data on four new-drill Dean wells in the coming weeks in its third-quarter earnings call.

Herb Vogel, SM president and CEO, told investors in May that Dean is the target. “There's prospectivity in the Wolfcamp A” underlying Dean, but “I would say we are not counting that.”

Among SM’s initial tests this spring, the vertical in one was taken below Dean to look at underlying formations, such as Wolfcamp. It was plugged back and a lateral was kicked off in Dean.

“If we're surprised that thermal maturity [in Wolfcamp A] is higher for some reason there than we expect it to be, that would be great news,” Vogel said.

“But we're really counting on this being more of a migrated-oil play.”

Recommended Reading

DOE Approves Non-FTA Permit Extension for Golden Pass LNG

2025-03-05 - Golden Pass LNG will become the ninth U.S. LNG export facility following the U.S. Department of Energy’s approval for an extension of its non-free trade agreement permit.

Court Rejects Activists’ Protest of Woodside LNG Pipeline Project

2025-03-31 - Woodside Energy Group prevailed against environmental groups’ arguments to stop a pipeline to Louisiana LNG in a case that originated before the Australian company bought the project.

Trade War! Or Maybe Not

2025-03-06 - An energy industry that prefers stability gets hit with whiplash as it attempts to adjust to the Great Disruptor taking over the White House.

Trump Fires Off Energy Executive Orders on Alaska, LNG, EVs

2025-01-21 - President Donald Trump opened his term with a flurry of executive orders, many reversing the Biden administration’s policies on LNG permitting, the Paris Agreement and drilling in Alaska.

API: Congress Needed for Long-Lasting Policy Changes

2025-01-14 - The American Petroleum Institute lays out its political plans as the next presidential administration prepares to take office.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.