The Anchor development will consist of seven subsea wells tied to the semi-submersible floating production unit in the Green Canyon area. (Source: Chevron Corp.)

To understand Chevron’s engineering feat at its 20,000-psi Anchor project offshore Gulf of Mexico (GoM), imagine a standard quarter, stamped with the likeness of George Washington.

Then imagine an elephant standing on that quarter.

“That's the pressure that we're operating in,” Chevron CEO Mike Wirth said Aug. 20 at EnerCom Denver.

Chevron made the Anchor discovery in 2014, Wirth said, about 130 miles south of New Orleans. The environment some 34,000 ft below sea level was a treacherous mix of high pressure and high temperature.

To operate in such environment would require a whole series of new equipment and technology that didn’t exist, at least not yet.

“We had to think long and hard about developing in conditions that had never been produced from before,” he said. “There was no equipment. You didn't have BOPs rated at 20,000 psi.”

“The hook loads for running casing were higher than the highest hook load you could put on a deepwater drill ship. We didn't have trees and subsea infrastructure rated at those conditions.”

Chevron started oil and natural gas production from the Anchor project in the deepwater GoM, the company said on Aug. 12. The $5.7 billion project reached final investment decision (FID) in 2019.

To get there, Chevron conducted endless R&D by equipment manufacturers finding new ways to produce drilling equipment and subsea production technologies capable of withstanding Anchor’s harsh operating conditions.

“So there was a whole series of equipment and technology advancements that were required in order to develop this field,” Wirth said. “It took a lot of hard work and a decade of time to advance these things, to qualify the technologies, to work closely with critical vendors, to design equipment that would operate safely under the conditions required. We had to build a first-of-its-kind drill ship with two 20,000-psi BOPs, a 3 million-pound hook load for running casing.”

Enter the service companies.

Deepwater innovation

Dril-Quip produced an economically viable 20,000 psi “in-the-wellhead” completion system capable of withstanding 350 F. Prototype testing of the tool started around 2019.

Transocean built and brought online its Deepwater Titan and Deepwater Atlas vessels. The vessels are the first deepwater drillships equipped with a 1,700-ton hoisting capacity, 20,000-psi well control fittings and a 10,000-psi mud system.

And NOV produced the industry’s first 20,000-psi BOP for use on the Transocean rigs.

With those advancements, Chevron sees the potential for unlocking a considerable amount of new production. Chevron said the discovery could hold recoverable reserves up to 440 MMboe.

“The new gear promises Chevron's Anchor and similar projects by Beacon Offshore Energy and BP will deliver a combined 300,000 bbl/d of new oil and put 2 Bbbl of previously unavailable U.S. oil within producers' reach,” Wood Mackenzie analyst Mfon Usoro said in an Aug. 12.

"These ultra-high-pressure fields are going to be a big driver for production growth in the Gulf of Mexico,” she said.

Anchor represents a breakthrough for the energy industry, said Nigel Hearne, Chevron’s executive vice president. “Application of this industry-first deepwater technology allows us to unlock previously difficult-to-access resources and will enable similar deepwater high-pressure developments for the industry.”

A second well in the Anchor project is also nearing first oil, according to Chevron executive Bruce Niemeyer. The Anchor semi-submersible floating production unit has a capacity of 75,000 bbl/d and 28 MMcf/d.

Usoro said the U.S. GoM has repeatedly proven itself as a hub for technological innovation and the deployment of the ultra-high-pressure technology puts the region once again at the forefront of a technology breakthrough.

Chevron is leading the way to unlock ultra-high-pressure reservoirs in the Inboard Paleogene, a formation which has never been produced, she said. “Production from the untapped reservoir has the potential to permanently change the landscape in the U.S. GoM, Usoro said. “Operators expect individual wells to recover at least 30 MMboe.”

GoM oil output to soar

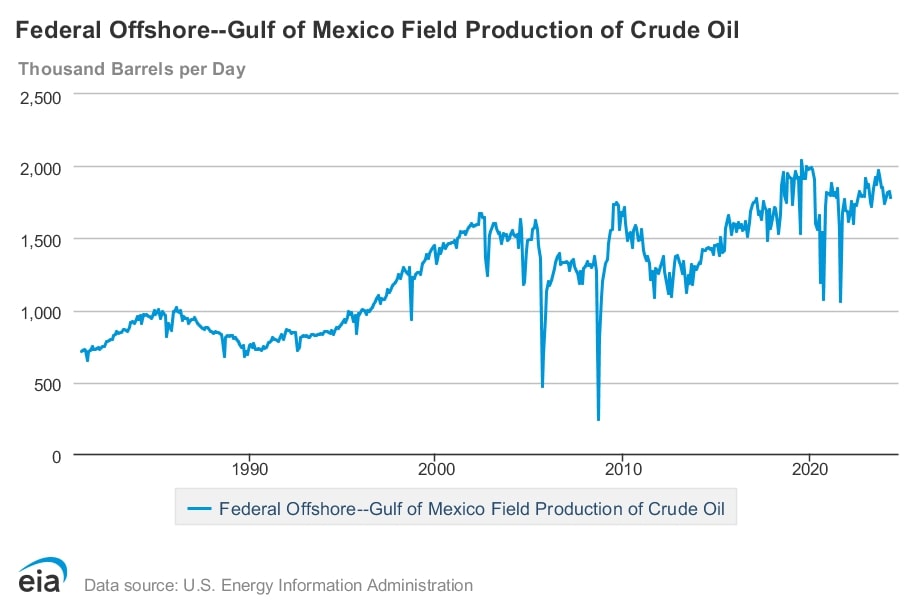

The U.S. portion of the GoM has produced below the record 2019 level of 2 MMbbl/d, but the additional crude from the deepwater high-pressure/high-temperature fields could help push the region well above its previous peak output.

The GoM provides roughly 15% of U.S. oil production. That share was much higher before the onshore shale boom in the Permian Basin.

“Yet absolute oil production in the region has generally grown over the past decade and been pretty stable—with some big exceptions—for a long time,” said S&P Global analyst Bob Fryklund. "We often call it kind of forgotten basin," but slated for more growth. S&P sees deepwater output rising above 2 MMbbl/d then plateauing for five to seven years.

Wood Mackenzie sees a 30% increase in deepwater output from 2023-2026, peaking around 2.7 MMboe, partly due to projects like Anchor.

Breaking the 20k-psi barrier

The new drilling and production equipment being trialed at Anchor will help other deepwater operators bring stranded assets online.

BP has its own high-pressure field challenge and hopes it can use the new kit to tap 10 Bbbl of discovered resources across its Kaskida and Tiber areas. Its first 20,000 psi project, Kaskida, was discovered in 2006, yet was put aside because of a lack of high-pressure technology.

“Developing Kaskida will unlock the potential of the Paleogene Formation in the Gulf of Mexico for BP, building on our decades of experience in the region,” said BP Executive Vice President Gordon Birrell.

“Kaskida will be BP’s sixth hub in the Gulf of Mexico and will feature a new floating production platform with the capacity to produce 80,000 bbl/d from six wells in the first phase,” Birrell said. Production is expected to start in 2029.

Similar HP/HT fields that would also benefit from the 20,000 psi technology are found off the coasts of Brazil, Angola and Nigeria, said Rystad analyst Aditya Ravi. “The Gulf of Mexico will be the proving ground for the new gear.”

The potential for the Anchor project and others has come from a “tremendous amount of work by not only engineers and technical people within our company, but with critical partners and vendors.”

Wirth said Anchor continues the industry's track record of advancing technology to continue unlocking resources and help provide the world with affordable and reliable energy.

“We took FID in 2019, saw first oil last week,” Wirth said. “We've got one well drilled and completed. We've got two more wells and we'll be completing here over the balance of this year. And really now, it's opened up a whole new regime in the deepwater Gulf of Mexico.”

Recommended Reading

Big Spenders: EPA Touts Billions in Clean Energy Spending

2025-01-15 - Nearly $69 billion in funding from the Inflation Reduction Act and Bipartisan Infrastructure Law has been dispersed by the Environmental Protection Agency in its clean energy push.

Congress Kills Biden Era Methane Fee on Oil, Gas Producers

2025-02-28 - The methane fee was mandated by the 2022 Inflation Reduction Act, which directed the EPA to set a charge on methane emissions for facilities that emit more than 25,000 tons per year of CO2e.

Trump Fires Off Energy Executive Orders on Alaska, LNG, EVs

2025-01-21 - President Donald Trump opened his term with a flurry of executive orders, many reversing the Biden administration’s policies on LNG permitting, the Paris Agreement and drilling in Alaska.

Biden to Ban Offshore Oil, Gas Drilling in Vast Areas Ahead of Trump Term

2025-01-06 - The ban is set to affect 625 million acres of ocean but mostly covers areas without important drilling prospects.

Trump Vowed to Undo LNG Pause, but Advisers Preaching Patience

2025-01-07 - President-elect Donald Trump’s team is considering extending the comment period on the Department of Energy’s LNG study.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.