FIGURE 1. Hexion’s OilPlus proppants increase the relative permeability of oil in the proppant pack. (Source: Hexion Inc.)

Typical proppant selection factors of size, strength, density and baseline conductivity do not accurately predict how proppants perform in a fracture at downhole conditions of temperature, closure pressure, moisture and high flow rate. Additional proppant selection factors that affect the results of fracturing treatments are proppant fines generation and migration, effective conductivity, proppant flowback, proppant embedment, proppant pack cyclic stress and proppant scaling or diagenesis.

The wettability of the proppant is another factor that should be considered for fracturing treatments in oil and liquids-rich reservoirs. Traditional proppants are hydrophilic in nature and attract water to the surface of the proppant. This water can block pathways for oil to flow, resulting in underperforming wells. In addition, if a proppant’s surface is entirely oleophilic, it would attract oil to the surface and a clear production pathway would not be achieved.

By altering the surface chemistry of the proppant, it is possible to create a proppant that is not inherently hydrophilic or oleophilic. The neutral wettability allows an increase in relative permeability to oil in the proppant pack. A surface-modified resin-coated proppant (RCP) was developed that demonstrates improved oil rates in laboratory testing. These results were confirmed by field production studies throughout North America.

Laboratory research

To test the effect of proppant surface wettability, a laboratory test was developed at Hexion’s Oilfield Technology Center. The process was as follows: proppant was packed in a glass column and saturated with water. Laboratory oil was then added and gravity was used to displace the water that was in the proppant pack. Once the water was displaced by the oil, the oil flow rate through the proppant pack was recorded. The oil flow rate was calculated from the volume of laboratory oil collected over time. Measurements were taken to determine how much was retained by the proppant pack. Care was taken to ensure that the median particle diameter of the proppant was consistent for all tests.

Several curable resin systems were designed and tested. Oil flow rates were compared to conventional RCPs. OilPlus proppants (Figure 1 above) were the result of this research and are the first proppants specifically designed for fracturing treatments in oil and liquids-rich reservoirs. These proppants have shown almost double (91% increase) the oil flow rate of conventional RCPs in laboratory testing.

This resin system increases the relative permeability of oil in the proppant pack resulting in higher oil production compared to conventional proppant. These advanced RCPs have all the benefits of curable RCPs including increased proppant flowback control, reduced proppant embedment, reduced proppant fines, decreased proppant scaling and higher effective conductivity compared to uncoated proppants.

The advanced resin technology has yielded years of enhanced oil production in all the major shale formations of North America. It provides higher flow rates compared to traditional RCP, ceramics and uncoated sand. This technology increases proppant pack relative permeability to oil. With the new proppant technology, water does not cling to the surface of the proppant. This allows a clear path through the proppant pack, resulting in increased hydrocarbon flow compared to traditional proppants.

Case study

An operator in South Texas was challenged to increase oil production while reducing the cost per barrel of oil. The dataset in this case study contained 27 wells, including 10 OilPlus proppant wells and 17 direct offset wells with another curable RCP.

All wells were completed by a single Eagle Ford operator in Karnes County, Texas, and were drilled to 3,505 m (11,500 ft) true vertical depth with a 1,311-m (4,300-ft) horizontal length. The operator used 5 million pounds of 30/50 mesh proppant and 40/70 mesh proppant with a 15% tail-in of OilPlus proppants or conventional RCP in all wells. Slickwater/crosslinked hybrid fracture fluids were used in all wells.

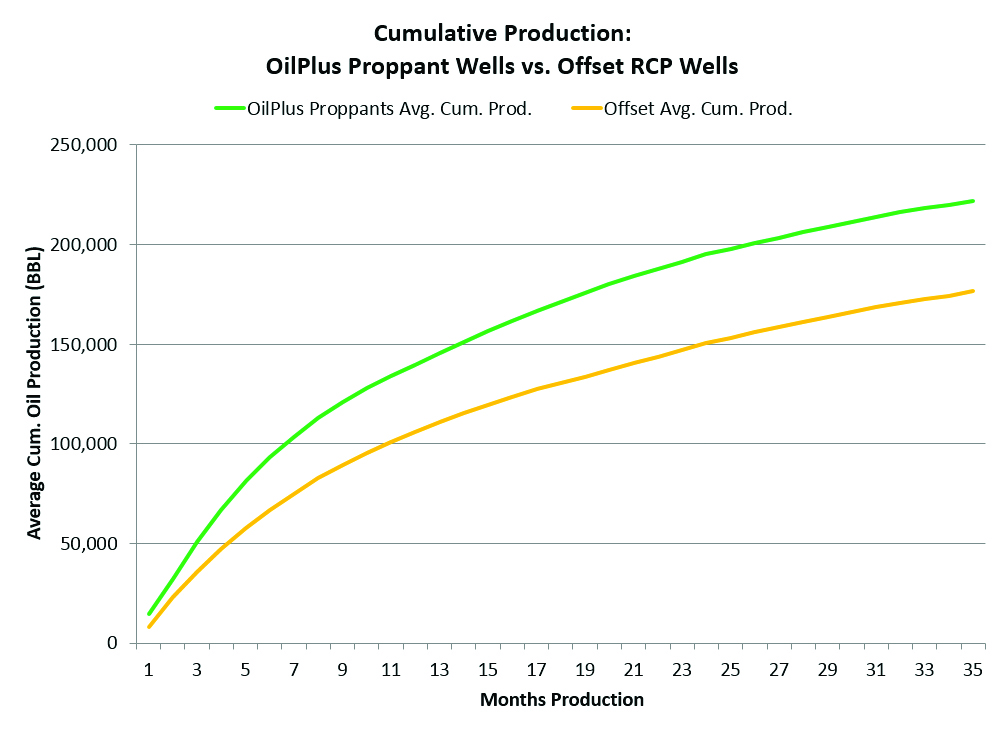

A 25% average production increase over three years per well was achieved utilizing the advanced RCP compared to conventional RCP (Figure 2). When looking at the cumulative production in Figure 2, the differential gap between the advanced RCP wells and offset wells widens over time, indicating that the advanced RCP continues to work after several years. Based on a $53/bbl oil price, the advanced RCP wells produced an average of $1.7 million more in revenue per well over the first year compared to the conventional RCP offset wells, as shown in Figure 3. If the operator had used the advanced RCPs in the offset wells, an additional $28.9 million in revenue would have been realized in only the first year.

Conclusion

The challenge for operators is how to operate effectively in a low oil price environment. Oil- Plus proppant provided higher oil flow rates in laboratory testing and in the field. This advanced resin technology increases the proppant pack’s relative permeability to oil, resulting in increased flow of hydrocarbons. This advanced RCP has helped yield three years of enhanced oil production in the Eagle Ford Shale as compared to a conventional RCP used in direct offset wells.

References available. Contact Jennifer Presley at jpresley@hartenergy.com.

Recommended Reading

EIA: NatGas Storage Plunges, Prices Soar

2025-01-16 - Frigid weather and jumping LNG demand have pushed natural gas above $4/MMBtu.

EIA: NatGas Storage Withdrawal Eclipses 300 Bcf

2025-01-30 - The U.S. Energy Information Administration’s storage report failed to lift natural gas prices, which have spent the week on a downturn.

NatGas Storage Withdrawal Hits Triple Digits Again

2025-02-13 - Analysts said the heavy withdrawals followed colder than expected weather and a growing demand for LNG.

NatGas in Storage Shows YOY Drop for First Time Since 2022

2025-01-03 - Despite a drop in gas in storage, prices took a hit from forecasts of warmer-than-expected weather.

Bernstein Expects $5/Mcf Through 2026 in ‘Coming US Gas Super-Cycle’

2025-01-16 - Bernstein Research’s team expects U.S. gas demand will grow from some 120 Bcf/d currently to 150 Bcf/d into 2030 as new AI data centers and LNG export trains come online.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.