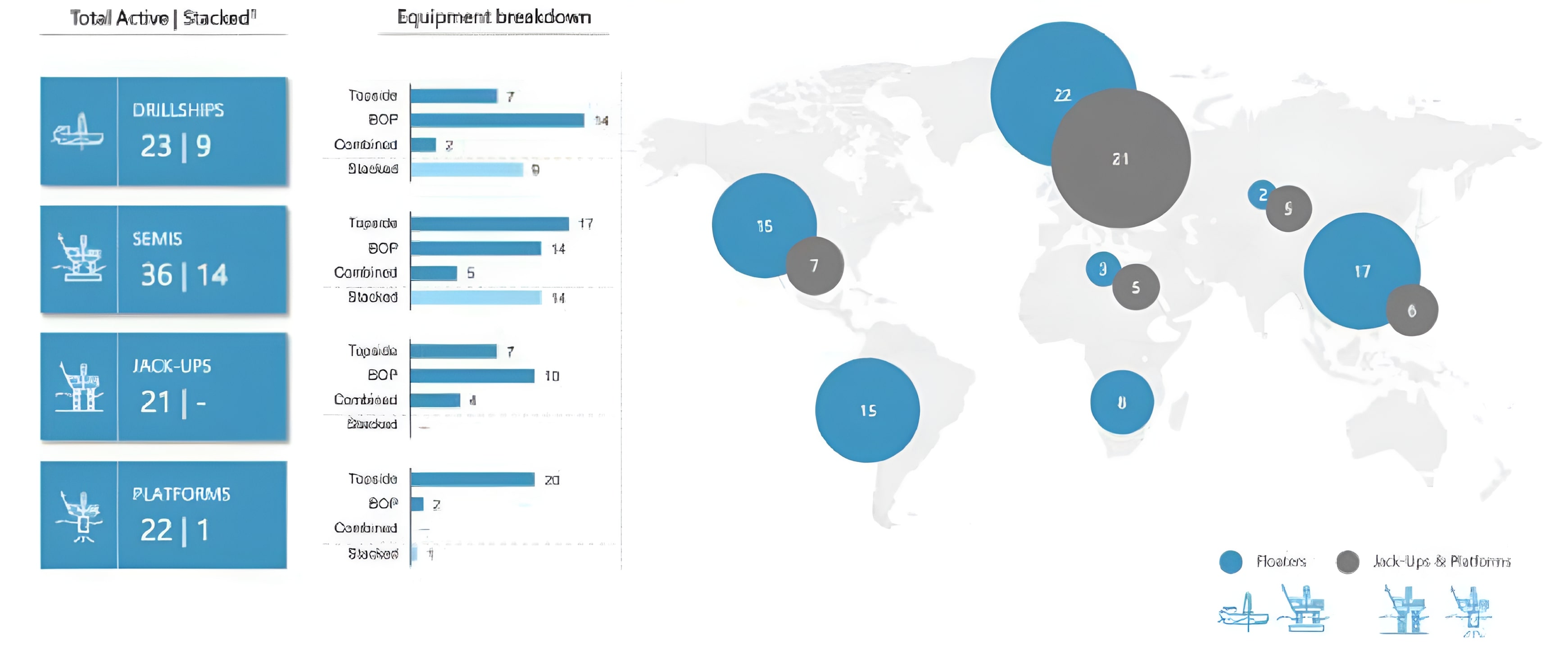

Some 75% of HMH’s business is offshore. It has field operations in 16 countries that serve operations in more than 60 countries, according to the S-1 filed. (Source: Shutterstock)

Baker Hughes and Akastor ASA are planning to IPO their onshore and offshore oilfield services 50-50 joint venture (JV), HMH Holding, which reports it plans to be active in the M&A market.

The number of shares and an anticipated price have not yet been determined, Akastor reported in an Aug. 13 press release.

The stock is expected to trade on NASDAQ as HMHW, according to the S-1 filed Aug. 12 with the Securities Exchange Commission.

Proceeds will be used to buy out some of Houston-based Baker Hughes’ and Norway-based Akastor’s equity in the company. Any additional balance will go to general corporate purposes, HMH reported.

The company, which includes the brands Hydril Pressure Control, Vetco Gray, Wirth and Maritime Hydraulics, was formed in 2021 in a merger of Baker Hughes’ subsea and surface drilling unit with Akastor’s unit MHWirth AS.

Publicly held Akastor is a direct investor in oilfield service (OFS) firms.

Some 75% of HMH’s business is offshore. It has field operations in 16 countries that serve operations in more than 60 countries, according to the S-1 filed.

M&A active

The company intends to be acquisitive in the OFS M&A market, it reported in the filing: “We believe there is a substantial opportunity set of potential acquisition candidates that will be available over the next several years.”

It added that its management team “has extensive M&A and integration experience in prior roles at other companies. Given management’s experience and prior track record, we are well positioned to recognize and capitalize on trends in the industry.”

Most recently, its Hydril PCP Ltd. sold 30% interest in Hydril Pressure Controlling Arabia Ltd. to Tanajib Holding Co. for $9.2 million upfront and $6.9 million deferred, HMH reported. The JV is expected to grow HMH’s operations in Saudi Arabia.

In July, HMH bought Drillform Technical Services Ltd. and affiliated assets in Canada, Oklahoma and Abu Dhabi for $21 million plus a potential earned kicker of $12 million.

HMH’s CEO is Eirik Bergsvik, who was with predecessor firms as well as with Hunter Group, Interwell AS and National Oilwell Norway.

CFO Thomas McGee was previously with private equity investor Warburg Pincus and NOV.

Eugene Chauviere III, COO, was previously with Baker Hughes, Hydril and Cooper Cameron Corp.

Joint book-running managers for the IPO are J.P. Morgan, Piper Sandler, Evercore ISI, Citigroup and DNB Markets. Stifel is co-manager.

Recommended Reading

Riverstone’s Leuschen Plans to IPO Methane-Mitigation-Focused SPAC

2025-01-21 - The SPAC will be Riverstone Holdings co-founder David Leuschen’s eighth, following the Permian Basin’s Centennial Resources, the Anadarko’s Alta Mesa Holdings and the Montney’s Hammerhead Resources.

Viper to Buy Diamondback Mineral, Royalty Interests in $4.45B Drop-Down

2025-01-30 - Working to reduce debt after a $26 billion acquisition of Endeavor Energy Resources, Diamondback will drop down $4.45 billion in mineral and royalty interests to its subsidiary Viper Energy.

Slant Energy Secures Capital Commitment from Pearl Energy Investments

2025-02-25 - Newly formed Slant Energy III LLC has secured an equity commitment from Dallas-based private equity firm Pearl Energy Investments.

Diamondback’s Stice to Step Down as CEO, Van’t Hof to Succeed

2025-02-20 - Diamondback CEO Travis Stice, who led the company through an IPO in 2012 and a $26 billion acquisition last year, will step down as CEO later this year.

Viper Makes Leadership Changes Alongside Diamondback CEO Shakeup

2025-02-21 - Viper Energy is making leadership changes alongside a similar shake-up underway at its parent company Diamondback Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.