Shallow Gulf of Mexico (GoM) hydrocarbon extraction has been around since 1937, when Superior Oil of California and Pure Oil constructed a wooden Creole platform in 4 m (13 ft) of water and pulled 4 MMbbl of oil out of the ground from 2,865 m (9,400 ft) over 31 years. Drilling and completion activities have since continued, yielding acceptable returns on investment (ROI) throughout the majority of the various commodity price swing environments. The transition to an industry focus on deepwater GoM activity was fueled by larger reserve bases, higher potential recovery factors and the increased potential for massive cash flow. Unfortunately, that shift was driven by a single relatively long-term positive imbalance in the price of liquid hydrocarbons and might not be sustainable in a sub-$60/boe environment. The cost of drilling a deepwater well can range from $80 million to $150 million, while shelf projects can run between one-quarter to one-third of that. Although the scale of potential recovery is less than in deep water, the cost of shallow shelf development is substantially lower.

Various operators report different breakevens for new-drill shallow shelf projects ranging from $35/boe to $50/boe in the 2016-2017 commodity environment. Recent merger-and-acquisition activity associated with the shallow-water GoM has totaled about $8 billion, clearly suggesting the industry recognizes the upside of taking advantage of lower development costs per barrel of oil equivalent associated with this play.

New well development is not the only way to recover reserves. It is well known that lower cost and innovative well intervention activities can incrementally improve recovery factors, increase the rate of recovery and dramatically lower the overall cost per barrel of oil equivalent. The suggestion, then, is that if the new-drill breakeven is $40/boe in 2017, the breakeven for intervention activities on existing wellbores should average substantially below that number.

During the past three years demand-related cost deflation has resulted in lower lifting costs across the industry, including the shallow-water shelf. However, commoditized service costs are historically directly tied to the supply-and-demand curve and therefore must necessarily be separated from the impact of leading-edge technology and process improvements.

Advancing intervention services

GoM shallow-shelf well intervention activities often are divided into two categories: heavy lifting, whereby the repair or replacement of an existing completion and tubulars requires the services of a workover or drilling rig, and light-duty intervention services, which can be performed by tailored intervention vessels. Some examples of light-duty interventions include:

- Surveys and other near-wellbore measurements, which can include acoustic conformance services for detecting a leak source, cement/density logging for cement integrity, electromagnetic corrosion studies and through-pipe sonic measurements;

- Conformance treatments, whereby advanced watercontrol systems can materially decrease water/hydrocarbon ratios;

- Installation or maintenance of chemical-injection delivery systems that provide flow assurance, scale inhibition, demulsification and corrosion protection;

- Resin sand-control consolidation systems through tubing services;

- Coiled tubing operations that provide downhole tools and processes, including scale control, restimulation and tubing/casing inspection or remediation—conventional tasks such as squeezing, proppant washing, gas-lift valve shifting, setting/pulling of tubing plugs and reperforating can be accomplished without the deployment of a large and costly rig also fit into this category;

- ROV services that can be employed for wellhead and riser inspection, diagnostics, and light maintenance tasks; and

- Refracturing services with advanced diverter technologies to recover incremental reserves over and above the original EUR for cases where a completion screen is not present.

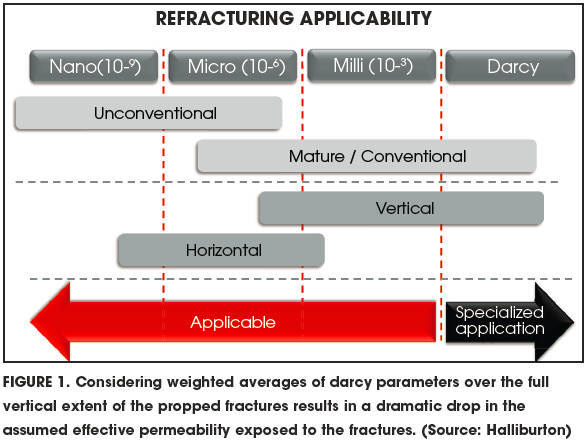

For many years a large number of onshore plays with net pay permeability in the millidarcy range were not considered as candidates for advanced stimulation and restimulation techniques. However, about four to five years ago several operators began to recognize that the long-standing practice of setting a cutoff porosity and establishing a net pay (ignoring any rock volume outside that chosen net pay) might have had unforeseen consequences, including missing production from bypassed pay zones.

A few operators elected to disregard that practice and instead considered weighted averages of darcy parameters over the full vertical extent of the propped fractures. This resulted in a dramatic drop in the assumed effective permeability exposed to the fractures. So instead of millidarcy permeability, they were dealing with low- or mid-microdarcy permeability, which subsequently shifted the given play into the unconventional category.

Experimentation with completion practices normally associated with unconventional delineation and development was initiated, and the subsequent commercial performance of a high percentage of wells drilled during the latest depressed commodity price environment testifies to the success of the process (Figure 1).

The concept applies to shallow-water Gulf Coast properties in two ways. First, there are several marginal (noncommercial) plays that could be considered moderate permeability and might be of interest as a potential refracturing candidate if the gross propped/net height ratio is large. Second, the lower permeability associated with behindpipe reserves suddenly becomes attractive, and these become candidates for the application of advanced stimulation techniques.

Fiscal justification

Heavy-lifting well intervention operations comprise only about 15% of the total Gulf Coast shallow-shelf expenditures. The balance of operations (about 85%) may typically be carried out with tailored service vessels, and much of the cost of such intervention is included in corporate opex budgeting.

The variety of lightweight well intervention scenarios suggests it is impossible to assign a blanket breakeven commodity price for any given intervention operation. However, there is ample evidence that the overall cost per barrel of oil equivalent (cost/boe) of multiple categories of intervention processes considered together is substantially lower than the new-drill breakeven, and therefore the cost/boe of incremental reserves recovered is typically substantially lower as well.

The vast majority of lightweight well intervention operations is clearly justified at $50/boe. There are several Gulf Coast shallow-shelf operators that have balanced portfolios containing a healthy mix of new-drills and targeted lightweight well intervention programs, and these operators are indicating reasonable ROIs where public information is available.

Taking advantage of the concept of total column height exposed to a propped fracture when the gross propped-to-net-height ratio is large (as opposed to focusing on net pay height alone) opens up new opportunities to apply learnings from other lower permeability plays to marginal quality shelf assets. In addition, targeting lower permeability behind-pipe reserves might have fiscal merit in the less than $40/boe environment.

A percentage of incremental reserves can be accessed via the existing operating expense structure as opposed to progressive capital allocation.

The shallow-water shelf has proven to be resilient over the years, largely due to the lower cost of well intervention activities and the continual improvements in materials, equipment and technological processes. With the right ROI for the operators combined with the correct application of advanced technology, the life of offshore wells can be extended for many more years to come. Extending the economic life of wells is a primary objective.

Recommended Reading

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.