Drilling rigs in Wyoming, where Powder River Basin E&P Peak Resources is positioning itself for an IPO, filings show. (Source: Shutterstock.com)

Peak Resources LP, an E&P led by industry veteran Jack E. Vaughn, is positioning itself for an IPO in the Powder River Basin.

Peak filed an S-1 registration statement with the U.S. Securities and Exchange Commission on Sept. 16. Peak has not yet priced its IPO range or disclosed how many shares it intends to offer.

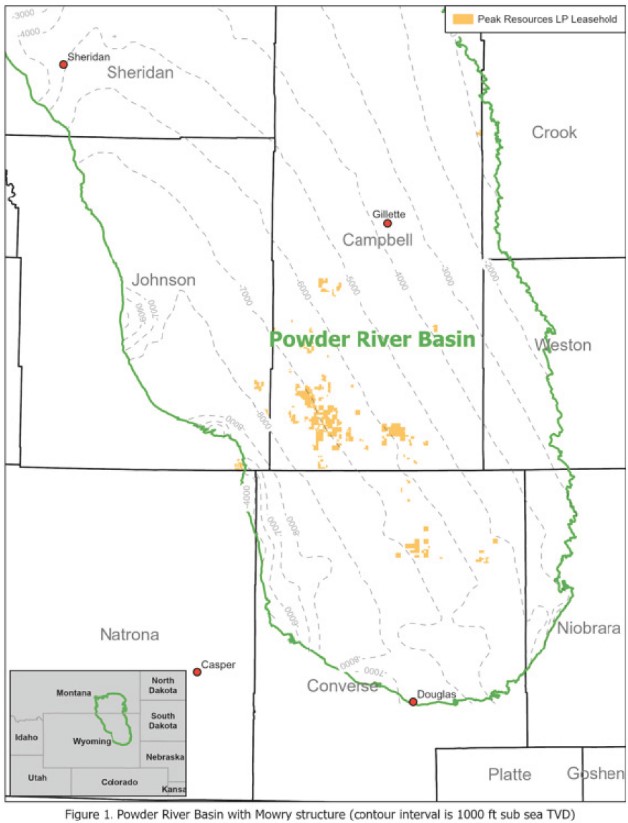

Durango, Colorado-based Peak held approximately 45,000 net (65,000 gross) acres in the Power River at the end of June, primarily within Campbell and Converse counties, Wyoming.

The company has drilled 56 net (104 gross) producing horizontal wells across the acreage position, which includes private, state and federal lands. Peak also owns interests in another five net (83 gross) non-operated horizontal wells in the basin operated by EOG Resources, Devon Energy, Anschutz Exploration, and Ballard Petroleum.

“Our small working interest in these non-operated wells allows us the benefit of ascertaining other operators’ techniques and advances at a relatively small cost,” the company said in its filing.

Peak's IPO plan is the first by an E&P that includes significant Powder River holdings since Cinco Resources filed an S-1 in 2012, according to SEC files. Cinco withdrew the plan in 2013 and was acquired in 2015 by Riley Exploration Group.

For the 12 months ended June 30, Peak averaged 2,749 boe/d, including 1,606 bbl/d of crude oil production.

Peak aims to boost production to an average of approximately 4,700 boe/d during 2025.

Peak has identified 530 net (1,770 gross) horizontal locations for future drilling. The company said it would target the Parkman, Shannon, Turner, Niobrara and Mowry reservoirs. Peak has been most actively developing the Mowry and Niobrara intervals.

At a 10% IRR, the company estimates 244 net locations are economic at $55/bbl and $1.85/MMBtu, and over 400 net locations are economic at $70/bbl and $2.36/MMBtu.

“…If we increase our current development cadence from eight gross wells per year to 24 gross wells per year (i.e., one full-time rig per year), our inventory would still span 27 years using the 658 gross (244 net) locations from the lower pricing assumptions above,” the company said.

Peak Resources is backed by Yorktown Energy Partners and HarbourVest Partners.

RELATED

Powder in the Hole: Devon May Fire up its PRB in Coming Years

Veteran leadership

Vaughn, who leads Peak Resources, is a veteran of the U.S. shale industry with nearly five decades of experience in the sector.

Vaughn, chairman and CEO, founded Peak in 2011, his fourth Peak E&P after building and flipping startups in the Barnett Shale, the Bakken and the Anadarko Basin’s Granite Wash play. Previously, he worked at EnerVest Management Partners and operated San Juan Basin coalbed methane property for it and GE Capital Oil & Gas. He began his career in 1968 with Amoco Oil, now part of BP.

Vaughn served on the board of Bonanza Creek Energy, a predecessor company of Colorado-based E&P Civitas Resources.

Peak president and COO Glen Christiansen worked the Rockies region for XTO Energy before joining Peak in 2011.

CFO Justin Vaughn was previously with an investor-relations management firm and PricewaterhouseCoopers.

Ali Kouros, corporate development and strategy director, was an advisor to Jefferies & Co. and an energy investment manager for Blackstone and EIG Global Energy Partners.

Board members include Bryan H. Lawrence, Yorktown founder and senior manager, and Bryan R. Lawrence, founder of investor Oakcliff Partners and a Yorktown member.

Director nominees are Greg LeBlanc, retired partner of investment firm Wellington Management, and Paul Vermylen Jr., a founder of Kestrel Heat.

Separately, Barnett shale-focused E&P BKV Corp. launched its long-awaited IPO for 15 million shares on Sept. 16.

The natural gas producer expects to price its IPO at between $19 and $21 per share, with proceeds ranging between $285 million and $315 million. The BKV IPO is expected to begin trading Sept. 26.

Hart Energy Editor-at-large Nissa Darbonne contributed to this article.

RELATED

Recommended Reading

On The Market This Week (Jan. 20, 2025)

2025-01-24 - Here is a roundup of marketed oil and gas interests in the Delaware Basin, Midcontinent and Bakken from select sellers.

On The Market This Week (Jan. 27, 2025)

2025-02-02 - Here's a roundup of marketed oil and gas leaseholds in Appalachian and the Central basins from select sellers.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

NAPE Panelist: Occidental Shops ~$1B in D-J Basin Minerals Sale

2025-02-05 - Occidental Petroleum is marketing a minerals package in Colorado’s Denver-Julesburg Basin valued at up to $1 billion, according to a panelist at the 2025 NAPE conference.

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.