Japanese firm Mitsui completed an acquisition of shale gas assets in Texas from private operators, the company said June 24. (Source: Shutterstock)

Japanese firm Mitsui & Co. Ltd. is deepening its foothold in U.S. unconventional shale gas through M&A.

Through its subsidiary Mitsui E&P USA LLC (MEPUSA), Tokyo-based Mitsui acquired a shale gas asset in Texas from E&Ps Sabana LLC and Vanna LLC, Mitsui announced June 24. Financial terms of the acquisition were not disclosed.

The acquired “Tatonka” asset includes approximately 46,500 acres with access to the U.S. Gulf Coast industrial corridor and new LNG export projects.

“MEPUSA will drill wells to evaluate the well performance and develop and operate the asset aiming for full-scale development after 2026,” Mitsui said in a release.

It’s unclear where exactly Sabana and Vanna held acreage or assets within the state of Texas. Texas Railroad Commission (RRC) records include an operator listed as Sabana Petroleum Corp., but the company has never reported oil or gas production.

Hart Energy has reached out to Mitsui & Co. for more information about the acquisition.

Last year, MEPUSA scooped up a 92% working interest in shale gas assets from Silver Hill Eagle Ford E&P LLC, a subsidiary of Silver Hill Energy Partners.

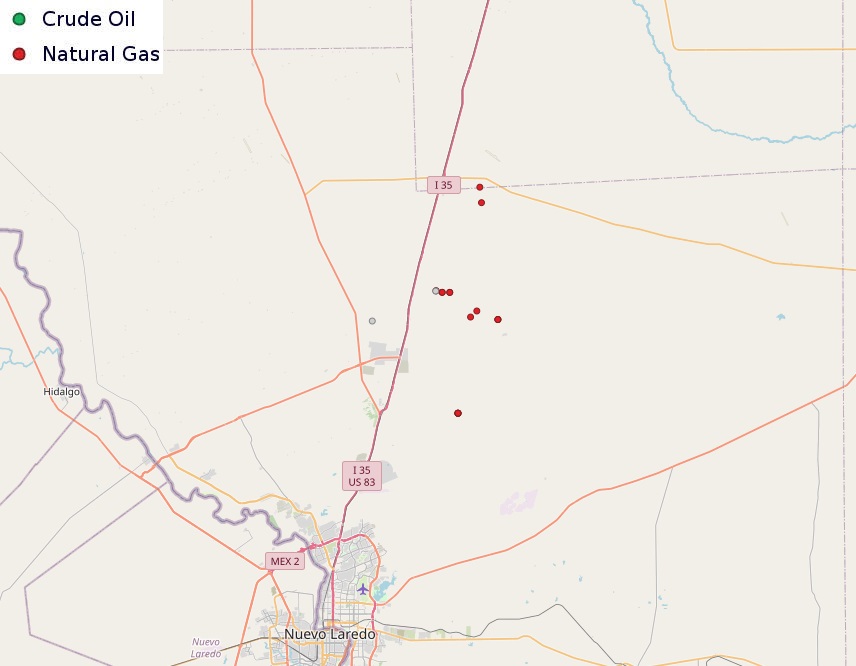

MEPUSA currently reports natural gas production from La Salle and Webb counties, Texas, according to RRC data.

MEPUSA develops and operates the South Texas gas asset, located near the U.S.-Mexico border. When announcing the Silver Hill acquisition last year, the company aimed for gas production from the field to reach over 200 MMcf/d.

Japanese energy firms have been acquisitive of U.S. shale gas opportunities.

In the Haynesville Shale, Rockcliff Energy II sold to Tokyo Gas Co. and partner Castleton Commodities in a $2.7 billion deal late last year.

Also in the Haynesville, Sabine Oil & Gas sold to a subsidiary of Osaka Gas Corp. for $610 million in 2019.

Recommended Reading

On The Market This Week (Jan. 20, 2025)

2025-01-24 - Here is a roundup of marketed oil and gas interests in the Delaware Basin, Midcontinent and Bakken from select sellers.

On The Market This Week (Jan. 27, 2025)

2025-02-02 - Here's a roundup of marketed oil and gas leaseholds in Appalachian and the Central basins from select sellers.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

NAPE Panelist: Occidental Shops ~$1B in D-J Basin Minerals Sale

2025-02-05 - Occidental Petroleum is marketing a minerals package in Colorado’s Denver-Julesburg Basin valued at up to $1 billion, according to a panelist at the 2025 NAPE conference.

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.