Double Eagle IV has ramped Permian Basin production past 120,000 boe/d in the core of the Midland Basin, Texas state data show. (Source: Shutterstock.com)

In an M&A cycle claiming many of the Permian’s biggest private equity-backed E&Ps, one of the basin’s brightest names remains up for grabs: Double Eagle IV.

Rumors have swirled for months about intense buyer interest for Double Eagle IV, the latest iteration of the company led by co-CEOs Cody Campbell and John Sellers.

Double Eagle IV, backed by EnCap Investments, Apollo Natural Resources and Elda River Capital, is reportedly shopping a sale in the range of $6 billion.

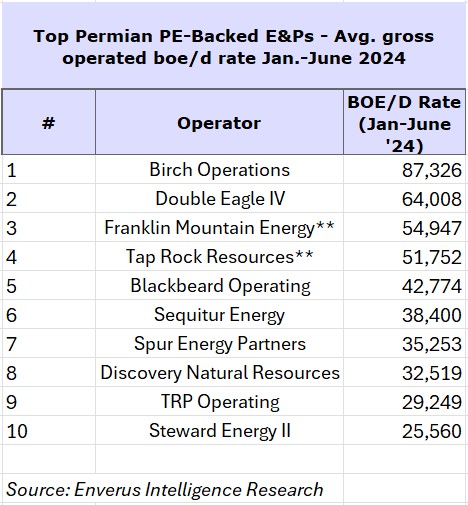

Texas Railroad Commission (RRC) data show that among private equity-backed producers still standing in the Permian Basin, Double Eagle stands out from the pack.

Amid the buzz of potential deals, Double Eagle has been stepping up production big time.

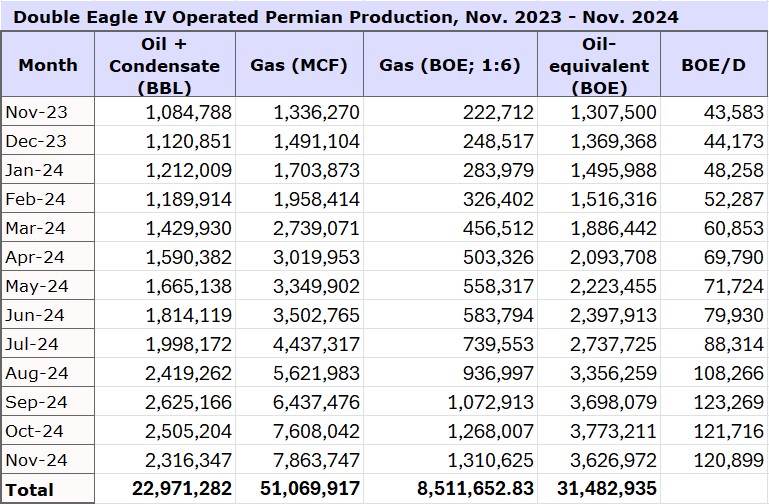

In the 12 months ending November 2024, Double Eagle IV produced about 31.5 MMboe (73% liquids), according to the most recent RRC figures.

Company-operated production averaged approximately 121,000 boe/d (64% liquids) in November 2024—a 177% increase from roughly 43,500 boe/d a year prior.

Over the same time period, Double Eagle’s liquids production grew to 2.3 MMbbl from about 1.1 MMbbl in November 2023—an increase of nearly 114%. Gas output rose 488% over the same period.

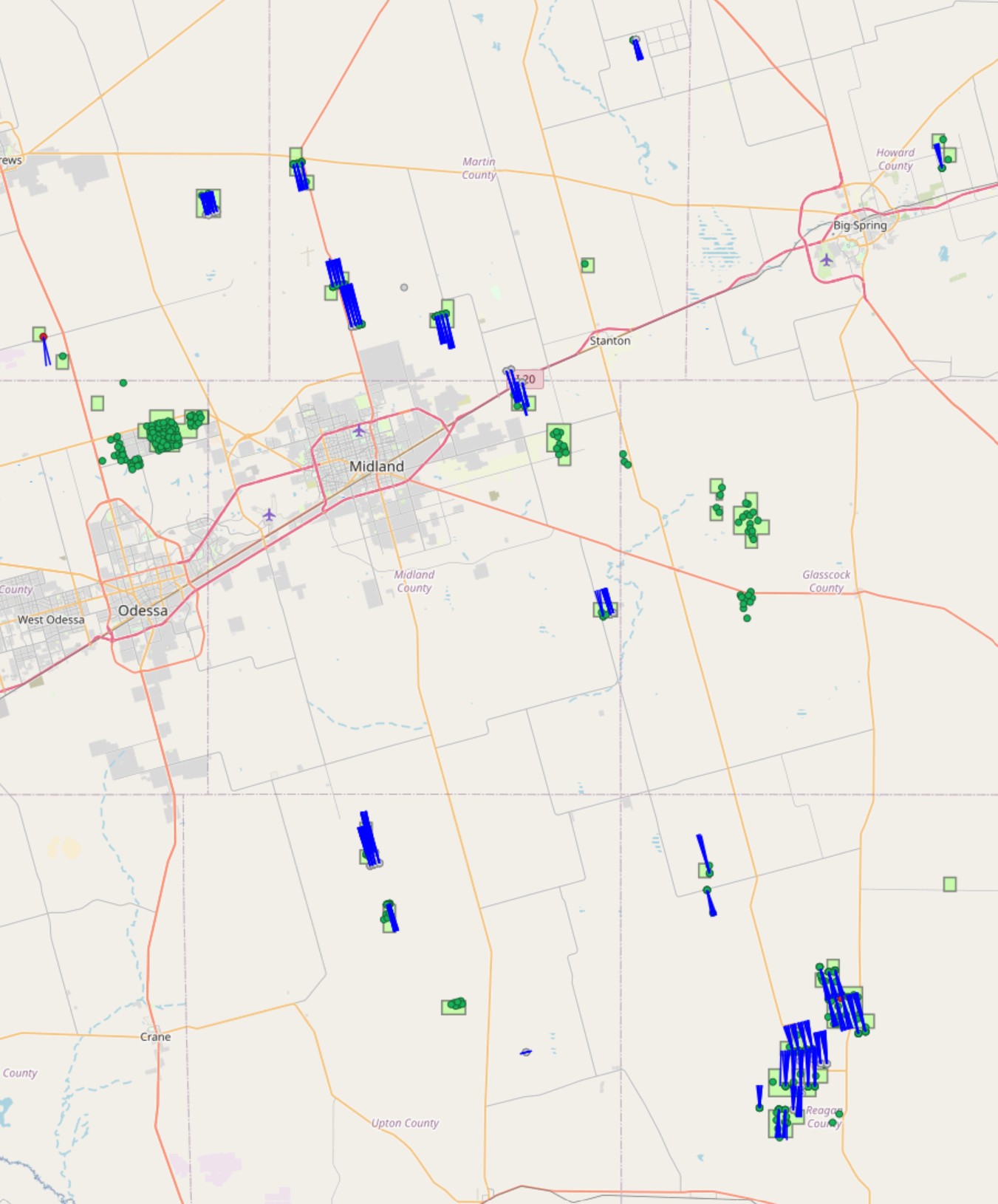

The bulk of Double Eagle’s production comes out of Reagan and Martin counties, Texas. But the company also has assets in Midland, Upton, Howard, Ector, Glasscock, Andrews and Dawson counties, data show.

Double Eagle executives declined to comment on its growing Permian portfolio.

In a shale play with fewer and fewer private M&A options, Double Eagle stands out as one of the most coveted opportunities, experts say.

Analysts at TD Cowen have speculated whether Ovintiv might take a shot at acquiring Double Eagle to add more Permian exposure. Those rumors never materialized, as Ovintiv made a deal for more Canadian Montney assets.

More recently, they pondered whether Civitas Resources could offload its legacy Colorado assets and acquire Double Eagle to grow in the Permian. TD Cowen analyst Gabe Daoud Jr. noted a strategic overlapping of Civitas’ and Double Eagle’s Permian acreage positions.

But acquiring Double Eagle would not come without risks, including a heavy price tag, a high decline rate from producing assets and only around 424 additional undrilled locations, Daoud reported in mid-January.

Other sizable private equity-backed producers still left in the Permian Basin include Birch Operations, Blackbeard Operating, Sequitur Energy, Spur Energy Partners, Discovery Natural Resources and Steward Energy II, according to data compiled by Enverus Intelligence Research.

With most of the core Permian Basin already locked up, several of these top remaining private producers are located on the fringes of the basin or in the Permian’s less popular conventional zones.

Blackbeard’s assets are in the Central Basin Platform, while Spur and Steward have large footprints in the Northwest Shelf.

Sequitur Energy and Discovery Natural Resources are both heaviest in the fringier southern Midland Basin.

RELATED

Report: Will Civitas Sell D-J Basin, Buy Permian’s Double Eagle?

Common targets, newer upside

Double Eagle co-executives Campbell and Sellers have never been ones to shy away from paying a premium for quality rock.

The two have completed thousands of individual transactions across more than 1 million acres for billions of dollars in aggregate deal volume.

Campbell and Sellers guided the previous iteration of Double Eagle—Double Eagle III, a subsidiary of DoublePoint Energy LLC—through a $6.4 billion sale to Pioneer Natural Resources in 2021.

After reloading with $2 billion in dry powder in 2022, Double Eagle IV got to work buying acreage in the core Permian Basin once again.

So far, the company has targeted drilling in the Midland Basin’s most common and accessible zones, the prolific Spraberry and Wolfcamp benches.

DE IV Operating has submitted IP data to regulators from 220 well completions in the Spraberry (Trend Area) Field, per RRC data. Most of the wells have landed in Reagan and Martin counties.

Virtually all of Double Eagle IV’s oil production over the past year came from Spraberry and Wolfcamp wells.

But Double Eagle is also on a growing list of operators interested in the Permian’s deeper, gassier Barnett Shale interval.

RRC records show DE IV Operating picked up two Barnett horizontals (~10,000-ft laterals) that were previously operated by Slant Energy. Slant brought the two Barnett wells online in Andrews County in early 2023.

Double Eagle’s Barnett Shale wells—Midland Farms 3940 #1H and #2H—have produced around 1.2 Bcf of gas and 472,000 bbl of condensate since coming online in February 2023.

Last year, state regulators also approved Double Eagle’s plans to drill two more Barnett Shale wells in Andrews County; both wells are permitted to reach a total depth of 10,920 ft.

Several operators, including Occidental Petroleum, ConocoPhillips, Diamondback Energy and Continental Resources, have landed laterals in the Permian Barnett in recent years.

RELATED

Permian Prowl: Exploratory Drilling, Permitting Up for Permian Barnett Wells

Red Raider power

As Campbell and Sellers embark on selling another multibillion-dollar E&P, it’s a far cry from their humbler West Texas beginnings.

Both natives of Canyon, Texas, roughly 17 miles southwest of Amarillo, the two ended up playing football together at Texas Tech University under legendary coach Mike Leach; Campbell went on to play for two NFL seasons as an offensive lineman for the Indianapolis Colts.

Campbell was still playing football at Texas Tech when Sellers and a third business partner formed a real estate development company, raising money through friends and family. Sellers and the third partner bought out Campbell when he went to play professionally in the NFL.

But around 2008, with the real estate investment market collapsing and energy prices skyrocketing, Sellers and Campbell decided to pursue oil and gas.

Since launching Double Eagle in 2008, most of the team’s efforts have been spent in the Permian Basin.

The company has also dipped into the Eagle Ford Shale, the Midcontinent and the Rockies over the years. In 2014, Double Eagle made a $225 million sale of SCOOP assets in the Anadarko Basin to Chesapeake founder Aubrey McClendon.

RELATED

Is Double Eagle IV the Most Coveted PE-backed Permian E&P Left?

Recommended Reading

Hart Energy Acquired by Crain Communications Inc.

2025-02-10 - Hart Energy has been acquired by privately held publisher Crain Communications Inc.

Boaz Energy Completes Sale of PermRock Properties to T2S

2025-04-01 - Boaz Energy II has completed the sale of PermRock Royalty Trust’s underlying oil and gas properties to T2S Permian Acquisition II LLC.

On The Market This Week (Jan. 20, 2025)

2025-01-24 - Here is a roundup of marketed oil and gas interests in the Delaware Basin, Midcontinent and Bakken from select sellers.

Howard Energy Partners Closes on Deal to Buy Midship Interests

2025-02-13 - The Midship Pipeline takes natural gas from the SCOOP/STACK plays to the Gulf Coast to feed demand in the Southeast.

EDF, TAQA Sign MOU to Advance Geothermal Systems in Saudi Arabia

2025-02-13 - EDF Saudi Arabia and TAQA Geothermal Energy will collaborate on geothermal cooling systems including power generation, HVAC applications and compressed air energy storage.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.