Mach Natural Resources is offering to sell common units to finance two pending acquisitions in the Midcontinent. (Source: Shutterstock/ Mach Natural Resources)

Mach Natural Resources (MNR) is offering 7.85 million common units to finance two pending acquisitions in the Midcontinent.

The offering is expected to generate gross proceeds of approximately $150 million, based on the $19.10 per unit closing price of MNR units on Sept. 3.

Oklahoma City-based Mach will also allow the underwriters an option to purchase an additional 1.18 million common units, the company told investors on Sept. 4.

Mach’s units were trading down over 4% around $18.22 per unit near midday on Sept. 4.

Net proceeds from the offering will go toward funding two pending acquisitions of oil and gas assets in Oklahoma’s Ardmore Basin and in the Anadarko Basin of western Kansas.

Led by Midcontinent veteran Tom Ward, Mach Natural Resources is organized as an upstream master limited partnership (MLP). A self-described “acquisition company,” Mach acquires cash flowing assets at a discount to PDP PV-10 to grow distributions to unitholders.

Collectively, Mach’s two pending acquisitions represent approximately $136 million in M&A, according to regulatory filings.

Most of the value—around $98 million—is ascribed to assets Mach is purchasing in the Ardmore Basin, a liquids rich fairway in south-central Oklahoma. Continental Resources and Camino Natural Resources, among other operators, are leading horizontal development in the Ardmore Basin.

On Aug. 26, Mach entered into an agreement to acquire 3,590 net acres and 19 operated wells in the Ardmore Basin, regulatory filings show.

Mach is paying $38 million for a “Western Kansas” acquisition in the Anadarko Basin. The deal includes 128,788 net acres and 270 operated wells, the company said.

Total proved reserves for the combined assets to be acquired is 10.6 MMboe with a PV-10 value of $153.8 million.

Production from the combined assets averaged 4,347 boe/d (45% oil, 30% NGL, 25% gas), as of the six months ended Feb. 29.

Mach anticipates output from the acquired assets to average 5,220 boe/d (47% oil, 25% NGL, 28% gas).

Following the two acquisitions, Mach expects its total acreage position to grow from 1,001,778 net acres to 1,134,156 net acres.

The sellers were not disclosed.

RELATED

Midcon Momentum: SCOOP/STACK Plays, New Zones Draw Interest

Midcon M&A

Mach is seeing competition for Midcontinent assets increase and asking prices creep up, Ward said in a recent Hart Energy interview.

Many operators have soured on the Midcontinent and the SCOOP/STACK plays after a series of high-profile bankruptcies among Midcon-heavy E&Ps over the past decade.

But as operators scour the Lower 48 for low-cost drilling locations, they’re turning over stones once again in Oklahoma, southern Kansas and the Texas Panhandle.

Experts anticipate an increase in Midcontinent-focused M&A over time, especially as the macro environment for natural gas prices improves.

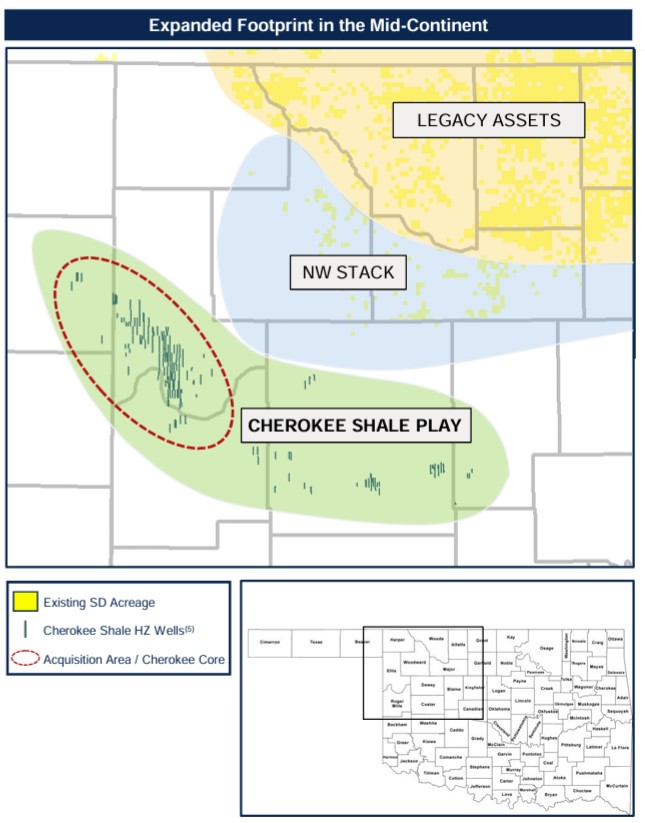

This week, Midcontinent E&P SandRidge Energy closed a $144 million acquisition in the Cherokee Play of the Western Anadarko Basin.

The deal, announced in July, was signed with private E&P Upland Exploration, according to SandRidge investor filings.

The Cherokee acquisition included 6,000 boe/d (40% oil) of net production, 42 producing wells and 4 DUCs in Ellis and Roger Mills counties, Oklahoma.

SandRidge is picking up leasehold interest in 11 drilling spacing units, adding inventory of up to 22, 2-mile lateral wells in the core of the Cherokee play.

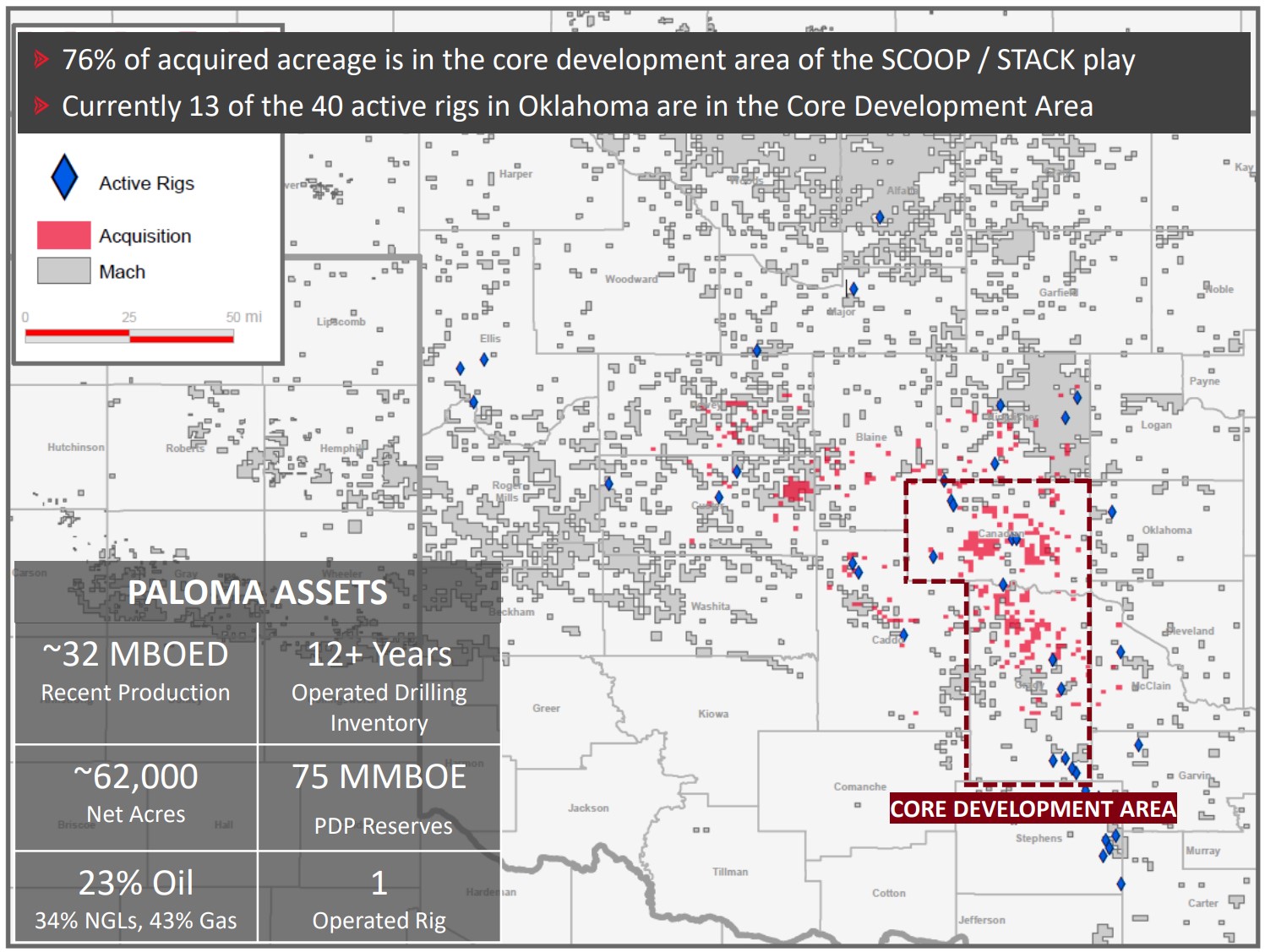

Mach has grown its own acreage position through a series of acquisitions. Last year, the company closed an $815 million acquisition from EnCap-backed Paloma Partners IV.

The Paloma acquisition added approximately 62,000 net acres across Canadian, Grady, McClain, Caddo, Custer, Dewey, Blaine and Kingfisher counties, Oklahoma, and around 32,000 boe/d of net production.

Analysts say two other private equity-backed Midcontinent operators, Camino Natural Resources and Citizen Energy III, will eventually look for an exit.

And several public producers have legacy Midcontinent positions that could be considered non-core assets for potential divestiture, including Marathon Oil, Devon Energy, Coterra Energy, Ovintiv and Gulfport Energy.

RELATED

Tom Ward: Mach Looks to Other Basins as Midcon Competition Heats Up

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

USEDC’s Plans for $1B in Capex, M&A on Track as Oil Prices Stumble

2025-04-11 - Volatility won’t affect Permian Basin-focused U.S. Energy Development Corp.’s day-to-day operations or its plans for deals, CEO Jordan Jayson told Hart Energy.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.