Unconventional oil extraction operations in Añelo, Neuquén province, in Argentina’s Vaca Muerta shale field. (Source: Shutterstock.com)

Argentina’s Vaca Muerta shale is producing record oil volumes, trending toward a 1 MMbbl/d output by the end of the decade.

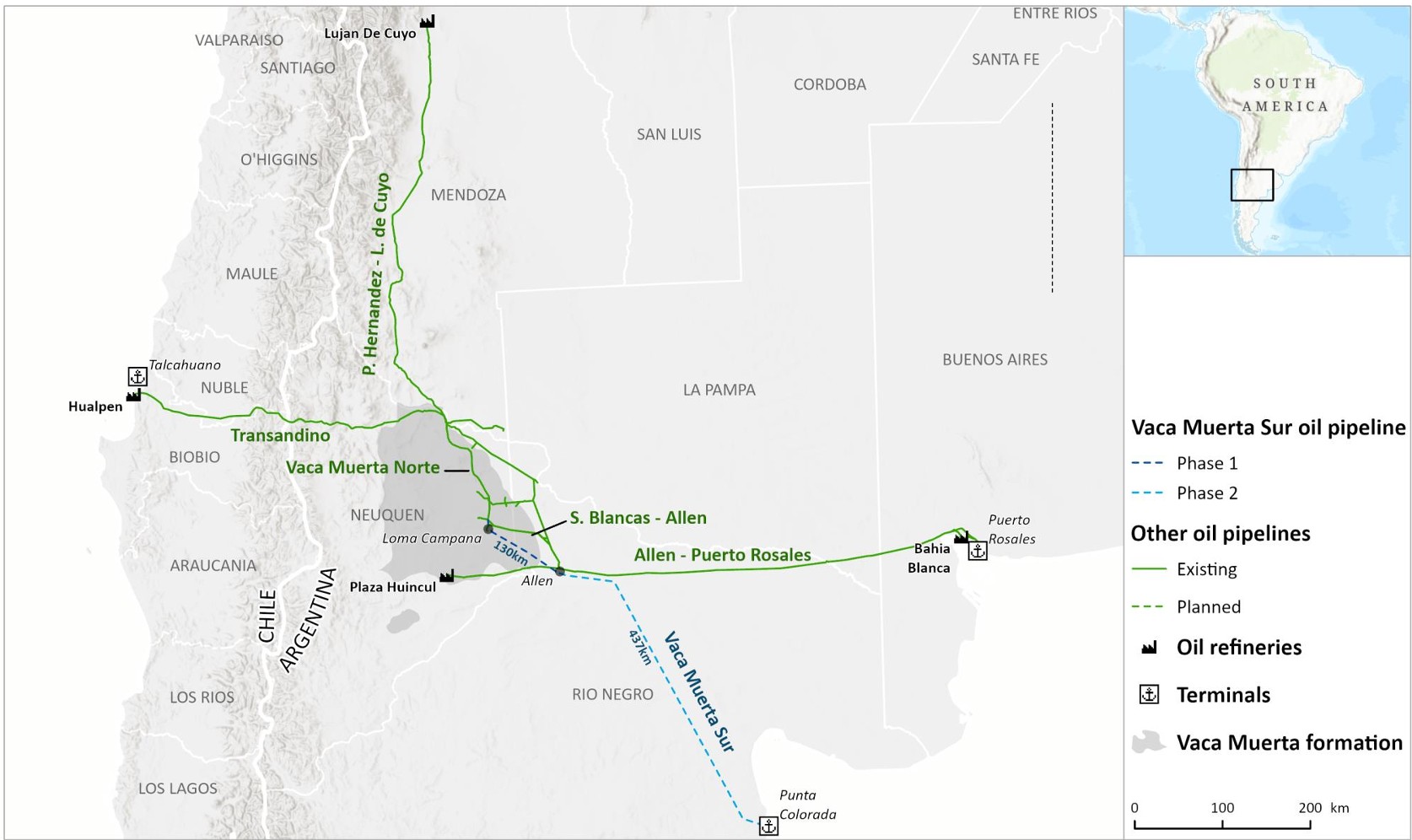

But takeaway constraints have always been barriers to growing crude output from Vaca Muerta, the vast shale field in Argentina’s remote Neuquén Basin.

“Argentina has lacked evacuation capacity to develop that resource in the Vaca Muerta,” Adrian Lara, Wood Mackenzie’s principal analyst for Latin America, told Hart Energy. “That’s not the only reason, but it’s been a main restriction.”

The new Vaca Muerta Sur crude pipeline project aims to alleviate some of the constraints. The midstream project has not only gained interest from local Argentine producers seeking to boost output, but also from global oil majors Chevron and Shell.

Chevron and Shell both own operated and non-operated interests in the Vaca Muerta Basin. Shell operates the Cruz de Lorena, Sierras Blancas, Coiron Amargo Sur Oeste (Shell interest 90% each), and Bajada de Añelo (Shell interest 50%) areas, according to investor filings.

Chevron operates a 100% interest in the east area of the El Trapial Field for unconventional development and 100% in the El Trapial’s conventional waterflood field.

Chevron holds a 50% non-operated interest in the Loma Campana and Narambuena concessions. There were 41 horizontal wells drilled in Loma Campana during 2023, per company filings.

Experts say the US$3 billion Vaca Muerta Sur pipeline is one of Argentina’s most significant infrastructure projects. It’s expected to be developed under an ambitious new incentive regime to spur large capital investments within the nation.

Vaca Muerta Sur, which received unanimous shareholder approval to move forward in mid-December, is designed to transport up to 550,000 bbl/d from the Loma Campana field in Vaca Muerta to an export point on the Atlantic coast.

The crude pipeline can also be expanded to move 700,000 bbl/d “if necessary,” state-owned producer YPF SA told investors last month.

The pipeline will be developed by midstream company VMOS SA. Vaca Muerta Sur’s initial shareholders included YPF SA, Vista Energy Argentina SAU, Pampa Energía SA and Pan American Sur SA.

Then later in December, Chevron Argentina SRL, Shell Argentina SA and Pluspetrol SA exercised their options to join as shareholders in the project.

Exxon Mobil agreed to sell its Vaca Muerta assets to Pluspetrol in November 2024.

The first phase of the Vaca Muerta Sur project is already under construction. The first tranche will carry 500,000 bbl/d from Vaca Muerta around 80 miles (~130 km) east to a pumping station in Allen, Río Negro.

VMOS will develop the second tranche of Vaca Muerta Sur, which will carry crude around 273 miles (~440 km) from Allen to an export terminal in Punta Colorada, Río Negro, on the Atlantic coast.

YPF, the top Vaca Muerta producer, has secured 120,000 bbl/d of transport capacity on Vaca Muerta Sur, according to company filings.

Vista Energy, the second-largest producer behind YPF, secured 50,000 bbl/d of takeaway capacity.

RELATED

Exxon Mobil to Sell Vaca Muerta Assets in Argentina to Pluspetrol

Vaca Muerta ramps up

Vaca Muerta oil production reached a new record of 400,000 bbl/d during the third quarter of 2024, a 35% increase year-over-year, according to a Rystad Energy analysis.

Producers brought online an average of 40 Vaca Muerta horizontals per month in the third quarter, up from 34 in the second and 33 in the first, according to Rystad.

“A record 46 new wells were brought online in September [2024] alone, of which 39 were in the oil zone and the remainder in the gas zone, underscoring the continued operational efficiency and momentum of Argentina’s flagship shale play,” Rystad analysts said in a December report.

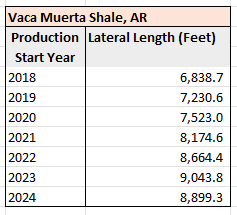

Vaca Muerta operators have also drilled longer and longer laterals in the play over time.

Lateral lengths for Vaca Muerta horizontals averaged approximately 8,900 ft in 2024, a 30% increase from 2018’s average of around 6,800 ft, according to Rystad data.

Chevron has drilled some of the longest Vaca Muerta wells. The company has reported laterals extending up to 14,700 ft (2.78 miles).

Vaca Muerta producers are also testing the stacked pay potential of the shale play. YPF is the current leader testing multi-bench pad development on its Vaca Muerta asset, Rystad Vice President of Upstream Research Radhika Bansal told Hart Energy.

Producers have mainly targeted Vaca Muerta’s Lower and Middle benches due to their high effective porosities, high total organic content and low water saturations, according to Enverus Intelligence Research.

RELATED

Chevron Pushing Longer Laterals in Argentina’s Vaca Muerta Shale

Barriers to growth

The involvement of the supermajors bodes well for Vaca Muerta Sur’s momentum, experts say.

But the pipeline’s construction still faces hurdles—including financing. Producers with stakes in the pipeline have agreed to cover 30% of the project’s roughly $3 billion price tag.

The remaining 70% is supposed to come from a syndicate of international banks, Bansal said.

“We actually think this is going to be a crucial thing this year for Argentina—seeing [financing] occurring,” Lara said.

Regulatory and political instability have been barriers for international capital to be deployed within Argentina. The Incentive Regime for Large Investments (Régimen de Incentivo para Grandes Inversiones or RIGI) aims to address those concerns.

The RIGI ensures certain tax breaks and other benefits for large-scale investments that spur economic development and employment within Argentina. RIGI projects may also freely import and export goods without prohibitions or restrictions.

To be covered under RIGI, projects require a total minimum investment of US$2 billion, with at least $400 million deployed in the first two years of development.

Qualifying export projects will enjoy stability in taxes, customs, foreign exchange matters and dispute resolution mechanisms for 30 years after startup.

VMOS aims to complete construction on the Vaca Muerta Sur extension during the fourth quarter of 2026 and commence commercial operations by summer 2027.

But depending on the fundraising process and the RIGI regulatory structure, that could be an ambitious timeline for Vaca Muerta Sur, Lara said.

“The commitment is there; the investment is going to come,” he said, “but when are you going to have it built?”

RELATED

Vista CEO: Bidding for Exxon’s Vaca Muerta Assets ‘Very Competitive’

Recommended Reading

If US Cancels, US Pays: Interior’s Burgum Calls for Sovereign Risk Insurance

2025-04-25 - With a sovereign risk insurance in place, a president cancelling a permit “would have to say ‘We're canceling this thing by fiat, but you get your money back that you've invested,” Interior Secretary Doug Burgum told energy industry members in Oklahoma City.

Expand’s Dell'Osso: E&Ps Show ‘Unusual’ Discipline with $4 NatGas Strip

2025-04-25 - Haynesville Shale’s largest gas producers are displaying restraint with a $4/Mcf forward curve. “That’s really unusual,” said Expand Energy CEO Nick Dell’Osso.

Amplify Energy Cancels PRB, D-J Deal on ‘Extraordinary Volatility’

2025-04-25 - Amplify Energy terminated an acquisition of oil-weighted assets in the Powder River and Denver-Julesburg basins from Juniper Capital after Amplify’s stock fell 58% since the deal was announced.

SLB Sees Short-Term Softening, Long-Term Rebound in Oil & Gas

2025-04-25 - SLB Ltd. says customers are likely to behave cautiously amid global trade concerns this year, but the future looks brighter in the long term.

Dividends Declared Week of April 21

2025-04-25 - With first-quarter 2025 earnings underway, here is a compilation of dividends declared from select upstream, midstream and service and supply companies.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.