ConocoPhillips path to acquiring Marathon Oil Corp. has passed another mile stone, with Marathon shareholders voting to approve the merger. (Source: Shutterstock, ConocoPhillips, Marathon Oil, PR Newswire)

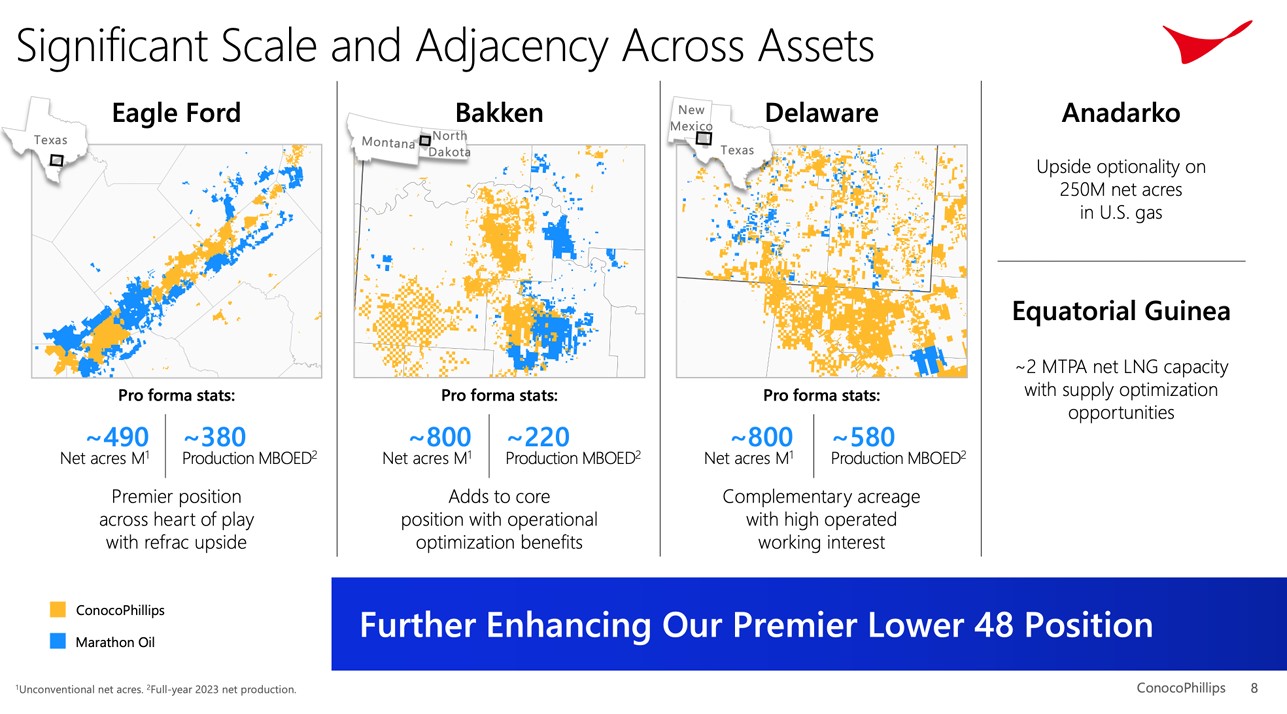

ConocoPhillips path to acquiring Marathon Oil Corp. has passed another mile stone, with Marathon shareholders voting to approve an all-stock transaction for approximately $17.1 billion, the companies said on Aug. 29.

The deal, which is valued at $22.5 billion including $5.4 billion of net debt, was first announced in May. The merger is still under review by the Federal Trade Commission after it sought a second request for information from the companies in July.

Marathon Oil will file the vote results of the special stockholder meeting in an 8-K form with the U.S. Securities and Exchange Commission.

Marathon Oil and ConocoPhillips said they continue to expect the transaction to close late in fourth-quarter 2024, subject to regulatory clearance and other customary closing conditions.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.