The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

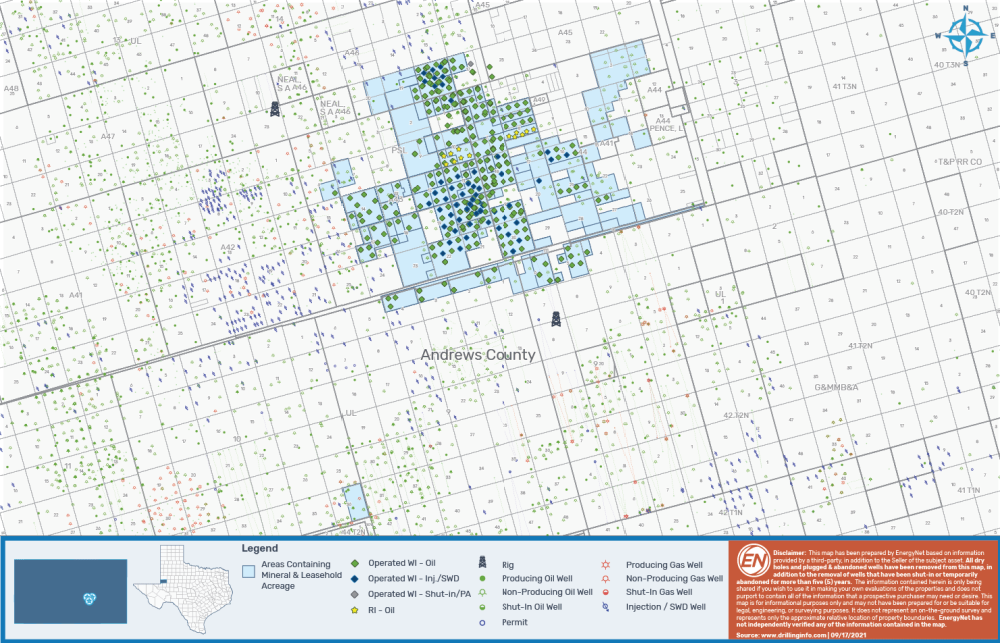

Chevron U.S.A. Inc. and Chevron MidContinent LP retained EnergyNet Indigo as the exclusive adviser for the sale of a conventional Permian oil position in Andrews County, Texas, in a sealed-bid offering closing Oct. 28.

The offering includes a legacy operated asset position covering roughly 13,705 net acres plus royalty interest, HBP leasehold and mineral fee in the Andrews/Parker Field.

Highlights:

- Legacy Operated Assets with Additional Royalty Interest within the Andrews/Parker Field in Andrews County, Texas:

- 93 Operated Producing Wells with an Average Ownership of ~98% Working Interest and ~87% Net Revenue Interest

- Producing from the Grayburg, Pennsylvanian, San Andres, and Wolfcamp Formations

- 31 Injection Wells

- Nine Royalty Wells with an Average Ownership of ~5%

- Stable Net Production of ~488 boe/d (~81% Oil) Last 12-month Average

- Field Average Annual Decline of ~3%

- Last 12-month Average Net Cash Flow of ~$168,000/month

- ~15,860 Gross (~13,705 Net) Acres

Bids are due at 4 p.m. CDT on Oct. 28. The effective date of sale is Oct. 1.

For complete due diligence information visit indigo.energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

McDermott Completes Project Offshore East Malaysia Ahead of Schedule

2025-02-05 - McDermott International replaced a gas lift riser and installed new equipment in water depth of 1,400 m for Thailand national oil company PTTEP.

Murphy’s Vietnam Find May Change Investor Views, KeyBanc Analysts Say

2025-01-09 - The discovery by a subsidiary of Murphy Oil Corp. is a reminder of the company’s exploration prowess, KeyBanc Capital Markets analysts said.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.