The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

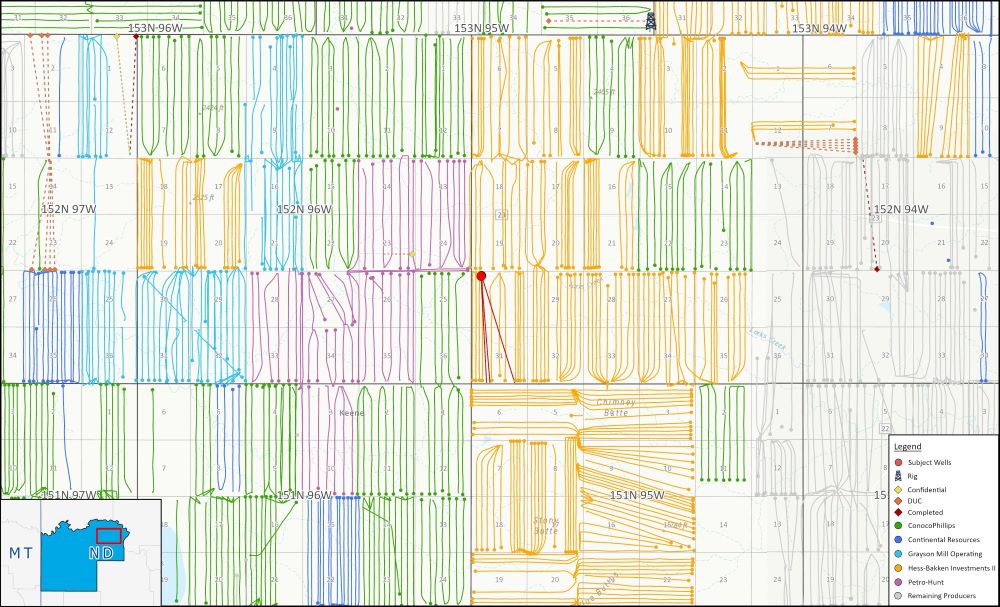

ConocoPhillips has retained EnergyNet for the sale of working interest participation in three wells located in the Bakken Shale in McKenzie County, North Dakota. The Lot # 120339 package includes four wells drilled/currently drilling.

Opportunity highlights:

- WI Participation in 3 Hz Wellbores:

- 3.125% WI / 2.604% NRI

- Projected Formations: 2-Middle Bakken & 1-Three Forks

- Total Participation Cost: $782,836.09

- Seller has Elected to Participate

- Operator: Hess Bakken Investments II, LLC

- Offset Activity:

- 1 Rig

- 2 Completed

- 4 Wells Drilled/Currently Drilling

- 10 DUCs

- 1 Permitted

- Select Offset Operators:

- Chord Energy

- Continental Resources, Inc.

- Grayson Mill Operating, LLC

- Petro-Hunt, LLC

Bids are due Sept. 11 at 5 p.m. CDT. For complete due diligence, please visit energynet.com or email Cody Felton, managing director, at Cody.Felton@energynet.com.

Recommended Reading

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

Delivering Dividends Through Digital Technology

2024-12-30 - Increasing automation is creating a step change across the oil and gas life cycle.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.