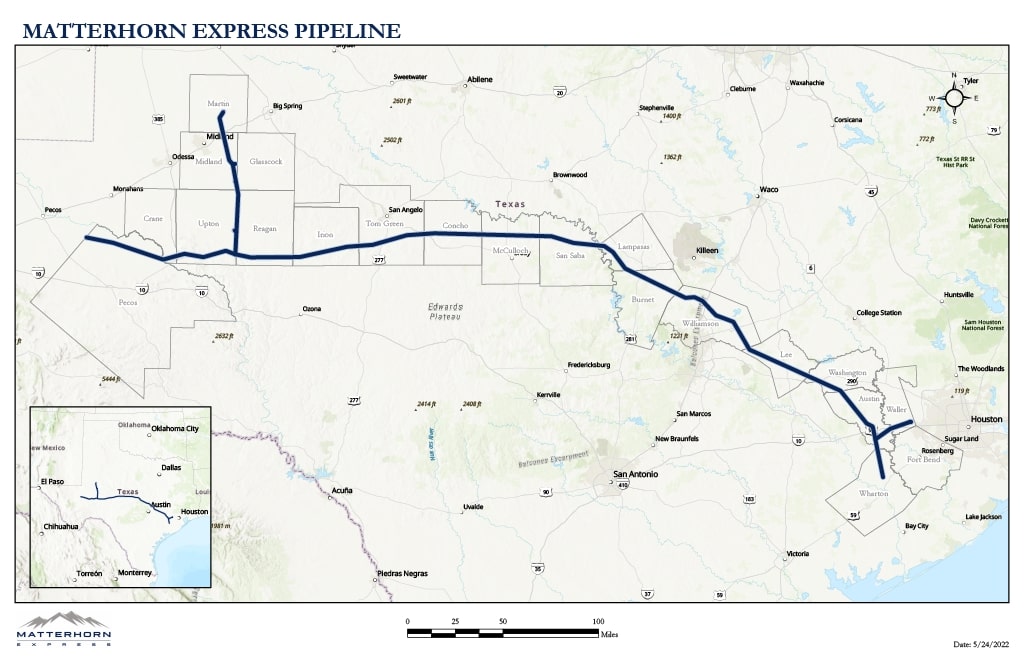

At capacity, the line provides 2.5 Bcf/d of natural gas egress from the Permian region to the Houston area. (Source: Shutterstock, Matterhorn Express Pipeline LLC)

The Matterhorn Express Pipeline flowed 317 MMcf of natural gas to customers on Oct. 1, as activity on the long-awaited pipeline ramped up, according to East Daley Analytics.

The line will begin moving 180 MMcf/d to Williams’ Transco pipeline and 137 MMcf/d to Enbridge’s Texas Eastern Transmission Systems near Katy, Texas.

The line first started flowing small amounts of gas in August to September time frame, according to reports. Flowing small amounts of gas is part of a pipeline’s normal startup operation.

The Matterhorn Express is owned by a joint venture including Whitewater Midstream, EnLink Midstream (recently acquired by ONEOK), Devon Energy and MPLX. Whitewater is the line’s operator.

At capacity, the line provides 2.5 Bcf/d of natural gas egress from the Permian region to the Houston area.

According to East Daley, prices at the Waha Hub jumped by $0.34/MMBtu on Oct. 1 to $0.45/MMBtu and then hit $0.62/MMBtu on Oct. 2, joining a nationwide rising natural gas price trend.

Waha prices remain far below the national average. Thanks to low, flat supplies, warmer-than-average weather and storm threats in the Gulf of Mexico, the price of gas at the Henry Hub flirted with $3/ MMBtu for much of the first week of October. Prices have not spent a substantial amount of time above $3 since the beginning of June. On the morning of Oct. 4, the Henry Hub was trading at $2.92/MMBtu.

Recommended Reading

Plains’ $725MM in Deals Add Eagle Ford, Permian Infrastructure

2025-01-08 - Plains All American Pipeline’s executed transactions with EnCap Flatrock Midstream in the Eagle Ford and Medallion Midstream in the Delaware Basin, among other moves.

Ironwood Launches Third Eagle Ford Midstream Co. After January Sale

2025-03-25 - Ironwood Midstream has launched its third iteration after having sold assets to Plains All American in January.

ONEOK, Enterprise Renew Agreements with Houston’s Intercontinental Exchange

2025-01-29 - ONEOK and Enterprise Product Partners chose to continue their agreements to transfer and price crude oil with Houston-based Intercontinental Exchange.

Tallgrass, Bridger Call Open Season on Pony Express

2025-02-14 - Tallgrass and Bridger’s Pony Express 30-day open season is for existing capacity on the line out of the Williston Basin.

Targa Buys Back Bakken Assets After Strong 2024

2025-02-20 - Targa Resources Corp. is repurchasing its interest in Targa Badlands LLC for $1.8 billion and announced three new projects to expand its NGL system during its fourth-quarter earnings call.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.