Heliogen's facility in Lancaster, California. The company's CEO says hybrid solar-thermal projects and an assist from tech can create “killer combinations” that offer a dispatchable energy solution. (Source: Heliogen)

As a child, did you ever use a magnifying glass to focus the sun’s light and burn a hole or melt something?

Concentrated solar power (CSP) is essentially the same concept, said Christie Obiaya, CEO of California-headquartered Heliogen. Instead of a magnifying glass, mirrors called heliostats are used to reflect and concentrate sunlight onto receivers that absorb the sun’s heat. That heat can then be used as is or to produce electricity with a steam turbine generator, paired with an electrolyzer to produce hydrogen or a thermal desalination unit.

Heat created by concentrated solar power systems can also be stored for later use, providing a solution when the sun sets or on cloudy days.

The technology has been around for decades and used in Africa, Asia, the Middle East and South America, though not so much in the U.S.

Heliogen aims to change that by incorporating its artificial intelligence (AI) technology, automation and other core intellectual property into a hybrid system that combines a solar field of mirrors with solar photovoltaic (PV) and thermal energy storage to tackle the long-duration energy storage dilemma.

The hybrid concept is not new, Obiaya said, noting CSP plus PV and energy storage is used, for example, by the Dubai Electricity and Water Authority. (Heliogen is not part of that project.)

Depending on the project’s location and solar source, the hybrid projects can be a “killer combination” of advanced technologies that offer a dispatchable energy solution.

“You can take advantage of the low-cost solar PV because solar PV over the last couple of decades has really ridden down the cost curve,” Obiaya told Hart Energy. “But as the sun goes down, daytime solar PV does not have a role to play and so that’s where the CSP for thermal energy storage kicks in.

“During the daytime, that CSP—the solar field of mirrors—can be collecting and essentially charging up the thermal energy storage, to be dispatched at night.”

Something Old, Something New

The concept of combining the solar energy and storage technologies with AI and automation is something Obiaya hopes will catch on in the U.S., where electrical grids are strained amid rising demand and prices due to higher natural gas prices.

Renewable energy companies have ramped up solar PV output, but the intermittency challenge remains. Temporary gas generators have been used at some plant sites to avoid blackouts, Obiaya said.

Plus, today’s short-duration energy storage technology is only able to discharge power for up to 10 hours or so and the batteries can be cost-prohibitive for large utility-scale solar farms. While long-duration storage provides more flexibility in balancing the grid, technologies are still evolving.

Heliogen has designed a hybrid power offering that combines CSP and PV with thermal energy storage, providing an alternative to traditional lithium-ion battery storage that typically provides a couple of hours of storage.

“If you’re looking for a long duration energy storage, [using batteries] becomes very quickly cost prohibitive because they’ve not driven down the cost curve yet,” Obiaya said. “The lowest cost incremental storage solution is thermal energy storage when you’re looking at long duration.”

The company, which is fleshing out detailed engineering for its hybrid projects, is focused on long-duration storage where baseload power is needed. CSP systems are championed for their flexibility. However, a history of high construction and installation costs as well as performance has slowed adoption in the U.S. Competition from low-cost natural gas to power grids is also a barrier.

CSP’s saving grace appears to be its thermal energy storage capability and improving technology, which has led to efficiency gains.

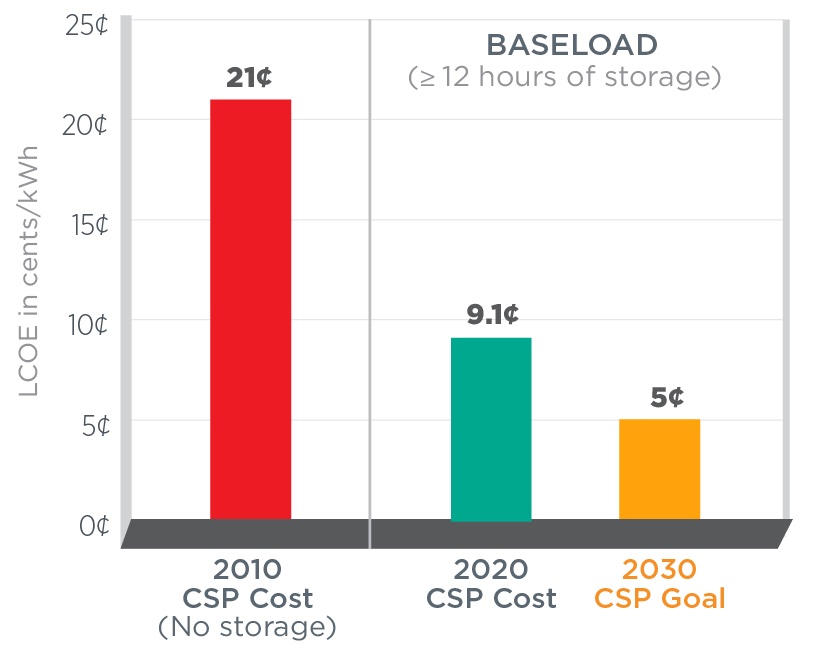

According to the U.S. Department of Energy’s Solar Energy Technologies Office, in the past decade, “the cost of electricity produced by CSP has dropped more than 50 percent thanks to more efficient systems and the wider use of thermal energy storage, which allows solar energy to be dispatchable around the clock and increase the time each day that a solar power plant can generate energy.” The department has set a goal for CSP to reach $0.05 per kilowatt-hour for baseload plants with at least 12 hours of thermal energy storage.

Improving technology

Speaking recently during an energy transition conference in Houston, Obiaya said Heliogen is improving solar-thermal by using advanced computing to eliminate spillage — in this context, a misalignment in which mirrors aren’t placed correctly on the tower.

Suboptimal point accuracy is why some previous projects underperformed, she said.

“Achieving the 500th of a degree tracking accuracy to optimize energy collection is extremely challenging for a mechanical system operated outdoors for decades in an uncontrolled environment and subject to wind and temperature fluctuations,” Obiaya said.

The cost-saving hybrid approach can be customized to any load profile and can share infrastructure, grid connections and support structures, she added.

“These hybrid plants are actually attracting a ton of interest from governments, commercial entities and investors worldwide, and they’re already proven in operation,” she said.

However, siting will play a role in whether the targeted CSP cost is hit in the U.S., since projects are dependent on the strength of the solar resource.

“Other projects across the world have successfully competed and won in the five and half- to 8-cent range. So, it seems like it should be achievable,” Obiaya told Hart Energy. “What we’re doing is enhancing that further. Our focus is really toward that target of $0.05 per kilowatt hour. But we talk with customers all the time that say, hey, ‘If you can get 8 and a half cents per kilowatt-hour of delivered energy inclusive of long duration energy storage, then that would be a success.’”

Though CSP has a larger capital outlay compared to PV with battery storage, Obiaya said the hybrid combining CSP, solar PV and thermal energy storage has a competitive all-in delivered cost of energy.

‘Strong’ Cash Position

Heliogen has financial backing from Bill Gates, NantCapital, Prime Movers Lab and Idealab Holdings among others, and plans to take advantage of tax credit incentives offered in the Inflation Reduction Act.

However, the company’s average global market capitalization dipped below the 30 consecutive days at $15 million minimum set by the New York Stock Exchange (NYSE) in November, forcing its delisting.

Obiaya addressed the NYSE delisting on the company’s third-quarter post-earnings call on Nov. 14, saying the move has had no impact on the company’s plans. Projects include the fully integrated Gen3 CSP commercial demonstration Project Capella with Woodside Energy in California, where it marked in October deployment of the first commercial-scale centrifugal particle receiver for on-sun testing and completion of the design verification of the prototype particle receiver.

The company is also building a small-scale commercial steam plant in Texas Permian Basin, and a project in Arizona where the company plans to use its hybrid power offering for green hydrogen production.

Heliogen reported third-quarter revenue of $2.3 million with 7 megawatts and three projects in its backlog — representing $73 million in contracted revenue. CFO Sagar Kurada said the company ended third-quarter 2023 with $91.6 million in liquidity.

“At the end of the day, our cash position remains strong,” Obiaya said. “We have the funding needed to execute through our near-term plans, including through the end of 2024, and we are looking forward to demonstrating the successful execution of the strategy that we outlined.”

Heliogen began trading this week on the OTCQX Best Market under the ticker symbol HLGN.

Recommended Reading

Shell Raises Shareholder Distributions and LNG Sales Target, Trims Spending

2025-03-25 - Shell trimmed its annual investment budget to a $20 billion to $22 billion range through 2028 after spending $21.1 billion last year.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Italy's Intesa Sanpaolo Adds to List of Banks Shunning Papua LNG Project

2025-02-13 - Italy's largest banking group, Intesa Sanpaolo, is the latest in a list of banks unwilling to finance a $10 billion LNG project in Papua New Guinea being developed by France's TotalEnergies, Australia's Santos and the U.S.' Exxon Mobil.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Q&A: Where There’s a Williams, There’s a Way for Gas

2025-04-09 - Midstream giant Williams Cos. leads the natural gas bulls on the great infrastructure buildout, President and CEO Alan Armstrong tells Hart Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.