Oil and Gas Investor Magazine - January 2024

Magazine

Ships in 1-2 business days

Download

The OGInterview

Time for Transition

Rich Dealy steps into the Pioneer Natural Resources CEO role as the Permian Basin pure-play integrates operations with Exxon Mobil in a $60 billion merger.

Features

Bryan Sheffield: Asset Sellers Need Bid/Ask Therapy

Advisers need to sharpen their pencils at the negotiation table because “all you’re going to do is upset your seller by promising a market that isn’t there. No one’s going to pay you.”

Private Equity Exits Hit Five-Year High

Some $30 billion worth of private deal-making in 2023 sets up slower pace ahead.

Paying the Permian Premium

Top-tier acreage in the basin is scarce and extremely expensive.

Permian Buyers, Sellers Find 'Goldilocks' Zone

M&A in the basin took off in 2023 because deal prices were not too low, not too high.

The Toby Rice Plan: 'Unleash US LNG'

The CEO of EQT Corp. wants to educate the public and avoid an inevitable energy “train

wreck.”

'Forgotten Child' Ohio Sees Oil Output Soar

More than $100 billion in investments have poured into the state’s oil and gas sector in the past decade.

Hart Energy's 50th Anniversary

Our reception was a place for the energy industry’s elite to meet, greet and eat.

Oil and Gas Investor Presents: Shale 2024

In this special shale industry outlook, Oil and Gas Investor editors provide their expertise in coverage and analysis of 2023's top stories—billions of dollars’ worth of consolidation, private equity exits, advances in artificial intelligence, the energy industry’s transition and, of course, the calamity of wars—and how they will shape the upcoming year.

Cover Story

As Pioneer Seals the Deal with Exxon, CEO Rich Dealy's Work Continues

Rich Dealy steps into the Pioneer Natural Resources CEO role as the Permian Basin pure-play integrates operations with Exxon Mobil in a $60 billion merger.

The OGInterview: As Pioneer's Run Ends, New CEO Dealy's Work Goes On

In this month's OGInterview, Pioneer Natural Resources CEO Rich Dealy discusses stepping into his role leading the Permian Basin pure-play as it integrates operations with Exxon Mobil in a $60 billion merger.

Feature

Bryan Sheffield: Asset Sellers Need Bid/Ask Therapy

Advisers need to sharpen their pencils at the negotiation table, E&P operator Bryan Sheffield said — because “all you're going to do is upset your seller by promising a market that isn't there. No one's going to pay you.”

DUG Appalachia: ‘Forgotten Child’ Ohio Sees Oil Output Soar

More than $100 billion in investments have poured into Ohio’s oil and gas sector in the past decade.

EQT CEO Toby Rice: Energy Transition Requires ‘Unleashing US LNG’

Toby Rice, CEO of EQT Corp., calls on political leaders to focus public conversation on energy solutions and avoid what he sees as an inevitable “train wreck” of an energy crisis.

Exxon-Pioneer Deal Breaks the Mold—Who Else Benefits?

Exxon Mobil's guidance indicates the supermajor intends to step on the gas once it completes the acquisition of Pioneer Natural Resources, which could lead to more investment in midstream infrastructure.

M&A: Permian Buyers, Sellers Find ‘Goldilocks’ Zone in 2023

Permian Basin M&A has taken off in 2023 largely because buyers and sellers are in a ‘Godilocks’ zone in which prices are just right, executives at RBC Capital Markets and Jefferies said.

Private Equity Exits Hit Five-year High with Occidental Deal for CrownRock

By value, Occidental Petroleum’s Dec. 11 deal for CrownRock, combined with other private-equity exits, totaled about $30 billion in 2023.

WoodMac: Top-tier Permian Inventory Scarce, ‘Extremely Expensive’

E&Ps large and small are scouring the Permian Basin to buy up top-quality drilling locations. But they’ll have to pay a hefty premium to get longer in America’s hottest oil play, according to WoodMac research.

A&D Watch

BP Buys Remaining Lightsource Stake for $320 Million

BP will take ownership of Lighthouse BP by acquiring an additional 50.03% interest in the company, which the supermajor described as a world leader in developing and operating utility-scale solar and battery storage assets.

Deckelbaum: US Shale Landscape Taking on New Shape Through M&A

In 2023, majors Chevron and Exxon Mobil took four public names off the board—Pioneer Natural Resources, Denbury, PDC Energy and Hess Corp.— using all-equity takeout mechanisms with scant premiums.

SilverBow Closes $700MM Deal for Chesapeake’s South Texas Assets

SilverBow Resources plans to develop its newly acquired high-return Chesapeake Energy inventory with an expanded capital program in 2024.

Which Occidental Assets Will Hit Chopping Block After $12B CrownRock Deal?

After weeks of market speculation, Occidental announced plans to acquire private E&P CrownRock LP for $12 billion, adding core Midland Basin inventory and more upside from deeper zones underground.

Commentary

Darbonne: Banksy, Climate Hubris and Life in the Anthropocene Epoch

As geoscientists look to define the Anthropocene Epoch, in which humanity is affecting the climate rather than merely being a byproduct of it, some are making the case more data might be a good idea.

E&P Momentum

Produced Water Solutions: Reuse, Recycle, Recover Revenue

Effectively managing produced water can mitigate environmental challenges and even result in revenue streams.

Editors Comment

Commentary: The Oil and Gas Future—Believe It or Not

If you believe the IEA’s analysis, plenty of oil and gas companies won’t survive very far into the future.

Energy Transition

Get Ready for More Consolidation—in Renewables, Investment Banker Says

Capital will continue to flow into lower carbon areas along with the traditional oil and gas business, according to Lazard’s George Bilicic.

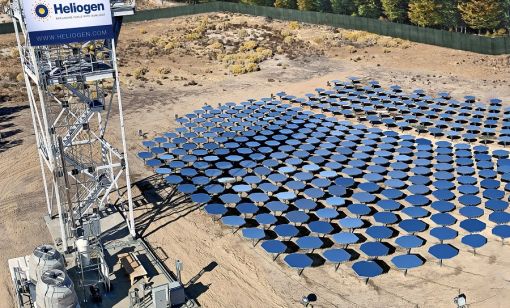

Mirrors, AI, Solar Offer ‘Killer Combinations’ for Energy Storage

Heliogen's CEO says hybrid solar-thermal projects and an assist from tech can create “killer combinations” that offer a dispatchable energy solution.

Finance & Investment

Bankers to E&Ps: Get Serious About Acquisitions or ‘Disappear’

Beyond large public companies, returns to investors are becoming a pillar of the E&P business model—from small-caps to private companies—while consolidation increasingly becomes a focus for shale players.

Paisie: Prices to Depend on Whether OPEC+ Keeps Cuts in Place

To convince the market of OPEC+’s ability to sway oil prices, the international organization will have to take back control and maintain production cuts at least until the second quarter of 2024.

Private Equity Money is There - for the Right Teams

Private Equity executives agreed that the investment space is in a healthier state than at the height of the shale boom and funding is available for “really good teams.”

From the Editor-in-Chief

Letter From the Editor: Cause for Consolidation

Shareholder demands for capital discipline and market resistance to its allure are forcing U.S. oil and gas companies to find an alternative growth strategy: consolidation.

Global Energy

Hirs: Energy’s Best Strategy for the Presidential Election? Support Both Sides

The upcoming presidential election sees energy concerns on the “second page” of the ballot, making choosing a side a necessity.

Hirs: Expansive Energy Policies Set to Shape 2025 Markets

The incoming administration’s policies on sanctions, tariffs, regulations and deportations will impact the oil and gas industry.

Permian 2.0? The Case for Argentina’s Vaca Muerta

Argentina’s Neuquén Province Energy Minister Alejandro Rodrigo Monteiro spoke with Hart Energy’s International Managing Editor Pietro D. Pitts in an exit interview about the importance of the Vaca Muerta and how the South American country is building a strong case for the play to be referred to as the Permian 2.0.

Q&A: PPHB’s James Wicklund on North, South American LNG, Irrational Net Zero Ambitions

In an exclusive Q&A, PPHB Managing Director James “Jim” K. Wicklund talks U.S., Canadian and Mexican LNG projects, difficulties Tellurian is having with its Driftwood LNG project and why the world may miss its net zero ambitions in 2050.

Midstream

Analysts: Volatility In Energy Business Is the New Normal

The East Daley Analytics webinar ‘Dirty Little Secrets’ forecasts instability over the mid-term as major changes come to most sectors of the oil and gas industry.

Enterprise Focuses on NGL in Permian with $3.1B in Projects

Enterprise Products announced a gas-related network expansion, while Marathon Petroleum’s MPLX midstream company continues its Midland Basin pipeline development.

Exxon Mobil’s Pioneer Deal Sends Mixed Signals for Permian Midstream

Following Exxon Mobil’s nearly $60 billion deal to buy Pioneer Natural Resources, pipeline companies await consolidation and potential production boosts.

Subal: Pockets of Growth Balance Fears of Slowdown

U.S. midstream and energy infrastructure has a mixed outlook for 2024, with a possible loss in demand and stronger focus on renewables offset by solid oil prices and a healthy midstream industry with pockets of growth.

Technology

Occidental: Parts of DAC Ready to Scale

A major challenge facing Occidental and other direct air capture ventures is whether the process can be made cost-competitive.

Virtual Looking Glass: Collaboration Speeding Evaluations with Digital Twins

Integrating digitized rock information with lab data is helping inform decisions in completions, EOR, carbon capture and storage, geothermal and other areas.

Weatherford’s Well Construction Platform at the Centro of It All

Weatherford’s Centro well construction platform utilizes five principles to cut costs and increase efficiencies for wells.

Trends & Analysis

Belcher: Energy Policy Outlook for 2024

Expect energy policy to be a dominant theme in the 2024 elections.

Varnado, Pharis: Navigating the Royalties Legal Landscape

With outside pressures expanding potential liabilities across the energy industry, producers need to understand the current royalty litigation landscape.