Even though traditional oil players Exxon Mobil Corp. and Chevron Corp. are inking multibillion-dollar deals to expand their fossil fuel portfolios, it doesn’t mean the energy transition is stalling, according to investment banking firm Lazard.

“I think there’s been a bit of confusion around those two transactions and some discussions around some other traditional energy companies about whether there’s some pivot away from the energy transition,” said George Bilicic, vice chairman of investment banking for Lazard. “Look at how companies like that are allocating capital, and there’s still firm commitment to the energy transition.”

Capital will continue to flow into both lower carbon areas as well as traditional oil and gas business, he said Nov. 8 during the Reuters Energy Transition North America conference in Houston. Exxon Mobil and Chevron, two of the world’s biggest oil producers, are still driving innovation and investing in areas such as biofuels, carbon capture, geothermal and hydrogen.

Energy players and industry watchers maintaining oil and gas will still be needed, especially as developing countries raise living standards by transitioning from coal to natural gas and oil, while other parts of the world turn to renewables and lower-carbon energy to reduce global emissions.

Chevron’s $53 billion move to acquire Hess Corp. and Exxon Mobil’s nearly $60 billion acquisition of Permian Basin pure play Pioneer Natural Resources left many wondering which oil deal will unfold next. But there could also be more M&A on the horizon in the energy transition space.

“We think there’s going to be some horizontal mergers,” Bilicic said, adding that it could mean a company good at development merges with one good at operations. The firm believes there will be more consolidation among companies looking to become public and gain more access to capital.

More consolidation?

Large strategics, equity firms and infrastructure funds are interested in acquiring companies in the broad renewable energy transition area, Bilicic added, though some of the larger strategics may have in place capital constraints and limitations on what they are willing to do.

“Enbridge bought a renewable natural gas company recently. RWE bought the Con Ed[ison’s clean energy] business. Shell bought Savion,” he said. “Just think about the transactions that have taken place over the last 5 to 7 years, and we think you’ll see the same thing over the next block of time.”

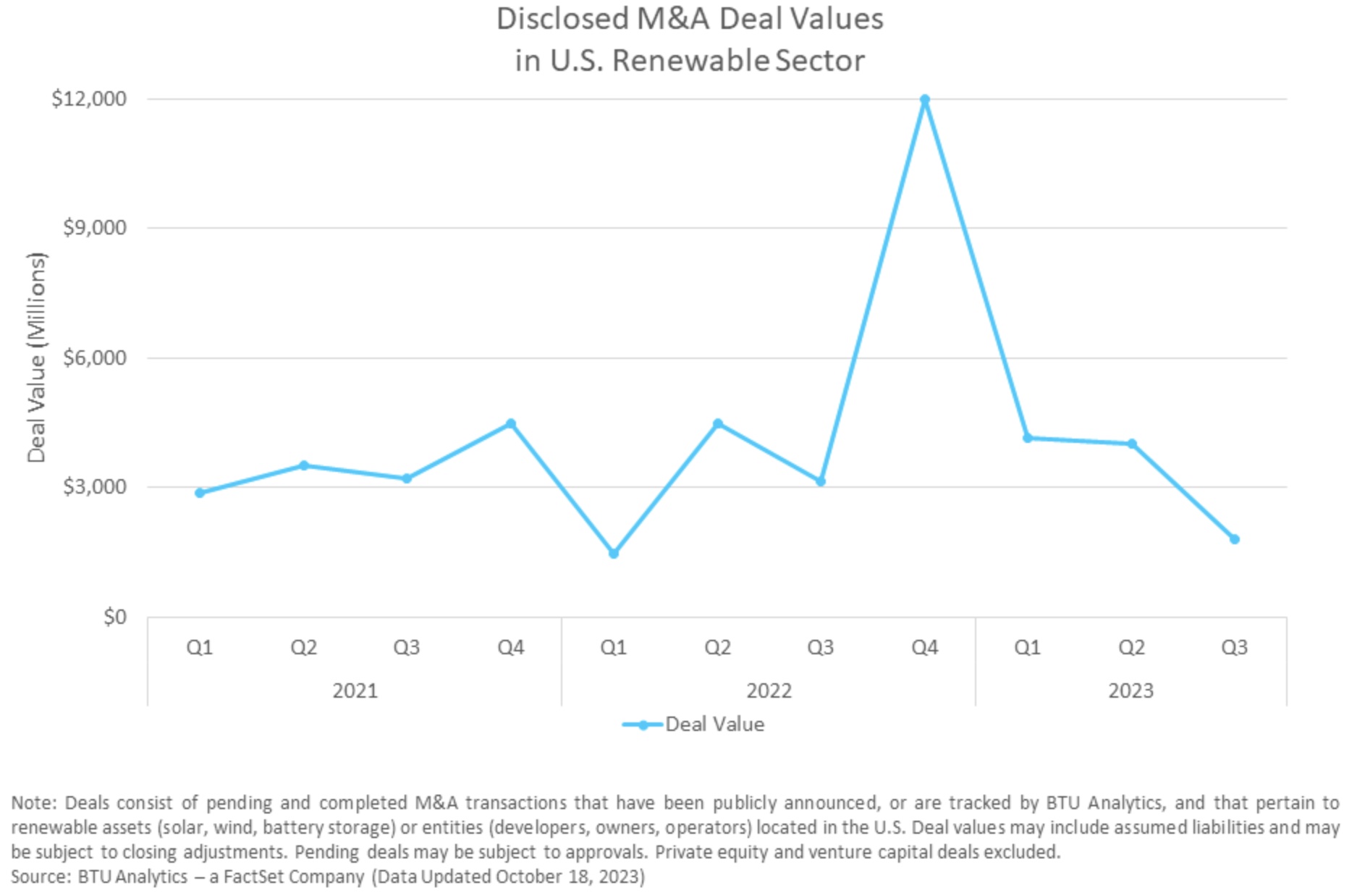

Deal activity in the renewables sector was robust in 2022 when the value of renewable M&A deals jumped to about $12 billion in the fourth quarter, according to data from BTU Analytics.

Though deal value has since sank to about $1.8 billion in the third-quarter 2023 compared to about $3 billion a year earlier—attributed to rising interest rates increasing the cost of capital—deal volume and associated renewable capacity is starting to pick up, data shows.

“The number of pending and completed M&A deals for the quarter reached 32. This marks a small gain from the 29 deals identified in the prior period, though it remains far below peak levels,” BTU said in a third-quarter 2023 report on renewable M&A activity. “The amount of acquired renewable assets—consisting of development-stage projects and operating facilities—has also advanced, reaching 30 GWs in the quarter. As with deal value, this also remains far below peak levels, meaning the sector may be operating far below full capacity.”

Cost of capital

The cost of capital is higher because long-term rates are higher, Bilicic said, noting everything—including labor and steel—is more expensive. Cost of capital is the return needed to justify budgeting capital for a project. Offshore wind is among the areas that were hit hard in the U.S.

“What we see is there is a kind of resetting of expectations on costs across everything that we do. And I think that’s flowing through the system,” he said.

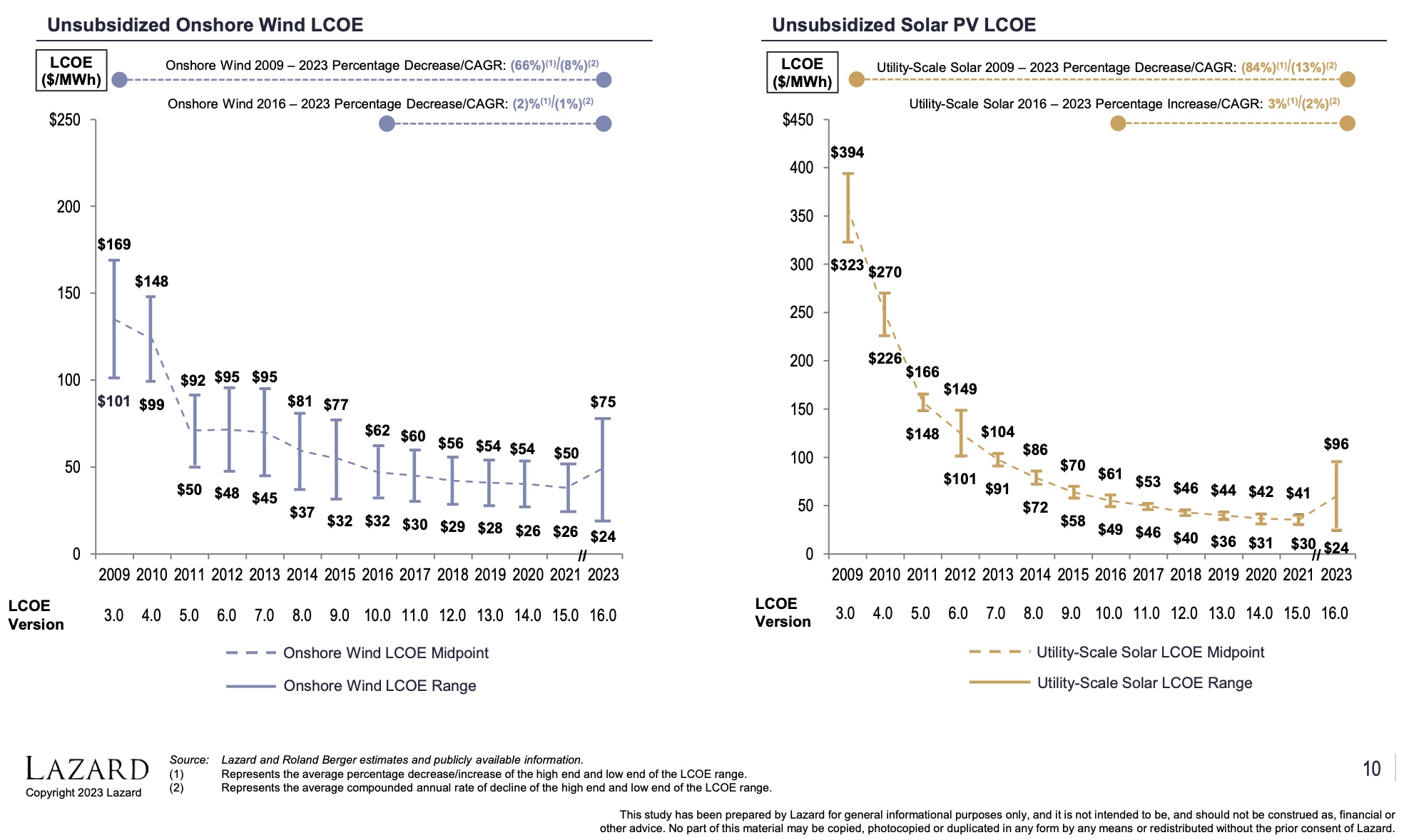

A levelized cost of energy (LCOE) analysis published by Lazard in April 2023 showed that despite inflation and supply chain challenges, the low end of costs for onshore wind and utility-scale solar declined.

“The reasons for which could catalyze ongoing consolidation across the sector—although the average LCOE has increased for the first time in the history of our studies,” Lazard said in its report.

Companies with scale that can manage the supply chain or have strong EPC [engineering, procurement and construction] partners that can help manage the supply chain are advantaged, Bilicic said.

“We think this is an industry—not because we’re in the business of helping companies consolidate—but we think the industry across all elements of energy, whether it’s Exxon or Chevron or utilities or renewables company... we’re going to see a lot of consolidation because of the opportunities to control costs, to access the lowest cost of capital and manage supply chain.”

Recommended Reading

LandBridge Closes Deal for 46,000 Surface Acres in Delaware Basin

2024-12-20 - LandBridge Co., which held a successful IPO in August, added about 53,000 acres and now holds about 273,000 acres.

Ovintiv Closes Montney Acquisition, Completing $4.3B in M&A

2025-02-02 - Ovintiv closed its $2.3 billion acquisition of Paramount Resource’s Montney Shale assets on Jan. 31 after divesting Unita Basin assets for $2 billion last week.

Amplify to Add D-J, Powder River Assets in Merger Agreement with Juniper Capital

2025-01-15 - Amplify Energy Corp. is combining with certain Juniper Capital portfolio companies in a merger agreement that adds 287,000 acres in the Denver-Julesburg and Powder River basins.

Logan Energy Closes Gran Tierra Joint Venture Acquisition

2024-12-18 - Logan Energy Corp. paid approximately $37 million for 50% working interests in Gran Tierra’s Simonette Montney assets and will assume operatorship.

Surge Closes on Divestment of Alberta Non-Core Gas Assets

2024-12-20 - Surge Energy said it has focused on developing its core Sparky and southeast Saskatchewan crude oil assets, leaving the Alberta non-core assets undercapitalized.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.