If we examine the past few years of MLP IPOs, it’s obvious that the structure is not being used exclusively to take midstream companies public and not every MLP IPO should be collapsed with the midstream. When the IPO market reopened in 2010 after the financial crisis, there were eight MLP IPOs that year, but only three of them were midstream names (there were also two coal MLP IPOs, one E&P MLP and two non-energy companies).

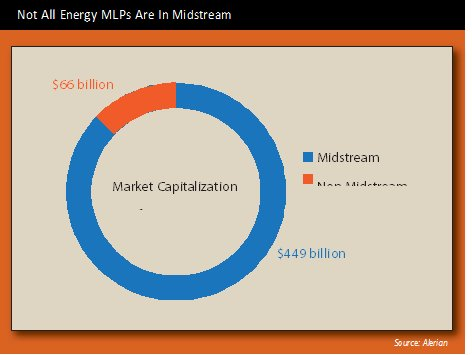

Through the first half of 2015, there were 11 new issues, but only five were midstream names. For completeness, from 2010 to today, inclusive, there were 94 MLP IPOs, and only 43 were midstream companies.

While part of the remainder is composed of familiar subsectors like E&P (eight MLP IPOs from 2010 to today) and marine transportation (six IPOs), a significant number ventured into nontraditional subsectors. There have been saltwater disposal, frac sand mining and offshore drilling MLPs over the years. Even further from the crude oil and natural gas value chain are renewable generation, trona and soda ash production and coking MLPs. Some of these new issues do not operate fee-based business models, and instead pay variable distributions, as opposed to the stable and growing distributions with which many MLP investors are familiar Nontraditional MLPs focus on a wide variety of commodities and rarely operate midstream assets. However, each sponsor has decided that utilizing the MLP structure is a way to enhance shareholder value.

Similarly, StoneMor Partners, an MLP that owns and operates cemeteries and funeral homes, compares itself to other MLPs in its investor presentations. This may be an accurate comp from a structural perspective, but most people would agree that refined products pipelines and cemeteries do not belong in the same asset class.

Of the 14 pre-IPO companies that have filed a public S-1 with the U.S. Securities and Exchange Commission to become an MLP, only three are midstream names. In fact, eight of these operate in nontraditional energy subsectors.

U.S. energy infrastructure assets may find a natural home in MLPs as utilities and large E&P companies move their holdings into the structure, but abroad, these types of businesses are owned by corporations. North of the border, Canadian firms such as Inter Pipeline Ltd. and Pembina Pipeline Corp. operate similar assets with similar business models.

Because assets, business models and distribution policies have a large impact on investment decisions, the midstream asset class is energy infrastructure. So many U.S. companies—both energy infrastructure and otherwise—structure themselves as MLPs. Let’s stop confusing the two.

Recommended Reading

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

AI-Shale Synergy: Experts Detail Transformational Ops Improvements

2025-01-17 - An abundance of data enables automation that saves time, cuts waste, speeds decision-making and sweetens the bottom line. Of course, there are challenges.

Permanent Magnets Emerge as a Game-Changer for ESP Technology

2024-12-19 - In 2024, permanent magnet motors installations have ballooned to 11% of electric submersible pump installations, and that number is growing.

Digital Twins ‘Fad’ Takes on New Life as Tool to Advance Long-Term Goals

2025-02-13 - As top E&P players such as BP, Chevron and Shell adopt the use of digital twins, the technology has gone from what engineers thought of as a ‘fad’ to a useful tool to solve business problems and hit long-term goals.

Momentum AI’s Neural Networks Find the Signal in All That Drilling Noise

2025-02-11 - Oklahoma-based Momentum AI says its model helps drillers avoid fracture-driven interactions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.