Three U.S. companies— ConocoPhillips, Ovintiv and Murphy Oil—are currently entrenched in Canada’s Montney Shale. And with good reason as they continue to carry over the U.S. shale boom to the north of the border.

The Montney boasts double-digit IRRs and Tier 1 acreage with a longer inventory lifespan than the Permian Basin due to lower activity levels than the extremely busy West Texas play. And new export infrastructure projects offer market diversity for varied products coming out of Montney.

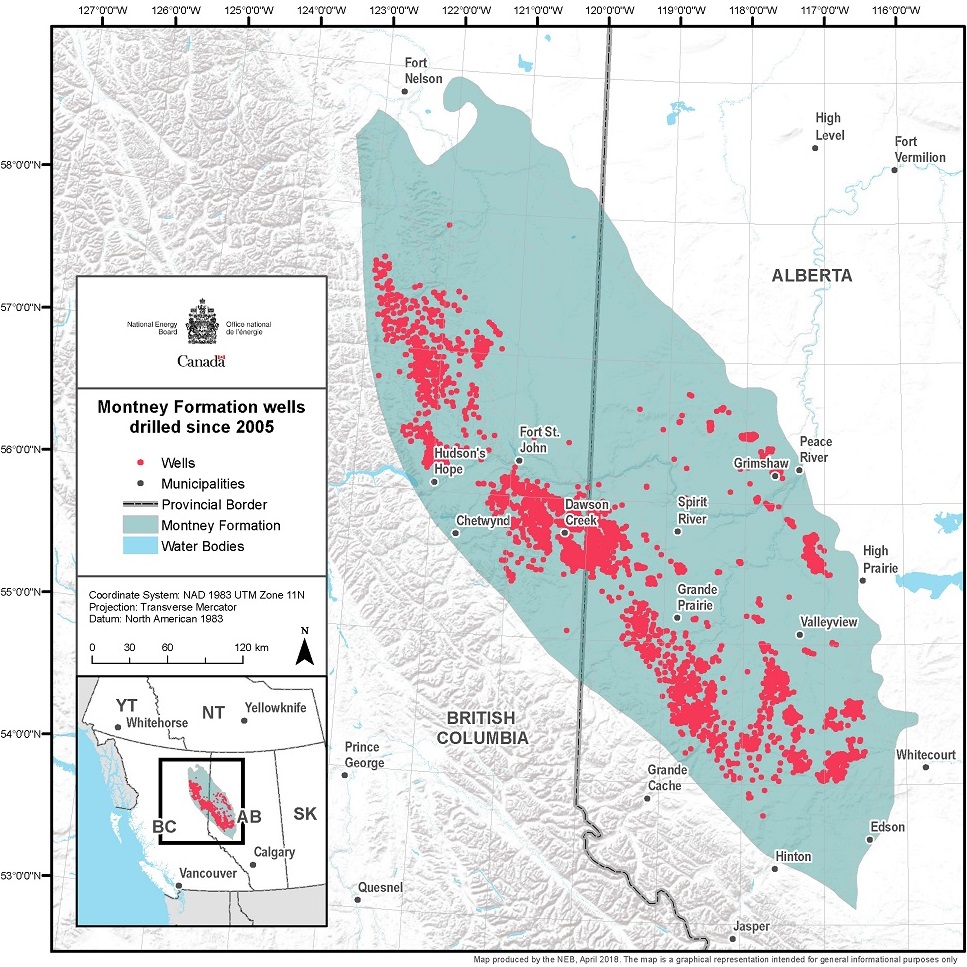

In the Western Canada Sedimentary Basin (WCSB), the Montney is primarily a condensate-rich natural gas play in northwest Alberta and northeast British Columbia (BC). The play offers both a scaled and developmental runway, and provides a one-stop shop with multiple product optionality: gas, oil and condensate.

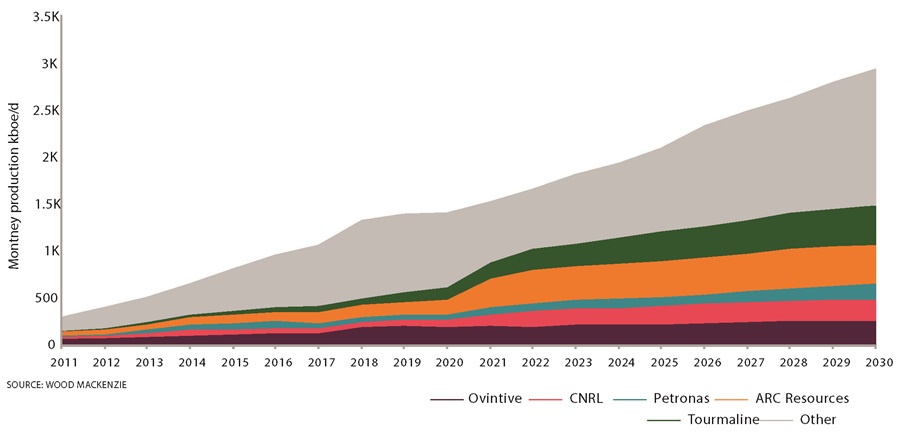

The Montney is one of the largest unconventional deposits in North America and has long been a mainstay for Canadian players. The play is highly concentrated with the top five producers—Calgary’s ARC Resources and Tourmaline Oil, Ovintiv, Canadian Natural Resources and Malaysia’s Petronas, in that order—controlling 59% of the oil and gas production in 2024, according to Wood Mackenzie.

Tourmaline’s interest in the Montney centers around economics and resources, for instance, while, for Ovintiv, it’s about inventory and returns.

“There has been increased interest in the Montney due to its strong economics and resource depth; newly relevant as many U.S. basins are starting to struggle from a supply-cost perspective and are running out of Tier 1 inventory,” a Tourmaline spokesperson told Oil and Gas Investor (OGI).

“Ovintiv has significant scale in the play with over a decade of premium condensate inventory, and well over two decades of premium gas inventory,” Ovintiv told OGI. “Our returns in the play are competitive with the top basins in North America, driven by superior well productivity, low drilling and completions costs, competitive royalty rates and strong price realizations.”

As Permian acquisitions have grown more expensive, dealmaking has started to move farther north to the emerging Uinta Basin, the more mature Bakken Shale and the Montney, said Mark Oberstoetter, head of Americas (non-Lower 48) upstream research at Wood Mackenzie.

Despite the national boundary, more U.S. companies and investors are again eying the Montney, which is very established, has high-growth potential and strong economics, Oberstoetter told OGI.

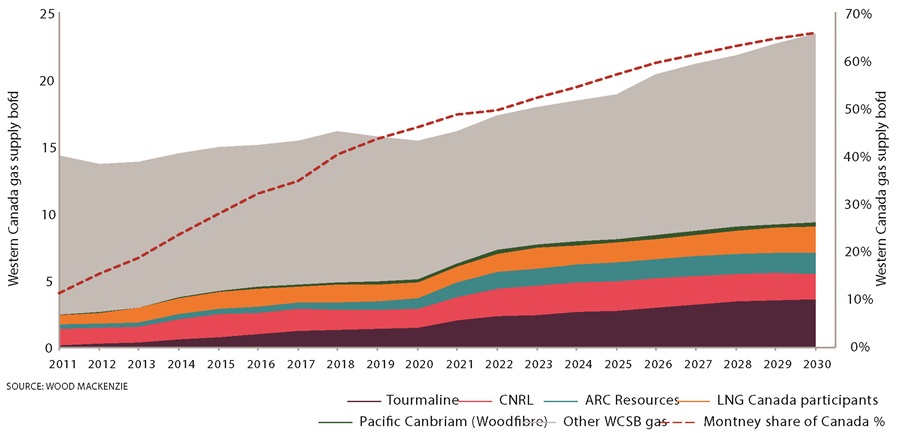

The Montney has around 170 Tcf in the ground. In the past 10 years, the play has spiked to emerge with the dominant share of Canada’s supply. Montney’s production is just below 10 Bcf/d and represents 54.3% of the estimated 18.4 Bcf/d of WCSB gas supply, he said.

Wood Mackenzie expects Montney’s gas production to exceed 10 Bcf/d by year-end 2024 and grow to 15.4 Bcf/d by 2030. By then, the Montney will represent 65.7% of the WCSB supply, which is projected to reach 23.4 Bcf/d in 2030.

The liquids-rich Montney regions rank among the top North American plays, with a sub-$45/bbl (or $2.25/Mcf) breakeven, according to Enverus Intelligence Research (EIR) analysts Tucker Keren and Jared Kugler.

“With about one-third the number of wells put on production each year as the Permian plays, the Montney has a long runway if activity levels hold,” Keren and Kugler said July 11 in a research piece. “Permian plays still hold the most remaining Tier 1 and 2 locations, but the Montney has a longer lifespan of Tier 1 and 2 sticks due to less activity in the play.”

Regarding increasing noise of private equity firms seeking M&A opportunities in Canada, Oberstoetter said a previous push didn’t work out well because it coincided with low prices at the Alberta Energy Co. (AECO) hub. AECO is the Canadian benchmark price in southern Alberta. Oberstoetter said U.S. companies continue to look at Canada for potential acquisitions, but most of the M&A activity remains dominated by the Canadians.

“You're still dealing with a [Justin] Trudeau government regulatory uncertainty. So, there's a lot of reasons not to pull the trigger, too. Maybe a Canadian consolidation might continue,” Oberstoetter said. “We're not shocked by the interest from U.S. companies just kind of checking things out.

“That said, those rumors have been spinning for two years now and no one’s pulled the trigger yet. So, more consolidations? That’s likely, but … it's not going to be a bonanza by any means.”

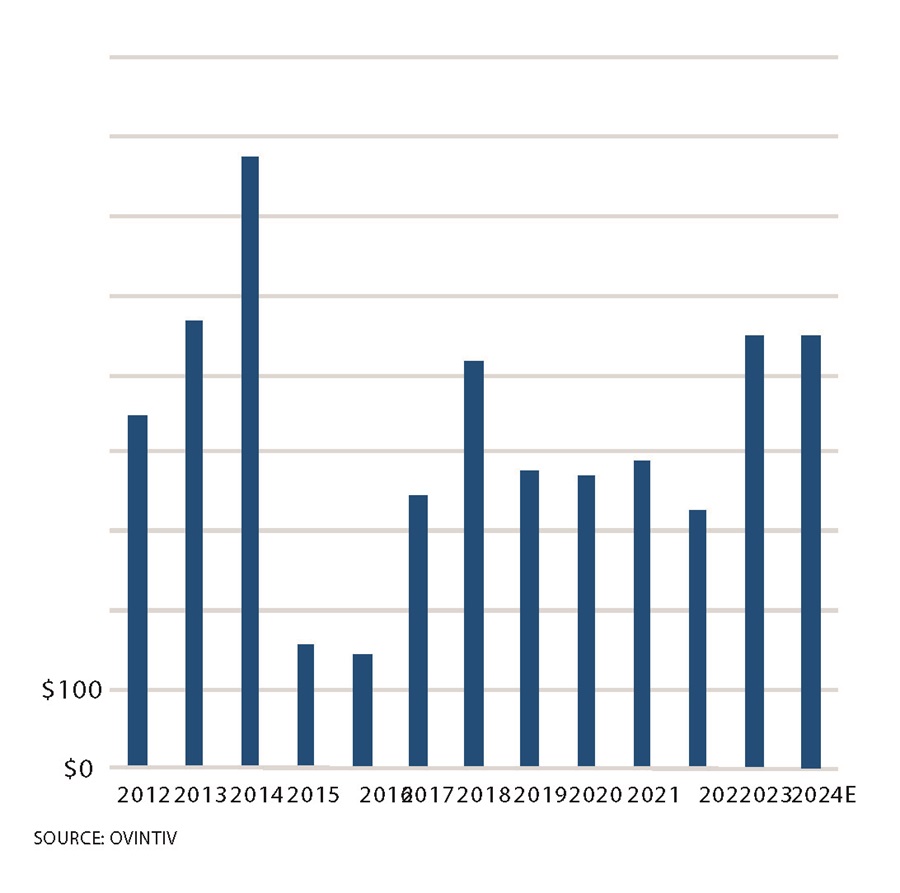

Ovintiv realizes top D&C Metrics

The Montney has been an anchor asset in Denver-based Ovintiv’s (and its predecessors’) portfolios for more than 20 years. There, the company’s acreage at year-end 2023 was 811,000 net acres, 441,000 net undeveloped.

“Ovintiv has significant scale in the [Montney] play with over a decade of premium condensate inventory and well over two decades of premium gas inventory,” a company spokesperson told OGI. “Our returns in the play are competitive with the top basins in North America, driven by superior well productivity, low drilling and completions costs, competitive royalty rates and strong price realizations.”

Ovintiv’s combined oil and gas flows from the Montney in 2024 represent about 13% of the play’s total. The Montney represented 42% of Ovintiv’s second-quarter 2024 production, according to data compiled by OGI.

Ovintiv’s average production in Montney was 251,000 boe/d in the second quarter 2024. Its Montney capex will range between $425 million and $475 million in 2024 to bring on 60 to 70 net wells, the company said.

Ovintiv will continue to allocate capital to its Montney window as the fundamentals for condensate as a premium product remain intact, Ovintiv President and CEO Brendan McCracken said during the company’s second-quarter analyst call.

McCracken cited the startup of the Trans Mountain Expansion (TMX) pipeline as “being an incremental tailwind to those fundamentals.” He said he sees the need for significant condensate imports into Western Canada to supply demand for diluents from oil sands producers.

Murphy recognizing its resource base

Houston-based Murphy’s Tupper Montney acreage is located in the WCSB in BC. There, Murphy has 118,235 net acres while boasting inter-well spacing of 984 ft to1,323 ft and 976 gross remaining locations.

Murphy’s combined oil and gas flows from the Montney in 2024 represent about 4% of the play’s total. The Montney represented 38% of Murphy’s second-quarter production, according to data compiled by OGI. The Tupper Montney has 50 years of inventory, Murphy said in a second-quarter 2024 presentation. And Murphy expects production in Tupper Montney to average 70,000 boe/d in the third quarter.

“We continue seeing great well performance from our optimized completion design; in particular, our average [30-day initial production] rate in our Tupper Main area has increased approximately 120% since 2019, and more than 200% since 2016,” Murphy President and COO Eric Hambly said during the company’s second-quarter analyst call.

Hambly said Murphy recognizes the size of its resource base and the remaining decades of gas it contains. Hambly said Murphy potentially could participate in the LNG space by selling its gas to some potential partners that are involved in the LNG Canada Phase 2 project.

ConocoPhillips expects modest production growth

Houston-based ConocoPhillips had 297,000 net acres of land in the Montney at year-end 2023.

Last year, ConocoPhillips progressed early development and appraisal activities and completed construction of the second phase of its Canadian central processing facility (CPF2). The facility started up in third-quarter 2023.

ConocoPhillips’ combined oil and gas flows from the Montney in 2024 represent about 5% of the play’s total. The Montney also accounted for 5% of ConocoPhillips’ second-quarter production, according to data compiled by OGI.

“The Montney is a solid unconventional play in Canada that fits very competitively within our global portfolio. We added a second rig in the Montney in January, and the combination of this second rig and the increased capacity from the startup of CPF2 has allowed us to ramp up production,” a ConocoPhillips spokesperson told OGI. “We expect to see continued growth in 2024, although it could be lumpy quarter-to-quarter due to well pad timing.”

The Montney volumes are strategically delivered into Edmonton, the origin of TMX.

“We had a really strong start here in 2024, where in the second quarter … we averaged 43,000 boe/d. That's more than double relative to the same quarter last year,” Kirk Johnson, ConocoPhillips’ senior vice president of global operations said during the company’s second quarter call.

Obstacles to hyper growth

The only factors preventing the Montney from entering into a “hyper growth mode” are unrelated to the resource potential, said Oberstoetter.

“It's the markets, it's the access, it's the pipeline routes and getting those approved and built at a reasonable cost. That's always been the constraining factor,” Oberstoetter said.

Norton Rose Fulbright Partner Robert Froehlich and Oberstoetter agreed the big reason the Montney is coming into vogue again is development of LNG Canada and completion of the TMX.

Froehlich said it’s been a long time coming for Canada to have some additional egress options because, traditionally, all of the country’s exports went to the U.S., said Froehlich, Norton’s head of Canadian energy, in an interview..

Canada has three LNG projects slated to come online: LNG Canada 14 million tonnes per annum (mtpa); Cedar LNG (3.3 mtpa); and Woodfibre LNG (2.1 mtpa).

“From a perspective of gas, I think those [projects] definitely do present more opportunities here in Canada,” Froehlich said. “In terms of specific investments tied to those projects, the opportunities are somewhat limited because those projects have a bit of vertical integration, particularly LNG Canada, where the upstream owners, mainly Montney producers, have interests in the project.

“But I think the expectation would be that once [LNG] exports commence, it helps to sort of firm up prices of the gas market up here. And there is also a fairly substantial growth opportunity in utilization of gas in Western Canada from a petrochemical’s perspective,” he added.

ARC Resources also is bullish on Canadian LNG: “Having decades of top-tier, low-cost inventory, in combination with an investment-grade credit rating, opens up high-caliber opportunities for LNG supply,” ARC said in its annual report.

Ovintiv told OGI it was supportive of all projects that enhance market access for the company’s products.

“We believe the Montney can be an important contributor to the world’s increasing demand for natural gas, supporting economic development and environmental solutions across the globe. With respect to condensate, we believe western Canada will remain a net importer of condensate for the foreseeable future, and as a result, the marginal western Canadian condensate barrel will remain closely tied to WTI prices,” Ovintiv said.

Oberstoetter is most optimistic about the play’s longer-term potential.

“You're dealing with super low gas prices so it's not really the time to be adding rigs, but the inventory is good. There's a long life there. The issue has been local gas prices,” he said. “We think LNG helps that on the margins. We don't think it's going to create a huge tailwind either for the local gas price but, if Montney has been able to grow in the past decade under very volatile low gas prices, we think it's perfectly fine growing the next decade.

“We'll keep feeling these LNG demands, we'll keep pushing volumes in the U.S., and we'll hopefully be a little bit more stable on the pricing standpoint once we get some of these LNG projects going,” he added.

TMX has also raised hopes.

On May 1, the TMX expansion began commercial operations, creating an expanded pipeline system with 890,000 bbl/d of capacity compared to 300,000 bbl/d earlier, according to Trans Mountain.

“The expansion of TMX has certainly helped in terms of both increasing the volume of exports that are possible just simply on a raw numbers’ basis, but also allowing more access to a global market and global pricing,” Froehlich said.

“And so, in terms of increased interest to the Montney, I think it has generally increased interests overall.”

Recommended Reading

Excelerate to Buy LNG, Power Assets from New Fortress for $1.055B

2025-03-27 - Excelerate Energy will buy a New Fortress Energy’s Integrated downstream LNG and power platform in Jamaica in a $1.055 billion cash acquisition.

DNO to Buy Sval Energi for $450MM, Quadruple North Sea Output

2025-03-07 - Norwegian oil and gas producer DNO ASA will acquire Sval Energi Group AS’ shares from private equity firm HitecVision.

Nabors SPAC, e2Companies $1B Merger to Take On-Site Powergen Public

2025-02-12 - Nabors Industries’ blank check company will merge with e2Companies at a time when oilfield service companies are increasingly seeking on-site power solutions for E&Ps in the oil patch.

M&A Target Double Eagle Ups Midland Oil Output 114% YOY

2025-01-27 - Double Eagle IV ramped up oil and gas production to more than 120,000 boe/d in November 2024, Texas data shows. The E&P is one of the most attractive private equity-backed M&A targets left in the Permian Basin.

ConocoPhillips Sells $600MM in Noncore Permian Basin Assets

2025-02-06 - Following its $22.5 billion deal to buy Marathon Oil, ConocoPhillips is targeting $2 billion in asset sales— a goal a company executive said would largely be achieved this year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.