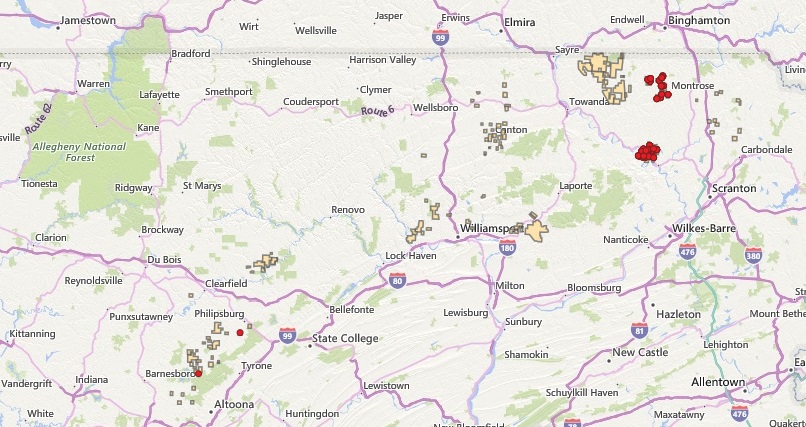

BKV Corp., the largest producer in the Barnett Shale (pictured), sold part of its Marcellus Shale portfolio in northeast Pennsylvania, regulatory filings show. (Source: BKV Corp.)

Barnett Shale gas producer BKV Corp. sold part of its Appalachia portfolio in a pair of transactions, regulatory filings show.

The two Marcellus Shale dispositions generated proceeds of $131.7 million for Denver-based BKV before closing adjustments.

After a historic run of upstream consolidation that focused almost entirely on oil-weighted properties—mostly in the Permian Basin—the tepid M&A market for natural gas assets is showing signs of thawing.

BKV’s roots are in the Marcellus, where the company’s Kalnin Ventures LLC initially began a string of acquisitions beginning around 2016 before the company more recently pivoted to the Barnett Shale.

The first deal, closed June 14, saw BKV sell its wholly owned subsidiary, BKV Chaffee Corners LLC.

BKV Chaffee owned a non-operated interest in around 9,800 net acres and 116 gross (24.2 net) wells and 122 Bcfe of proved reserves in northeast Pennsylvania. The deal also included BKV’s interest in a midstream system operated by Repsol Oil & Gas.

BKV generated $106.7 million through the BKV Chaffee sale.

In the second sale, closed June 28, the company sold non-operated upstream assets from BKV Chelsea, including 6,800 net acres, 214 gross (15.4 net) wells and 35 Bcfe of proved reserves.

The company generated $25 million through the BKV Chelsea sale. Buyers for the two transactions were not disclosed.

BKV expects to record a gain on the sale of its non-op interests in the second quarter.

RELATED

Ohio Oil, Appalachia Gas Plays Ripe for Consolidation

Following the two divestitures, BKV still holds approximately 19,400 net acres in northeast Pennsylvania (~98% HBP), the company said in an updated S-1 filed July 5 with the U.S. Securities and Exchange Commission (SEC).

BKV has secured downstream capacities for its Appalachia gas into Gulf Coast markets via the Tennessee Gas Pipeline and into the northeast corridor via the Millennium pipeline.

BKV has looked to sell assets from its northeast Pennsylvania (NEPA) portfolio for some time. The company retained EnergyNet earlier this year to market the BKV Chelsea package, which included assets in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

BKV’s Appalachian Basin production during the first quarter averaged 132.8 MMcf/d and consisted entirely of natural gas.

Much of the high-profile upstream M&A over the past year has focused on oily assets in the Permian Basin. The market for gas-focused M&A has moved much more slowly. With Henry Hub prices so low, many would-be sellers haven’t been willing to make a deal.

But the A&D market has started to see natural gas activity—notably, a tie-up between Chesapeake Energy and Southwestern Energy in a $7.4 billion merger.

The combination of Chesapeake and Southwestern is poised to yield the nation’s largest natural gas producer, overtaking current leader, Pittsburgh-based EQT Corp.

On July 10, Diversified Energy announced signing a conditional agreement to buy working interest in operated natural gas assets in East Texas from Crescent Pass Energy for about $106 million.

In the Haynesville Shale play of Louisiana and East Texas, Rockcliff Energy II sold to Tokyo Gas Co. and partner Castleton Commodities in a $2.7 billion deal late last year.

Private E&P Aethon Energy recently acquired a smaller package of Haynesville properties from LNG developer Tellurian Inc. for $260 million.

Chevron Corp. is also reportedly marketing a largely undeveloped acreage block in the East Texas Haynesville.

RELATED

BKV CEO: Barnett E&P Waits for Right Window to Launch IPO

Launch window

The Appalachia divestitures focus BKV’s portfolio even more on the Barnett Shale, where the company is the top gas producer.

BKV’s Barnett acreage position was approximately 460,000 net acres at the end of the first quarter; production averaged 688.3 MMcfe/d (76% gas, 24% NGL) during that period.

The latest investor update from BKV comes as the private E&P watches for an opportune moment to launch an IPO.

The company filed paperwork proposing an IPO with the SEC in November 2022, but BKV has yet to disclose how many shares it aims to sell or how much they will cost.

Chris Kalnin, BKV’s CEO, told Hart Energy earlier this year that the Barnett E&P is “at the ready” to launch its IPO. But a laundry list of issues—depressed natural gas prices, multiple U.S. bank failures and geopolitical strife in the Middle East—made 2023 an unattractive year to move forward with BKV’s public offering.

A smattering of upstream MLPs and service companies held IPOs last year, including:

- TXO Partners LP, an MLP led by XTO founder and industry veteran Bob Simpson;

- Mach Natural Resources LP, a Midcontinent-focused MLP led by Chesapeake co-founder and industry veteran Tom Ward;

- Kodiak Gas Services, a provider of contract compression services; and

- Frac sand specialist Atlas Energy Solutions, with a large position in the Permian Basin.

The energy IPO market saw a notable uptick in activity this summer with offerings completed by Tamboran Resources and LandBridge.

Australian producer Tamboran Resources Corp. is the first non-North American shale-gas E&P to IPO on the New York Stock Exchange, according to Dealogic.

Tamboran shares opened at $22.50 on June 27 after the company priced them at $24 per share the day prior. The offering raised $75 million for 3.125 million shares, down from expectations to sell 6.5 million shares for $156 million.

TBN shares were trading around $24 per share near midday on July 12.

Tamboran is leading the development of Australia’s gas-rich Beetaloo Basin, which reportedly contains similar geologic characteristics to the Marcellus Shale.

LandBridge Co. owns and manages around 220,000 surface acres in Texas and New Mexico, primarily in the Delaware Basin.

The company’s shares opened June 28 at $19.48 and closed at $22.95 in light volume; LB shares were trading at $31.54 per share near midday on July 12.

RELATED

Recommended Reading

Hydrogen Hopefuls Advised to Focus on Offtake Amidst Funding Turbulence

2025-04-09 - Hydrogen is one way to reduce emissions when used in place of higher-emissions fossil fuel sources where feasible, but costs and infrastructure pose challenges.

Baker Hughes CEO: Expect ‘Volatility, Noise’ Around Energy Transition

2025-03-12 - Baker Hughes and Linde executives spoke about lower carbon resources such as hydrogen and geothermal, which will be part of the energy mix but unlikely to displace natural gas.

API’s Multi-Pronged Approach to Lower Carbon Operations

2025-01-28 - API has published nearly 100 standards addressing environmental performance and emissions reduction, which are constantly reviewed to support low carbon operations without compromising U.S. energy security.

Energy Transition in Motion (Week of March 14, 2025)

2025-03-14 - Here is a look at some of this week’s renewable energy news, including a record-breaking year for solar capacity additions.

CF Industries Form JV to Build $4B Low-Carbon Ammonia Project in Louisiana

2025-04-08 - CF Industries has reached a FID with JERA and Mitsui for an ammonia production facility in Louisiana. CF Industries sealed a deal with Occidental’s 1PointFive to capture and store CO2 from the facility.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.