Facing record-low commodity prices, U.S. dry gas producers have curtailed production and deferred new completions in the first half of 2024. (Source: Shutterstock.com)

U.S. natural gas producers have weathered through a period of historically low commodity prices, waiting on demand growth from new LNG export projects.

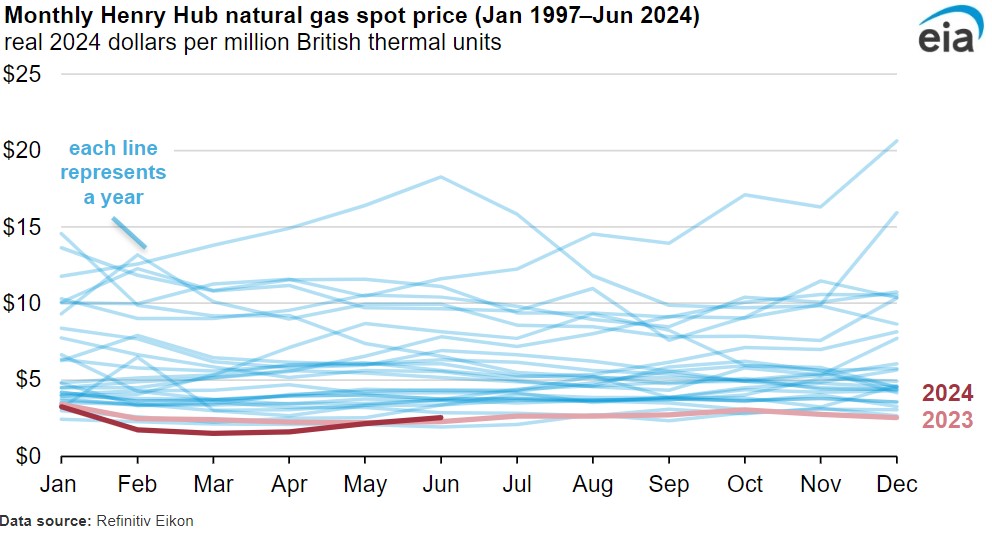

The first half of 2024 for gas producers was mired by record-low prices and production curtailments, according to data compiled by the U.S. Energy Information Administration (EIA).

Henry Hub wholesale natural gas prices fell by 20% to $2.56/MMBtu between January and June, the EIA reported, citing Refinitiv Eikon data.

Henry Hub gas prices averaged $1.49/MMBtu in March, the lowest average monthly inflation-adjusted price since at least 1997.

Additionally, prices from February through April 2024 were the lowest ever recorded for those months, per EIA data.

Natural gas prices declined throughout much of 2023 due to record-high production, flat consumption, relatively high gas storage inventories and mild winter weather.

RELATED

Kissler: Are We Set Up for a Summer Natural Gas Rally?

Production

U.S. dry gas production averaged 106 Bcf/d during November 2023 and December 2023, the most ever produced, the EIA said.

That was also at a time when warmer-than-usual winter temperatures led to decreased gas demand for space heating.

Amid the oversupplied market and glutted storage inventories, gas-focused producers began curtailing production and deferring new completions during the first half of 2024.

Companies including Chesapeake Energy, EQT Corp., Range Resources, CNX Resources and Gulfport Energy reported declining activity in their first-quarter earnings.

Dry gas production fell to 101.6 Bcf/d in April, the lowest level since December 2022.

Natural gas injections into storage during May and June were down 11% and 31% over their respective five-year averages. However, curtailment efforts by dry gas producers have yielded relatively muted effects.

“As production has decreased and inventories are nearing the range of the previous five years, prices have increased from February and March but remain near historic lows,” the EIA wrote in a July 22 report.

Gas-focused producers are slashing production and drilling activity where possible, but they’re also having to contend with near-record volumes of associated gas emerging from oil-focused basins like the Permian and Bakken.

Associated wet gas production in the Permian Basin, the nation’s top oil-producing basin, is closely tied with production from new oil wells.

RELATED

Permian To Drive Two-thirds of US Oil Output Growth Through '25 – EIA

Gassing up for 2025

Producers are languishing through 2024, but brighter days for the natural gas sector may yet be on the horizon.

U.S. operators see new avenues for growth ahead, including supplying feed gas for new LNG export projects along the Gulf Coast or feeding power-hungry artificial intelligence (AI) data centers.

The EIA expects Henry Hub gas prices to average $2.90/MMBtu in the second half of 2024, the EIA reported in its most recent Short-Term Energy Outlook.

Henry Hub prices are forecast to rise into next year as new LNG export projects come online and ramp up output, including Golden Pass LNG, Plaquemines LNG Phase I and Corpus Christ LNG Stage III.

EIA forecasts show Henry Hub gas prices averaging $3.29/MMBtu in 2025.

On July 22, U.S. LNG developer Tellurian Inc. agreed to sell to Australian firm Woodside Energy Group Ltd. for approximately $900 million. Tellurian’s value was tied to its fully permitted Driftwood LNG project, situated along the Louisiana Gulf Coast.

RELATED

Tellurian’s Martin Houston: Selling to Woodside the ‘Right Deal’

Recommended Reading

Hydrogen Hopefuls Advised to Focus on Offtake Amidst Funding Turbulence

2025-04-09 - Hydrogen is one way to reduce emissions when used in place of higher-emissions fossil fuel sources where feasible, but costs and infrastructure pose challenges.

Baker Hughes CEO: Expect ‘Volatility, Noise’ Around Energy Transition

2025-03-12 - Baker Hughes and Linde executives spoke about lower carbon resources such as hydrogen and geothermal, which will be part of the energy mix but unlikely to displace natural gas.

API’s Multi-Pronged Approach to Lower Carbon Operations

2025-01-28 - API has published nearly 100 standards addressing environmental performance and emissions reduction, which are constantly reviewed to support low carbon operations without compromising U.S. energy security.

Energy Transition in Motion (Week of March 14, 2025)

2025-03-14 - Here is a look at some of this week’s renewable energy news, including a record-breaking year for solar capacity additions.

CF Industries Form JV to Build $4B Low-Carbon Ammonia Project in Louisiana

2025-04-08 - CF Industries has reached a FID with JERA and Mitsui for an ammonia production facility in Louisiana. CF Industries sealed a deal with Occidental’s 1PointFive to capture and store CO2 from the facility.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.