(Source: Shutterstock)

What will it take to deploy low-carbon intensity (LCI) hydrogen at scale in the U.S. and reach net-zero by 2050?

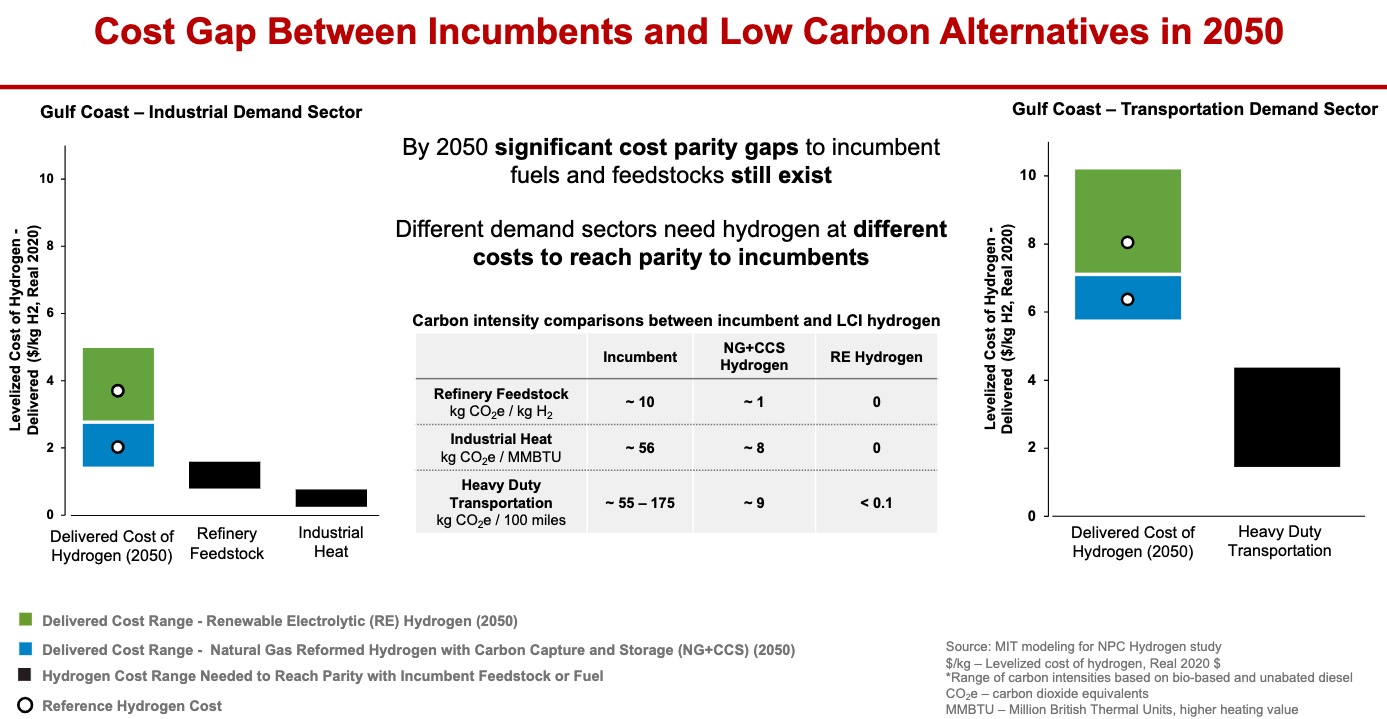

The National Petroleum Council (NPC) says shrinking the cost gap between incumbent fuels and lower carbon alternatives, a price on carbon and about $1.9 trillion in capital investment—to name a few solutions—is needed, according to a report recently released by the council on harnessing hydrogen.

As it stands today, the nation is not on track to reach net-zero emissions by 2050 under existing federal policies. The report on hydrogen was released in late April at the request of U.S. Energy Secretary Jennifer Granholm, who reportedly called the findings “sobering.” The NPC report, which utilizes the Stated Policies and Net Zero by 2050 modeling scenarios, lays out a roadmap on how to get on track. Critical enablers include policy and regulation; societal considerations; impacts and safety; technology; and research, development and demonstration investments.

“This is sobering, but I don’t think it’s reason for despair,” Austin Knight, vice president of hydrogen for Chevron Corp. and chair of the NPC’s hydrogen study, said during a panel discussion about the study in early May. “The current policy shows you get some activation, you get some doubling of the current system, and the foundations start to be built. But what’s necessary is something well beyond what’s currently in place, and that’s what this report delivers.”

Hydrogen has been championed as a promising way to decarbonize hard-to-abate sectors such as steel and cement, while also serving as a low-emissions alternative in other areas such as transportation and energy storage. Hydrogen can be made from various techniques and feedstocks that include water electrolysis using electricity from renewables, fossil fuels, natural gas as well as nuclear energy. Each comes with varying levels of carbon intensity.

The U.S. has taken steps to help grow the hydrogen sector. Moves have included incentivizing development via the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act, along with its Regional Clean Hydrogen Hubs program providing up to $7 billion to establish at least six regional hubs across the U.S.

Still, more is needed, experts say.

Critical enablers

NPC’s report, the culmination of about 18 months of work, offered 23 recommendations to help the hydrogen industry grow through 2050.

Implementing a price on carbon backed by legislation was among the critical enablers cited. Without carbon pricing, both demand and production side incentives are needed. These included adjustments to the 45V production tax credit, such as extending subsidies beyond 2032, providing access to infrastructure capital and making the permitting process more efficient.

The NPC also called for improved community engagement encouraging best practices and equitable representation, while also ensuring public safety.

Other recommendations focused on technology. Areas with gaps included hydrogen leak detection; hydrogen storage and infrastructure; and efficiency and costs for production technologies and end-use applications.

Reaching net-zero would require a nearly sevenfold increase in hydrogen production from today’s 11 million tonnes per annum (mtpa) to about 75 mtpa.

Today, hydrogen is mainly produced using natural gas as feedstock without the carbon capture and storage (CCS) component. The report shows growth in both natural gas plus CCS as well as electrolytic hydrogen. But the net-zero path with electrolytic hydrogen requires more capital—$1.8 trillion plus about $100 billion for natural gas plus CCS.

“It’s a steep mountain in front of us, but it’s one that’s the right one to climb as we start moving through these solutions,” Knight said.

The report provides a clear-eyed view of what it is going to take, said Mike Kerby, senior adviser of corporate strategic planning for Exxon Mobil Corp. He applauded the U.S. Department of Energy (DOE) for its work with the IRA, which gives companies a tax credit of up to $3/kg of hydrogen produced based on the emissions rate of the production process.

However, “the IRA can be a bridge to nowhere if you don’t have, as we laid out, some of these additional policies that are going to be needed to close those gaps,” Kerby said.

Hydrogen could help reduce up to 8% of emissions in the net-zero scenario, according to the study. That will require activating new uses for hydrogen, including in hard-to-abate sectors. Nevertheless, existing policies aren’t sufficient to trigger investment, the report states.

Stimulating hydrogen demand

The so-called “carrots” in the IRA aren’t enough to close the economic gap on the demand side, said Brian Fisher, managing director for RMI, or the Rocky Mountain Institute. The DOE, as well as other governments around the world, are looking at demand-side incentives.

“We saw Japan announce $21 billion [worth] of demand side incentives for hydrogen, Germany $6 billion,” Fisher said, adding the Hydrogen Demand Initiative is working with the DOE to create and allocate $1 billion in demand side incentives for hydrogen hub projects. “All of this works when you close the economic gap and you can actually get a long-term offtake agreement to get financeable projects.”

Identifying companies willing to pay the green premium now to help bring down costs over time is another task, he added.

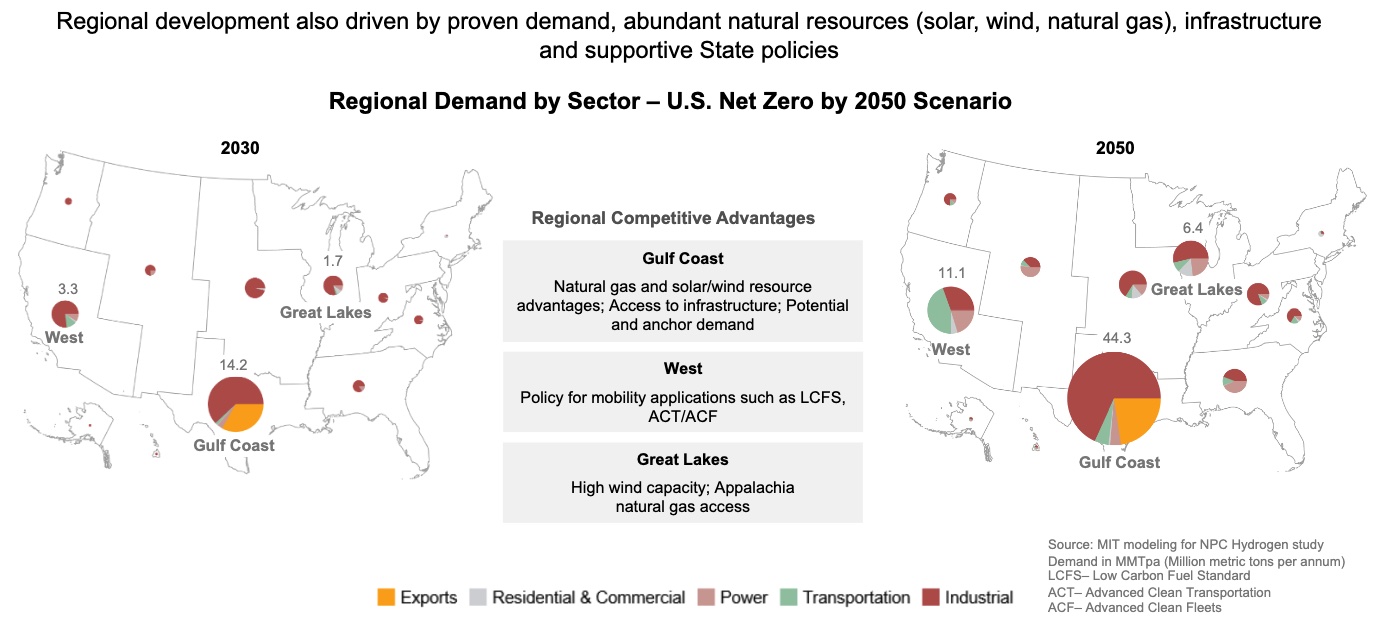

The NPC’s three-phased roadmap starts with the activation phase, with industrial demand growth around existing local infrastructure. The Gulf Coast region, led by Texas, is expected to remain at the helm. About 60% of the potential hydrogen supply in the U.S. is likely to come from the Gulf Coast, according to the NPC.

The activation stage is followed by expansion through the establishment of regional hubs with demand growth in transportation and power, the report states. Then comes the at-scale phase as interregional infrastructure fully scales across the industrial, transportation and power sectors.

“We’re in an activation stage right now,” said Mark Shuster, deputy director of energy division for the Bureau of Economic Geology at the University of Texas.

Scaling will cost a lot.

“This is just enormous, even ginormous,” Shuster said. “Coming from university, I have a lot of belief in technology. But I tell you to get to scale, we’re also going to need policy to kind of push things along.”

Having a predictable regulatory framework that the industry can work within is key, including for building pipelines and storage facilities, Shuster added.

Kerby pointed out that the U.S. is already one of the largest producers and users of hydrogen, producing about 11 MMmt per year. It’s used mostly today in fertilizer production and refining.

The greatest future demand is expected to come from the industrial sector, but exports of hydrogen could become another anchor for the industry, according to Fisher.

“Right now with the IRA, the lowest delivered cost of hydrogen into Europe is the U.S. Gulf Coast. It’s the cheapest place to produce [hydrogen] at landed cost,” Fisher said. “It even beats producing it locally in northern Europe … where most of the industrial demand is.”

The study is not intended to be a crystal ball or a precise projection of the future, Knight said, but rather a guide to help inform what reality could be and what it would take to get there.

“You get the policy right. You start making breakthroughs in technology. Industry can do this and will deploy capital,” he said. But “the numbers have to work and the technologies have to be there.”

Recommended Reading

Exxon CEO Darren Woods: Hydrogen Incentives ‘Critical’ for Now

2025-02-03 - Exxon Mobil CEO Darren Woods said the end goal for energy policy should be a system in which no fuel source remains dependent on government subsidies.

Energy Transition in Motion (Week of Feb. 7, 2025)

2025-02-07 - Here is a look at some of this week’s renewable energy news, including a milestone for solar module manufacturing capacity.

Belcher: Texas Considers Funding for Abandoned Wells, Emissions Reduction

2025-03-20 - With uncertainly surrounding federal aid as the Trump administration attempts cost cutting measures, the state is exploring its own incentive system to plug wells and reduce emissions.

Oxy Secures Class VI Permits for Stratos DAC Project

2025-04-07 - Occidental Petroleum has secured permits from the Environmental Protection Agency to store CO2 at its Stratos DAC facility. Located in Texas, Stratos is designed to capture and store up to 500,000 metric tons of CO2 annually, Oxy says.

Report: Trump to Declare 'National Energy Emergency'

2025-01-20 - President-elect Donald Trump will also sign an executive order focused on Alaska, an incoming White House official said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.