The Gulf of Mexico (GoM) and the North Sea are two of the key global offshore regions. Together these two regions account for about 20% of the global offshore production and represent 25% of global offshore investments. This article will take a closer look at how these regions will develop going forward.

Production

Looking at historical offshore production, the trends have been similar for the two regions. Both the North Sea and GoM experienced a considerable decrease in production from 2000 to 2013. During this period the North Sea production declined from 10 MMboe/d to 6 MMboe/d, while the GoM production declined from 4 MMboe/d to 2 MMboe/d.

From 2014 the declining trend was broken for both regions, and production started to increase again. This was a result of the sanctioning of new projects and the redevelopment of mature producing fields. In the North Sea new fields such as Knarr, Gudrun, E. Grieg, Laggan and Jasmine started up, while mature assets such as Valhall, Ekofisk and Eldfisk were redeveloped. In the GoM it was the deepwater projects that halted the production decline, with Lucius, Jack/St. Malo and Delta House being the primary sources of new production.

In the medium term production is expected to decline due to the lack of sanctioning activity over the last few years. The North Sea production could drop as much as 1 MMbbl/d over the next five years, while GoM production could drop about 300 Mboe/d during the same period (Figure 1).

Competitiveness

As both the North Sea and GoM are competing with other sources of production for investments, it is important to consider competitiveness. Figure 1 illustrates this by showing the average breakeven price and payback time for different sources of new production compared to new projects in Norway, the GoM and U.K.

Figure 2 shows how the average breakeven prices for nonsanctioned projects in both Norway and the GoM is less than $50/bbl and lower than all the competing segments for projects to be sanctioned in the coming years. In fact, the Norwegian projects have a breakeven price that is $10/bbl lower than shale.

The fact that the North Sea and GoM are competitive with other sources of production is a key reason why Rystad Energy expects activity to improve for these regions going forward. Increased sanctioning activity will result in an increase in investments in 2019. This also will contribute to the stagnation of the production decline and eventually lead to an increase.

Sanctioning activity

Since 2013 the sanctioning activity in both regions has been trending downward. From 2010 to 2013 1.5 Bboe of new resources were sanctioned yearly in the North Sea compared to 200 MMboe in 2016. In the GoM the average was 700 MMboe annually during 2010 to 2013 compared to 330 MMboe in 2016. The reduced activity has affected spending and the medium-term production outlook.

Many projects were delayed due to the low oil price, but as E&P companies improve the concept and reduce the costs associated with these projects, Rystad Energy expects the sanctioning activity in both regions to increase again from 2018. Furthermore, as the oil price gradually improves, many projects are in the pipeline to be sanctioned. In the North Sea, about 2 Bboe of new volumes could be approved over the next three years, while that number is 850 MMboe for the GoM.

Figure 3 shows the largest projects that are expected to be sanctioned over the next few years. The single largest project is Johan Castberg in the Barents Sea. The Statoil-operated discovery will be developed as an FPSO unit and could get the final approval in 2018. Statoil and its partners have worked on reducing the costs for this project and have changed the development concept. In total, the breakeven oil price has dropped from $80/bbl to about $35/bbl. The second largest project is Phase 2 of Johan Sverdrup. Phase 2 consists of a new processing platform and subsea infrastructure, which will increase the plateau production from about 400 Mbbl/d to about 600 Mbbl/d.

Kaskida is the largest discovery in the pipeline for upcoming sanctioning in the GoM. This HP/HT field was discovered in 2009. Another discovery in the Lower Tertiary is Anadarko’s Shenandoah discovery. Anadarko is continuing to appraise this discovery and is planning for a semisubmersible development solution.

Two other interesting discoveries are Wisting and Alta/Gohta. Together with Johan Castberg, these projects will transform the Barents Sea to an oil-producing province and a key Arctic region. To increase the resource estimates for these projects and improve the commerciality, several new prospects are being drilled in this area within the next two years.

Spending and oilfield service market

The low oil price environment has affected oilfield service companies dramatically over the last two years. In terms of revenue, companies exposed to the service market in the North Sea and GoM have experienced a decline of 42% from the peak in 2014. After five years of consecutive growth of 13% on average, the market came to a hard stop in 2015 when E&P companies put on the brakes to halt investments. The revenue was reduced by more than 50% for some companies such as NOV, Transocean and Subsea 7 (Figure 4).

The high oil price from 2010 to 2014 stimulated many new field developments in the GoM and North Sea. Large developments such as Jack/St. Malo, Mars B and Big Foot in the GoM and Goliat, Martin Linge and QUAD204 in the North Sea caused a record high inflow of contracts to service companies, which led to one of the largest booms in the service industry. The low volumes of sanctioned projects in 2014 coupled with many projects being completed in 2015 resulted in reduced backlogs for service companies. However, service companies in many other regions experienced larger drops such as onshore North America, where revenues fell by more than 60%.

Although oil prices have recovered substantially during 2016, 2017 still looks to be weaker than 2016 in terms of oilfield service purchases. As effective unit prices in the industry are still falling, the market is expected to contract by 15% and 7% in North America and Western Europe, respectively. The good news is that E&P companies are willing to sanction new projects again after two years of drought. Project commitments such as Mad Dog Phase 2, Kaikias and Johan Castberg show that it is possible for companies to improve the project economics for offshore fields in these regions and make them competitive. It will take some time before these new projects offset the decline of spending in existing fields, but with oil prices hovering between $50/bbl and $65/bbl for this year and next year, there is likely to be much more activity in terms of project sanctioning. Phase 2 of Johan Sverdrup in Norway, the revival of Rosebank in the U.K. and smaller subsea tiebacks in the GoM will stimulate spending growth from 2019.

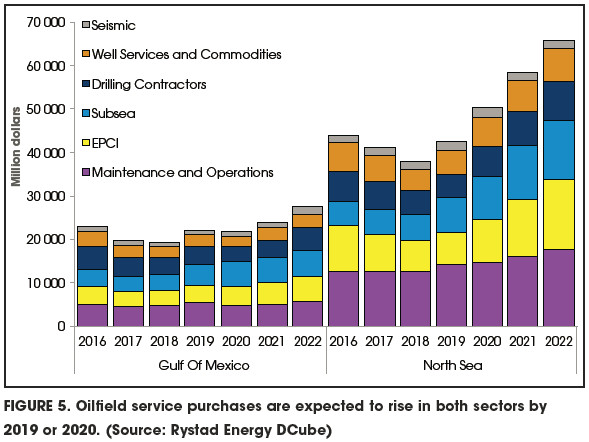

In terms of the market growth for various segments, the engineering, procurement, construction and installation (EPCI) market and maintenance, modification and operation market looks the most promising, with an average compounded growth of 13% and 7%, respectively, from 2016 to 2022. For the other segments the annual growth is expected to lie in the range of 4% to 6%. The rapid EPCI growth is due to the portfolio of projects being heavily tilted toward larger standalone developments with a large EPC scope rather than many small subsea tiebacks (Figure 5).

For early recovering segments, suppliers should look after the maintenance and operations market, which is expected to grow from 2018 onward. The new fields, such as Kraken, QUAD204, Gina Krog and Jack Phase 2 commencing production in 2017, will generate many new frame agreements. A lot of delayed maintenance at aging fields will be up for grabs by service companies from 2018 onward, when this work is overdue.

Another service segment that will witness growth in 2018 is the subsea market, where brownfield activity will drive intervention and replacement of equipment for subsea installations. For other segments growth is expected from 2019 onward, when the development of new resources is at full speed.

After such a deep cut in this market it will take some time before the industry experiences a full recovery. Even with oil prices of $90/bbl to $100/bbl for the next decade, the market will not be back to 2014 levels before 2024. If oil prices are kept at $50/bbl long term, this service market will remain highly challenged and is expected to stay at 2017 levels. There is not a lack of potential projects to be sanctioned, but even though some best-inclass projects have shown stellar improvement in the cost base, this cannot be enforced for the complete portfolio of discovered but nonsanctioned projects due to complexity. With smaller reserves, HP/HT, heavy oil and other complex factors, breakeven prices are typically above $60/bbl for many developments. Hence, for the North Sea and GoM oilfield service markets to truly see a comeback, oil prices will need to improve above these levels. If not, service companies will need to look elsewhere for growth.

Recommended Reading

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.