Non-op player Northern Oil & Gas (NOG) is digging deeper in the Permian Basin (pictured) by teaming up with operating partners on joint acquisitions. (Source: Shutterstock.com)

Northern Oil & Gas (NOG) is becoming a major M&A player by scooping up minority interests.

The non-operated oil and gas space is a crowded one, and perhaps growing more crowded in certain subsets of the A&D market. But Minneapolis-based NOG stands out from the pack.

As non-op increasingly emerges as an asset class of its own, NOG is focused on doing things most other players can’t.

“I think you’ve seen it in minerals: There are certain things that anybody can do,” NOG CEO Nick O’Grady told Hart Energy, “and then there are certain things that not everybody can do.”

“Generally, returns follow the things that not everybody can do,” he said.

NOG is seeing certain parts of the non-op space growing more crowded and competitive, particularly in the realm of deals trading under $100 million.

“What we’ve seen is as the mineral space has become so saturated, the natural evolution to that is to move over to non-op,” NOG President Adam Dirlam said.

But for transactions above the $300 million mark, it’s still mostly the same half-dozen usual suspects in the room, O’Grady said.

The ability to do large-scale acquisitions has really put NOG in a league of its own in the non-op space.

NOG boasts a market capitalization of approximately $3.7 billion. That’s bigger than many pure play operators like California Resources Corp. (~$3.3 billion), Comstock Resources (~$2.8 billion), Crescent Energy (~$2.6 billion) and Gulfport Energy (~$2.5 billion).

And it dwarfs other publicly traded non-op players like Granite Ridge Resources (~$804 million) and Vitesse Energy (~$731 million), which was spun out from Jefferies Financial Group in early 2023.

Vitesse CFO James Henderson recently told Hart Energy the company isn't in the "same class" as NOG and was unlikely to do a tagalong deal.

“Everyone wants to compare [them to Northern] but they’re way bigger, they’ve been around,” Henderson said.

Both Vitesse and NOG have deep legacy roots in the Williston Basin (hence the “Northern” part of Northern Oil & Gas). Granite Ridge is deep in the Delaware Basin, but the company also holds interests in the Eagle Ford, the Denver-Julesburg (D-J) Basin, the Haynesville, the Midland Basin and other basins.

Several private equity firms and PE-backed players also operate in the non-op space, including Quantum Energy Partners, Riverbend Energy Group, Sixth Street, Tailwater Capital, North Hudson Resource Partners and Ellipsis.

In January, Ellipsis announced an acquisition of non-op assets in the Permian, the D-J and the Haynesville.

RELATED

NOG’s Banner 2Q: Biggest M&A Deals, New Basins, Record Production

Advent of the co-purchase

More recently, NOG has moved from the Williston into other geographies, like the Permian Basin and Appalachia.

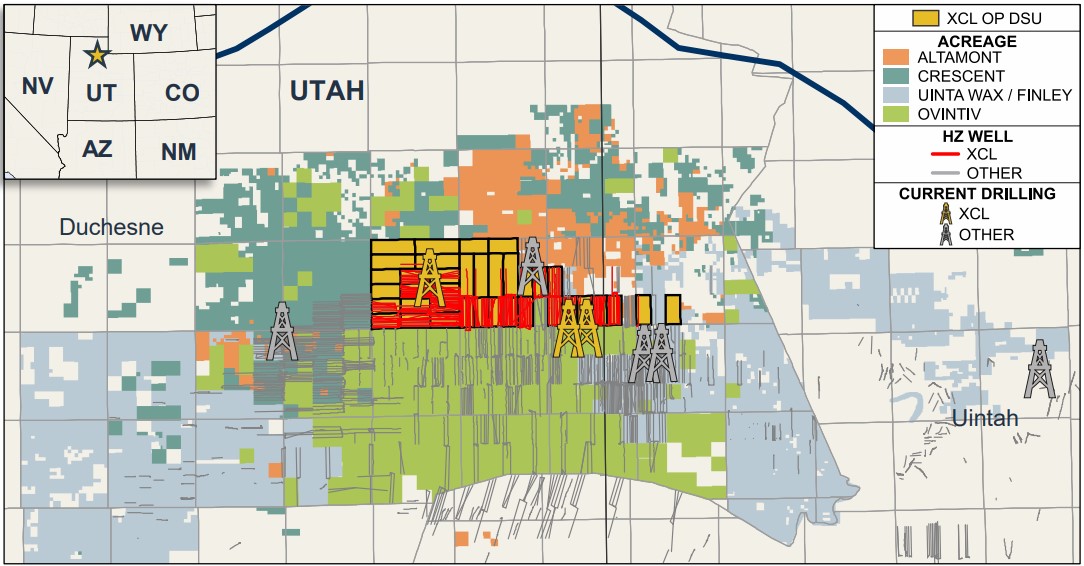

The company is also expanding into Utah’s Uinta Basin, a waxy crude play red hot with deal rumors and M&A activity.

NOG is joining forces with operator SM Energy to jointly acquire Uinta producer XCL Resources for a total of $2.55 billion.

NOG will assume a 20% interest in the XCL assets for $510 million; SM Energy will pay $2.04 billion for the majority 80% interest.

The XCL deal represents NOG’s largest acquisition in the company’s history.

It also represents a furthering of NOG’s unique “co-purchase” strategy, where the company tags along with an experienced operating partner to make large-scale acquisitions more digestible.

On several occasions, NOG has tapped the co-purchase strategy in the Delaware Basin:

- NOG partnered with Vital Energy to acquire Delaware Basin E&P Forge Energy II for $540 million, with NOG acquiring a 30% stake for $162 million;

- NOG partnered with Earthstone Energy to acquire Delaware Basin E&P Novo Oil & Gas for $1.5 billion, with NOG paying $500 million for a third of Novo’s assets. Days after closing the Novo deal, Earthstone itself was acquired by Permian Resources for $4.5 billion; and

- NOG teamed up again with Vital to acquire Delaware Basin E&P Point Energy Partners for a collective $1.1 billion, with NOG buying 20% for $220 million.

“What’s interesting is that Vital represents the dawn of the co-purchase process,” O’Grady said. “Frankly, it wasn’t something that we went looking for— [Vital deserves] a lot of credit because they came to us.”

But NOG still faces pushback from analysts and investors for its co-purchase strategy. The classic non-op model of buying interests for incredibly cheap valuations, they say, has just morphed into buying expensive operated assets.

They’re not entirely wrong, O’Grady said.

“But what we’ve observed,” he said, “is we’ve been buying operated assets from private hands and seeing our public operators squeeze materially better returns out of them on the back end.”

Companies like Permian Resources, SM Energy and Vital Energy are among the most adept operators and producers in the nation. They’re drilling some of the most productive new oil wells on among the most high-quality acreage blocks in the Lower 48.

You don’t get those results from upping a non-op working interest in a legacy PDP-heavy asset with shallow declines.

NOG has already reported huge synergies through its partnerships with Vital and Permian Resources.

The company is confident SM Energy will meet or exceed expectations with the XCL assets in Utah. NOG already has exposure to SM-operated wells in the Midland Basin, O’Grady said.

RELATED

Building a Better Non-op? Control the Purse Strings, Executives Say

Bridging a gap

SM investors were somewhat spooked by the company’s jump into a new basin: SM shares fell by over 10% the day after announcing the XCL acquisition. They’re down over 13% since the announcement on June 27.

NOG’s stock reaction was relatively muted. NOG shares dropped 2% the day of the announcement, and they’re down around 4.5% since then.

That’s because it’s much less risky to be a non-op partner entering a new basin than the operator themselves, in the market’s eyes.

NOG’s non-op strategy is certainly capital intensive, especially when spending money to develop, Dirlam said. NOG’s averaged gross authorization for expenditure (AFE) cost for wells it elected to participate in was $9.5 million in 2023, up from $8 million in 2022, according to regulatory filings.

But O’Grady is the first to admit NOG’s role is akin to shuffling through blueprints while a multi-basin operator like SM actually does the heavy lifting.

“It’s one funnel of capital allocation for an operator,” O’Grady said. “They have to think about field offices and dedicated teams for each basin. It’s a larger exercise for them.”

Owning a larger operated working interest isn’t inherently riskier than owning a smaller working interest, Dirlam said. But you don’t hit home runs every time in the oil and gas business, either.

“If you put too many eggs in one basket, that’s where things can get sideways pretty quickly,” Dirlam said.

Being able to take a portion of that underlying risk off an operators’ hands is a big reason why NOG’s co-purchase model has been attractive for E&Ps pursuing major acquisitions.

The co-purchase strategy also helps fill a capital void in the upstream sector, giving operators greater breadth to go out and acquire more assets, O’Grady said.

“We all have our capital limitations, and ultimately that is a big part of the role we’re playing,” O’Grady said. “We’ve become a bridge solution, and we’re a much better partner than a lot of the private capital solutions that are out there today because we are true oil and gas concern.”

Dirlam said NOG has “cracked the code” on large-scale non-op: getting creative on deal structuring, having the appropriate guard rails in place to manage risk while being equitable on both sides.

“Or at least it appears that way,” Dirlam said, “in terms of being able to rinse and repeat some of these more complicated exercises with one or more counterparties involved in the mix.”

RELATED

SM Stock Dives Over 10% as Investors Weigh $2B Uinta Basin Deal

Divestiture deluge

Experts anticipate a wave of non-core packages to hit the divestiture market on the heels of a U.S. upstream M&A megacycle.

Occidental recently sold operated Barilla Draw assets in the southern Delaware Basin to Permian Resources for $817.5 million—part of a debt-reduction campaign after closing a $12 billion takeover of Midland E&P CrownRock.

But as E&Ps search for drilling inventory, they’re hesitant to part with operated shale locations, particularly in the Permian Basin. Instead, non-op packages, minerals and royalties and midstream interests are being tapped for divestiture.

On hold to close a $26 billion takeover of Midland private producer Endeavor Energy Resources, Diamondback Energy sold $95 million in non-op Delaware properties.

Appalachia gas giant EQT Corp. sold a portion of its non-op Marcellus assets in northeast Pennsylvania to Norwegian energy firm Equinor.

Under terms of the transaction, Equinor sold 100% of its interests in operated Marcellus and Utica assets and paid a cash consideration of $500 million. EQT, in exchange, provided 40% of its non-op interest in northeast Pennsylvania assets.

EQT is marketing the remaining 60% today.

That EQT already sold a portion of the non-op Marcellus assets makes the remaining 60% a bit more palatable, O’Grady said.

“It wasn’t that it wasn’t financeable for us, but I don’t think we want to become a gas company,” he said, noting that NOG's portfolio already holds interests in a gas asset operated by EQT.

But NOG does want to participate in non-op divestitures hitting the market. After all, “some of the best non-op is controlled by operators,” Dirlam said.

Taking out non-op interests in larger operated packages could make sense, too.

“What we hope to do as NOG is to be able to participate in all of the above,” O’Grady said.

RELATED

Oxy Nears $4.5B Debt Reduction Target Post Barilla Draw Sale

Recommended Reading

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Stonepeak Backs Longview for Electric Transmission Projects

2025-03-24 - Newly formed Longview Infrastructure will partner with Stonepeak as electric demand increases from data centers and U.S. electrification efforts.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.