A Hart Energy review of Diamondback’s and Endeavor’s July production showed less than 500 bbl/d from their leasehold in Borden, Crockett, Gaines and Irion counties, according to Texas Railroad Commission (RRC) data. (Source: Shutterstock/ Endeavor Energy)

Will there be Diamondback Energy divestments of some newly non-core Permian property now that it has closed on fellow Permian pureplay operator Endeavor Energy Resources?

UBS Securities analyst Josh Silverstein reported Oct. 14, “We look for more details on the divestiture program.”

Kaes Van’t Hof, Diamondback president and CFO, told investors in August, “We didn't put so much cash in the deal that we had to be a seller of assets.”

In the $26 billion acquisition, Diamondback paid with stock and $8 billion in cash. The deal closed on Sept. 10.

While there may be some high-grading, Van’t Hof added, “I don't think you'll see us be a forced seller of assets post-deal-close.”

Diamondback already sold its interest in WTG Midstream Holdings to Energy Transfer in May for $375 million and 11.5 million of its Viper Energy shares in March for $402.5 million, he noted.

As for what else might be sold, “I think we're going to be very, very stingy on keeping operated properties in the Permian because they're kind of worth their weight in gold right now,” he said.

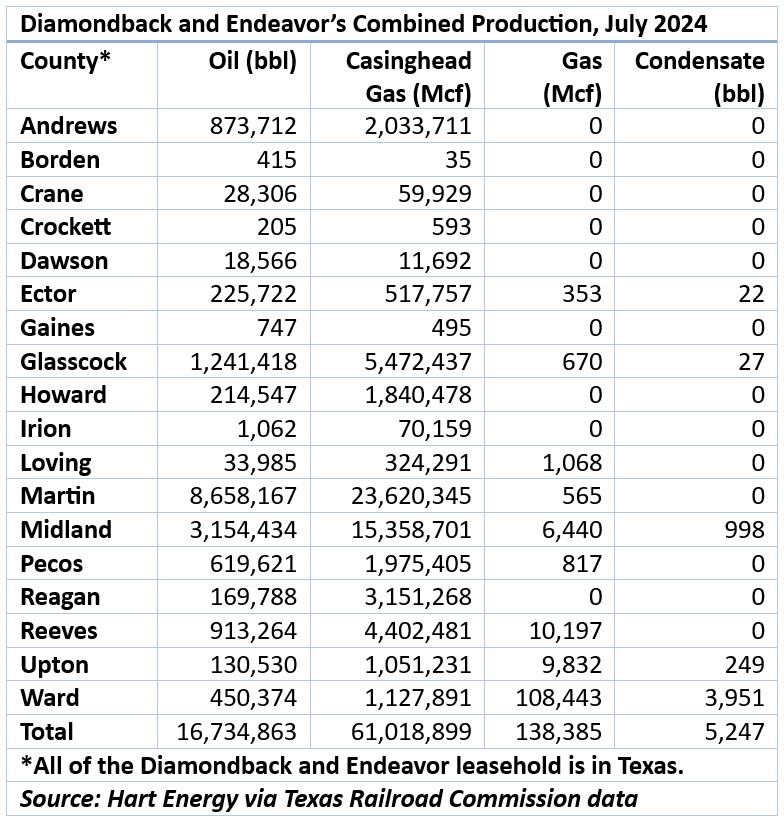

A Hart Energy review of Diamondback’s and Endeavor’s July production showed less than 50 bbl/d from their leasehold in Borden, Crockett, Gaines and Irion counties, according to Texas Railroad Commission (RRC) data.

In Dawson County, which is currently a hot expansion area for EOG Resources, SM Energy and privately held operator Birch Resources, Diamondback’s and Endeavor’s combined July output was 599 bbl/d, according to the RRC.

RELATED

Hot Permian Pie: Birch’s Scorching New Dean Wells in Dawson County

$625 per lateral foot

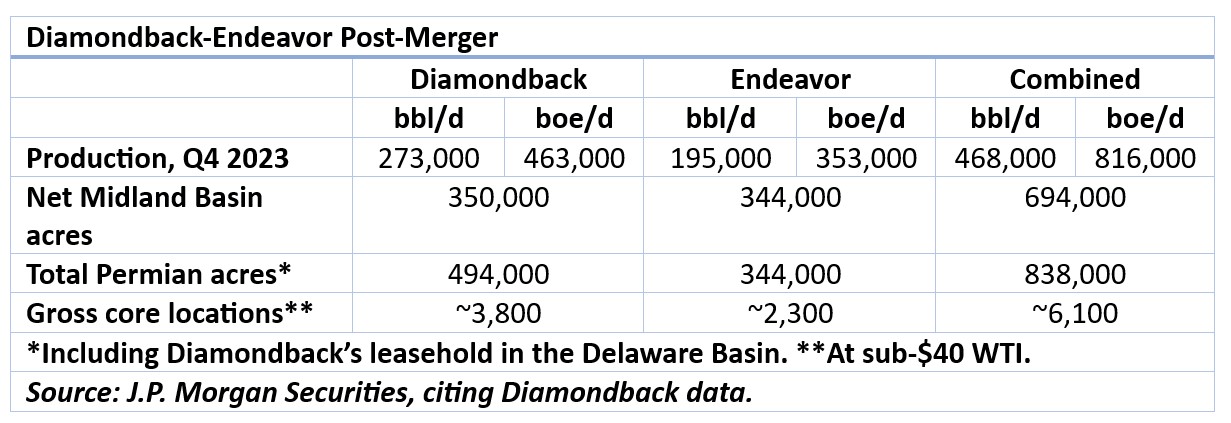

Diamondback is “hitting the ground running” in up-shifting D&C efficiencies on its newly acquired Endeavor property, moving to simul-frac development, J.P. Morgan Securities analyst Arun Jayaram reported Oct. 14.

The operator’s Midland Basin wells cost $625 per lateral foot.

“Thus far in 2024, Diamondback has cited some 8% year-to-date drilling efficiencies—26 wells per rig per year vs. 24 wells per rig per year at year-end 2023,” Jayaram wrote on Oct. 2.

As for completions, the operator is posting 15%-plus efficiency gains, approaching 100 wells per crew versus 80 wells per crew.

This has been “while pushing lateral lengths 2.6% longer vs. the prior [guidance of] 11,800 feet vs 11,500 feet.”

The combined rig count is now 21, down from 24 when the deal was announced in February, he wrote on Oct. 14.

And Diamondback sees potential to maintain its combined July output of 540,000 bbl/d with between 18 and 20 rigs, he added.

In completions, six full-time simul-frac fleets were anticipated for the combined companies’ Midland Basin property when the deal was announced.

But Diamondback “now expects it can execute this program with five [or so] simul-frac fleets as the company is completing [some] 100 wells per simul-frac fleet vs. the original guide that estimated 80 wells per fleet,” Jayaram reported.

In addition to moving Endeavor’s operations to Diamondback’s existing simul-frac program, UBS’ Silverstein reported, “further synergies will come from two new e-fleets.”

Jayaram reported these are the Halliburton-operated Zeus e-fleets.

Across the street

Meanwhile, Diamondback has moved 700 of Endeavor’s roughly 1,200 employees to its own offices on West Texas Avenue in downtown Midland.

The remaining Endeavor employees continue officing across the street at the former Endeavor headquarters, Jayaram wrote on Oct. 14.

“It appears that the company is quickly progressing on its $550 million/year synergy target,” he added.

Silverstein raised his target Oct. 14 on Diamondback shares to $235.

Jayaram is favoring the stock, recommending that investors Overweight it in their portfolios.

He had put a December 2025 price target of $182 on the shares on Oct. 2.

But he raised that on Oct. 14 to $205, while the ticker was already $190 and due to WTI trading at some 10% more on the escalation of conflicts in the Middle East.

Recommended Reading

Kimmeridge to Grow to 1 Bcf/d Via Bits and Bids, Including Haynesville

2025-03-31 - Kimmeridge Texas Gas expects to be producing nearly as much gas as its 1.3 Bcf/d Commonwealth LNG plant will export when it comes online in 2029, said CEO Dave Lawler.

Exxon Sits on Undeveloped Haynesville Assets as Peers Jockey for Inventory

2025-04-09 - Exxon Mobil still quietly holds hundreds of locations in the Haynesville Shale, where buyer interest is strong and inventory is scarce.

Exclusive: Kimmeridge's Lawler Avid for Eagle Ford's Dry Gas Window

2025-04-11 - Kimmeridge Texas Gas CEO David Lawler discusses the company's approach to doubling gas production to 1 Bcf/d and pending regulatory project approvals, in this Hart Energy Exclusive interview.

Improving Gas Macro Heightens M&A Interest in Haynesville, Midcon

2025-03-24 - Buyer interest for Haynesville gas inventory is strong, according to Jefferies and Stephens M&A experts. But with little running room left in the Haynesville, buyers are searching other gassy basins.

Aethon Dishes on Western Haynesville Costs as Gas Output Roars On

2025-01-22 - Aethon Energy’s western Haynesville gas wells produced nearly 34 Bcf in the first 11 months of 2024, according to the latest Texas Railroad Commission data.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.