While the Permian Basin has seen crude oil production grow this year, the latest employment data in the upstream sector indicates that as E&Ps boost productivity and efficiency, they aren’t necessarily hiring. (Source: Shutterstock)

U.S. oil production hit a record high of 13.31 MMbbl/d in December 2023 and averaged 13.05 MMbbl/d through May 2024.

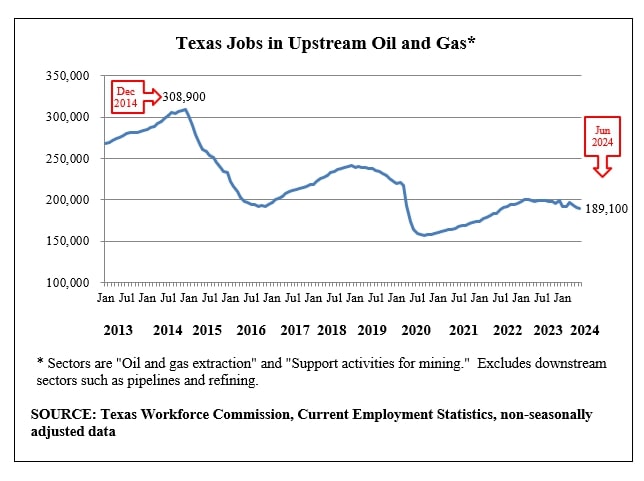

Despite record high production, upstream employment rolls in Texas— the nation’s leading oil and gas producer— has seen jobs disappearing at a precipitous rate.

As of June, employment numbers have dropped five out of six months this year as efficiencies have enabled E&Ps to grow production with fewer rigs and workers, the Texas Oil & Gas Association (TXOGA) said in a July 24 report.

Generally, upstream employment has been on a downward trend for years. Since December 2014, after OPEC’s infamous Thanksgiving production meeting sent prices spiraling downward, upstream jobs have fallen by nearly 39% to 189,100 in June, according to Texas Workforce Commission (TWC) data.

Oil and gas jobs have generally been on the uptick since the depths of the pandemic in 2020. That pattern has showed signs of changing in the first half of the year.

While the Permian Basin has seen crude oil production grow this year, the latest employment data in the upstream sector indicates that as E&Ps boost productivity and efficiency, they aren’t necessarily hiring.

In a “cautionary note,” TXOGA said that newly released TWC data indicates upstream oil and gas June employment fell by 2,000 compared to May.

The declines are mostly due to greater efficiency among E&Ps, TXOGA says.

“Operational efficiencies are driving strong production with fewer rigs, which can translate to declining industry job numbers,” TXOGA president Todd Staples said in a news release.

In March, upstream job data showed employment in the upstream sector of the Texas oil and gas industry grew by 4,500 jobs, representing the highest single-month growth since June 2011, according to TWC.

“Clearly, oil and natural gas companies are delivering more energy with greater efficiency and lower emissions than ever before,” Staples said.

While Baker Hughes data shows the rig count declined by 14% between June 2023 and June 2024, the U.S. Energy Information Administration estimated rig productivity gains of more than 20% year-over-year across major shale basins.

Analysts’ research bears out some of those improvements as well as lower input costs.

“Both E&Ps and service providers are emphasizing significant efficiency improvements, albeit for different reasons,” Wood Mackenzie analyst Nathan Nemeth wrote in a July 29 report. “More efficient operations are helping E&Ps drill and complete wells faster, cutting costs. At the same time, OFS [oilfield service] firms are utilizing more efficient kit and workflows to sustain elevated prices.”

Operators that have adopted e-frac spreads and simul-frac have already realized significant cost savings. Decisions on completion techniques and equipment can result in a cost range of $100/ lateral ft, according to WoodMac.

Other factors include “declining input pricing for oil country tubular goods, proppant and diesel, combined with substantial drilling and completion efficiency gains are pushing costs lower,” Nemeth said.

In Texas, the state’s oil and natural gas production gained market share in the first half of 2024, with TXOGA projections through June 2024 showing that Texas is averaging 5.7 MMbbl/d, TXGOA Chief Economist, Dean Foreman, wrote in the association’s monthly energy economics review.

TXOGA estimates that Texas produced 42.8% of U.S. crude oil and 28.3% of U.S. natural gas marketed production in June 2024, a small gain in market share since December 2023.

However, the Permian Basin of Texas and New Mexico is headed for slower production, albeit robust growth, partly thanks to gains from faster and cheaper drilling and completions, according to a July 24 report by Goldman Sachs Research.

“This year, every stage of a well’s building cycle in the Permian was 20[%]-50% faster than in 2019, with the total average time from rig to production decreasing by a third to 63 days,” Yulia Grigsby, an energy economist in Goldman Sachs Research, wrote.

The acceleration will boost the share of new and productive wells amid the stock of declining wells, according to Goldman Sachs.

On the horizon, overall North American activity is expected to slow down through the end of the year, service company executives said during second-quarter earnings reports.

NOV, Halliburton, SLB, Liberty Energy, Helmerich & Payne and Weatherford all expected softer activity for second-half 2024. Executives said the slower pace is being driven by industry consolidation and low gas prices that have led some gassy E&Ps to curtail production.

Service companies have worked to position themselves to work even more efficiently as they cater to E&Ps. Liberty credited innovation within its supply chain to innovate and drive efficiencies in procurement, construction and “delivery of essential materials for frac operations” as a factor bolstering its second-quarter performance.

Recommended Reading

Trump Ambiguous Whether Canadian-Mexico Tariffs to Include Oil

2025-01-31 - At a news conference, President Trump said that he would exclude oil from tariffs before backtracking to say that he “may or may not” impose duties on crude.

Baker Hughes Wins LNG Technology Orders for Venture Global

2025-01-30 - Baker Hughes Co. also signed a multiyear services agreement to support the first two phases of Venture Global’s Plaquemines LNG project in Louisiana.

EIA: NatGas Storage Withdrawal Eclipses 300 Bcf

2025-01-30 - The U.S. Energy Information Administration’s storage report failed to lift natural gas prices, which have spent the week on a downturn.

Fatal Texas Oilfield Accident Leaves One Dead, Two Injured

2025-01-29 - One man was killed and two others were injured at an oilfield in Texas on Jan. 29 where ProPetro Services was conducting fracking operations at a well site owned by Permian Resources Corp.

NatGas Prices, E&Ps Take a Hit from DeepSeeking Missile

2025-01-28 - E&Ps such as Expand Energy and EQT Corp. saw share prices drop on news of less power-intensive AI, but analysts predict the natural gas market will rebound as LNG exports and overall power demand continues to increase.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.