The Permian Basin will drive U.S. oil production growth for the foreseeable future, according to the U.S. Energy Information Administration. (Source: Shutterstock)

The Permian Basin’s importance to the U.S.’ overall oil production growth can’t be understated.

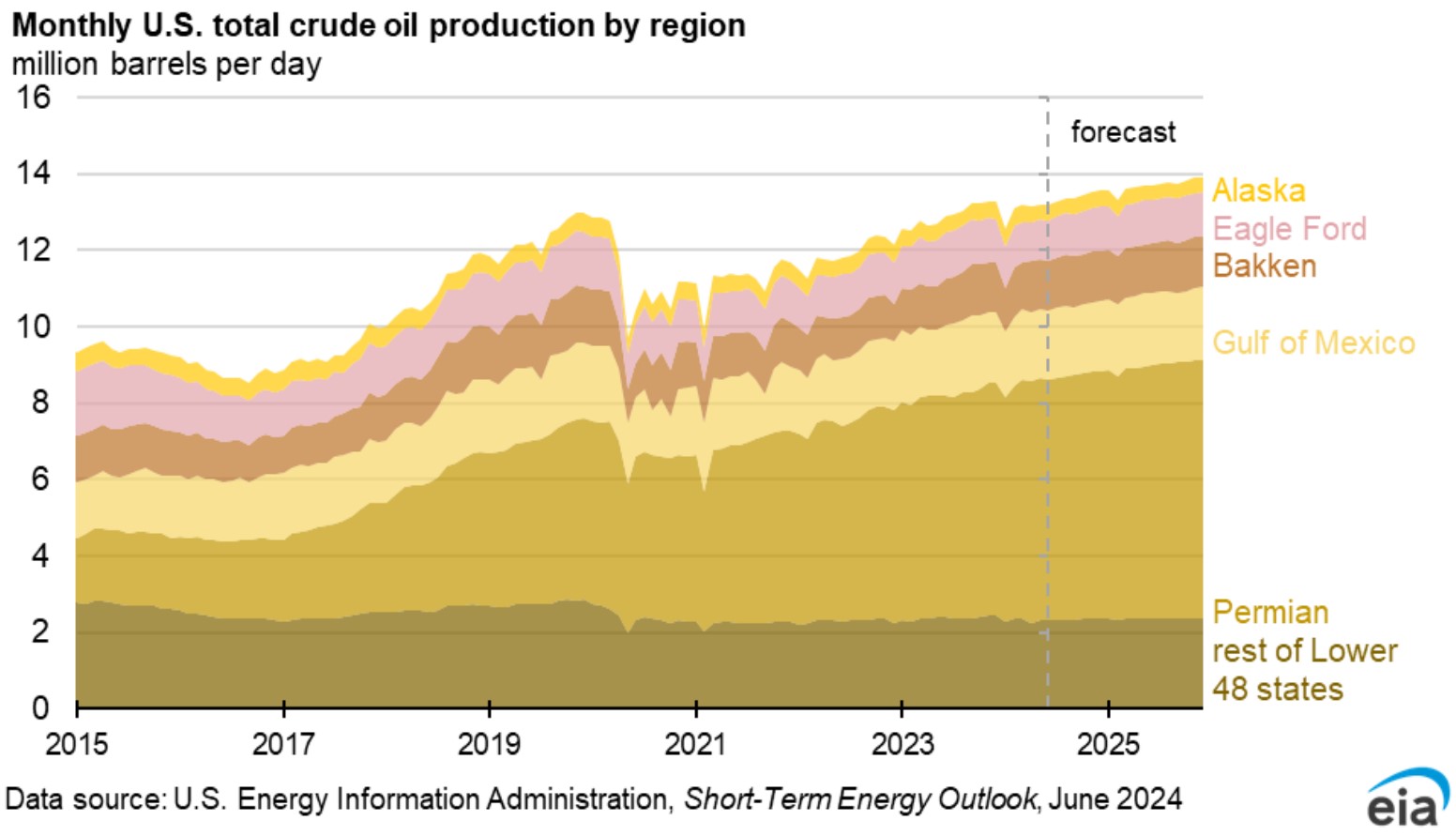

Production from the Permian region, mostly in Texas, will contribute almost two-thirds of all U.S. crude oil production growth through the end of 2025, according to figures published June 11 by the U.S. Energy Information Administration (EIA).

“The Permian region’s proximity to crude oil refining and export terminals on the Gulf Coast, established takeaway capacity and improved new well productivity support crude oil production growth in the region,” the EIA wrote in its June 2024 Short-Term Energy Outlook.

The Eagle Ford Shale in South Texas and the offshore Gulf of Mexico regions will contribute the second- and third-largest shares of oil output growth, at 15% each.

Based on recent production data from newly completed wells, operators in the Permian, Eagle Ford and Bakken regions have “noticeably” increased their productivity on a per-rig basis over the past 18 months, the EIA reported.

That’s true in the Bakken shale of North Dakota and Montana, where a growing number of operators have been drilling longer 3- and 4-mile lateral horizontal wells.

Oil production from newly completed wells per rig in the Bakken averaged around 1,500 bbl/d during 2023—but jumped to 1,800 bbl/d during the first quarter of 2024.

Drilling efficiencies are also being brought to bear in the Permian Basin. Crude production from newly completed wells per rig in the Permian averaged 1,400 bbl/d in the first quarter of 2024, up from the 2023 average of 1,300 bbl/d.

New-well output from the Eagle Ford per rig held steady at an average of 1,200 bbl/d during the first quarter.

The EIA anticipates U.S. oil production will grow by 2% to average 13.2 MMbbl/d during 2024, before growing by another 4% in 2025.

“If our forecast is realized, U.S. crude oil production would set new annual records in both 2024 and 2025,” the EIA wrote.

RELATED

Exxon Mobil Goes Long with Permian’s Poker Lake Well

Improving gas macro?

The great oil and gas epic has played out in a rather Dickensian fashion over the last 12 months to 18 months. It’s been among the best of times to be a low-cost oil producer—but the worst of times to be a natural gas producer.

U.S. gas producers have languished through a prolonged period of low commodity prices, driven by elevated storage inventories, mild winter weather and record volumes of associated gas emerging from oily plays like the Permian and Bakken.

But dry gas producers are responding by shutting in production, deferring new well completions and shifting drilling activity to liquids-rich fairways.

Declining activity was a common refrain echoed throughout the natural gas industry’s first-quarter earnings, with curtailments and deferrals reported by EQT Corp., Chesapeake Energy, Range Resources, CNX Resources, Gulfport Energy and other producers.

U.S. marketed natural gas production is expected to fall by 1% in 2024, including a 9% decline from the Haynesville region and a 4% decline from Appalachia.

Those declines will be partially offset by associated gas growth from the Permian Basin, where wet gas volumes are closely tied with production from new oil wells.

Curtailment efforts by gas producers, though not quite needle-moving, are putting upward pressure on commodity pricing.

The EIA forecasts Henry Hub natural gas prices will average $2.50/MMBtu this year—a 13% improvement from last month’s forecast—with prices rising from $2.12/MMBtu in May to $3.30/MMBtu in December.

Gas producers lamented a relatively warm winter season for pushing down demand. Now, they’re hoping for a hot summer, and their wishes may come true.

Henry Hub front-month futures prices fought their way back above $3/MMBtu on June 10 after a heat wave followed earlier forecasts for a warmer-than-usual summer.

It was the first time the price had exceeded $3 since Jan. 16. Natural gas traded at $3.03 at the Henry Hub early June 11.

RELATED

Recommended Reading

Venture Global LNG Pares IPO Hopes by 15% to $2.2B

2025-01-22 - LNG exporter Venture Global nearly halved the price per share, while increasing the number of shares it expects to offer.

Energy Transfer Announces $3B Senior Notes Offering

2025-02-19 - Midstream company Energy Transfer plans to use the proceeds from its $3 billion offering of senior notes to refinance existing debts and for general partnership purposes.

EOG’s Donald F. Textor to Retire from Board

2025-02-11 - Textor was first elected a director of EOG Resources in 2001, where his counsel played a key role in EOG’s growth, Chairman and CEO Ezra Y. Yacob said in a press release.

Artificial Lift Firm Flowco Seeks ~$2B Valuation with IPO

2025-01-07 - U.S. artificial lift services provider Flowco Holdings is planning an IPO that could value the company at about $2 billion, according to regulatory filings.

Magnolia’s Board Adds Ropp as Independent Director

2025-01-07 - Alongside his experience in oil and gas operations, R. Lewis Ropp has a background in finance, capital markets and investment management, Magnolia Oil & Gas said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.