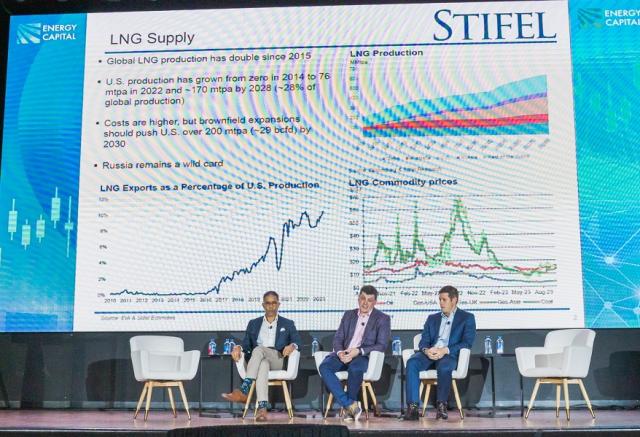

Pietro D. Pitts (left), Hart Energy's international managing editor, discusses discusses LNG financing with Benjamin Nolan, managing director of Stifal Financial Corp. and Tyler Kruse, Mexico Pacific Ltd.’s vice president for corporate finance at Hart Energy’s Executive Capital Conference in Dallas.

DALLAS — Gas production from the U.S. Permian Basin will anchor Mexico’s Pacific’s Saguaro Energía LNG facility and offer the basin’s producers a relief valve for associated gas — straight into premium LNG markets in Asia, Tyler Kruse, vice president of corporate finance for Mexico Pacific Ltd. said on Oct. 2.

“The facility will connect the cheapest natural gas from the Permian Basin's Waha hub to the world's largest demand center, Asia,” Kruse said during a panel discussion at Hart Energy’s Energy Capital Conference.

Kruse added that Permian associated gas is approximately $1/MMBtu cheaper than gas supplying Gulf Coast LNG projects from Henry Hub. Saguaro Energía LNG will connect the lowest-cost U.S. gas basin with high-demand markets in Asia through liquefaction on Mexico’s west coast, he added.

Stifel Financial Corporation managing director Ben Nolan said during the panel that "unless there’s a global recession there is a case to be made for 8% LNG growth through the end of this decade," which bodes well for Mexico Pacific.

Mexico Pacific’s anchor project, the Saguaro Energía LNG export facility is in Puerto Libertad, Sonora, Mexico. The facility will include three trains with a processing capacity of five million tonnes per annum (mtpa), each with a combined nameplate capacity of 15 mtpa (roughly 2 Bcf/d). The company envisions future expansions to include three additional trains with 5 mtpa of capacity each.

Saguaro Energía LNG, located on Mexico’s western Pacific coast, aims to leverage its access to low-cost Permian gas. The facility will source gas from Waha and be shipped along a 253 km pipeline on the U.S. side of the border. The line will connect with an 802 km pipeline on the Mexican side of the border. Both segments have capacity to handle 2.8 Bcf/d of gas.

Kruse said the Mexican government is supportive of LNG infrastructure development and that the risk from the drug cartels has been studied and “taken seriously, but not a major concern.”

FID imminent

Kruse said a final investment decision (FID) related to Mexico Pacific’s Saguaro Energía LNG facility is imminent and will come by year-end 2023. The facility is expected to start up by year-end 2027.

Kruse said the initial FID is focused on Train 1 and Train 2 with Train 3 expected to follow in quick succession. Mexico Pacific is continuing to secure financing to commence construction of the facility.

Quantum Capital Group is the controlling owner and lead sponsor of Mexico Pacific.

Saguaro Energía LNG advantage

Once the Permian gas reaches the Puerto Libertad liquefaction facility, Mexico Pacific expects the facility to capitalize on a shorter shipping route to Asia as its LNG cargoes will not have to pass through the Panama Canal.

The facility’s Pacific Coast location provides for a 55% shorter shipping route, which translates into savings of $1/MMbtu or more and a 60% lower carbon emissions profile compared to Gulf Coast peers, Kruse said.

The facility has the backing of Shell, Exxon Mobil and ConocoPhillips with key additional end-user customers secured, including Chinese firms Guangzhou Gas and Zhejiang Energy.

“Contracted customers pay fixed fees for pipeline and liquefaction services under 20-year take-or-pay SPAs [sale and purchase agreements], removing commodity risk exposure,” according to the to Mexico Pacific's website.

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

PE Firm Voyager to Merge Haynesville OFS Firm with Permian’s Tejas

2025-03-17 - Private equity firm Voyager Interests’ Haynesville Shale portfolio company VooDoo Energy Services will merge with Tejas Completion Services as part of a transaction backing Tejas, Voyager said.

On The Market This Week (Jan. 6, 2025)

2025-01-10 - Here is a roundup of listings marketed by select E&Ps during the week of Jan. 6.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Inside Ineos’ US E&P Business Plan: Buy, Build, Buy

2025-01-27 - The E&P chief of U.K.’s Ineos says its oily Eagle Ford Shale acquisition in 2023 has been a profitable platform entry for its new U.S. upstream business unit. And it wants more.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.